Tag Archive: FX Daily

FX Daily, September 26: Dollar Mixed while Stocks Slide to Begin Last Week of Q3

The US dollar is narrowly mixed. The euro, yen and Swiss franc are higher, while the dollar-bloc and sterling are softer. The moving element here is not so much the greenback, which serving more as a fulcrum, but idiosyncratic, country-level developments.

Read More »

Read More »

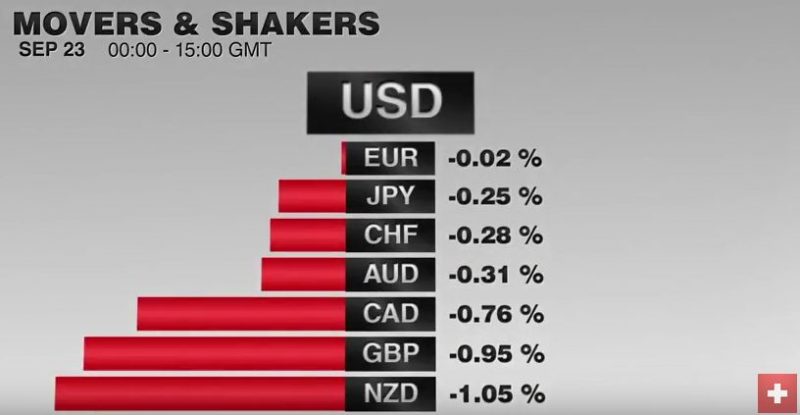

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

The EUR/CHF accelerated its decline since yesterday's strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged.

We know that the Swiss Franc has similar "counter-dollar" status as gold.

Read More »

Read More »

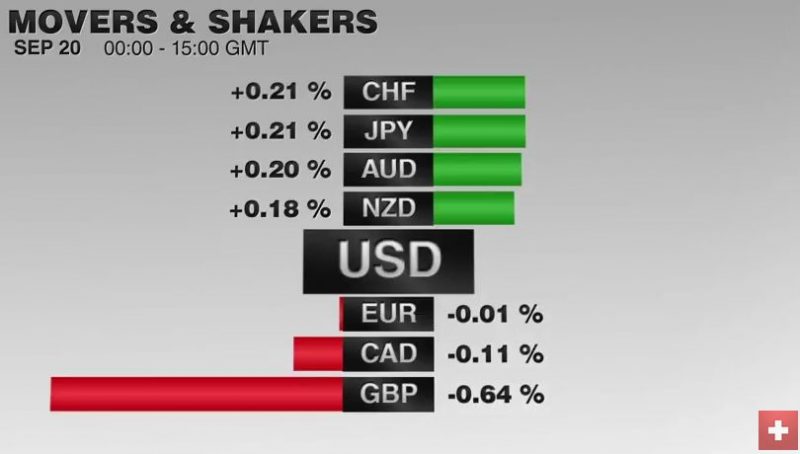

FX Daily, September 20: The Swiss Franc Continues To Rise.

The trade balance express if a currency is overvalued or not. The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued. And the franc continues to appreciate.

Read More »

Read More »

FX Daily, September 19: Dollar Begins Important Week on Softer Note

The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »

Read More »

FX Daily, September 15: Early Update: Full Calendar but Little News

Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and two September Fed surveys. Yet the economic updates are unlikely change sentiment ahead of next week FOMC and BOJ meetings.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

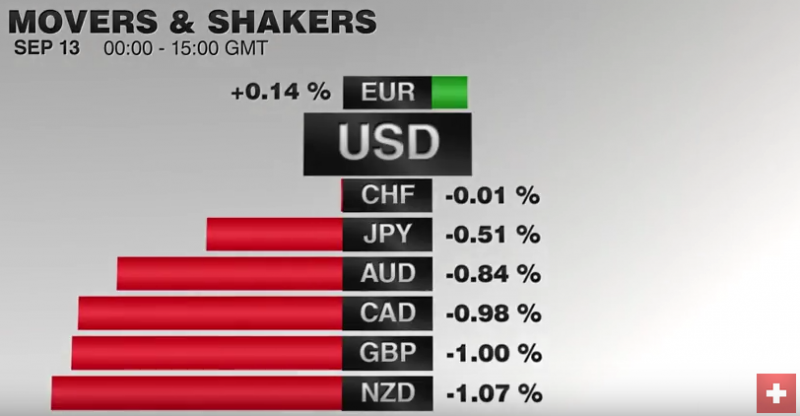

FX Daily, September 13: Much Noise, Weak Signal

The last ECB meeting and Dragh's hawkish comments is for us the main reason of the euro strength, this despite stronger Swiss GDP growth.

Read More »

Read More »

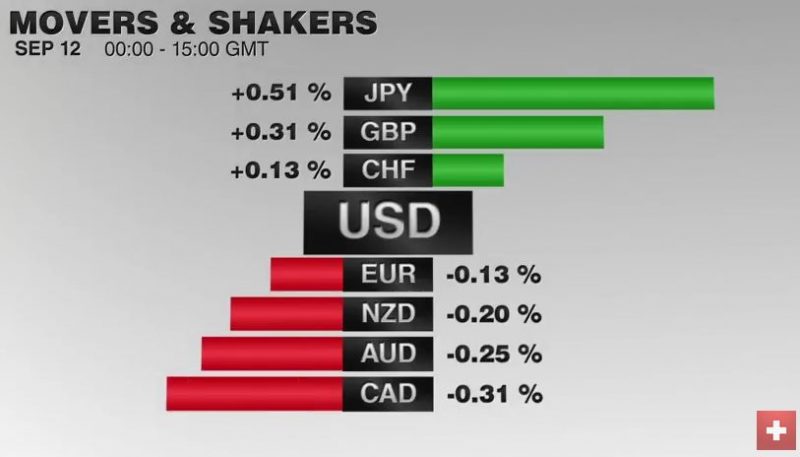

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

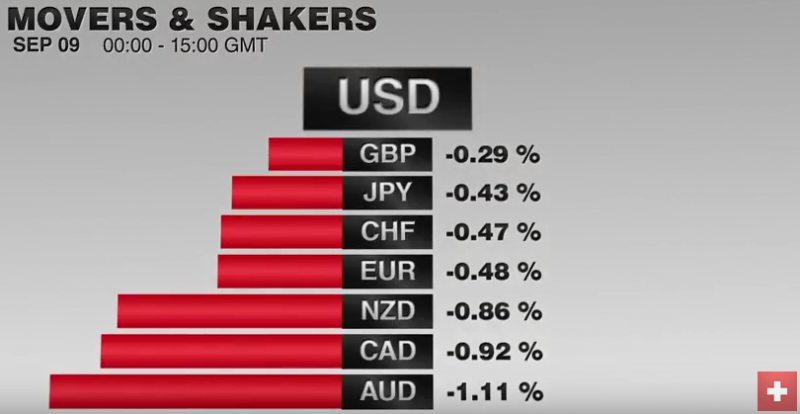

FX Daily, September 9: Ahead of the Weekend

The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed.Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays. The streak may end today. The euro has found support nearly $1.1260, and the intraday technicals favor a move higher in the US morning.

Read More »

Read More »

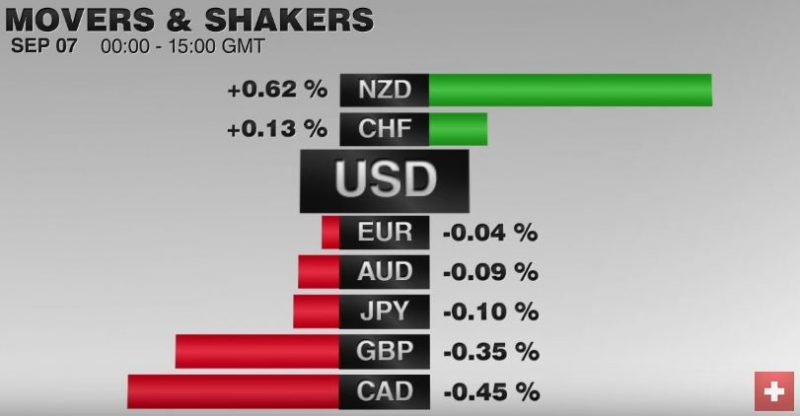

FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of...

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

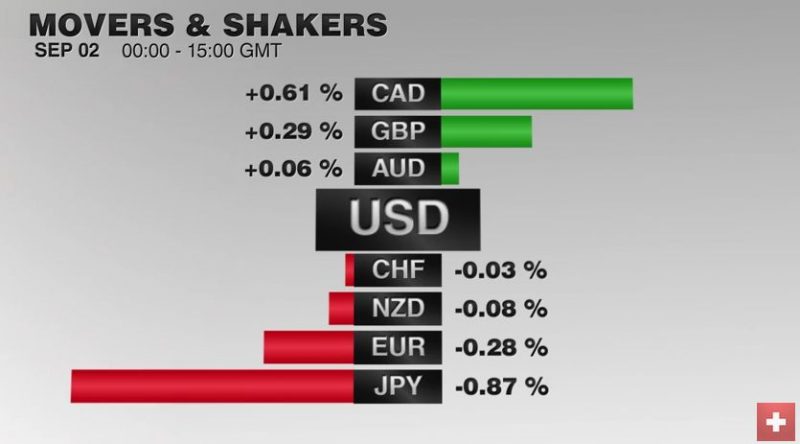

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

FX Daily, September 01: A Couple of Surprises to Start the New Month

The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

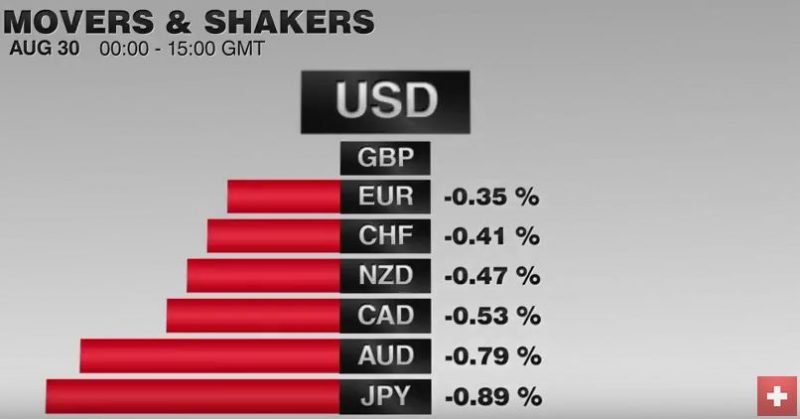

FX Daily, August 30: Greenback Remains Firm, Awaiting Fresh Cues

The US dollar is trading firmly, largely within yesterday's ranges. The odds implied by the September Fed fund futures eased to 36% from 42% before the weekend, but ahead of Fischer's Bloomberg TV appearance, and tomorrow's ADP employment estimate, the market seems cautious about fading the dollar's strength.

Read More »

Read More »

FX Daily, August 25: Narrow Ranges Prevail as Breakouts Fail

The US dollar remains mostly within the ranges seen yesterday against the major currencies.The market awaits fresh trading incentives and the end of the summer lull, which is expected next week. The Jackson Hole Fed gathering at which Yellen speaks tomorrow is seen as the highlight of this quiet week.

Read More »

Read More »

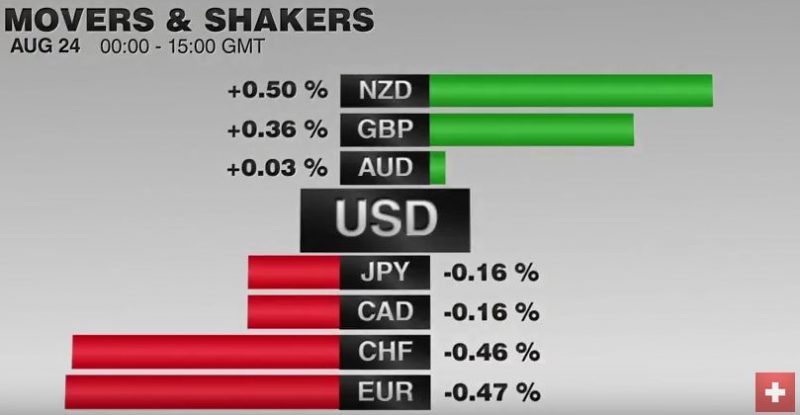

FX Daily, August 24: Narrowly Mixed Greenback in Summer Churn

The US dollar is going nowhere fast. It is narrowly mixed against the major currencies. The market awaits for fresh trading incentives, with much hope placed on Yellen's presentation at Jackson Hole at the end of the week. Is it too early to suggest that the build-up ahead of it is too much?

Read More »

Read More »