Tag Archive: FX Daily

FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The … Continue...

Read More »

Read More »

FX Daily, June 20: Brexit not the main Swiss Franc Driver

Recently I enumerated the different drivers for the continuing strength of the franc. Most commentators mentioned Brexit fears, but I insisted on the low rate and yield environment in the United States after the last Non-Farm Payroll report and the FOMC.

Today's jump in sterling confirmed my view. This anticipation of an Anti-Brexit vote was not followed by a franc decline against USD. This also implies that a Brexit will not entrench a huge...

Read More »

Read More »

FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal

and political tragedy. Her needless death provided an inflection

point. The suspension of the referendum campaigns and a steady stream of reports and speech...

Read More »

Read More »

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

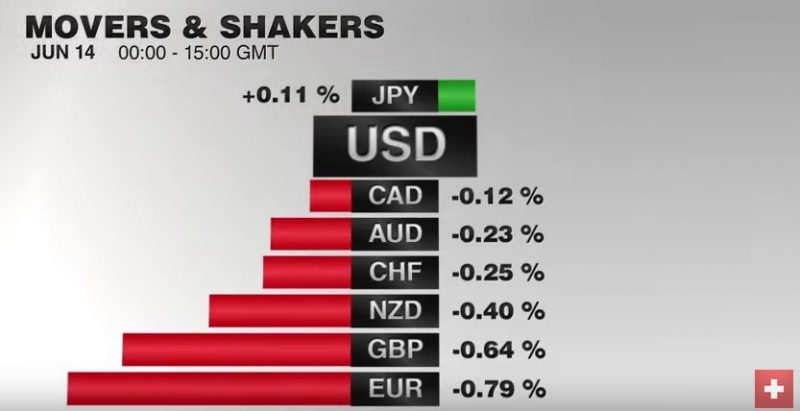

FX Daily, June 14: Capital Markets Remain at UK Referendum’s Mercy

"The Swiss Franc was the strongest performer, EUR/CHF has fallen to 1.08 by 0.8%". A spate of opinion polls showing a tilt toward Brexit, and the leading UK newspaper urging the Leave vote on the front page, keep the global capital markets on edge. Equities are lower, though of note ahead of the MSCI decision first thing Wednesday in Asia, Chinese shares eked out a small gain.

Read More »

Read More »

FX Daily, June 13: Brexit Dominates

Swiss Franc Chandler is a bit puzzled about the Swiss Franc, that got stronger despite speculators being short CHF. We see weaker oil prices and weaker China as major reason, why sight deposits are falling and speculators are long the dollar. FX Rates The risk that the UK votes to leave the EU next … Continue reading »

Read More »

Read More »

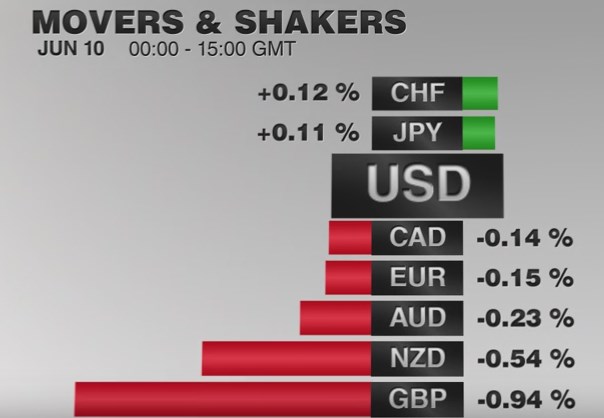

FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

Once again, CHF was one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular "Weekly SNB sight deposits" report. For the week, it is the dollar-bloc and franc that have maintained weekly gains.

The US dollar weakened in the first half of the week as

participants continued to react to the shockingly poor jobs report and shift in Fed...

Read More »

Read More »

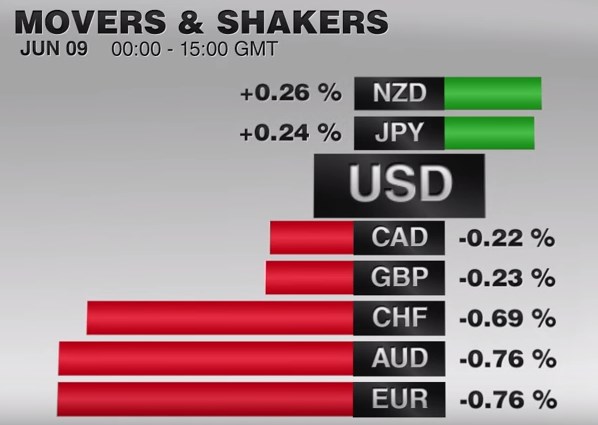

FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD.

The US dollar is posting modest upticks against most of the

European currencies and the Canadian and Australian dollars. However, it has fallen against the yen and taken out the

recent low, leaving little between it and the May 3 l...

Read More »

Read More »

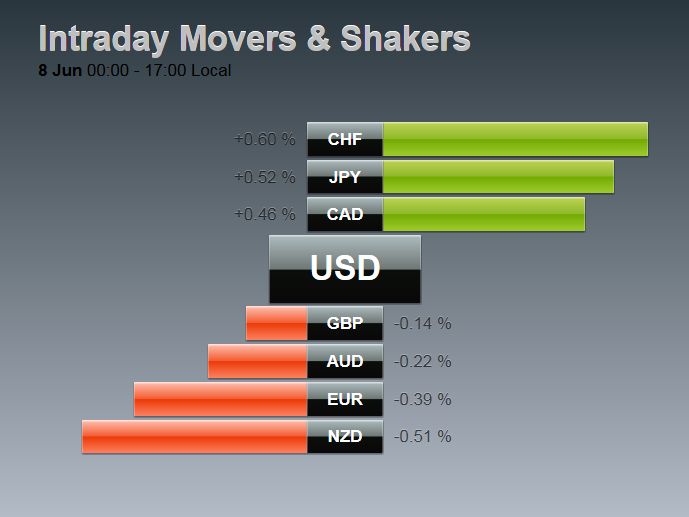

FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

Once again the Swiss Franc appreciates both against EUR and USD.

The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596.

The foreign exchange market is quiet. The euro remains confined to the

narrow range seen on Monday between $1.1325 and $1.1395. We continue to

look for higher levels near-term as the

drop from May 3 (~$1.1615) to May 30 (just be...

Read More »

Read More »

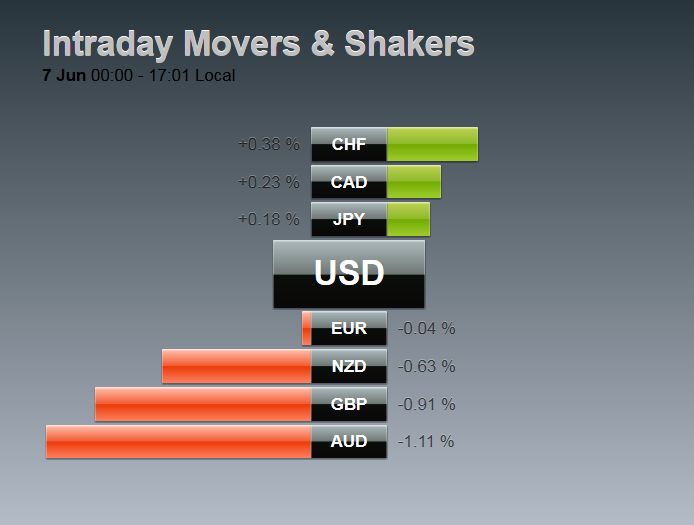

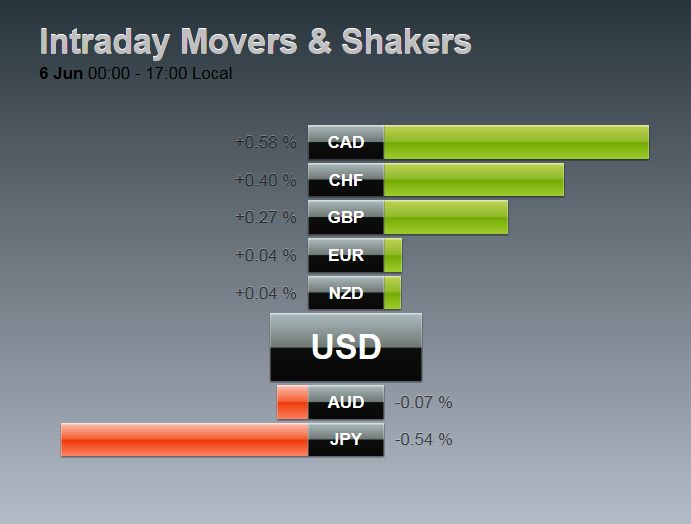

FX Daily, June 6: Shallow Bounce in Dollar, though Sterling Pressured by Brexit Polls

With the dismal jobs reports, speculators had to buy euro to cover their shorts (mostly against USD, but also against CHF). This led to a rising EUR/CHF on Friday. Today fundamental rules were valid again: In times of slow growth, the Swiss franc appreciates. Hence EUR/CHF was down by 49 bips. After the …

Read More »

Read More »

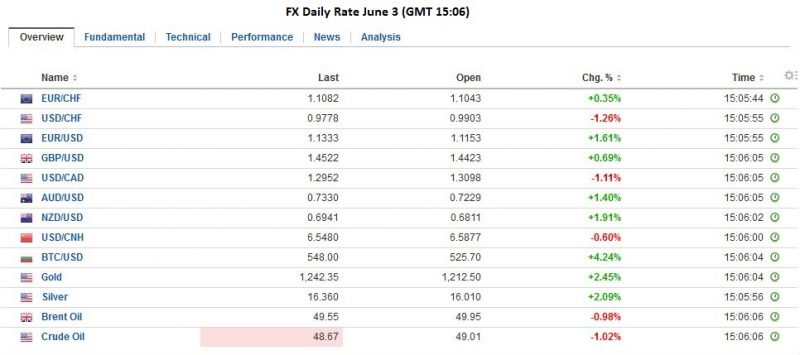

FX Daily, June 3: FX Market Shocked by Non-Farm Payrolls

Massive surprise in the US job report was reflected in currency rates. The EUR/CHF surprisingly increased, despite weak US data. This reflects the fact that the ECB is currently considered the most dovish central bank. The dollar lost 2% against the yen, 1.6% against the euro and 1.3% vs. the Swiss franc.

Read More »

Read More »

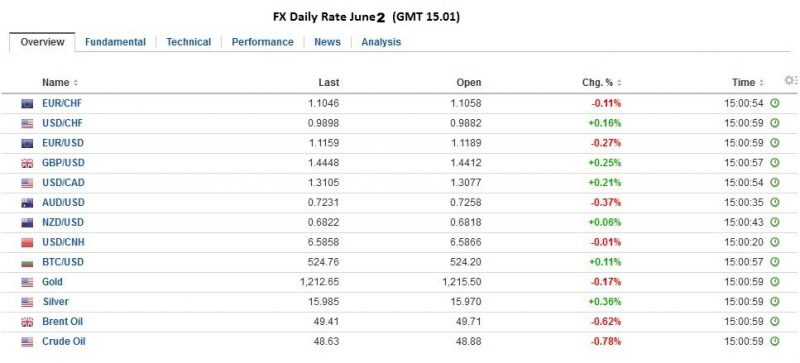

FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would … Continue reading...

Read More »

Read More »

FX Daily, June 1: Swiss SVME PMI strongest PMI

The Swiss SVME PMI was the strongest PMI in this data release. It is driven by machinery and electronics industry. They strongly compete with the Germans, and got shocked by the end of the peg.

Surprisingly they have outperformed in recent months.

Read More »

Read More »

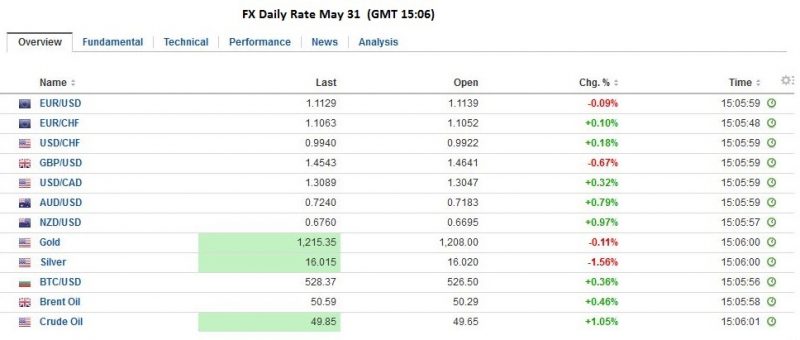

FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data...

Read More »

Read More »

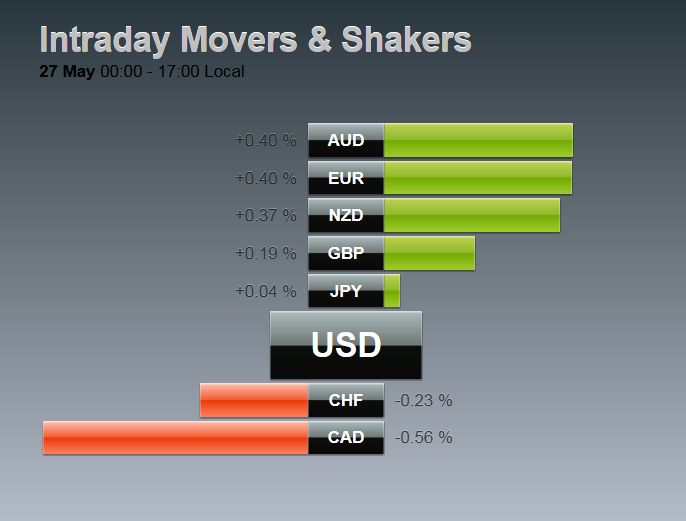

FX Daily, May 27: Dollar Firms as Traders Await Yellen

The US dollar is winding down the week on a firm note, but still in a consolidative mode. The euro and yen and Australian dollar are well within yesterday's ranges while sterling and the Canadian dollar pushing through yesterday's lows.

Asian ...

Read More »

Read More »

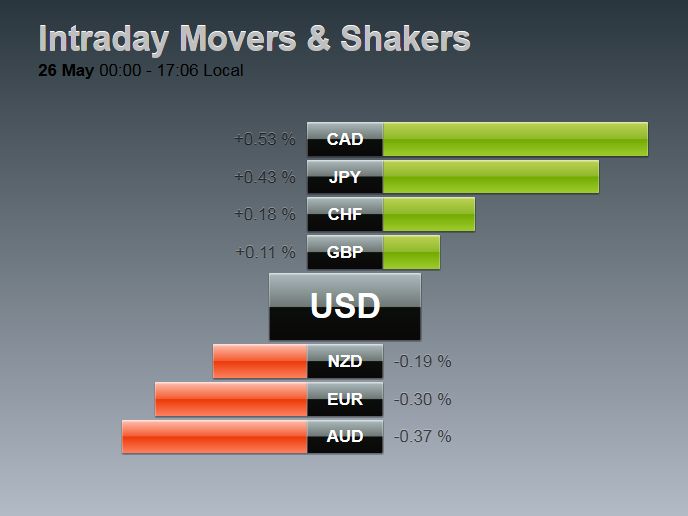

FX Daily, May 26: Dollar Softer in Consolidation Mode

The US dollar is trading with a softer bias today after the momentum stalled yesterday. The pullback is shallow but could be extended a bit more in the North American session. The US reports weekly jobless claims, durable goods orders and pending home sales. However, the market already appeared to take on board that the …

Read More »

Read More »

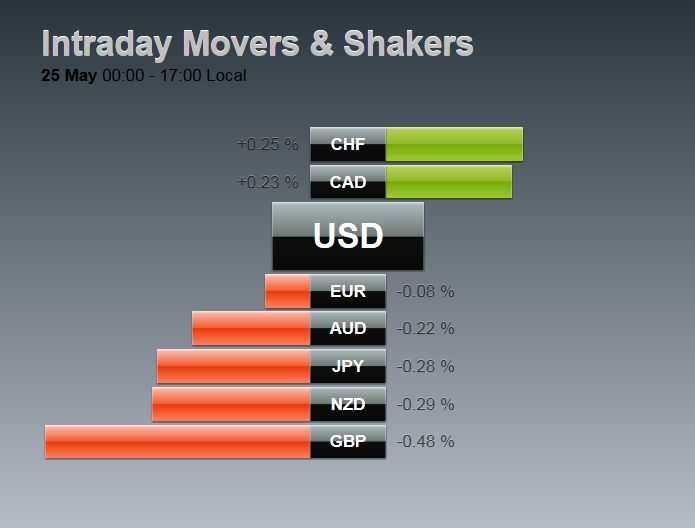

FX Daily, May 25: Dollar Marks time

The US dollar is little changed against the major currencies as yesterday’s moves are consolidated and traders wait for fresh developments. Global equities were higher after Wall Street’s advance yesterday. Asia-Pacific bond yields were firm, following the US lead, but European 10-year benchmark yields are lower, led by the continued rally in Greek bonds …

Read More »

Read More »

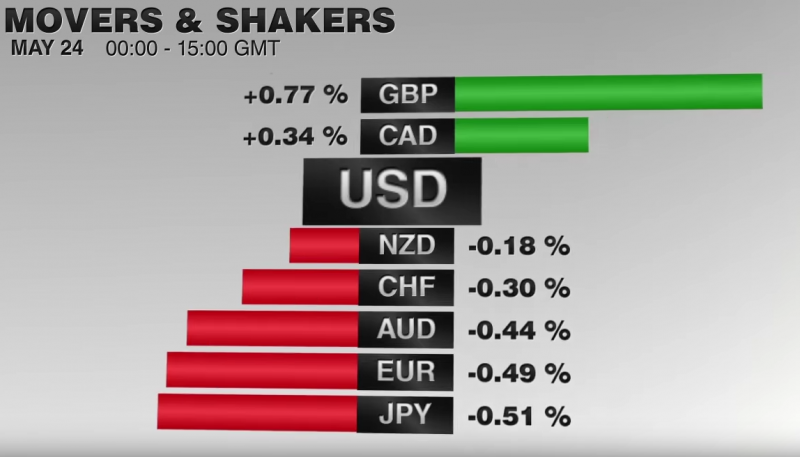

FX Daily, May 24: Dollar Regains Momentum, Sterling Resists

The US dollar lost momentum yesterday but has regained it today. The euro has been pushed through last week's lows near $1.1180. The next immediate target is $1.1145, which corresponds to the lower Bollinger Band today, though the intraday te...

Read More »

Read More »

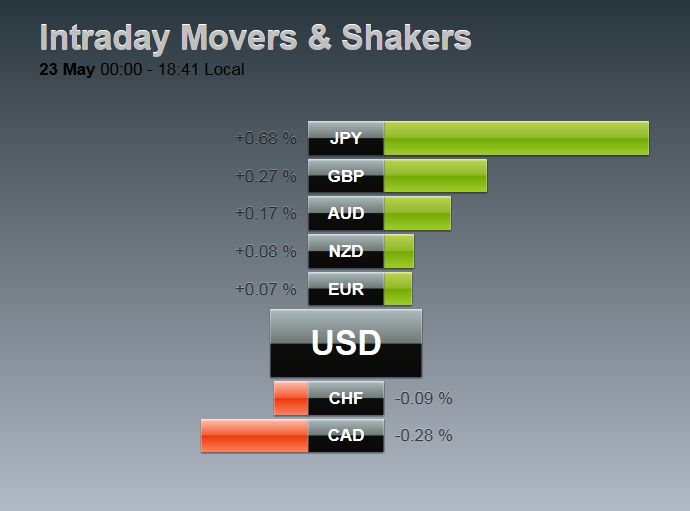

FX Daily May 23

The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week.

The US dollar is...

Read More »

Read More »