Tag Archive: newslettersent

Weekly Speculative Position: Net Short Euro and Yen Are Falling. Short CHF Stable

Speculators are net short CHF with 13.6K contracts against USD. This is nearly unchanged. But net short of Euro and Yen are Diminishing.

Read More »

Read More »

FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China's PMI are among the data highlights.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM was truly mixed last week, pulled in both directions by both idiosyncratic risks and global developments. MXN, BRL, and ZAR were the best performers on the week, while TRY, HUF, and RON were the worst. MXN gained despite signs that Trump will maintain a bellicose stance towards Mexico, but we think the peso remains vulnerable to further selling.

Read More »

Read More »

FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

The US dollar spent the first month of the new year correcting lower after a strong advance in the last several months of 2016. We argue that the correction actually began in mid-December following the Federal Reserve's rate hike.

Read More »

Read More »

Great Graphic: Mexico and China Unit Labor Costs

Mexico has been gaining competitiveness over China before last year's depreciation of the peso. The depreciation of the peso, and other US actions can contribute to the destabilization of Mexico. An economically prosperous and stable Mexico has long been understood to be in the US interest.

Read More »

Read More »

Those over 25 may pay more for Swiss health insurance

The Swiss States Council commission on public health endorsed a plan that could lead to higher health insurance premiums for those over 25. Swiss health insurance providers are required to pay into a communal pot to spread risk between insurance companies.

Read More »

Read More »

The Grand Strategy: Fixed Spheres of Influence or Variable Shares?

The US has a direct investment strategy for historical reasons. It competes against export-oriented strategies. The FDI strategy does make low-skilled domestic labor compete with low-skilled foreign worker, but skilled workers abroad complement the skilled domestic worker.

Read More »

Read More »

Emerging Markets: What has Changed

Press reports suggest that China’s central bank has ordered banks to limit new loans in Q1. Fitch revised the outlook on Nigeria’s B+ rating from stable to negative. Russia announced details of the FX purchase plan. Brazil’s central bank confirmed it will simplify the reserve requirement system for banks. S&P cut the outlook on Chile’s AA- rating from stable to negative.

Read More »

Read More »

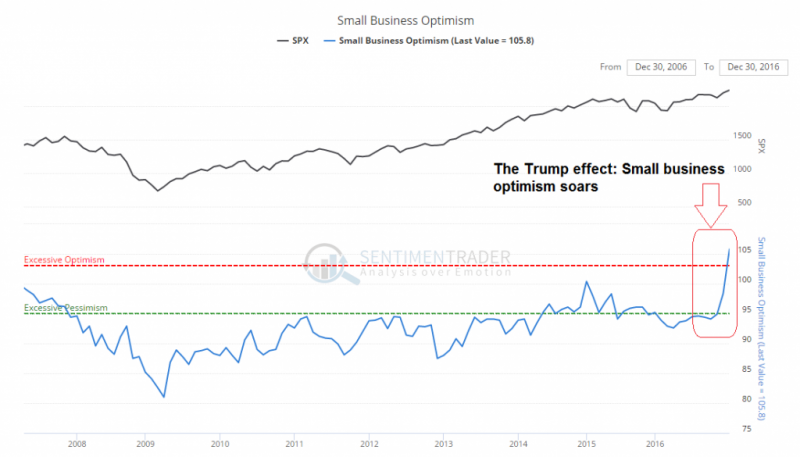

With Trump Optimism of Small Business Soars

“You boys know what makes this bird go up? Funding makes this bird go up. That’s right. No bucks, no Buck Rogers.” - Gordon Cooper and Gus Grissom, The Right Stuff (film). Things are looking up for the United States economy in 2017. You can just feel it. Something great is about to happen.

Read More »

Read More »

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

Immigration to Switzerland slows for third year in a row

ZURICH (Reuters) - Net immigration to Switzerland slowed for a third consecutive year in 2016, potentially easing concerns over immigration that have strained Switzerland's ties with the surrounding European Union. Around 143,100 immigrants arrived in Switzerland in 2016, down nearly 5 percent from the previous year, while around 78,000 foreigners left, an increase of 5.6 percent.

Read More »

Read More »

US GDP Misses, but Final Domestic Sales Accelerate

Net exports was a large drag on growth. Inventories flattered growth. Underlying signal, final domestic demand, increased 2.5% after 2.1% in Q3.

Read More »

Read More »

Are Interest Rates No Longer Driving the Dollar?

Many are concerned that the dollar and interest rates have become decoupled. We are not convinced. Correlations, not to be eyeballed, are still robust.

Read More »

Read More »

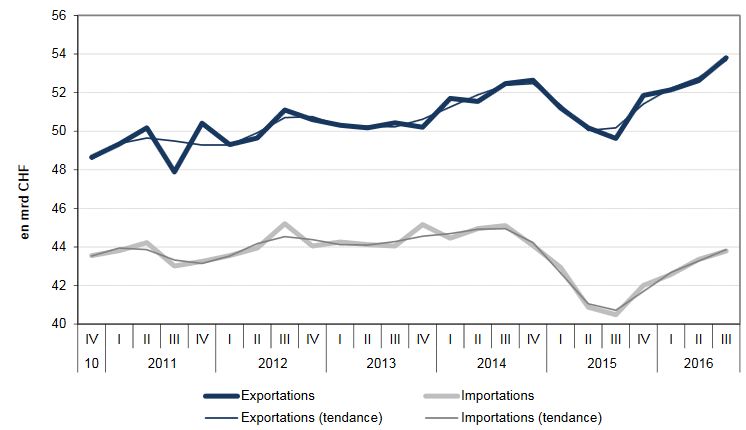

2016: Swiss Exports and Swiss Trade Balance at New Record-Highs: Swiss Franc Shock Digested

Following a decline the previous year, foreign trade grew again in 2016, with chemicals and pharmaceuticals shaping the trend. Exports climbed by a total of 3.8% (real: - 0.8%) to a record high of CHF 210.7 billion. However, the two other large groups – machinery and electronics, and watches – were unable to participate in the growth. Imports increased by 4.1% (real: +1.2%) to CHF 173.2 billion. The trade surplus reached a new peak of CHF 37.5...

Read More »

Read More »

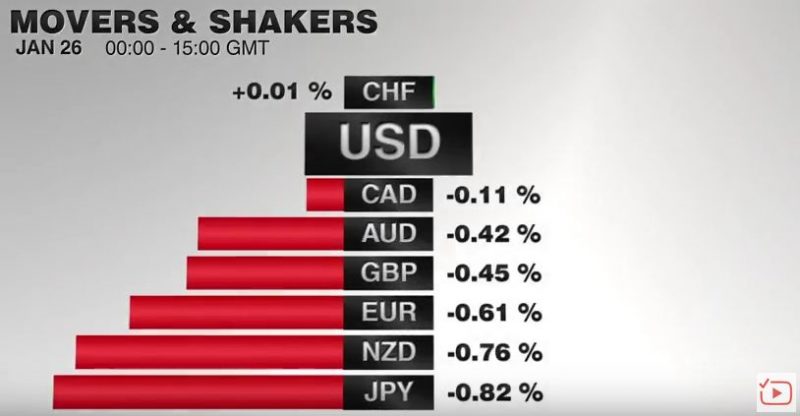

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

Cool Video: Bloomberg’s Daybreak–Trump and Rates

On what Trump's first working day as POTUS, I had the privilege to be on Bloomberg's Daybreak to talk about the wagers on US interest rates in the futures market. In the most recent CFTC reporting week, which ended on January 17, speculators in the 10-year note futures market reduced the record net short position. It is only the second week reduction since the end of November.

Read More »

Read More »

Swiss fact: work days lost to strikes in Switzerland close to one ninth of neighbouring countries

Across the ten years to 2008, Switzerland lost an average of 3 working days per 1,000 workers to strikes a year. This compares to 32 days in Austria, 33 days in France, and 55 days in Italy. Germany was close behind Switzerland with 4 days. The combined average for Switzerland’s neighbours: Austria, Germany, France and Italy, was 26 days. Switzerland’s 3 day average was one ninth or 11% of this.

Read More »

Read More »

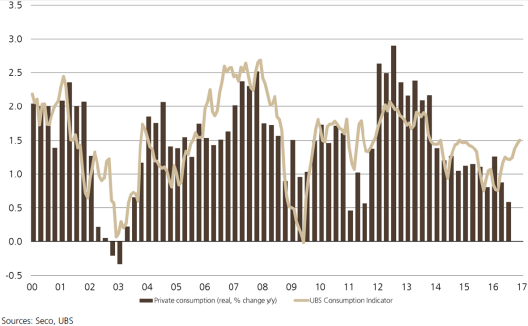

Switzerland UBS Consumption Indicator December: Automobile market with record year-end results

The UBS consumption indicator rose from 1.45 to 1.50 points in December. The positive trend of last fall continued and signalizes solid growth prospects for private consumption this year. New car registrations in the automobile sector, which are at an all-time high, are at the root of this positive outlook.

Read More »

Read More »