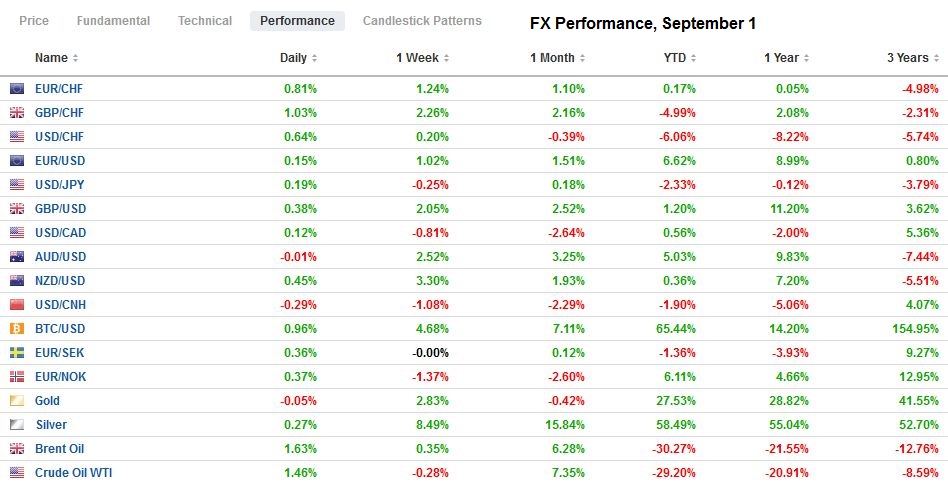

Swiss FrancThe Euro has risen by 0.77% to 1.0867 |

EUR/CHF and USD/CHF, September 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar has been sold-off across the board. The euro approached $1.20, and sterling neared $1.3450. The greenback traded below CAD1.30 for the first time since January. Most emerging market currencies but the Turkish lira, are also advancing today. The S&P 500 seven-day rally was snapped yesterday, but Asia Pacific bourses except to Tokyo and Syndey rose. Australia’s 1.7% drop seems exaggerated. It is the biggest loss since the end of July and appeared to be a combination of earnings/news-driven, though the financials were also among the weakest sectors. Europe’s Dow Jones Stoxx 600 is slightly firmer, but here too, financials are under pressure. US shares point to a higher open. Bond yields mostly a couple basis points higher, and the US 10-year benchmark is around 72 bp. Gold approached $2000 an ounce. October WTI had a weak close yesterday but no follow-through selling today, leaving it in about a 25 cent band on either side of $43 a barrel. |

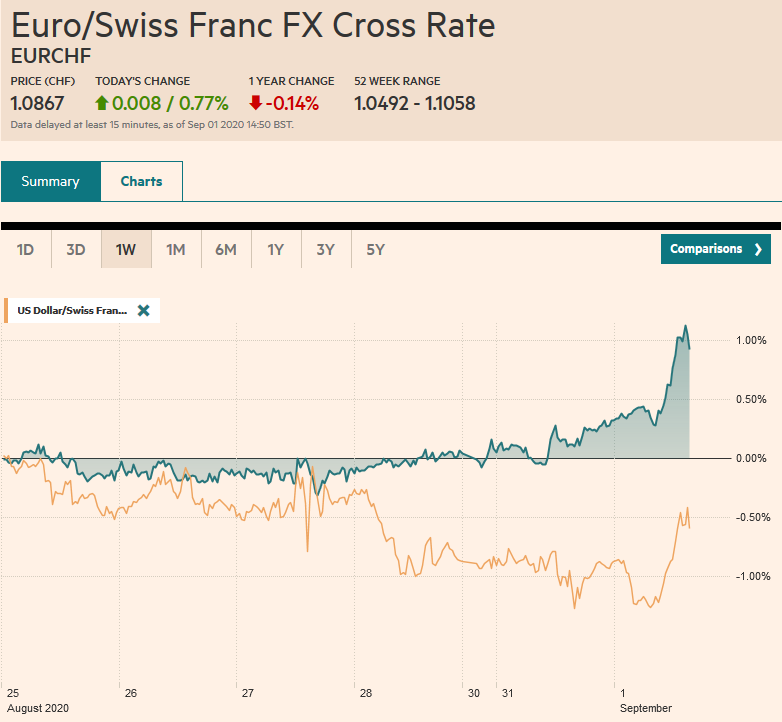

FX Performance, September 1 |

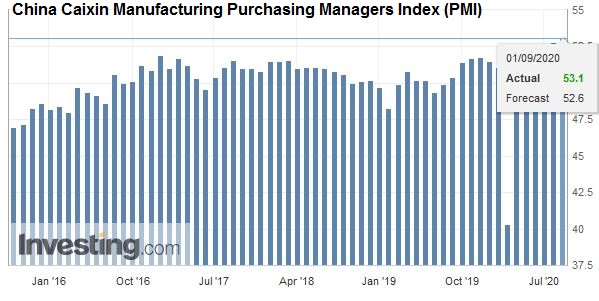

Asia PacificThe Caixin manufacturing PMI was stronger than expected at 53.1 (52.8 in July) as economists had anticipated a small decline. Export orders were above the 50-level for the first time this year, and the overall index rose for the fourth consecutive month. The recovery looks intact, but a key element, domestic consumption (e.g., retail sale) have been a laggard. |

China Caixin Manufacturing Purchasing Managers Index (PMI), August 2020(see more posts on China Caixin Manufacturing PMI, ) Source: investing.com - Click to enlarge |

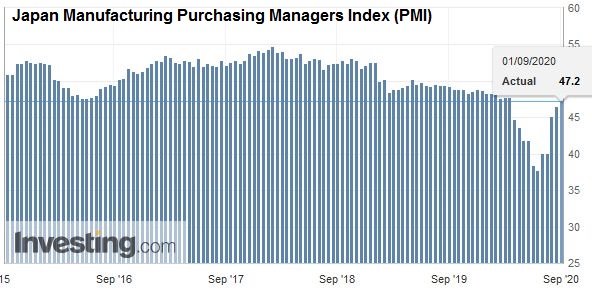

| Japan reported an uptick in unemployment in July to 2.9% from 2.8%, and the job-to-applicant ratio slipped to 1.08 from 1.10. Separately, it reported its manufacturing PMI was revised to 47.2 from a preliminary reading of 46.6 and 45.2 in July. Turning to politics, the LDP adopted rules that favor members of parliament over the rank-and-file in picking Abe’s successor. In the last selection, both components had equal weight. The new rules are thought to favor Cabinet Secretary Suga and would seem to underscore the likely continuity we have suggested. |

Japan Manufacturing Purchasing Managers Index (PMI), August 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The Reserve Bank of Australia kept rates steady at 25 bp as widely expected. It did leave the door open to additional measures as it expanded its Term Funding Facility. About A$52 bln has already been provided (three-year loans at 25 bp), and there is the capacity of around A$200 bln. New loans can be made until the middle of next year.

The optics of South Korea’s trade figures made them appear worse than they are because of the number of working days. The headlines reported a 9.9% drop in exports year-over-year after a 7.1% decline in July. Imports contracted by 16.3% the 11.6% slide in July. However, when adjusted for average daily activity, exports fell 3.8% year-over-year, the least since March, and eight of the 15 main export items increased in August over July. Exports to the US, China, and the EU all rose for the first time in a couple of years. Separately, Seoul reported an uptick in the manufacturing PMI to 48.5 from 46.9.

The dollar is a narrow range against the Japanese yen, and when it did poke above, JPY106 was met with fresh sales. There is an option for about $755 mln at JPY106.00 and one for $550 mln at 105.50 that expires today. While the other major currencies seem to be breaking out or probing range-limits, the dollar is near the middle of the JPY105-JPY107 range that dominated August. The Australian dollar traded above $0.7400 for the second session, but some profit-taking seems to be sapping the momentum. Initial support is now seen in the $0.7360-$0.7370 area. The PBOC reference rate for the dollar was set at CNY6.8498, a little weaker than the median bank model in the Bloomberg survey. The dollar is at its lowest level since May 2019 against the yuan. Hong Kong Monetary Authority continues to intervene to prevent the dollar from falling through its floor.

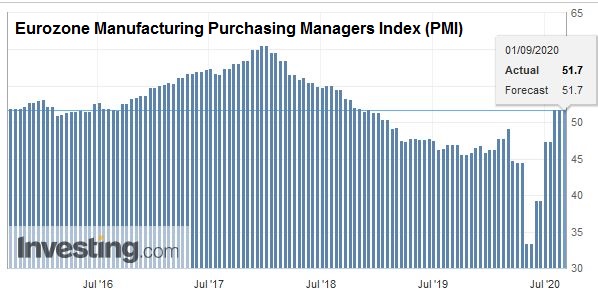

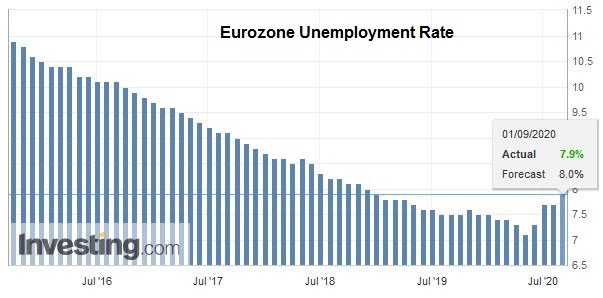

EuropeThe eurozone’s August manufacturing PMI is uninspiring. The aggregate was unchanged at 51.7 from the preliminary report, down from 51.8 in July. Germany’s flash reading of 53.0 was revised to 52.2 but still is an improvement over the 51.0 level in July. France was revised to 49.8 from 49.0, but still off the 52.4 reading in July. Spain also dipped below the 50 boom/bust level to 49.9 from 53.5 in July. Italy was a pleasant surprise. Its manufacturing PMI rose to 53.1 from 51.9. It was the fourth consecutive improvement and the best since June 2017 and boosted by domestic orders. However, some of the shine was dulled by the jump in unemployment to 9.7% from a revised 9.3% in June (initially reported at 8.8%). The eurozone as a whole reported an unemployment rate of 7.9% in July, up from 7.7% in June. |

Eurozone Manufacturing Purchasing Managers Index (PMI), August 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

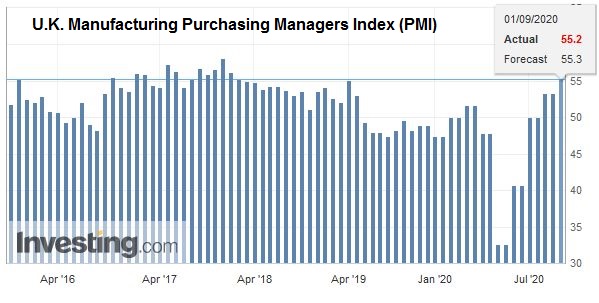

| The UK’s August manufacturing PMI was revised to 55.2 from 55.3 of the preliminary report and 53.3 in July. It remains at its best level since February 2018. |

U.K. Manufacturing Purchasing Managers Index (PMI), August 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The eurozone’s August inflation fell. The headline rate stands at -0.2% after a 0.4% year-over-year increase in July. The core rate plummeted to 0.4% from 1.2%. The inflation readings have been distorted by the postpones of summer sales and other pandemic-related distortions of seasonal practices. Core goods inflation stands at -0.1%. However, service prices also seem distorted by the pandemic. At 0.7%, the year-over-year rate for core services is a record low. Although some observers want to blame the euro’s strength in recent months, we are less sanguine and share ECB board member Schnabel’s views, who is in charge of the central bank’s market operations, that the exchange rate is not a major concern. |

Eurozone Unemployment Rate, July 2020(see more posts on Eurozone Unemployment Rate, ) Source: investing.com - Click to enlarge |

| The euro traded to almost $1.20 for a new two-year high. Recall that since the euro’s launch in 1999, it has averaged $1.20. There is an option for about 665 mln euros at $1.20 that expires today. There is another option for about 930 mln euros struck at $1.1950 that rolls off today. Initial support is seen near $1.1960, and the market looks poised to have another run at the $1.20 level in the North American session. For the sixth session, sterling has risen above the previous session’s high. It approached the $1.3450 area. We have suggested the $1.35 level is the next important chart area. Support is now seen around $1.34. Sterling continues to outperform the euro and is at its best level since early June against the single currency. |

Germany Manufacturing Purchasing Managers Index (PMI), August 2020(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

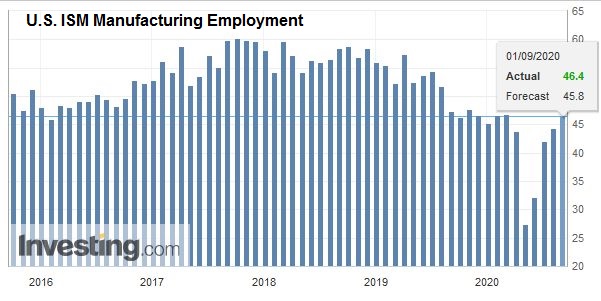

AmericaThe Vice-Chair of the Federal Reserve Clarida played down the likelihood that the FOMC will back up its adoption of an average inflation target with yield curve control at this month’s meeting. He suggested that the Summary of Economic Projections may be adjusted. Clarida appeared more open to changing forward guidance and increasing bond purchases. Note that the Fed’s balance sheet has fallen by around $180 bln since peaking over two months ago. New Jersey Governor Murphy threw his support behind bills that would tax high-frequency trading firms, many of whom operate in northern New Jersey. The bill was first drafted over a month ago, but no hearings have been held yet. The tax would ostensibly apply to the trading of stocks and derivatives. The purpose would be to raise revenue rather than slow down the activity as in a Tobin Tax. The US sees the final manufacturing PMI for August. The flash report showed an increase to 53.6 from 50.9. However, the ISM will be looked at for confirmation. The median forecast in the Bloomberg survey is for a rise to 54.8 from 54.2. July construction spending is expected to recover from the 0.7% decline in June. Auto sales may be the most important of today’s report. |

|

| A continued recovery in sales may be needed to sustain the output, which has been a key driver in the recovery of the manufacturing sector. Last August, sales were nearly 17 mln at a seasonally adjusted annual rate. Last month, they may have been around 15 mln. |

U.S. ISM Manufacturing Employment, August 2020(see more posts on U.S. ISM Manufacturing Employment, ) Source: investing.com - Click to enlarge |

Canada reports its August manufacturing PMI. Another modest gain is expected. The July reading of 52.9 was the highest since January 2019. Mexico sees its August PMI reports. Both the manufacturing and service PMIs are likely to have remained below 50 though small upticks are likely. Mexico also reports July remittances. These are holding up considerably better than anticipated. The worker remittances in H1 20 averaged $3.13 bln a month, nearly 10% above the average from H1 19 (~$2.88 bln).

The US dollar slipped below CAD1.30 for the first time early this year. The greenback has fallen for the past five sessions against the Canadian dollar. The low for the year is about CAD1.2960, and there is little in the way of a test and ultimate break. Initial resistance is now pegged in the CAD1.3020-CAD1.3040 area. The greenback has carved a little shelf near MXN21.74. A convincing break would spur a test on the June low close to MXN21.47. The 200-day moving average is a little above there, and the dollar has not traded below it since early March.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,ECB,EMU,Featured,FOMC,Japan,newsletter,South Korea