Tag Archive: U.S. Producer Price Index

A Producer Price Index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

FX Daily, March 12: Trump Dump as Market Turns to ECB

Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump's national address in the Asian session failed to reassure investors.

Read More »

Read More »

FX Daily, February 19: Investors’ Confidence Snaps Back

Overview: After shunning risk yesterday, investors re-entered the fray today, and the animal spirits returned. The MSCI Asia Pacific Index snapped a four-day slide, and China's markets were among the few losers in the region today. Europe's Dow Jones Stoxx 600 recovered yesterday's losses in full and is again at record highs. US shares are also trading firmer and are poised to recoup yesterday's decline.

Read More »

Read More »

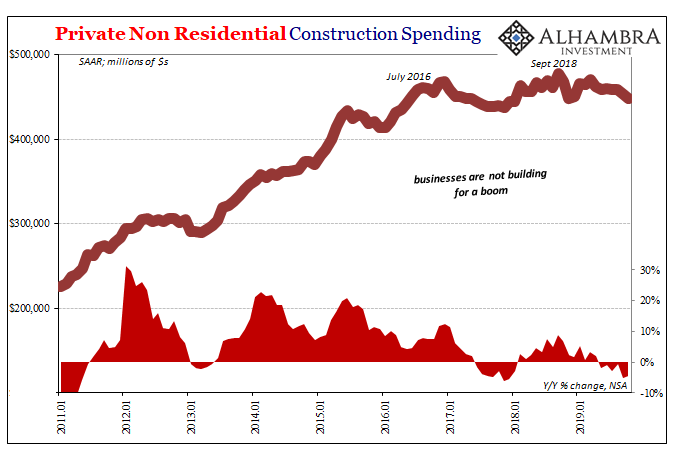

Consistent Trade War Inconsistency Hides The Consistent Trend

You can see the pattern, a weathervane of sorts in its own right. Not for how the economy is actually going, mind you, more along the lines of how it is being perceived from the high-level perspective. The green light for “trade wars” in the first place was what Janet Yellen and Jay Powell had said about the economy.

Read More »

Read More »

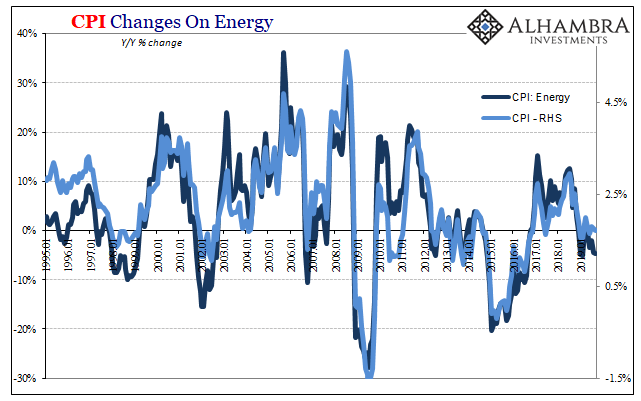

CPI Changes On Energy: The Inflation Check

After constantly running through what the FOMC gets (very) wrong, let’s give them some credit for what they got right. Though this will end up as a backhanded compliment, still. After having spent all of 2018 forecasting accelerating inflation indices, from around New Year’s Day forward policymakers notably changed their tune.

Read More »

Read More »

FX Daily, September 11: Dollar is Firm as ECB is Awaited

Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas that the political tensions may ease. South Korea reported better trade data for the first ten days of September.

Read More »

Read More »

FX Daily, July 12: Greenback Limps into the Weekend

Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in response, and Spanish and Portuguese bonds bore the burden in Europe.

Read More »

Read More »

FX Daily, June 11: Markets Take Another Small Step Away from the Edge

Overview: The recovery in equities continues today in light news day. Nearly all the bourses in the Asia Pacific region rose, led by a 2.6% gain of the Shanghai Composite. The MSCI Asia Pacific Index rose for a third session. European equity benchmarks are rising for the sixth time in the past seven sessions.

Read More »

Read More »

FX Daily, September 12: Dollar Chops in Narrow Ranges

Eurostat confirmed that EMU industrial output fell for a second consecutive month in July. The 0.8% decline was larger than expected and is the third decline of such a magnitude in four months and weighed on the euro. German and Spanish industrial output had surprised on the downside last week, and Italy matched suit today with a report showing a 1.8% contraction, much larger than expected, and bringing the year-over-year rate to -1.3% (workday...

Read More »

Read More »

FX Daily, July 11: Escalating Trade Tensions Set Tone for Capital Markets

The US took the first step in making good its threat to put a 10% tariff on $200 bln of Chinese goods in response to the PRC retaliating for the 25% tariff on $34 bln of its exports. The US provided a list of products that will get the new tariffs after the public comment period is completed at the end of next month. This time the list included numerous consumer goods, like digital cameras, baseball gloves, but have left off popular products, like...

Read More »

Read More »

FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro's losses. The euro dipped below $1.1825. The single currency is off a cent this week after falling nearly two last week. A 38.2% retracement of the euro's gains since the beginning of last year is found a little above $1.1700 and...

Read More »

Read More »

FX Daily, April 10: XI’s Day, but Not So Good for Putin

It did not look so good. The S&P 500 fell about 1.65% in the last couple hours of trading yesterday paring its gains. Press reports indicated that President Trump's lawyer's office, house and hotel were the subject of search warrants. A Bloomberg report citing people who knew said that China would consider devaluing the yuan.

Read More »

Read More »

FX Daily, February 15: Stocks Jump, Bonds Dump, and the Dollar Slumps

The significant development this week has been the recovery of equities after last week's neck-breaking drop, while yields have continued to rise. The dollar has taken is cues from the risk-on impulse from the equity market and the sales of US bonds more than the resulting higher yields. Asia followed US equities higher.

Read More »

Read More »

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

Read More »

Read More »

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

FX Daily, December 12: UK Front and Center, but Sterling is Laggard in Today’s Move Against the Dollar

The US dollar is trading with a lower bias against most of the major and emerging market currencies. The upside surprise in Sweden's inflation is helped the krona recover from its recent slide. It is the strongest of the majors, gaining 1.1% against the dollar and nearly as much against the euro, which is in a third of a cent range below $1.18.

Read More »

Read More »

FX Daily, November 14: Euro Rides High After German GDP

Sterling is trading in the lower end of yesterday's range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation.

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

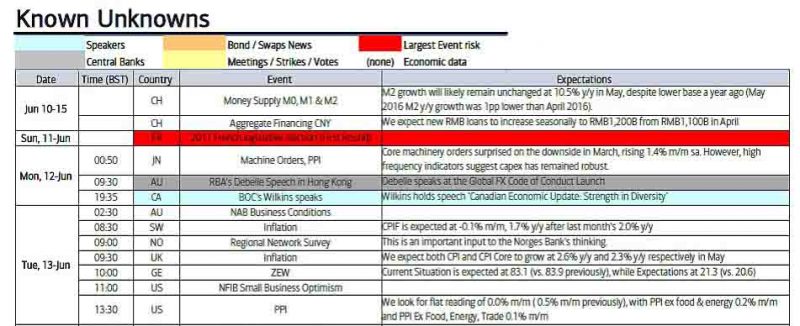

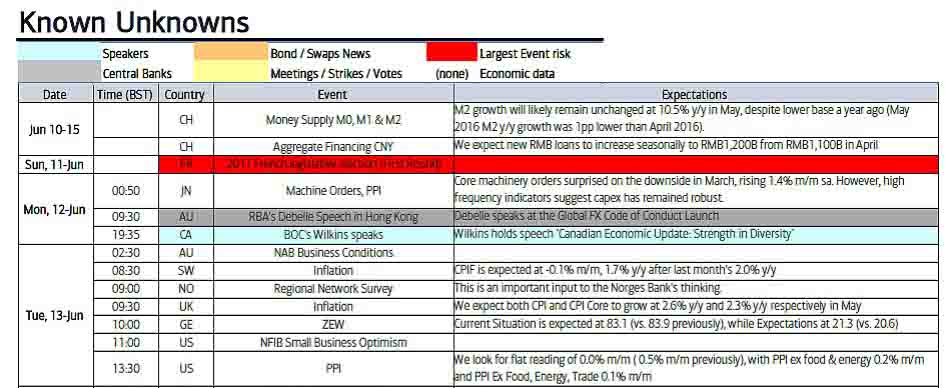

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »