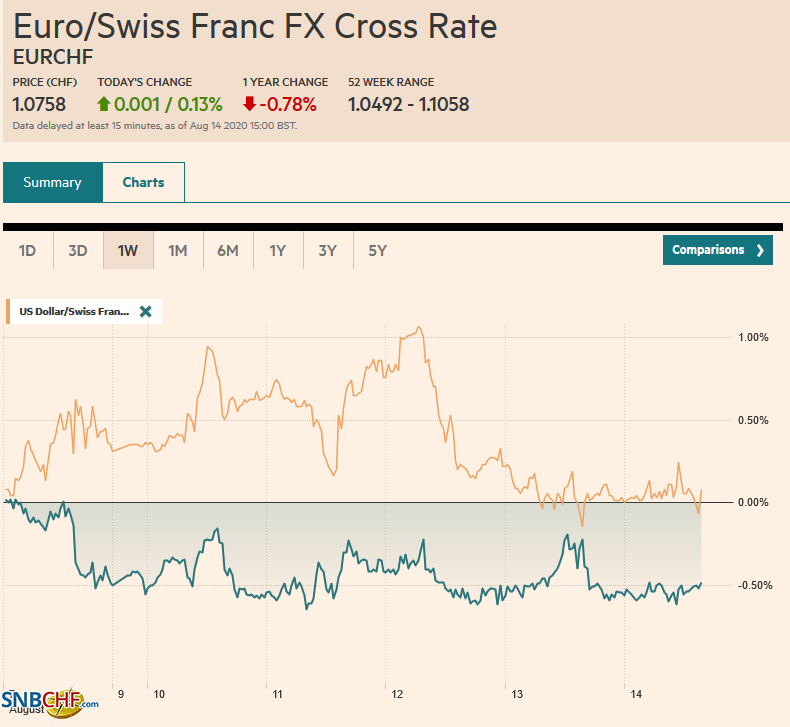

Swiss FrancThe Euro has risen by 0.13% to 1.0758 |

EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The equity rally is stalling ahead of the weekend. Most markets in the Asia Pacific region eased, though China and Australia advanced. Japanese shares were mixed. The Nikkei, though advanced for the fourth consecutive session, while the Topis slipped. European stocks are off more, and once again, the 200-day moving averaging is capping the Dow Jones Stoxx 600. Its 1.6% loss through the European morning, leaves the benchmark up about 0.8% for the week. US shares are trading lower, and the S&P 500’s 0.6% gain for the week coming into today may be at risk. After the Treasury’s sloppy reception of the 30-year bond sale yesterday, the benchmark 10-year yield is pulling back after poking through 70 bp. The rise in US yields seemed to drag Asia Pacific yields higher. In Europe, yields are a little firmer today. The dollar is mixed. The Scandis are leading the weaker currencies as this week’s are pared. Sterling and the yen are posting small gains, while the euro is straddling unchanged levels. Emerging market currencies are mostly lower, and the Turkish lira remains under pressure. The JP Morgan Emerging Market Currency Index is snapping a three-day advance. Gold has stabilized and is trading in a $12 range on either side of $1950, but its nine-week advance has ended. Oil remains firm but within well-worn ranges. The September WTI contract is higher for the second week, but the price action remains largely confined to a $41-$43 range. |

FX Performance, August 14 |

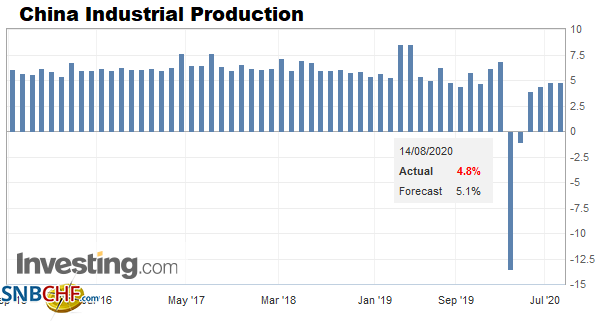

ChinaChina’s July data missed expectations, suggesting the recovery may be stalling. Industrial production rose 4.8% year-over-year. This is the same pace as June, and economists had forecast an advance. |

China Industrial Production YoY, July 2020(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

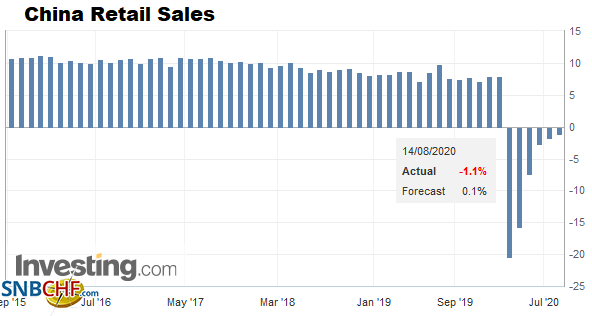

| The more troubling miss was retail sales. Economists had projected a small gain. Instead, retail sales fell 1.1% year-over-year after a 1.8% loss in June. Consumption continues to lag behind output, it would seem. |

China Retail Sales YoY, July 2020(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

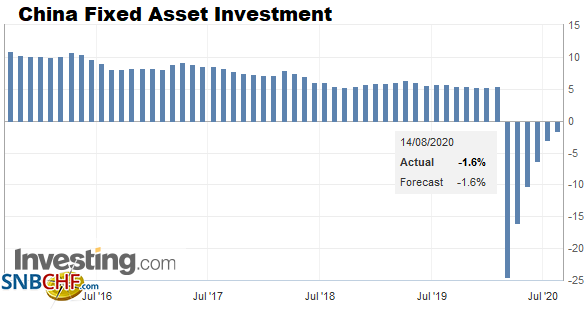

| The improvement of fixed asset investment also suggests progress on the supply side, while demand struggles. This proxy for capex fell 1.6% year-over-year, about half of June’s 3.1% decline. |

China Fixed Asset Investment YoY, July 2020(see more posts on China Fixed Asset Investment, ) Source: investing.com - Click to enlarge |

Governor Lowe of the Reserve Bank of Australia acknowledged that although he would prefer a weaker currency, he is not prepared to intervene and recognizes that the Australian dollar is not overvalued. While refusing to rule out negative policy rates, Lowe continued to suggest it was unlikely. Meanwhile, fresh outbreaks of the virus and beyond Auckland warns that New Zealand is likely to decide next week to postpone the September national election. The Prime Minister’s Labour Party government is running well ahead in the polls.

Japan’s June tertiary index rose more than expected. The 7.9% increase was above the median forecast in the Bloomberg survey for a 6.4% gain. The May figure was revised down to a 2.9% decline instead of 2.1%. Japan is one of the last major countries to report Q2 GDP. It will do so at the start of next week. It is expected to report a 7.5% quarter-over-quarter contraction.

For the third consecutive session, the dollar met sellers as it poked above JPY107. Initial support now is seen near JPY106.45 and then JPY106.00. The greenback’s five-day rally is at risk today. The Australian dollar has been unable to resurface above $0.7200 as its recent gains are consolidated. Although support near $0.7130 is holding, the risk may still be on the downside. There is a A$712 mln option at $0.7100 that expires today. The dollar edged higher against the Chinese yuan for the second day after the PBOC set the reference rate at CNY6.9405, a little softer than the bank models implied. Despite the dollar’s gains today, it is finishing lower for the sixth week in the past seven.

EuropePress stories highlight how an increasing part of Russia-China trade was being settled in euros. On the one hand, this illustrates the success in seeking alternatives to the US dollar. The use of the euro has preceded the EU Recovery Fund, and joint bonds that many have argued will enhance the euro’s international role. However, it also shows that Russia and China’s first alternative, using their own currencies, has largely gone nowhere. |

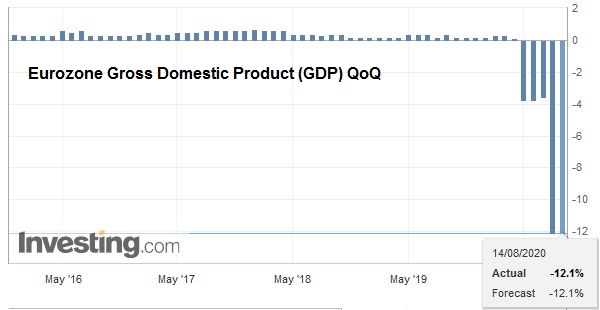

Eurozone Gross Domestic Product (GDP) QoQ, Q2 2020(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| Germany has reported the most new cases of the virus since early May, and France’s head of its Health Agency warned that the situation is deteriorating there. The UK said it will require travelers from France and the Netherlands, as well as four other countries to quarantine. Travel and related stocks were sold. |

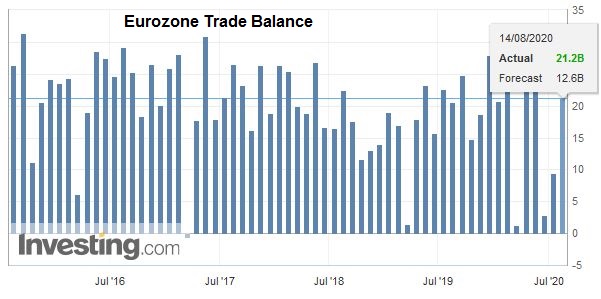

Eurozone Trade Balance, June 2020(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The normalization of Israel and UAE ties surprised observers. Although it has been generally embraced, Palestinians, Iranians, and Turkish officials have been critical. UAE joins Egypt and Jordan, normalizing relations with Israel. Further annexation of the West Bank was halted, but the Israeli Prime Minister Netanyahu said it was “temporary.” Israel’s equity market is closed today. The dollar continues to hover around ILS3.40-ILS3.42 as it has for the last couple of weeks.

The euro peaked near $1.1865 yesterday before falling below $1.18 in late dealings. It is struggling today and has been in a range of about 20-ticks or so around $1.1800. There are a number of expiring options that are nearby. The most important one is for almost 990 mln euros at $1.18. There is another for 1.1 bln euros at $1.1825 and 1.1 bln euros at $1.1750. Just below $1.1790, the euro is essentially flat on the week. Sterling is trading sideways. It has mostly traded with a $1.30-handle this week. It settled last week near $1.3050.

United States

The first two legs of the US quarterly refunding went off without a hitch, but yesterday’s 30-year sale was messy. The difference between how it was trading in the when-issued market and the final sale was about 2 bp, which was most since March. The bid-cover was also the least of the year. Primary dealers had to take almost 20% of the $38 bln that were sold, higher than usual. While some observers explained the sloppy auction on the stronger than expected reads this week on PPI and CPI and the deluge of supply. While it is possible, it also seems that the participants may have been curbed by the anticipation of next week’s 20-year bond sale. There has been concern among some participants that the new long-end issue would sap the demand for the 30-year, which typically does not draw the same kind of interest as the shorter-term maturities.

| There is good reason to believe that China is woefully behind in meeting its trade obligations under the Phase 1 trade agreement. It is supposed to be officially reviewed here in the middle of August, but no date has been set. We argued that if the US were to acknowledge that the emperor was not wearing clothes, it would be compelled to act. It does not appear ready to do so. Therefore, economic advisor Kudlow’s remarks that Lighthizer was “satisfied” with China’s commitment to the trade deal is not surprising and kicks the can down the road, so it does not have to acknowledge what nearly everyone seems to recognize. |

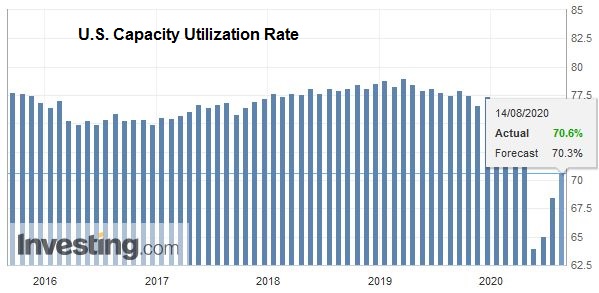

U.S. Capacity Utilization Rate, July 2020(see more posts on U.S. Capacity Utilization Rate, ) Source: investing.com - Click to enlarge |

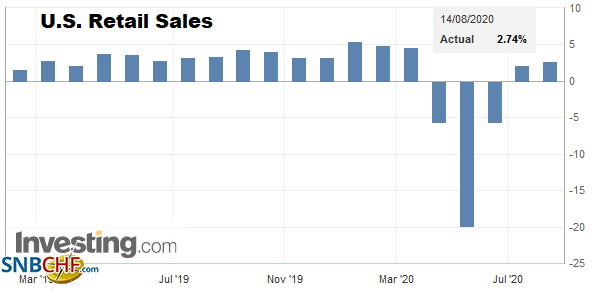

| The US reports July retail sales and industrial production figures today. Both are expected to be firm but moderate considerably from June’s pace. Headline retail sales may slow to around 2% from 7.5%, and the components used for GDP calculations may slow to less than 1% from the 5.6% jump in June. The industrial output may have risen a solid 3% in July after a 5.4% gain previously. Manufacturing is also expected to slow to 3% (from 7.2% in June), but after the dramatic miss on returning workers in the employment report, the risk is on the downside. |

U.S. Retail Sales YoY, July 2020(see more posts on U.S. Retail Sales, ) Source: investing.com - Click to enlarge |

| Canada reports existing home sales. Canada’s housing and auto production appear to be leading the recovery. Any rise after the 63% surge in June is impressive, and economists expect another 20% gain in July. Mexico’s central bank delivered the widely expected 50 bp cut yesterday. The market seems divided on whether there is scope for another cut this year. We think it is, though, it may not be until Q4 by which time price pressures may ease. Currently, Mexican inflation is just above the 3% mid-point of its inflation target range. |

U.S. Industrial Production YoY, July 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

The greenback briefly dipped below CAD1.32 yesterday for the first time since February but is holding above there today. There is a $580 mln option at CAD1.32 that expires today and another for $1.5 bln at CAD1.3250. The US dollar fell each session this week coming into today. It settled last week near CAD1.3380. The US dollar has recorded lower highs against the Mexican peso (so far) this week. It made a new low for the month today near MXN22.12, but the bounced back to MXN22.22. Initial resistance is seen in the MXN22.30 area.The US reports July retail sales and industrial production figures today. Both are expected to be firm but moderate considerably from June’s pace. Headline retail sales may slow to around 2% from 7.5%, and the components used for GDP calculations may slow to less than 1% from the 5.6% jump in June. The industrial output may have risen a solid 3% in July after a 5.4% gain previously. Manufacturing is also expected to slow to 3% (from 7.2% in June), but after the dramatic miss on returning workers in the employment report, the risk is on the downside.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,China Fixed Asset Investment,China Industrial Production,China Retail Sales,Currency Movement,EUR/CHF,Featured,Israel,newsletter,RBA,U.S. Retail Sales,USD/CHF