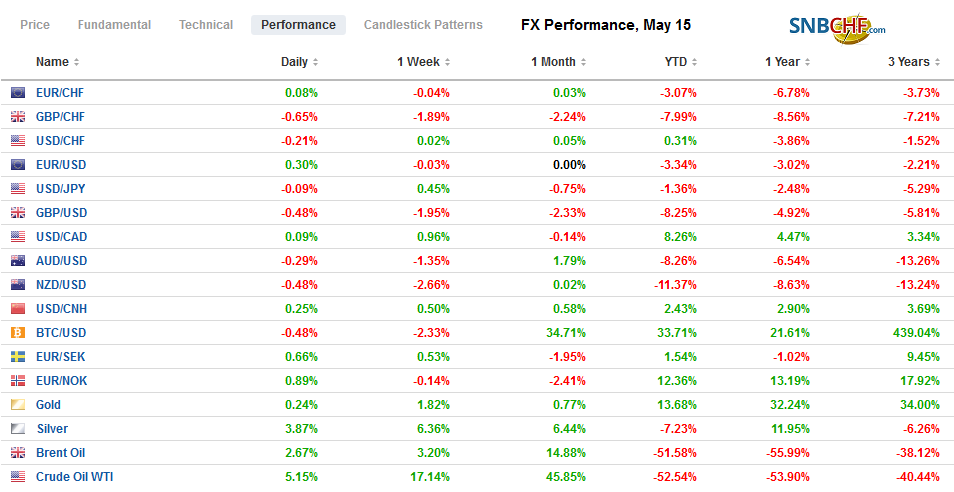

Swiss FrancThe Euro has risen by 0.10% to 1.0522 |

EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week’s losses. Australia’s 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week. The Dow Jones Stoxx 600 is up around 1% to pare this week’s loss to about 3.2%. US stocks are firm and look poised to extend yesterday’s recovery. Benchmark 10-year yields are a little softer in most of Europe, and at 61 bp, the US 10-year Treasury yield is off nine basis points this week, the most among the G7 countries. The dollar is narrowly mixed, and for the week, only the Norwegian krone of the majors is higher on the week. Among emerging markets currencies today, Eastern and Central Europe are outperforming Asia Pacific. For the week, the Turkish lira is the strongest currency, advancing nearly 2.5% to snap a four-week slide. The JP Morgan Emerging Market Currency Index is off almost 0.5% for the week, its first decline in three weeks. Gold is approaching the mid-April high around $1747.50 for a nearly two percent gain on the week. July WTI edged to $29, its highest level since April 20 before consolidating. This is the third weekly gain, during which time the price of WTI has risen by nearly a third. |

FX Performance, May 15 |

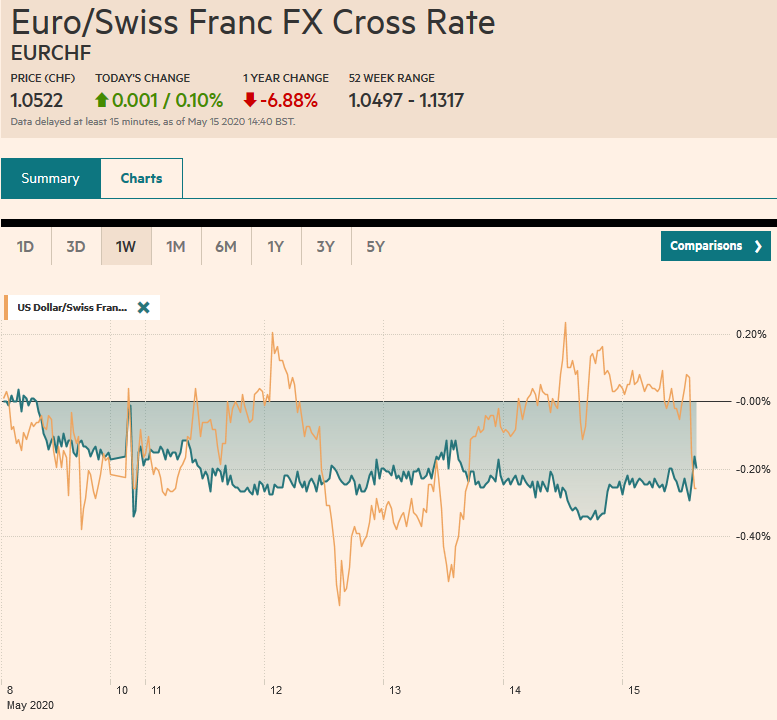

Asia PacificChina’s April data shows a recovery is taking hold, though consumption is lagging behind output. Retail sales fell 7.5% year-over-year in April, which was worse than expected, but better than the 15.8% decline in March. Industrial production rose 3.9% from a year ago after contracted 1.1% in March. |

China Industrial Production YoY, April 2020(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

| It was more than twice the gain median forecasts projected in the Bloomberg survey. Fixed investment was off 10.3% in April from a year ago, following a little more than a 16% slide in March. Surveyed joblessness rose to 6% from 5.9%. After next week’s National People’s Congress session, additional monetary and fiscal stimulus is expected. |

China Retail Sales YoY, April 2020(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

| Early Monday in Tokyo, Japan will report Q1 GDP. Economists expect a little more than a 1% contraction for the quarter and a 4.5% annualized rate. In Q4 19, the world’s third-largest economy shrank by 1.8% (-7.1% annualized). The current quarter will be the third consecutive decline in output, and a contraction of more than 5% (21.5% annualized) is expected. 2 |

China Fixed Asset Investment YoY, April 2020(see more posts on China Fixed Asset Investment, ) Source: investing.com - Click to enlarge |

The dollar has remained in the range set on Monday (~JPY106.40-JPY107.75). It has spent most of the recent session a tighter JPY106.80-JPY107.20. There are $2.4 bln in options expiring today struck at JPY107.00. The Australian dollar remains resilient. Yesterday, it did fall below the 20-day moving average but recovered to settle above it (~$0.6435). It has not closed below it since early April. Resistance is being encountered in the $0.6475 area. The dollar has edged higher for the third session against the Chinese yuan and is fraying the CNY7.10 level, the upper end of its month-long range. On the week, it is up about 0.4%.

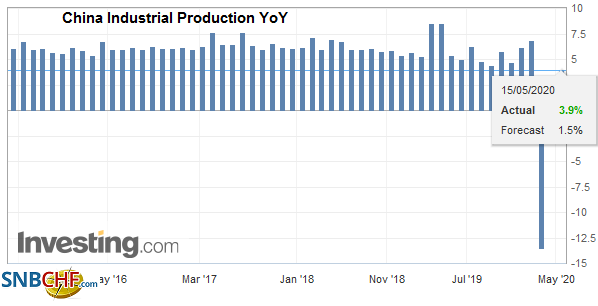

EuropeGerman Q1 GDP was spot on expectations with a 2.2% quarter-over-quarter decline. The surprise came as Q4 19 was revised to show a small contraction (-0.1%), underscoring the economic weakness as a pre-existing condition before the virus outbreak. It has freed itself from the self-imposed debt constraints, and its fiscal efforts are estimated to be around 7.5% of GDP, though this includes loan guarantees as well as spending commitments. |

Germany Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on Germany Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| It does support the idea of a “K” bottom, whereby some countries, with the fiscal space, can emerge stronger, and perhaps earlier than others. The flash PMIs next week are expected to show some improvement sequentially. |

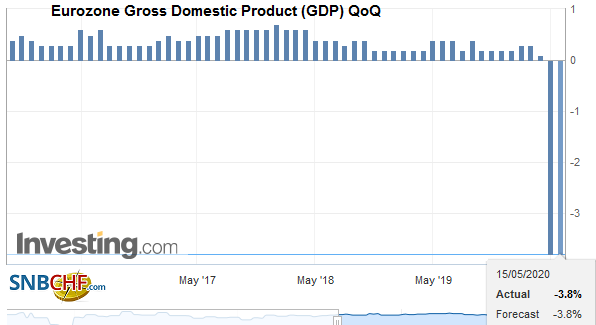

Eurozone Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| The latest round of UK-EU trade talks ends today. Little progress has been reported. The EU has rejected London’s proposal to place testing and certification activities for autos, chemicals, and pharmaceuticals in the UK. Disputes over fisheries and judiciary have not been resolved. There are rising frustrations on both sides. There will be another round of talks before the senior politicians meet again. Prime Minister Johnson has threatened to walk away from the negotiations if progress is not made by mid-year. It is difficult to see an alternative to a disruptive outcome. Separately, the UK is in trade talks with the US and Japan. |

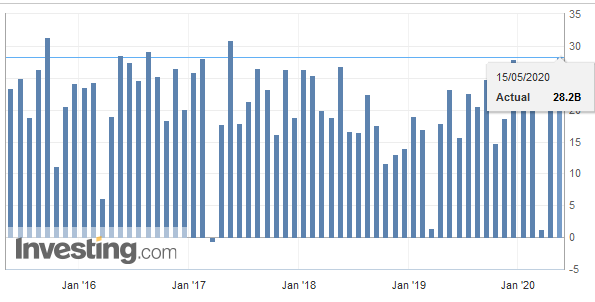

Eurozone Trade Balance, March 2020(see more posts on Eurozone Trade Balance, ) Source: investing.com - Click to enlarge |

The euro is in a little more than a quarter of cent range today below $1.0820. There are nearly 570 mln euro options at $1.08 that is set to expire today. It finished last week around $1.0840. The high for the week was just shy of $1.09, and the low was set yesterday near $1.0775. Sterling matched its lowest level since March yesterday, near $1.2165. It recovered to $1.2240 today, where it was greeted with fresh sales. A close above $1.2250 would help stabilize the tone, but there is an option there that expires today for around GBP255 bln that may help prevent it.

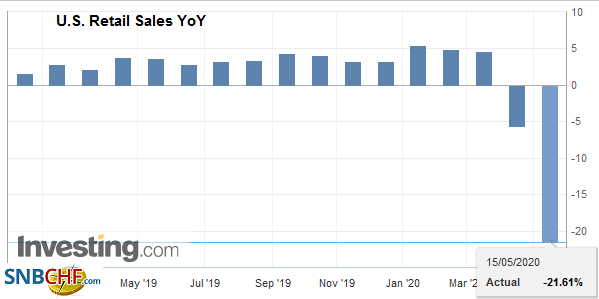

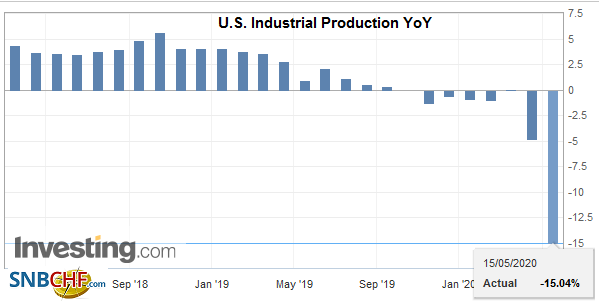

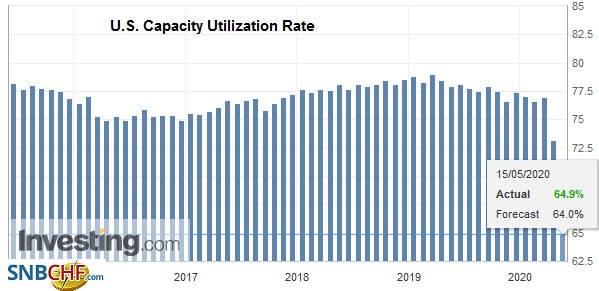

AmericaThe US reports April retail sales and industrial production figures today. Significant declines are widely anticipated. The median forecasts in the Bloomberg survey have fallen in recent days, and both are now expected to fall 12%. It seems unreasonable to expect that investors respond much to the news, leading to seeming anomalies with the equity markets. |

U.S. Retail Sales YoY, April 2020(see more posts on U.S. Retail Sales, ) Source: investing.com - Click to enlarge |

| More importantly, outside of the weekly jobless claims, where yesterday’s report has been distorted by a data entry error (~270k more initial claims) and a distortion caused by California’s every two-week filing rather than weekly as other states, the first indicator for May is due. It is the Empire State manufacturing survey. It may provide the first confirmation that the economy is bottoming. It is expected to rise to -60 from the record low of -78. During the worst of the Great Financial Crisis, it fell to -34.3. |

U.S. Industrial Production YoY, April 2020(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

| There have been many claims about the US lack of manufacturing. This is simply not true. The US is the world’s second-largest manufacturer behind China. Before last year’s slump, it was at record levels. Many times, observers confuse employment in the sector with output. Employment has been in a secular downtrend, but this is a function of rising productivity. Others bemoan that is accounts for a shrinking share of GDP. That is true, but that reflects the growth of the output in services. The US imports about 15% of GDP, meaning the other 85% is produced domestically. With US government assistance, Taiwan Semiconductor announced it will build a $12 bln facility in Arizona that will employ 1600 people is a talking point today as it touches many issues, including re-on-shoring, and building to get inside the threatened US protectionist walls. |

U.S. Capacity Utilization Rate, April 2020(see more posts on U.S. Capacity Utilization Rate, ) Source: investing.com - Click to enlarge |

The Federal Reserve purchased a little more than $300 mln of corporate ETFs on the first day of the facility’s operation. It was a component of the increase (of almost $213 bln) in the Fed’s balance sheet to $6.93 trillion. Separately, the Fed reported that foreign central banks added about $21.2 bln to their Treasury holdings for which it provides custody services. It is the fifth week in a row that the central banks are replenishing their holdings of Treasuries that were liquidated in the March and early April mayhem. During a five-week stretch, they sold about $154 bln in Treasuries.

The US dollar is little changed against the Canadian dollar (~CAD1.4065) as the North American session is about to begin. There is a relatively large option (~$775 mln) at CAD1.4085 that expires today. Risk appetites (S&P 500 proxy) may be the key to how the Canadian dollar finishes the week. The pullback in equities this week is helping the greenback snap a two-week decline against the Loonie. In the broad picture, the US dollar is consolidating in a narrowing range around CAD1.40. The Mexican peso showed little reaction to the widely anticipated central bank’s decision to cut rates by 50 bp for the third time. At 5.50%, its target rate is still high in both nominal and real terms. The greenback is trading with a heavier bias against the peso for the third session. However, it settled last week near MXN23.65, and it is finding support now ahead of MXN23.70. It has also been broadly consolidating for the past month around MXN24.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China Fixed Asset Investment,China Industrial Production,China Retail Sales,Currency Movement,EUR/CHF,Eurozone Gross Domestic Product,Eurozone Gross Domestic Product QoQ,Eurozone Trade Balance,FX Daily,Germany,Germany Gross Domestic Product,manufacturing,newsletter,U.S. Capacity Utilization Rate,U.S. Industrial Production,U.S. Retail Sales,USD/CHF