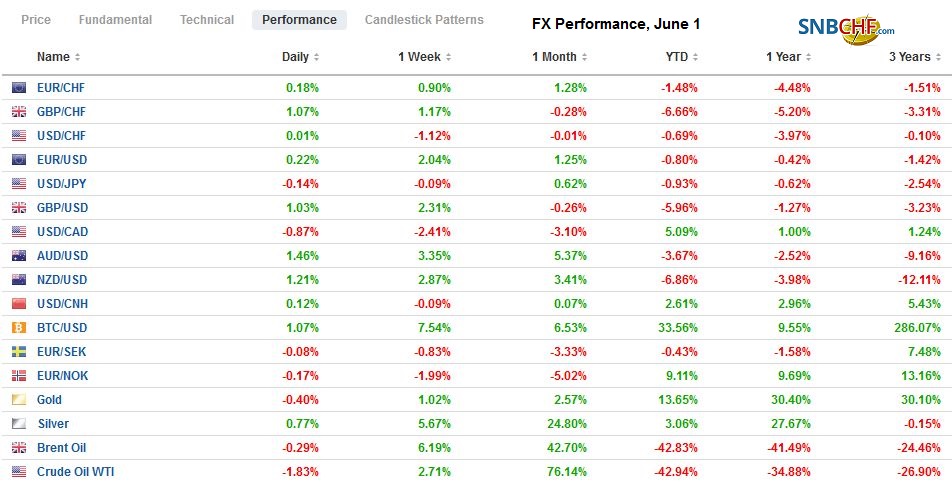

Swiss FrancThe Euro has risen by 0.15% to 1.0689 |

EUR/CHF and USD/CHF, June 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: US stocks extended their gains ahead of the weekend after President Trump shied away from specific actions against China-Hong Kong, and today Hong Kong shares recovered smartly from last week’s 3.6% slide. The Hang Seng rose 3.3% today, and the Shanghai Composite gained over 2%. All the markets in the region advanced. Europea’s Dow Jones Stoxx 600 was up about 0.5% in late morning turnover, which would be the fifth gain in six sessions. US shares are trading with a softer bias, and many link it to the social unrest in many cities that could hinder re-openings. However, the losses are thus far too small to extrapolate to shift in sentiment or drivers. Benchmark 10-year bonds yields have edged 1-3 bp higher, and the US 10-year yield remains pinned near 66 bp. The dollar is weaker, with the Australian dollar leading the majors with a 1% gain. The euro is the weakest of the majors, and it is up about 0.3%. Most emerging market currencies are also gaining on the US dollar. The South Korean won is the strongest, with about a 1% gain. The JP Morgan Emerging Market Currency Index has edged higher. Today’s gain, if sustained, would be the ninth in the past 11 sessions. Gold extended its advance for a third consecutive session but stalled near $1745. Oil is flat, with the July WTI contract around $35.40. |

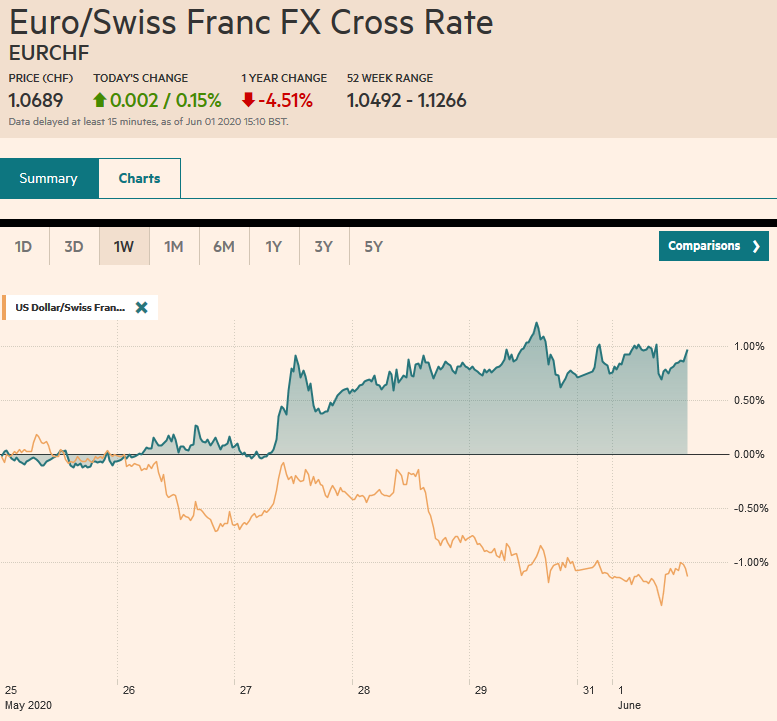

FX Performance, June 1 |

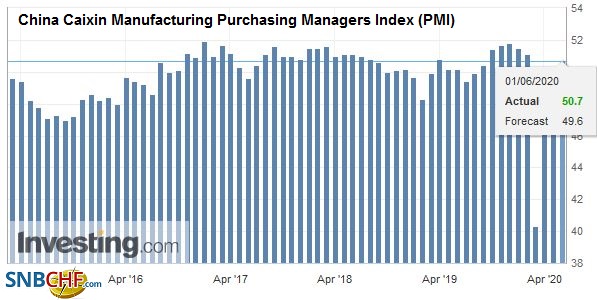

Asia PacificChina’s official PMI disappointed. The composite was unchanged from April (53.4) as the slippage in the manufacturing (50.6 vs. 50.8) offset in full the rise in services (53.6 vs. 53.2). Manufacturing output fell to 52.2 from 53.7, but new orders and new export orders rose but remain below the 50 boom/bust level. Construction, perhaps reflecting local government’s infrastructure push, rose to 60.8 from 59.7. Both the manufacturing and service PMIs showed a rise in business expectations but continued weakness in employment. On the other hand, the more export-oriented Caixin manufacturing PMI rose to 50.7 from 49.4 in April. |

China Caixin Manufacturing Purchasing Managers Index (PMI), May 2020(see more posts on China Caixin Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| Reports indicate that Beijing ordered its large agriculture combines to halt US purchases as the relationship is reviewed. There had been significant inquires into 20-30 cargoes at the end of last week, and China’s imports or US soy and ethanol reportedly increased in the first half of May. Like others, we have been skeptical that China could fulfill its obligations under the Phase 1 agreement. China was to buy $36.5 bln of US farm products 2020 and in Q1 bought roughly $3.35 bln. Despite threats of walking away from the agreement, the US won’t because China’s failure would give it yet another cudgel.

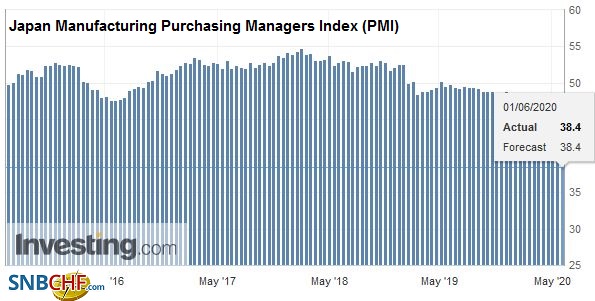

Turnover in Hong Kong dollar options surged before the weekend (~$3.7 bln), according to reports, and a third was struck outside the band. Forward points eased at the end last week and are little changed today, still near the most extreme in a couple of decades. Talk that the peg could change to the Chinese yuan seems exaggerated. Pegging to a currency that is not convertible has its own challenges and could undermine its stability. The peg could be adjusted, but without calmer markets, it seems unduly risky. Hong Kong is a full member of the World Trade Organization, but it is unlikely to deter the US from denying it most favored nation status. The three- and 12-month Hong Kong dollar forward points eased but remain elevated. Broadly, the May PMI readings in the region were mixed. Japan’s was unchanged from the flash reading of 38.4, down from 41.9 in April. South Korea’s slipped to 41.3 from 41.6 in April. After cutting rates last week, South Korea is expected to unveil a third budget (where 3/4 of the funds are expected to be spending in the first three months) later this week. Australia’s manufacturing PMI rose to 44.0 from 42.8 of the flash estimate and 44.1 previously. India’s PMI edged up to 30.8 from 27.4. |

Japan Manufacturing Purchasing Managers Index (PMI), May 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Month-end flows saw the dollar recover ahead of the weekend form JPY107.10 to JPY107.90. It is trading in a narrow range of JPY107.40-JPY107.85 today. There are expiring options on both sides of that range. At JPY107.40 is a $525 mln option, and at JPY107.80 is an $820 mln option. After coiling for most of last week, the Australian jumped higher today, seemingly confirming the breakout. It reached almost $0.6775, more than a cent above last week’s close. This is its best level since late January. At the start of the year, it was above $0.7000. The PBOC set the dollar’s reference rate at CNY7.1316, a little lower than the models suggested and below the previous day’s close. Although the dollar eased against the yuan, it rose against the offshore yuan, fully recovering from its initial loss.

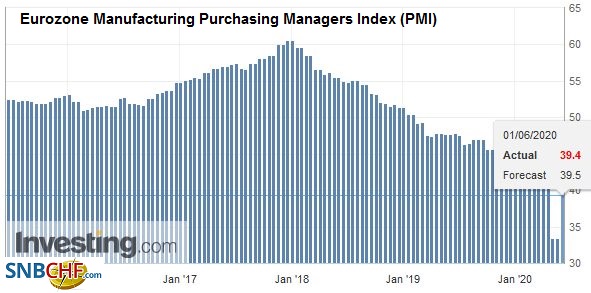

EuropeThe main interest today is the final manufacturing PMI for May. Germany was the source of disappointment. The flash May reading of 36.8 was shaved to 36.6. France’s edged up to 40.6 from 40.3. Italy and Spain rose more than expected. Italy’s rose to 45.4 from 31.1 and Spain’s improved to 38.3 from 30.8. The aggregate reading was 39.4 down from 39.5 of the initial estimate but above the 33.4 final April report. |

Eurozone Manufacturing Purchasing Managers Index (PMI), May 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

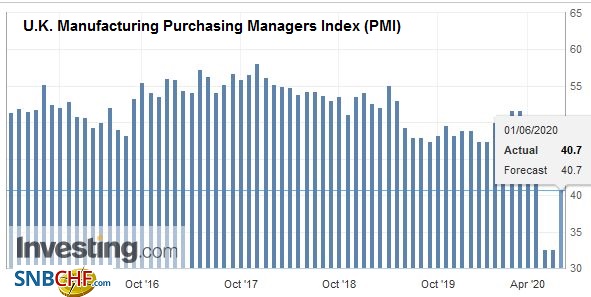

| The UK’s manufacturing PMI edged up to 40.7 from 40.6 of the flash estimate and 32.6 in April. Reports suggest that even though the furlough pay program will taper in Q3, the UK government is looking to provide more stimulus in July. Later this month, the Bank of England is widely expected to increase its bond purchase program. Although Bank of England officials have kept the option on the table, a move to negative interest rates is not likely in the coming months. |

U.K. Manufacturing Purchasing Managers Index (PMI), May 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The euro’s advance extended to a fifth session today with it briefly poking above $1.1150, the best level since late March. The momentum stalled in the European morning, and the euro slipped below $1.1120. There is an option at $1.1100 for 1.7 bln euros that expires today. The proximity of the ECB meeting (Thursday) where it is widely expected to substantially boost its Pandemic Emergency Purchase Progam and could adjust some other policy measures may make short-term participants hesitant about driving the euro much highs. The late March high was just shy of $1.1165, and the $1.12 area is psychologically important. Sterling firmed to about $1.2425. It has not seen this level since May 8. Sterling’s momentum also stalled in Asia, and it drifted lower in the European morning. It could slip back toward the $1.2350 area with changing the tone.

America

Merkel had already rebuffed the US invite for a G7 meeting at the end of the month when the White House suggested that will delay the meeting until September or later. That did not seem to matter as much as getting to suggest that Australia, South Korea, India, and Russia may be invited. It is a thinly-veiled attempt to isolate China while overlooking that Russia had been un-invited following its annexation of Crimea. Trump argues that the G7 no longer “properly represents what is going on in the world.” Indeed, in recent years, the G20 appears to have grown in importance. Separately, although the UK joined Australia, Canada, and the US in condemning China’s move on Hong Kong, the EU itself has been quiet, and Germany, which takes over the rotating EU Presidency starting in July called for a “critical and constructive dialogue.”

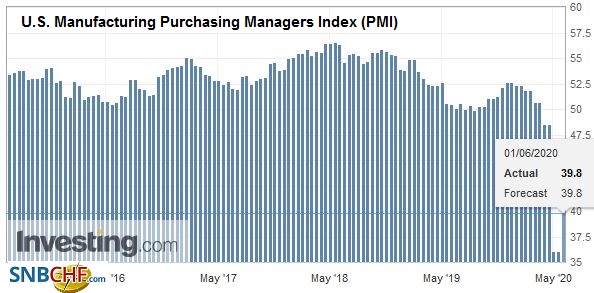

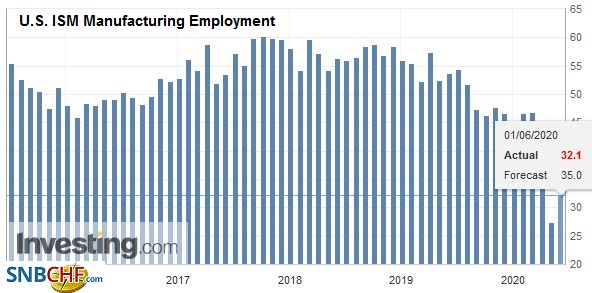

| The US reports the final May manufacturing PMI and the ISM. The take-away is that nearly every survey and sentiment indicator for May ticked up from April. While growth collapsed here in Q2, with the Atlanta Fed putting it at -51.2%, sequential improvement is consistent with a recovery in Q3. Canada also reports May’s manufacturing PMI. It stood at 33.0 in April. The Bank of Canada meets in the middle of the week. It is expected to stand pat and let its past actions take effect. Note that it is Governor Poloz’s last meeting. |

U.S. Manufacturing Purchasing Managers Index (PMI), May 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The data highlight of the week for both the US and Canada will be the jobs report on June 5. Mexico’s manufacturing PMI is also on tap. In April it was at 35.0. Also, watch Mexico’s worker remittances. This is an important source of hard currency for the country. They unexpectedly surged in March to $4.02 bln compared with forecasts for $2.75 bln. The strength of the dollar in March was cited as a factor. The median forecast in the Bloomberg survey calls for a $2.6 bln in April. Worker remittances were about $2.9 bln in April 2019. |

U.S. ISM Manufacturing Employment, May 2020(see more posts on U.S. ISM Manufacturing Employment, ) Source: investing.com - Click to enlarge |

The US dollar slipped below CAD1.3700 in Asia for the first time since March 11. Here too, the greenback’s momentum stalled in late Asia/early Europe, and it has bounced toward CAD1.3740. A close above there could set the stage for a further US dollar recovery tomorrow. On the downside, the next key technical area is near CAD1.3600. The US dollar also slipped through MXN22.00 briefly for the first time since March 16. Nearby resistance is pegged in the MXN22.10-MXN22.20 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,China Caixin Manufacturing PMI,Currency Movement,EUR/CHF,Eurozone Manufacturing PMI,FX Daily,Hong Kong,Japan Manufacturing PMI,newsletter,U.K. Manufacturing PMI,U.S. ISM Manufacturing Employment,U.S. Manufacturing PMI,USD/CHF