Swiss FrancThe Euro has fallen by 0.29% to 1.0774 |

EUR/CHF and USD/CHF, August 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The poor price action on Tuesday in the S&P 500 was shrugged off, and new highs for the recovery were made as the record high nears. The dollar, on the other hand, seemed to find plenty of sellers against most of the major currencies. The yen was a notable exception. The dollar traded above JPY107 for the first time nearly three weeks yesterday, but could not sustain the move today. The yen is also trading at new lows for the year against the euro. The soft yen gave Japanese shares a boost. Most markets in the region rose except Hong Kong and Australia. The MSCI Asia Pacific Index made new six-month highs today. European shares are slightly lower, and US stocks are flat. Bond yields are a little lower across the board, with the US 10-year pulling back three basis points to around 0.65%. New Zealand’s benchmark 10-year yield fell nine basis points following yesterday’s decision to expand its bond purchases. The dollar is on its back foot, slipping against all the major currencies but the New Zealand dollar. The euro, which tested support in front of $1.17 yesterday, is knocking on $1.1840, highs for the week. Among emerging market currencies, the Turkish lira remains under pressure as the government’s defense has crumbled. Gold is firm, but below yesterday’s $1950 high. Light sweet crude for September delivery is flat near $42.75. Last week’s high was around $43.50, where the 200-day moving average is found. |

FX Performance, August 13 |

Asia Pacific

The New Zealand dollar proved resilient to the central bank’s decisions to boost its bond purchases and threaten negative yield and buying foreign bonds if necessary. After falling to one-month lows near $0.6525, the Kiwi recovered to $0.6600 in the North American morning before consolidating. It found support near $0.6560 today. A decision will be made after the weekend about the election scheduled for September 19. The development of the outbreak and length of the needed lockdown will be better understood. Prime Minister Arden and the governing Labour Party is widely expected to win the election and is ahead in recent polls 55%-28% over the National Party. A decision to postpone the vote would have the National Party’s support. The leader suggested a new date in November or even next year would be acceptable. Ostensibly, it would give the National Party time to muster a stronger campaign.

Australia created 114.7k jobs in July, half the revised 228.4k in June (210.8k initially). The unemployment rate edged up to 7.5% from 7.4% as the participation rate jumped to 64.7% from 64.1%. The median forecast in the Bloomberg survey called for an increase of 30k jobs, and in the actual report, the full-time positions rose by 43.5k after falling a revised 23.6k in June. Part-time employment rose by 71.2k after a 252k revised increase previously. The full impact of the outbreak and lockdown in Victoria will likely be seen in next month’s report.

The People’s Bank of China is one of the few major central banks that has not engaged in long-term asset purchases associated with quantitative easing. However, a small item in its balance sheet caught analysts’ attention, and some argue this could represent bond purchases by the PBOC. More data due tomorrow may shed light on it. A category of sovereign bond ownership that includes central banks and clearing houses rose about CNY18 bln to CNY1.78 trillion ($256 bln) in July. While this could be PBOC helping to facilitate smooth auctions, we are skeptical. The amount is too small to be of policy significance. We are more persuaded by suggestions that it is likely the result of a foreign central bank buying Chinese bonds through its currency swap arrangement with the PBOC. China’s 10-year bond yields 2.94%.

The dollar is about a 35-tick range against the Japanese yen, holding below JPY107.00. There are two expiring options to note. The first is for about $890 mln at JPY106.70, and the other is for $850 mln at JPY107.00. Initial support is seen near JPY106.40. The Australian dollar approached the high for the week (~$0.7190), but demand fizzled, leaving it flat near $0.7165. Nearby support is pegged near $0.7140. The New Zealand dollar is trading within the ranges seen yesterday, but look for a retest on the low its saw near $0.6525. The greenback fell to new five-month lows against the Chinese yuan (~CNY6.9310) but bounced to CNY6.9455 to snap a three-day fall. The PBOC set the dollar’s reference rate at CNY6.9429, in line with expectations.

EuropeThe US shifted some of its $7.5 bln tariffs on European goods for retaliation against the subsidies for Airbus that the WTO ruled were illegal. It appears that some UK and Greek goods were removed from the list of goods and were added to Germany and France. Jams and knives were now subject to 25% tariffs. UK biscuits and gin were given a reprieve, though the tariff on other UK alcohol remained. We have noted since US actions began that the other shoe has yet to drop. That shoe is that charges that Boeing received illegal subsidies from the US are making their way through the WTO process, and a decision could be issued as early as next month. |

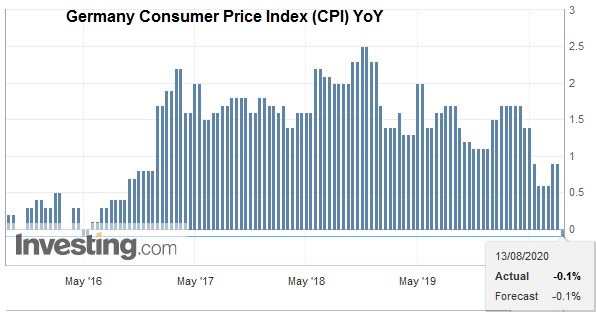

Germany Consumer Price Index (CPI) YoY, July 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

Italy successfully sold 30-year bonds today at 1.91%, a plump yield compared with other bonds of that maturity in Europe. Spanish and Portuguese yields for that tenor are a little below 1.1%. Italy raised 1.25 bln euros for bonds that mature in 2050.

The euro is trading at its best levels for the week, having bounced smartly yesterday from the week’s lows near $1.1710. If $1.17 is the lower end of the range, the $1.1900 area represents the upper-end. The buying in Europe has left the intraday momentum indicators stretched. Initial support is seen near $1.1825, where an option for about 635 mln euros expires today. Note that a 1.5 bln euro option at $1.1900 expires tomorrow. Sterling held support near $1.30 yesterday and is pushing toward $1.31 today. An option for GBP750 mln at $1.30 will roll-off today. The week’s high was set around $1.3130, and that may be too far for today as the momentum stalls in late-morning turnover in Europe.

America

The median forecast calls for another small decline in weekly jobless claims to 1.1 mln from almost 1.19 mln. It still seems unreasonable high given that the economy appears to be expanding at a 14%-20% annualized clip. A disappointing increase would likely spur dollar sales, and an unwind of some of this week’s increase in yields. The executive order on the federal unemployment insurance has not been implemented yet, and that may have discouraged new applications. Despite a solid reception to the US 10-year note sale, the yield rose three basis points to 67.5 bp. It was the fourth consecutive increase, but that streak is set to end today.

After the markets close today, the Fed makes its weekly report. Recall that its balance sheet peaked two months ago and has fallen in six of the past eight weeks for a cumulative decline of about $223 bln. During the same eight week run, the ECB’s balance sheet has grown by around 755 bln euros. The euro has appreciated against the dollar for the last seven consecutive weeks.

Mexico’s central bank is widely expected to cut the overnight rate from 50 bp to 4.50%. The rate stood at 7.25% in January. Banxico cut rates at five consecutive meetings through June before standing pat in July. Headline CPI has risen to about 3.6% from 2.15% in April, but real and nominal rates remain relatively high. The peso has appreciated by a little more than 8% over the past three months, leaving it down roughly 15.4% for the year. Assuming a 50 bp cut is delivered today, we suspect there is scope for another 50 bp cut in Q4.

The greenback has slipped to new six-month lows against the Canadian dollar near CAD1.3220. The low for the year was set in early January just below CAD1.2960. The CAD1.3260 area may offer the nearby cap today. Rising equities and firm oil prices. Note that Canada’s two-year yield near 30 bp is almost twice the US yield. The US dollar is coiling in tight ranges against the Mexican peso. The MXN22.25-MXN22.55 has confined the greenback this week is within a narrower MXN22.30-MXN22.40 range now. It has been recording lower highs for the past six sessions.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australia,Currency Movement,EUR/CHF,Featured,New Zealand,newsletter,USD/CHF