Tag Archive: newslettersent

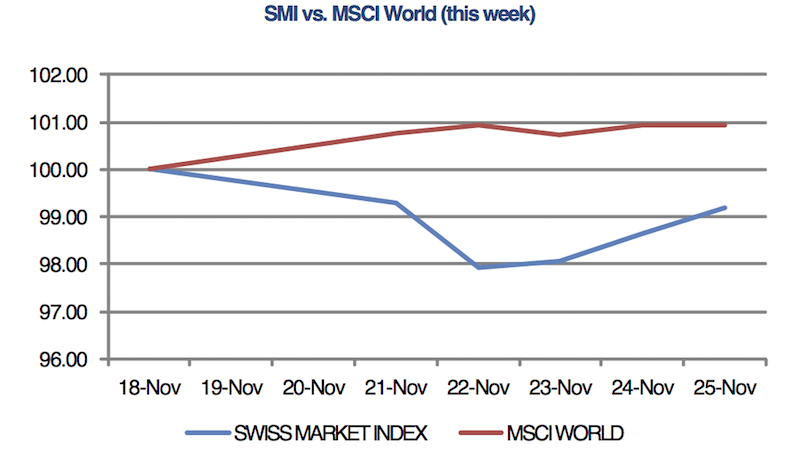

Swiss stocks down as the US dollar hits decade high

Swiss pharmaceutical and luxury goods giants pulled the Swiss Market Index (SMI) down again this week as investors dropped large cap firms. Global stocks however continued to rise, along with energy prices, on the promise of Trump’s reflationary administration. The US dollar headed further up, reaching decade highs.

Read More »

Read More »

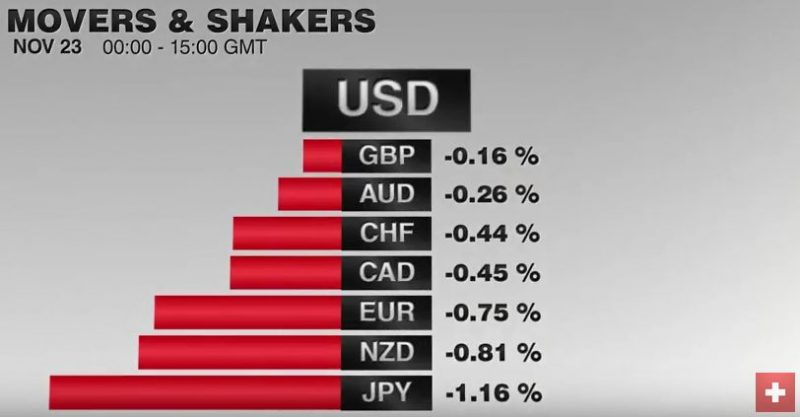

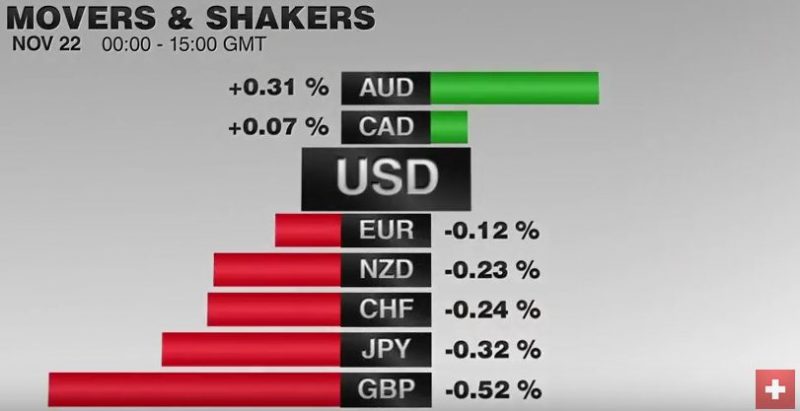

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

Steep price increases for Swiss Rail passengers despite deflation

Today, Swiss Rail announced big price increases on some tickets and passes. The new prices will apply from 11 December 20161. According to the Swiss government consumer price index, average prices declined by 2.1% between October 2010 and October 20162.

Read More »

Read More »

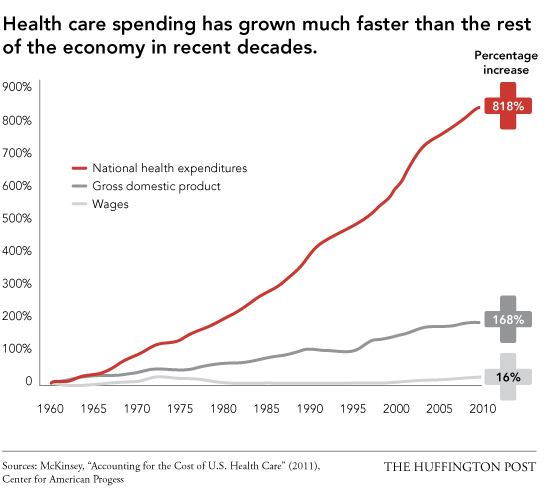

Healthcare: Inflation Hidden in Plain Sight

Charles Hugh Smith shows how health care costs are exploding in the United States and how this will lead sooner or later to inflation.

Read More »

Read More »

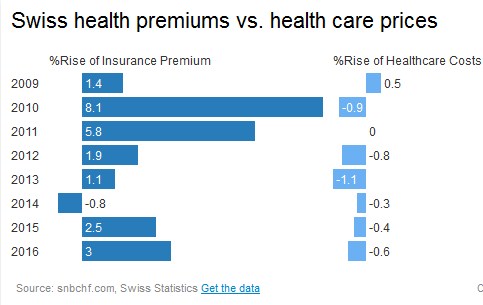

Health Care Premiums: Is Swiss Statistics Hiding Inflation?

The latest data releases from Swiss Statistics shows that health care premiums have risen by 3%, while health care prices for consumers have fallen. The reason may be the oligopoly structure of the Swiss health care system. But also that we consume higher and higher quantities of health care. Or is Swiss Statistics cheating on inflation?

Read More »

Read More »

Love him or Hate him: Trump is the Revolution Against the Establishment

The 2016 U.S. presidential elections are unprecedented: I don’t believe we have ever witnessed before a campaign year so toxic, so dangerously divisive and full of ad hominem attacks. Both camps have vilified the opposition and their followers, creating a schism in society. There has been no rational dialogue on the issues that truly concern the American public.

Read More »

Read More »

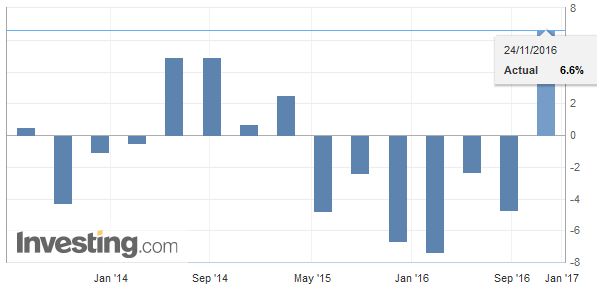

Production, orders and turnover statistics of the secondary sector in the 3rd quarter 2016

Industrial production in the secondary sector rose by 1.1% in 3rd quarter 2016 in comparison with the same quarter a year earlier. Turnover also rose by 1.1%. Orders received increased by 6.6% and orders on hand grew by 2.8%. This is shown by provisional results from the Federal Statistical Office (FSO).

Read More »

Read More »

Shuttered Geneva offices show impact of lost banking secrecy

Three years after Lloyds Banking Group Plc sold its private bank in Geneva, the only signs of life at the now-empty building are piles of cigarette butts and nutshells lying on its dirty window ledges. The riverside offices at Place de Bel-Air are a short walk away from the remaining private banks, hedge-fund managers and luxury-goods stores in the heart of the Swiss city. The locked entrance, where millionaire clients used to come and go, is a...

Read More »

Read More »

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

Too Early for “Inflation Bets”?

After 35 years of waiting… so many false signals… so often deceived… so often disappointed… bond bears gathered on rooftops as though awaiting the Second Coming. Many times, investors have said to themselves, “This is it! This is the end of the Great Bull Market in Bonds!”

Read More »

Read More »

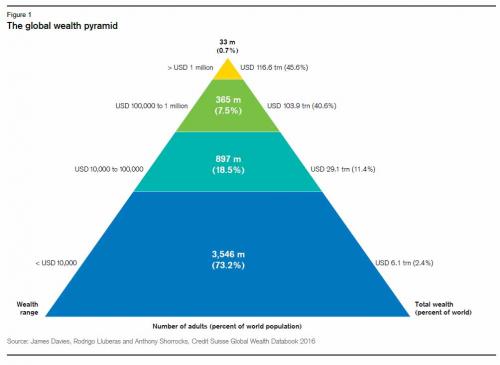

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

Swiss watch exports have biggest monthly drop in seven years

Shipments fell to 1.68 billion francs ($1.7 billion), the Federation of the Swiss Watch Industry said in a statement Tuesday. The decline was much greater than expected and was made worse because October was the weakest month of last year, according to Zuzanna Pusz, an analyst at Berenberg.

Read More »

Read More »

Switzerland risks power independence as nuclear vote looms

The nation faces losing a third of domestic supplies and becoming a net buyer of power if it opts to start closing its five nuclear plants as early as next year. The Swiss will vote on Sunday and the anti-nuclear proposal has a slender lead in opinion polls.

Read More »

Read More »

Why Reshore Manufacturing? It’s the Only Way to Avoid Defective Pirated Parts

If you want to lose your brand, your pricing power and your customers, by all means, rely on a global supply chain filled with defective parts that cannot possibly be detected. Reshoring the entire supply chain so it can be trusted is the low-cost solution once you add up the total lifecycle costs of a hopelessly counterfeit global supply chain.

Read More »

Read More »

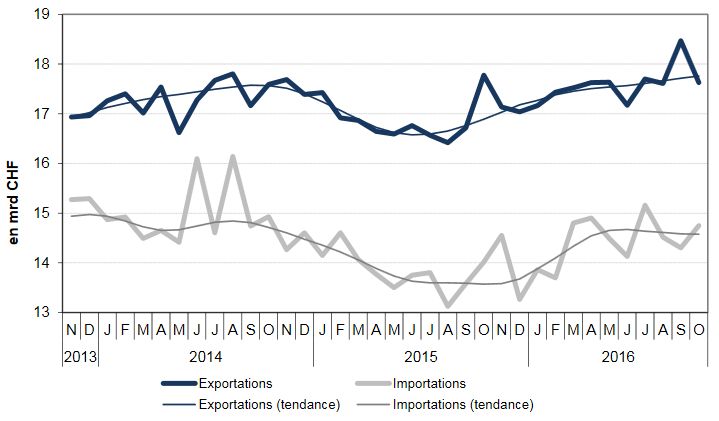

Swiss Trade Surplus Shrinks in October

In October 2016, Swiss exports were down 5.6% (in real terms: - 10.4%) against the previous year. Imports rose by 1.8%YoY (in real terms: -1%). The trade surplus diminished, after months of rising exports.

Read More »

Read More »

FX Daily, November 22: Bonds and Stocks Rally, Leaving Greenback to Meander

The US dollar entered a consolidative phase yesterday, and this carried into today's activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide.

Read More »

Read More »

Swiss are the world’s wealthiest, says report

According to a recent report by the bank Credit Suisse, the Swiss are worth more on average than the residents of any other nation. The bank’s annual Global Wealth Report calculates average net worth per Swiss adult to be US$ 561,900 (CHF 567,500). Switzerland’s combined personal wealth of US$ 3.5 trillion represents 1.4% of the global total, while the nation’s population represents 0.1% of the global total.

Read More »

Read More »

Putting an End to the Regulatory Industry

Corporate life in America these days is fraught with tedium. First the MBAs imposed their silly six sigma processes and reduced workers to mere widgets. Then the regulators went through and squashed out any fun that remained.

Read More »

Read More »