Tag Archive: U.S. ISM Manufacturing Employment

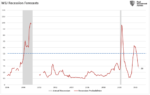

The Institute of Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) Report on Business is based on data compiled from monthly replies to questions asked of purchasing and supply executives in over 400 industrial companies. For each of the indicators measured (New Orders, Backlog of Orders, New Export Orders, Imports, Production, Supplier Deliveries, Inventories, Customers Inventories, Employment, and Prices), this report shows the percentage reporting each response, the net difference between the number of responses in the positive economic direction and the negative economic direction and the diffusion index. Responses are raw data and are never changed. The diffusion index includes the percent of positive responses plus one-half of those responding the same (considered positive). The resulting single index number is then seasonally adjusted to allow for the effects of repetitive intra-year variations resulting primarily from normal differences in weather conditions, various institutional arrangements, and differences attributable to non-moveable holidays. All seasonal adjustment factors are supplied by the U.S. Department of Commerce and are subject annually to relatively minor changes when conditions warrant them. The PMI is a composite index based on the seasonally adjusted diffusion indices for five of the indicators with varying weights: New Orders --30% Production --25% Employment --20% Supplier Deliveries --15% and Inventories -- 10%. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

FX Daily, June 01: CNY Softens after PBOC’s Move; Equities Advance on Stronger World Outlook

The US dollar fell against most major currencies following the PBOC's modest move to reduce the upward pressure on the yuan. Follow-through selling was seen earlier today, and sterling reached a new three-year high. However, the dollar found a bid in the European morning, while the Scandi currencies held on to most of their earlier gains.

Read More »

Read More »

FX Daily, June 1: US Dollar Losses are Extended, but Momentum Stalls in the European Morning

Overview: US stocks extended their gains ahead of the weekend after President Trump shied away from specific actions against China-Hong Kong, and today Hong Kong shares recovered smartly from last week's 3.6% slide. The Hang Seng rose 3.3% today, and the Shanghai Composite gained over 2%. All the markets in the region advanced. Europea's Dow Jones Stoxx 600 was up about 0.5% in late morning turnover, which would be the fifth gain in six sessions. ...

Read More »

Read More »

FX Daily, April 02: Monday Blues

The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is set to start the new quarter about 0.3% lower. Although the subdued price action may not reflect it, there have been several new economic reports and developments.

Read More »

Read More »

FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is evident today, the first trading day of March. The dollar is extending its gains against most currencies but is only managing to consolidate in a narrow range against the yen.

Read More »

Read More »

FX Daily, February 01: Fed’s Hawkish Hold Keeps Dollar Consolidation Intact

The Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of unwinding its balance sheet. Most reckon she has done an admirable job at the Federal Reserve, not only in terms of the economic performance on her watch but also the nimble execution policy.

Read More »

Read More »

FX Daily, January 03: Dollar Stabilizes, but Sees Little Recovery

The US dollar is stabilizing but the tone remains fragile. The euro, which has advanced for five consecutive sessions coming into today is slightly lower. The euro had stalled yesterday as it approached last year's high set in September near $1.2090. Yesterday was also the third consecutive close above the upper Bollinger Band, which is found today near $1.2060.

Read More »

Read More »

FX Daily, December 01: Dollar Consolidates Weekly Gain, while Equities Ease to Start New Month

The release of the manufacturing PMIs confirm that the synchronized global expansion remains intact. The focus today is on three unresolved political challenges: US tax reform, the UK-Irish border and the talks that may produce another grand coalition in Germany. The US dollar is mixed, with the dollar-bloc currencies and Scandis pushing higher.

Read More »

Read More »

FX Daily, November 01: Super 48 Hours

This is it: The next 48 hours will be among the busiest of the year. The Bank of England meets tomorrow, and it not only gives a verdict on interest rates but also provides an update of its economic projections (Quarterly Inflation Report). And, among the innovations, the MPC minutes will be released. Ahead of the Federal Reserve meeting, the market will have the ADP private-sector job estimate.

Read More »

Read More »

FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU manufacturing PMI weighs on the euro. The UK also reported a disappointing manufacturing PMI, and more differences with the Tory government are taking a toll on sterling. Japan's Tankan Survey was stronger than expected, but...

Read More »

Read More »

FX Daily, September 06: Wake Me up when September Ends

The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank's decision. We are concerned that given the strong performance and market positioning, a rate hike could spur "buy the rumor, sell the fact" activity. Alternatively, a disappointment if the Bank does not hike could also lead to some Canadian dollar sales.

Read More »

Read More »

FX Daily, August 01: The Most the Dollar Can Hope for on Turn Around Tuesday is Consolidation

After taking a step lower in the North American session yesterday, the dollar is consolidating today. The euro is holding above $1.18, and the dollar held JPY110.00. Global equities are mostly higher, while bonds are mixed. Asia-Pacific yields were mostly higher, while European rates are a little lower. The US 10-year yield is flat just below 2.30%.

Read More »

Read More »

FX Daily, July 03: Dollar Bounces to Start H2

The beleaguered US dollar is enjoying a respite from the selling pressure that pushed it lower against all the major currencies in the first six months of 2017. A measure of the dollar on a trade-weighted basis fell about 5% in the first half after appreciating nearly 8% in Q4 16.

Read More »

Read More »

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

FX Daily, December 01: Dollar is on the Defensive, though Yields Rise

The US dollar is trading heavily against most of the major currencies, but the general tone appears consolidative in nature. Despite a disappointing UK manufacturing PMI (53.4, a four-month low), sterling is near a three-week high above $1.2600.

Read More »

Read More »