| After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp (see full Goldman preview here), while the BOJ, BOE and SNB all remain on hold.

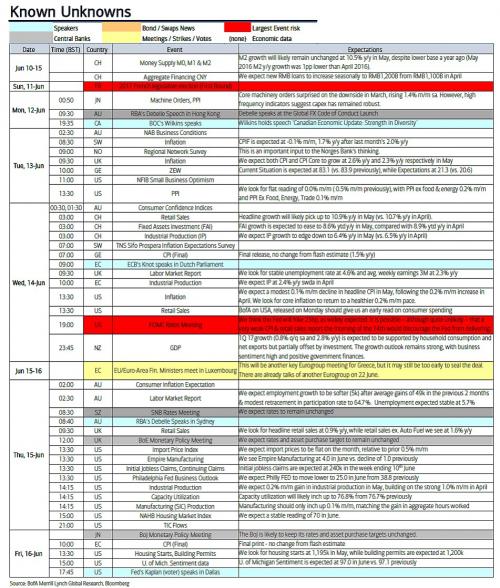

Courtesy of BofA, here is the breakdown of key events:

After the eventful UK election, and less than eventful ECB meeting, the week ahead is a busy one, opening with the first round of the French parliamentary elections and with a plethora of data releases and central bank decisions to keep markets occupied. Another important Eurogroup meeting for Greece rounds out a full schedule. The FOMC meeting will be the main event of the week, where the Fed will deliver a 25 bps rate hike, in line with market expectations. While very weak retail sales or CPI could dissuade the Fed, this remains a very unlikely scenario absent a collapse in Wednesday’s CPI print. BofA expects lower inflation and growth forecasts, while the dots will show 3 hikes in 2018 and 3.25 hikes in 2019. The press conference will likely be focused on balance sheet normalization and implementation timing.

The BoJ is likely to keep its rates and asset purchase targets unchanged, with focus still on potential changes to the “around JPY80tn” guideline for the pace of JGB purchases, which will stay for now. The BoJ will be inclined to send a dovish message, differentiating itself from the Fed and ECB. In the UK, although data since the last meeting justifies a more dovish tone, there will also most likely be no change in policy from the BoE. BofA again expects no change in policy from the SNB. They will likely remain consistent with previous statements, emphasizing persistent overvaluation of the CHF and reinforcing their readiness to intervene in FX or take further action if necessary.

There will be monetary policy meetings in Russia, Turkey, Indonesia and Chile. We forecast Russia CBR to cut the monetary policy rate by another 50bp.

A busy week ahead in the US, with retail sales, CPI, industrial & manufacturing production, housing data and Philly FED, all in addition of the key FOMC meeting. In the Eurozone, we have final inflation prints and industrial production, as well as the first round of the French legislative election is held on Sunday. In the UK, another important week ahead after the eventful General election. We have a BoE meeting, labor market report, CPI and retail sales on the schedule. In Japan and Switzerland the main event will be the BoJ and SNB decisions respectively. In Australia, focus centers on the labor market report, with business and consumer sentiment also released. In New Zealand, 1Q GDP is coming up. |

|

Below is the breakdown of key events by day, courtesy of DB’s Jim Reid:

Here is a somewhat more organized list courtesy of Goldman:

|

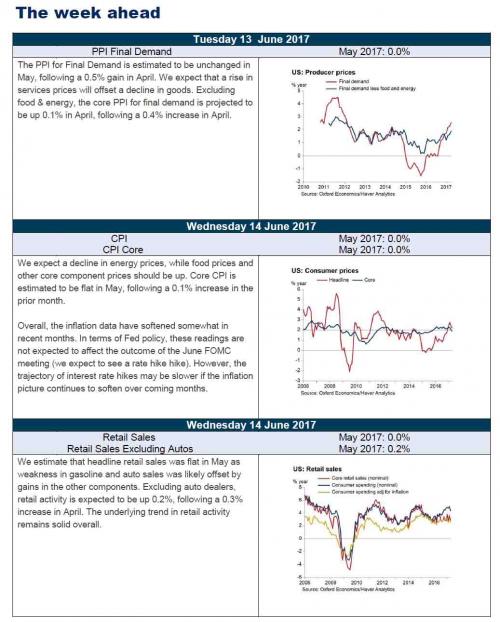

U.S. Producer Prices, U.S. Consumer Prices and U.S. Retail Sales, 2017(see more posts on U.S. Consumer Price Index, U.S. Core Consumer Price Index, U.S. Producer Price Index, U.S. Retail Sales, ) |

|

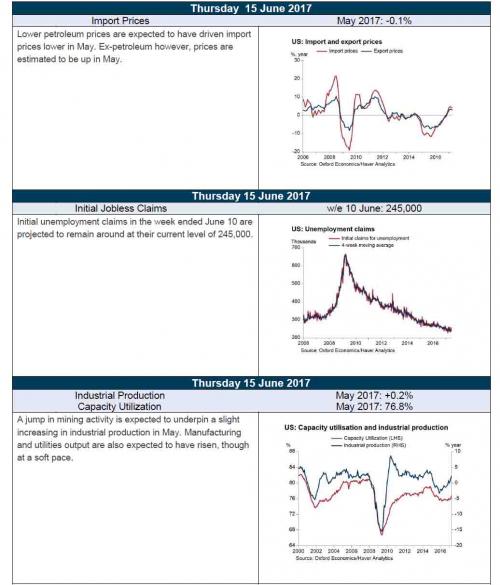

U.S. Import/Export Prices, U.S. Unemployment Claims, U.S. Industrial Production/Capacity Utilization, 2017(see more posts on U.S. Capacity Utilization, U.S. Industrial Production (ZH), U.S. Initial Jobless Claims, ) |

Looking at just the US, here is Oxford Economics’ visual breakdown of the key events: |

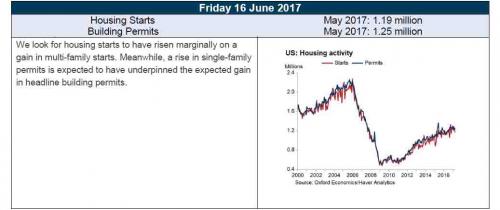

U.S. Housing Activity, 2017(see more posts on U.S. Housing Starts, ) |

Finally, here is Goldman with the full breakdown of events just in the US, together with consensus expectations:

The key economic releases this week are the Consumer Price Index and retail sales reports on Wednesday. The June FOMC statement will be released on Wednesday at 2PM.

Monday, June 12

- 02:00 PM Monthly budget statement, May (consensus -$87.0bn, last -$52.5bn)

Tuesday, June 13

- 08:30 AM PPI final demand, May (GS flat, consensus flat, last +0.5%); PPI ex-food and energy, May (GS +0.2%, consensus +0.2%, last +0.4%); PPI ex-food, energy, and trade, May (GS +0.1%, consensus +0.2%, last +0.7%): We estimate that headline PPI was unchanged in May, reflecting a modest rise in core producer prices offsetting a decline in energy prices. We estimate PPI ex-food, energy, and trade services rose by 0.1%, but we expect a somewhat firmer 0.2% increase in the ex-food and energy measure, reflecting sequentially improving retail margins.

Wednesday, June 14

- 08:30 AM CPI (mom), May (GS -0.05%, consensus flat, last +0.2%); Core CPI (mom), May (GS +0.15%, consensus +0.2%, last +0.1%); CPI (yoy), May (GS +2.0%, consensus +2.0%, last +2.2%); Core CPI (yoy), May (GS +1.8%, consensus +1.9%, last +1.9%): We expect a 0.15% increase in May core CPI, a reacceleration from the weak readings of the prior two months, but not enough to prevent the year-over-year rate from declining further (to +1.8% from +1.9% in April). Our forecast reflects several cross-currents. On the positive side, we note scope for a rebound in apparel and physician services prices, as well as a sequentially smaller drag from communications and pharmaceuticals where we expect a waning impact from disinflationary product launches. Notably, we expect a pause in telecom-related disinflation after three months of sizable drops: Verizon and AT&T (both covered by Brett Feldman) have both announced another round of new plan features, but they were not introduced until early June. On the negative side, we expect additional weakness in used car and shelter inflation, reflecting some further deterioration in industry pricing data in both categories. We estimate a 0.05% drop in headline CPI, reflecting rising food prices, but a sharp drop in energy prices. This would be consistent with the year-over-year rate slowing by two-tenths to 2.0%.

- 08:30 AM Retail sales, May (GS -0.1%, consensus +0.1%, last +0.4%); Retail sales ex-auto, May (GS flat, consensus +0.1%, last +0.3%); Retail sales ex-auto & gas, May (GS +0.2%, consensus +0.3%, last +0.3%); Core retail sales, May (GS +0.2%, consensus +0.3%, last +0.2%): We estimate core retail sales (ex-autos, gasoline, and building materials) rose 0.2% in May, reflecting a disappointing rebound in mall-based discretionary categories following weaker-than-expected results in the first four months of the year. We also estimate a 0.2% increase in the ex-auto ex-gas component, though we note the possibility that weaker April housing trends could weigh on sales in the building materials category. We estimate a flat reading in the ex-auto component and a 0.1% drop in the headline measure, reflecting an 8% pullback in seasonally adjusted gas prices.

- 10:00 AM Business inventories, April (consensus -0.1%, last +0.2%)

- 2:00 PM FOMC statement, June 14-15 meeting: As discussed in our FOMC preview, another rate increase from the FOMC next week is now extremely likely and market attention will likely focus on the implications for the policy outlook, as recent data has sharpened the dilemma that the two sides of the mandate are sending increasingly different signals. The statement will likely characterize economic activity as picking up, but recognize that inflation slowed since earlier this year. While we expect the FOMC to lower its estimate of the structural unemployment rate by one-tenth next week, the new data still have broadly offsetting implications for the policy outlook in standard Taylor rules, and we expect the “dot plot” to show relatively stable funds rate projections. We see a signal of heightened inflation concern as the main dovish risk and an upgrade of the balance of risks as the main hawkish risk. The press conference should provide some clarity on whether the next tightening step after June will be balance sheet normalization or a third funds rate hike. We expect balance sheet adjustment to start in September and the Fed hiking cycle to resume in December. With respect to the balance sheet, we assume initial caps on the amounts of securities that can run off in any given month of $10bn for UST and $5 billion for MBS, that rise over four quarters to caps of $40 billion and $20 billion, respectively.

Thursday, June 15

- 08:30 AM Philadelphia Fed manufacturing index, June (GS +28.0, consensus +25.0, last +38.8): We estimate the Philadelphia Fed manufacturing index fell 10.8pt to 28.0 in June. In the May report, the headline index rose by 16.8pt to +38.8, though the sub-components were a bit less strong. We expect the index to retrench from elevated levels, but likely to levels still consistent with a solid pace of expansion in manufacturing activity, given encouraging industrial company results and commentary.

- 08:30 AM Empire State manufacturing index, June (consensus +5.0, last -1.0); 08:30 AM Import price index, May (consensus flat, last +0.5%); 08:30 AM Initial jobless claims, week ended June 10 (GS 245k, consensus 241k, last 245k); Continuing jobless claims, week ended June 3 (consensus 1,920k, last 1,917k): We estimate initial jobless claims were unchanged at 245k in the week ended June 10. Claims fell 10k to 245k in the previous week to a level somewhat above consensus expectations, possibly boosted by seasonal adjustment difficulties during the weeks around Memorial Day, which have seen somewhat elevated readings in recent years. We expect that trend to continue next week, with an unchanged reading that is somewhat above recent averages.

- 09:15 AM Industrial production, May (GS +0.5%, consensus +0.2%, last +1.0%); Manufacturing production, May (GS +0.2%, consensus +0.1%, last +1.0%); Capacity utilization, May (GS +76.9%, consensus +76.8%, last +76.7%): We estimate industrial production increased 0.5% in May, reflecting solid growth in the utilities and mining components. However, we estimate manufacturing production rose a more modest 0.2%, reflecting broad cyclical improvement in many manufacturing categories, but a pullback in auto production.

- 10:00 AM NAHB housing market index, June (consensus 70, last 70): Consensus expects the NAHB homebuilders’ index to remain flat in June, after the index rebounded 2pts to 70 in the May report, just below the cycle high.

- 04:00 PM Total Net TIC Flows, April (last -$0.7bn)

Friday, June 16

- 08:30 AM Housing starts, May (GS +6.0%, consensus +3.9%, last -2.6%); Building permits, May (consensus +1.8%, last -2.5%): Despite broadly disappointing hard indicators of April housing activity, we believe single-family fundamentals continue to be favorable. Additionally, a large and growing pipeline of apartment projects in the planning stages suggests a rebound in multi-family starts. Taken together, we expect a 6.0% rise in overall housing starts, reversing the 2.6% drop in April.

- 10:00 AM University of Michigan consumer sentiment, June preliminary (GS 97.8, consensus 97.1, last 97.1): We estimate the University of Michigan consumer sentiment index rose 0.7pt to 97.8 in the June preliminary reading, after edging down in May. Our forecast reflects continued elevated readings in higher frequency consumer surveys as well as an expected boost from rebounding stock prices. Gas prices declined meaningfully over the last month, suggesting scope for a negative impact on the report’s measure of 5- to 10-year ahead inflation expectations, which at 2.4% in May was already at the low end of its recent range.

- 12:45 PM Dallas Fed President Kaplan (FOMC voter) speaks: Dallas Fed President Robert Kaplan will give a speech to the Park Cities Rotary Club in Dallas, Texas. Media and audience Q&A is expected.

Tags: Australia,Bank of England,Bank of Japan,Business,China,Consumer Price Index,Consumer Sentiment,Core CPI,CPI,disinflation,ECB,economy,Eurozone,federal government,Federal Reserve System,fixed,France,Germany,Greece,Housing market,Housing Starts,inflation,Initial Jobless Claims,Italy,Japan,Jim Reid,Macroeconomics,Michigan,Monetary Policy,money,New Zealand,newslettersent,Swiss National Bank,Switzerland,Turkey,U.S. Capacity Utilization,U.S. Consumer Price Index,U.S. Core Consumer Price Index,U.S. Housing Starts,U.S. Industrial Production (ZH),U.S. Initial Jobless Claims,U.S. Producer Price Index,U.S. Retail Sales,Unemployment,United Kingdom,University Of Michigan