Tag Archive: China Caixin Manufacturing PMI

The Chinese HSBC Manufacturing PMI is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as an leading indicator for the whole economy. When the PMI is below 50.0 this indicates that the manufacturing economy is declining and a value above 50.0 indicates an expansion of the manufacturing economy. Flash figures are released approximately 6 business days prior to the end of the month. Final figures overwrite the flash figures upon release and are in turn overwritten as the next Flash is available. The Chinese HSBC Manufacturing PMI is concluded from a monthly survey of about 430 purchasing managers which asks respondents to rate the relative level of business conditions including employment, production, new orders, prices, supplier deliveries, and inventories. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY.

FX Daily, June 01: CNY Softens after PBOC’s Move; Equities Advance on Stronger World Outlook

The US dollar fell against most major currencies following the PBOC's modest move to reduce the upward pressure on the yuan. Follow-through selling was seen earlier today, and sterling reached a new three-year high. However, the dollar found a bid in the European morning, while the Scandi currencies held on to most of their earlier gains.

Read More »

Read More »

FX Daily, June 1: US Dollar Losses are Extended, but Momentum Stalls in the European Morning

Overview: US stocks extended their gains ahead of the weekend after President Trump shied away from specific actions against China-Hong Kong, and today Hong Kong shares recovered smartly from last week's 3.6% slide. The Hang Seng rose 3.3% today, and the Shanghai Composite gained over 2%. All the markets in the region advanced. Europea's Dow Jones Stoxx 600 was up about 0.5% in late morning turnover, which would be the fifth gain in six sessions. ...

Read More »

Read More »

FX Daily, April 1: Hemorrhaging Resumes

Overview: There is no reprieve for investors. Equities are falling sharply. Nearly all the Asia Pacific markets slumped but Australia. Chinese markets fared better than most, but the Nikkei was off 4.5%, and India was down almost as much in late dealings. Europe's Dow Jones Stoxx 600 is off more than 3% near midday, led by a sell-off in banks that are suspending dividends and share buybacks.

Read More »

Read More »

FX Daily, March 2: Central Banks’ Words of Assurance have Short Life

Overview: Comments beginning with Powell before the weekend, and BOJ and BOE earlier today promising support have saw equity markets briefly stabilize after last week's dramatic moves. The G7 will hold a teleconference this week, but speculation of a coordinated rate move does not seem particularly likely. Most of the large stock markets in the Asia Pacific region rallied, led by a 3%+ advance in China.

Read More »

Read More »

FX Daily, January 02: Equities Start New Year with a Pop

Overview: Equities have begun New Year like, well, last year, with most Asia Pacific markets advancing, led by more than 1% gains in China, Hong Kong, and Thailand. Only South Korea and Indonesian markets fell. In Europe, the Dow Jones Stoxx 600 is up almost 1% in late morning turnover. US shares are trading higher as well, and the S&P 500 is up nearly 0.6%.

Read More »

Read More »

FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Overview: An unexpected increase in China's Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain.

Read More »

Read More »

FX Daily, September 30: A Busy Week Begins Quietly

Overview: As the quarter ends, the capital markets are mixed. Equities in Asia Pacific were heavier, except in Hong Kong and Australia, while shares were mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. US shares are trading firmer. Benchmark 10-year bond yields are 2-3 basis points higher, though Australia's bond yield was up seven basis points.

Read More »

Read More »

What Happened Monday

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action.

Read More »

Read More »

FX Daily, July 01: Trade Optimism Meet Reality of Disappointing PMI

Overview: A new tariff truce between the US and China, coupled with the North Korean diplomacy and Russia-Saudi tentative agreement boosted investor confidence and sharp equity rallies. Japanese and Chinese equities rallied 2-3%. Most markets rallied in Asia-Pacific except for South Korea's Kospi and Hong Kong markets were closed as the handover was commemorated.

Read More »

Read More »

FX Daily, April 30: Dollar Pares more Gains as EMU GDP Surprise

Overview: The S&P 500 set a new record high and close yesterday, but the lift to global markets was not strong enough to overcome the disappointing Chinese PMI. Although Chinese equities traded higher on ideas that the news will spur additional stimulative measures, other Asian markets were mixed.

Read More »

Read More »

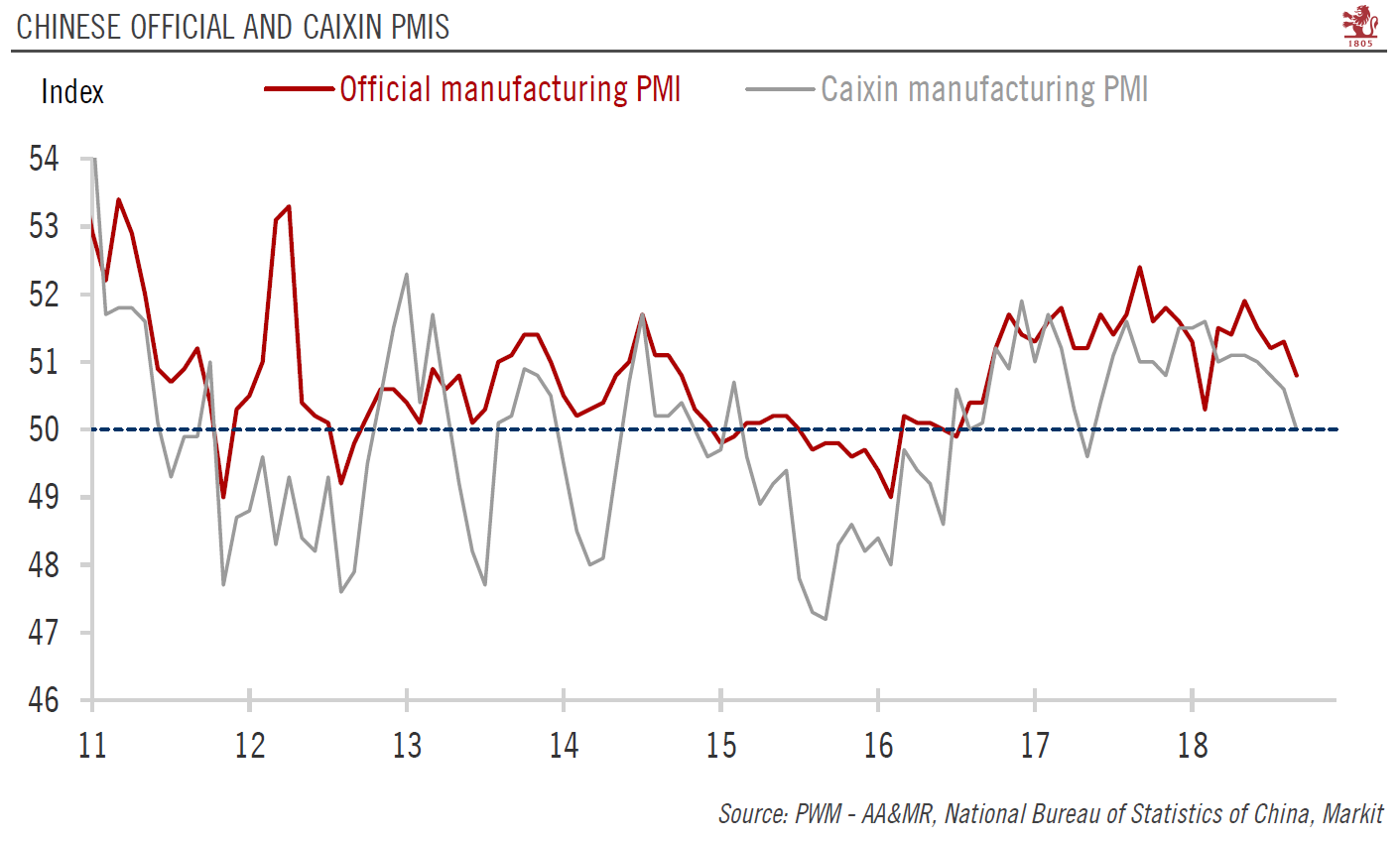

China PMIs jump in March

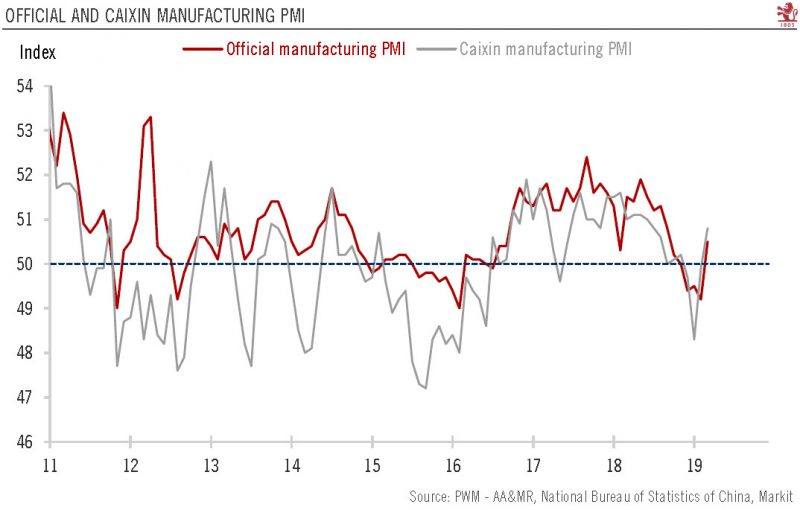

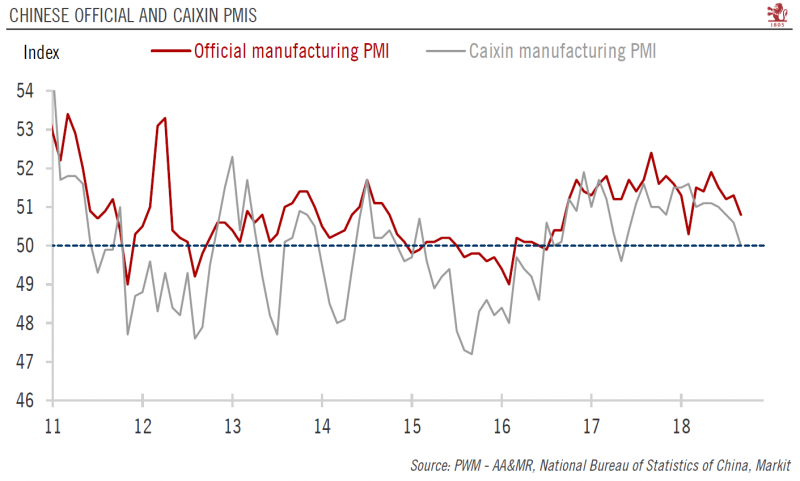

Industrial gauges rebound on seansonality as well as policy easing.Chinese PMI readings moved back into expansion territory in March. The official Chinese manufacturing PMI rose to 50.5, up from 49.2 in February, and beating the Bloomberg consensus of 49.6, while the Caixin manufacturing PMI came in at 50.8, also up from 49.9 in February and beating the consensus expectation of 50.0.

Read More »

Read More »

China’s Global Slump Draws Closer

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity.

Read More »

Read More »

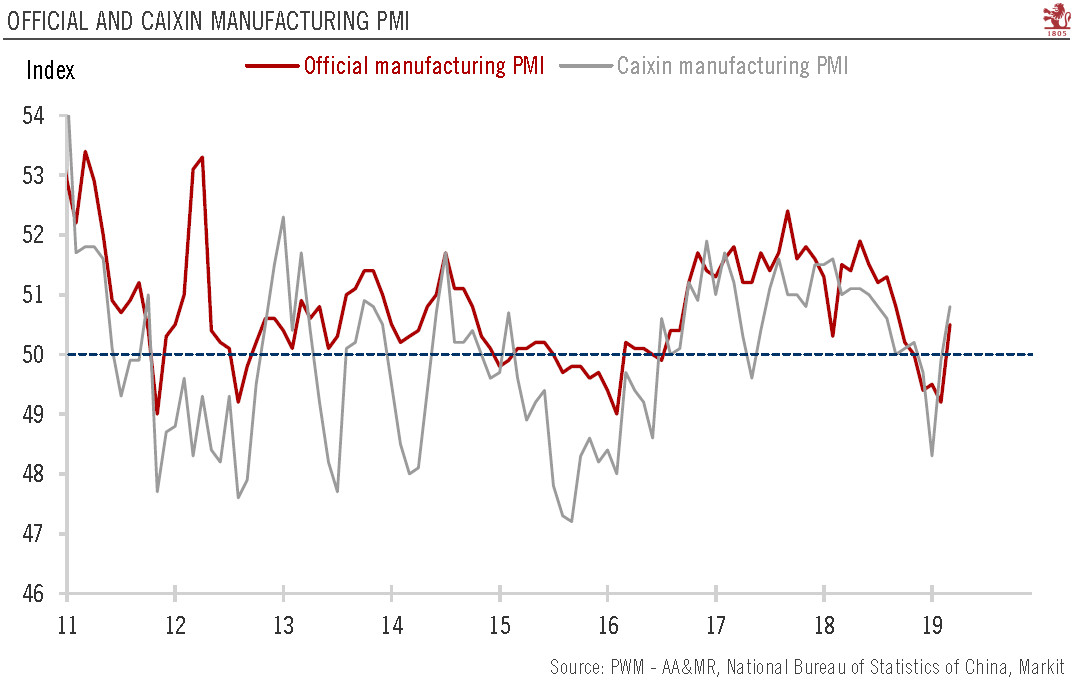

Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4.China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4.In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June.

Read More »

Read More »

FX Daily, June 01: Ironic Twists to End the Tumultuous Week

The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade).

Read More »

Read More »

FX Daily, May 02: Confident Fed Key to New Found Respect for the Dollar

There is a brief respite in the powerful short squeeze that has fueled the dollar's dramatic recovery. The greenback which was nearly friendless a month ago now has many suitors. It is higher on the year against all the major currencies but the yen (~2.6%), the Norwegian krone (~1.6%) and sterling ~0.9%). It is virtually flat against the euro.

Read More »

Read More »

FX Daily, April 02: Monday Blues

The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is set to start the new quarter about 0.3% lower. Although the subdued price action may not reflect it, there have been several new economic reports and developments.

Read More »

Read More »

FX Daily, March 01: USD Snaps 3-Month Slide, Firm Ahead of Powell Part II

The US dollar rebounded last September and October before the downtrend resumed in November, and lasted through January. The dollar gained broadly last month, except against the yen, which rose almost 2.4% in February. This pattern is evident today, the first trading day of March. The dollar is extending its gains against most currencies but is only managing to consolidate in a narrow range against the yen.

Read More »

Read More »

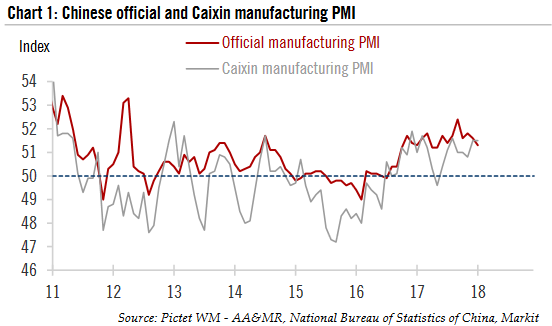

China: PMIs suggest moderation in momentum in Q1

China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1). The official non - manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month.

Read More »

Read More »

FX Daily, February 01: Fed’s Hawkish Hold Keeps Dollar Consolidation Intact

The Yellen Fed ended on a high note. She took over the reins the of Federal Reserve an implemented a strategic normalization process monetary policy, and helped engineer not only the first post-crisis rate hikes but also the beginning of unwinding its balance sheet. Most reckon she has done an admirable job at the Federal Reserve, not only in terms of the economic performance on her watch but also the nimble execution policy.

Read More »

Read More »

FX Daily, January 2: Dollar Slump Accelerates

The US dollar's slump seen in the final two weeks of 2017 is carried into today's activity. The greenback's sell-off extends to the emerging market currencies as well. The Hungarian forint is the strongest rising nearly 1%, ostensibly helped by the euro approaching last year's high. However, our sense that fumes and momentum more than fresh news is pushing the dollar down is illustrated by the Korean won. It has gained nearly 0.9% today even though...

Read More »

Read More »