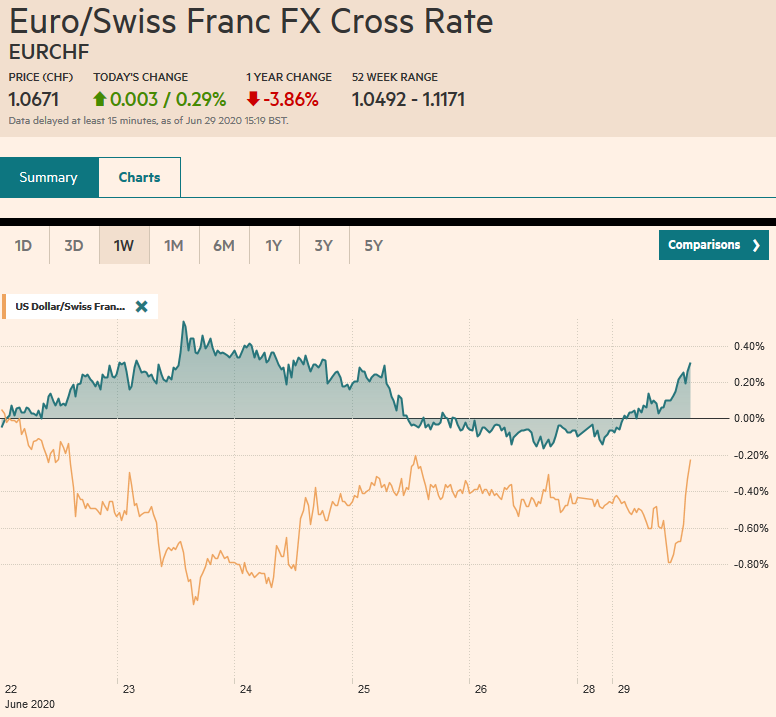

Swiss FrancThe Euro has risen by 0.29% to 1.0671 |

EUR/CHF and USD/CHF, June 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets re-opened from a two-day holiday at the end of last week. Led by energy and consumer staples, Europe’s Dow Jones Stoxx 600 recouped initially losses to poke into positive territory in late morning dealings. US shares are hovering around little changed levels after the S&P finished last week below the 200-day moving average (~3021). Bond yields are steady to firm with the US benchmark 10-year yield around 64 bp. The dollar is softer against most major currencies, but sterling, while emerging market currencies are mixed. Eastern and Central European currencies are faring the best. The drop in oil prices and risk of US response to reports that it put a bounty on US soldiers in Afghanistan, is putting the Russian rouble under pressure. Gold is little changed around $1771 an ounce, and WTI for August delivery has rebounded after being off 2% lower. It has slipped in four of the past five sessions as the new Covid cases raise concerns about demand recovery. |

FX Performance, June 29 |

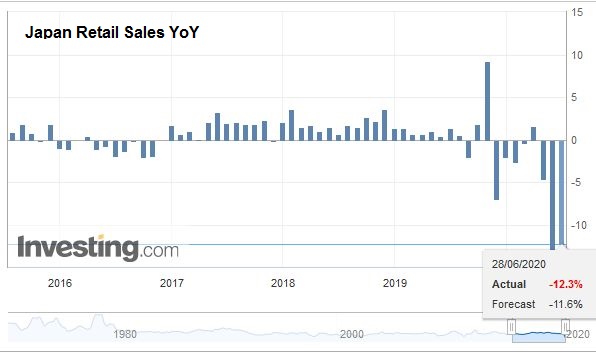

Asia PacificOn two different occasions recently, China has warned that unless the US stops confronting it in so many areas, and crossing “red lines,” it will not fulfill the Phase One trade agreement. Trade negotiator Liu He was quoted along these lines on June 18. Around the same time, Yang Jiechi to US Secretary of State Pompeo at their meeting in Hawaii. Both President Trump and Treasury Secretary Mnuchin has threatened total disengagement. By Beijing’s reckoning, it has fulfilled a little less than 20% of the import objectives in the first five months of the year. Separately, China reported that industrial profits rose in May (6%) to snap a four-month slide State-owned enterprises reported a 39.3% decline in profits in the first five months of the year compared to an 11% decline in private sector firms. Consumers in Japan went shopping in May. Retail sales rose 2.1% in May after crashing a revised 9.9% in April (initially -9.6%). The year-over-year decline moderated to 12.3% from a revised 13.9% drop. Tomorrow, Japan reports employment and industrial output figures for May. Unemployment is expected to have ticked higher while industrial output likely continued to contract. The Q2 Tankan survey results will be published Wednesday, and sharp falls are expected. |

Japan Retail Sales YoY, May 2020(see more posts on Japan Retail Sales, ) Source: investing.com - Click to enlarge |

Hong Kong’s May trade figures were worse than expected. Exports fell 7.4%year-over-year after a 3.7% decline in April. Imports were off 12.3% in May and 6.7% in April. The net result was a small trade deficit (HKD13.7 bln vs. HKD23.3 bln). Exports to the mainland edged 0.3% higher from a year ago, while exports to the US 14.4% lower. Imports from China were down 14.4%, while shipments from the US were 30% lower than a year ago.

The dollar has been mostly confined to a third of a yen range above JPY107.00. Last week’s high was about JPY107.45. Support is seen in the JPY106.80-JPY107.00 range. The Australian dollar has remained within the pre-weekend range (~$0.6840-$0.6895). Australia reports trade, retail sales, and the PMIs this week. The PBOC set the dollar’s reference rate a little softer than the models suggested. The offshore yuan edged lower in the last four sessions but recouped some of its losses with today’s modest gains (~CNH7.0735).

Europe

UK and EU trade talks are to accelerate in July. UK Prime Minister Johnson renewed his threat to walk away from negotiations if unspecified progress is not made. Abandoning talks, however, would seem to undermine the case that will have to be made in there is a post-exit disruption, which there is bound to be, that the government did everything it could to avoid the outcome. Johnson and UK officials still refer to leaving without a new trade agreement as leaving on “Australian terms,” which means falling back to WTO terms (i.e., steep tariffs). This is what used to be called a “hard exit.”

The poor showing of Macron’s party in local elections warns of the likelihood of a government reshuffle, and that means that Prime Minister Philippe may be ousted shortly. There had been rumors of his departure before the weekend’s second round. The Socialists held on to Paris (Hidalgo), and the Greens did well. In Poland, voters denied President Duda a majority, and a run-off will be held in a couple of weeks (July 12) against the liberal mayor of Warsaw Trrzaskowski. A third political development was the new grand coalition in Ireland and a rotating prime minister. Michael Martin will assume the post for the next six months, and then Leo Varadkar will return.

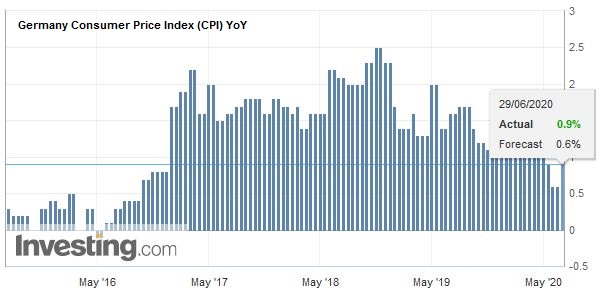

| German and Spanish June CPI figures were released ahead of the aggregate figures for the eurozone tomorrow. Today’s report reduces the chance of a sub-zero print. German states reported gains on the month, which lift the year-over-year rate. The harmonized measure for the country, due shortly, may have ticked up to 0.6%-07% from 0.5% in May. Spain’s harmonized measure remained in deflationary territory (-0.3%) after falling 0.9% in the year through May. The eurozone as a whole reported a 0.1% year-over-year rise in CPI in May. After today’s reports, it may have risen to 0.2% in June. |

Germany Consumer Price Index (CPI) YoY, June 2020(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

The euro is firmer and edged above the $1.1270 area, which is the (50%) retracement objective of last week’s decline and houses an expiring option for almost 990 mln euros. There is another option with the same strike for 1.4 bln euro that expires tomorrow. Also, there is an option for about 890 mln euros that expires today at $1.1300 and another that expires there tomorrow for 1.3 bln euros. The next retracement is near $1.1290, and last week’s high was nearly $1.1350. Sterling reached a high near $1.2390 late in the Asian session before being sold $1.2315 in the European morning to match the pre-weekend low, which is also the low for the month. The intraday technical readings of over-extended and a bounce is likely in the North American session, though the next level of support is seen near $1.2280.

America

The holiday-shortened week begins slowly. The US reports May pending home sales and the June Dallas Fed manufacturing survey. Tomorrow both Powell and Mnuchin go before Congress to talk about fiscal policy. The highlights of the week are auto sales (July 1) and employment data (July 2). As the quarter winds down, the Atlanta and St. Louis Fed GDP trackers are projecting a 39.5% and 38.4% Q2 contraction, respectively. The New York Fed’s model shows a more modest 16.3% contraction and a 1.5% expansion in Q3.

The reduction in the Fed’s balance sheet reported last week was the second consecutive contraction, and the balance sheet is now smaller than it was at the end of May. This, coupled with the rise in the average effective Fed funds rate (to around 8 bp from 5 bp last month), and slower M2 growth, has given rise to the idea that the Federal Reserve is snugging policy. This reading does not sit right with us. The reduction of the Fed’s balance sheet is mostly a reflection of the normalization of the markets and less demand for swaps with the foreign central banks and less need for injections via the repo market. Still, some of the Fed’s facilities, such as for commercial paper, money markets, and primary dealers have seen lukewarm interest in recent weeks, and the Main Street facility is not up and running yet.

Mexico’s economy is being hard hit. Before the weekend, it reported its IGAE economic indicator, which is a proxy for the domestic GDP. It fell by nearly 20% in April (year-over-year) after an 11% slide in March. The IMF forecasts the economy to contract by 10.5% this year. It also reported an unexpected trade deficit for May ahead of the weekend. Trade has imploded, exports are falling faster than imports. Exports were off 57% from a year ago (-47% in April), while imports fell 47% (-31% in April). Automotive exports were down a whopping 90%.

The US dollar reached its highest level since June 1 ahead of the weekend near CAD1.3715. It is consolidating thus far today. Initial support is seen near CAD1.3635 and then CAD1.3600 today. It reports April GDP tomorrow (median forecast in the Bloomberg survey is for an 11.8% contraction after a 5.8% decline in March). A move above CAD1.3700-CAD1.3720 targets CAD1.3800-CAD1.3830. The greenback recorded new highs for the month against the Mexican peso before the weekend near MXN23.08 and reached almost MXN23.10 earlier today. It has straddled the MXN23.00-handle today. Initial support is seen near MXN22.90. It finished last month closer to MXN22.17 (for around an 8.25% decline, snapping a three-month advance).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,China,EUR/CHF,federal-reserve,FX Daily,Germany Consumer Price Index,HK,Japan Retail Sales,Mexico,newsletter,Trade,USD/CHF