Tag Archive: Great Graphic

Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax reform.

Read More »

Read More »

Great Graphic: Dollar Index Bottoming?

The Dollar Index set the year's high on January 3 a little above 103.20. Today it made a marginal new lows for the year at 95.464. The previous low, set at the end of last month was 95.47.

Read More »

Read More »

Great Graphic: Aussie is Approaching 15-month Trendline

This Great Graphic, made on Bloomberg, depicts the Australian dollar since April 2016. We drew in the trendline from that April high, through the November high and the March 2017 high. It nearly catches last month's high as well. It comes in now near $0.7725.

Read More »

Read More »

Great Graphic: Dollar Breaks Out Against Yen

The dollar is at new lows for the year against the euro and Swiss franc. Draghi's comments earlier that transitory forces are dampening price pressures were seen as broadly similar to the Fed's leadership's assessment about US prices. The implication is that the ECB will announce tapering its purchases as it extends them into next year.

Read More »

Read More »

Great Graphic: US Wage Growth Exceeds Productivity Growth

One of the longstanding challenges to growth US aggregate demand has been that wages have not kept pace with inflation and productivity. The decoupling appears to have taken place in the late 1960s or early 1970s depending on exactly which metric one uses.In my book, the Political Economy of Tomorrow, I argue the decoupling of men's wages from productivity and inflation made it possible and necessary for women to enter the workforce in large...

Read More »

Read More »

Great Graphic: Fed, ECB, and BOJ Balance Sheets

This Great Graphic composed on Bloomberg shows the balance sheets of the Federal Reserve, the European Central Bank, and the Bank of Japan as a proportion of GDP.

Read More »

Read More »

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

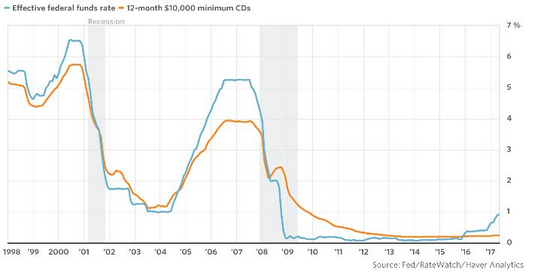

Great Graphic: Sticky Pass Through

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD.

Read More »

Read More »

Great Graphic: Don’t be Misled by Sterling Stability, Investors are Concerned

The Great Graphic, created on Bloomberg, shows the options skew (three-month 25 delta risk reversal) in the white line, and sterling is the yellow line. The takeaway is that the market appears to be more nervous than the relatively firm sterling in the spot market suggests. Typically, one might expect those with sterling exposure to sell calls (and receive funds) rather than buy puts (new expenditure).

Read More »

Read More »

Great Graphic: Iron Ore and the Australian Dollar

This Great Graphic, from Bloomberg, shows the correlation between the price of iron ore and the Australian dollar on a rolling 60-day basis over the past year. The correlation is a little more than 0.81. The relationship is the tightest since last August. This is purely directional.

Read More »

Read More »

Great Graphic: US Rate Curve and the Euro

This Great Graphic was created on Bloomberg. It shows two times series. The yellow line and the left-hand scale show the euro's exchange rate against the dollar for the past year. The white line depicts the spread between the US two-year and 10-year yield.

Read More »

Read More »

Great Graphic: OIl and the S&P 500

The fluctuation of oil prices is often cited as an important factor driving equities. Our work shows that this is not always the case and that the correlation between the price of oil and the S&P 500 continues to ease.

Read More »

Read More »

Great Graphic: Trade-Weighted Dollar

US TWI has appreciated a little since the end of Q1. The euro and sterling's strength are exceptions to the rule. The dollar has edged up against the currencies of the US top four trading partners here in Q2.

Read More »

Read More »

Great Graphic: Gas and Oil

Steep falls in gasoline and oil prices. Large build in gasoline inventories and record refinery work shifted some surplus from oil to the products. OPEC is expected to roll over its output cuts, but non-OPEC may find it difficult and US output continues to rise.

Read More »

Read More »

NAFTA Trade Update

The trade tensions between the US and Canada set the Canadian dollar to lows for the year. The dollar's downside momentum against the Mexican peso has eased. The Canadian dollar looks attractive not against the US dollar but against the peso.

Read More »

Read More »

Longevity and Income

Rich people live longer than poor people in the US. This disparity undermines the progressive nature of Social Security. Disparity of income seems more important than the slowdown in growth in explaining why few US people are doing better than their parents at the age of 30.

Read More »

Read More »

State of Dollar Bull Market

The dollar market is intact, despite the pullback here at the start of 2017. We have seen similar pullbacks in 2016 and 2015. Divergence remains the key driver.

Read More »

Read More »

Euro’s Record Losing Streak Against the Yen

The euro has fallen for 11 consecutive sessions against the yen. Interest rates, US and German in particular, seem to be the main driver. Technicals are stretched, but have not signaled a reversal yet.

Read More »

Read More »

Great Graphic: Emerging Market Stocks

MSCI Emerging Market Index is up 12.25% here in Q1. The index is approaching long-standing technical objectives. Look for profit-taking ahead of quarter-end as fund managers rebalance.

Read More »

Read More »

Great Graphic: Fed’s Real Broad Trade Weighted Dollar

To begin assessing the dollar's impact on the US economy, nominal bilateral exchange rates may be misleading. From a policymakers' point of view, the real broad trade weighted measure is more important. The Federal Reserve tracks it on a monthly basis.

Read More »

Read More »