Swiss Franc |

|

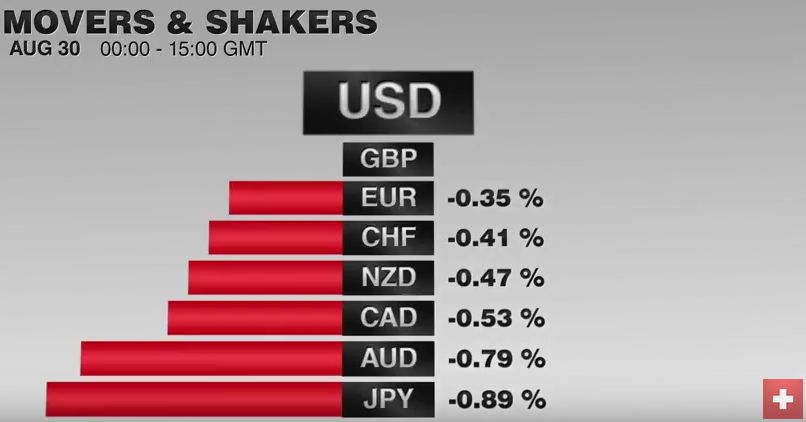

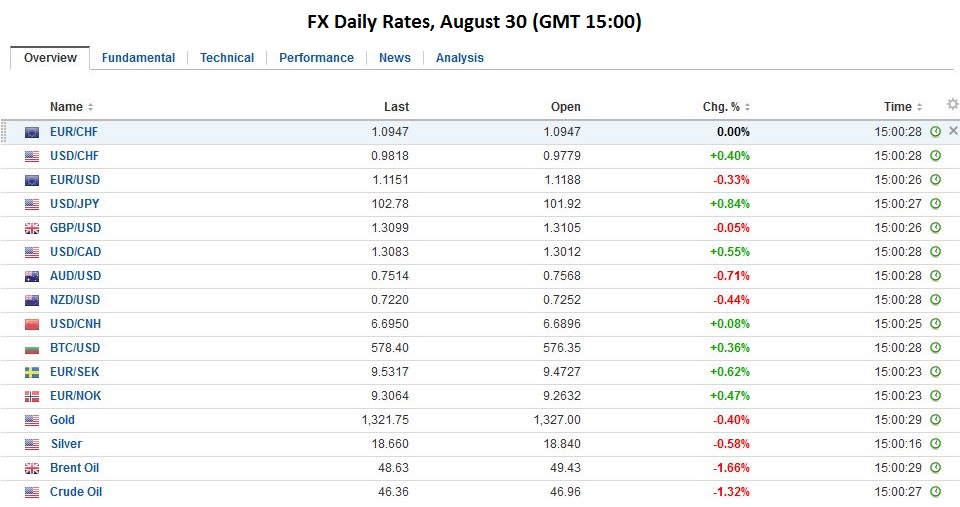

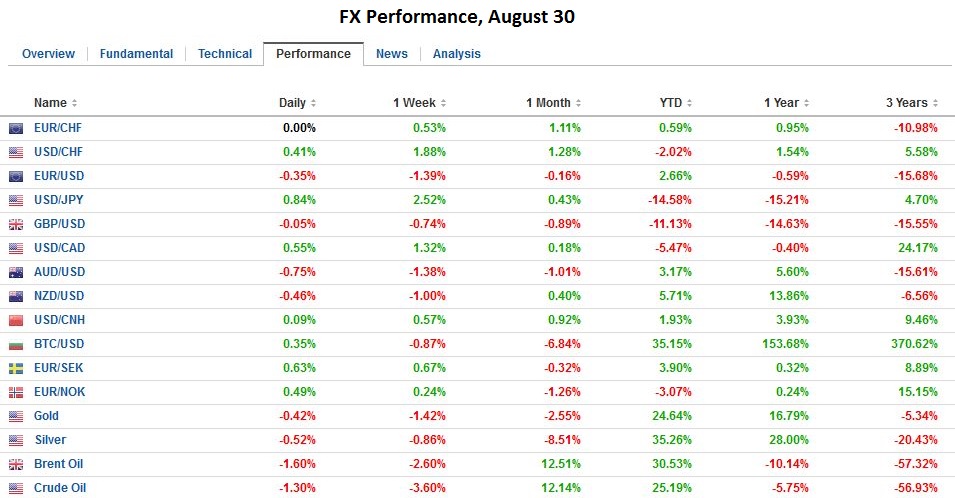

FX RatesThe US dollar is trading firmly, largely within yesterday’s ranges. The odds implied by the September Fed fund futures eased to 36% from 42% before the weekend, but ahead of Fischer’s Bloomberg TV appearance, and tomorrow’s ADP employment estimate, the market seems cautious about fading the dollar’s strength.

|

|

| There are several developments to note today. First is the batch of Japanese data. The key takeaway is that the labor market remains tight, with the unemployment rate slipping to 3.0%, the lowest since 1995, and consumption appears to have begun Q3 on a firm note. Employment rose by 200k in July, while unemployment fell 70k. The participation rate slipped to 60.3% from 60.5%. Although both retail sales and overall household spending remain lower than a year ago, both rose in July and by more than expected. Household spending rose 2.5% in July, and retail sales rose 1.4%.

The market’s focus is on the BOJ meeting later this month and Kuroda’s recent reiteration that monetary policy has not been exhausted. The dollar has already traded on both sides of yesterday’s narrow range against the yen. Yesterday’s high was near JPY102.40, and a close above it would be constructive. Resistance is seen near the month’s high in the JPY102.65-JPY102.85 range. Rising equities today and the firmer US bond yield, (though the 10-year is below the 1.63% level seen at the end of last week), may see the dollar probe higher in early North American turnover. |

|

| Australia reported an 11.3% surge in July building approvals. It is ten-times more than expected, though follows a downward revision to the June series (to -4.7% from -2.9%). It is the strongest report in two years. However, it was not sufficient to lift the Australian dollar. The Aussie encountered fresh selling near $0.7580, just shy of yesterday’s high. Yesterday’s low was seen near $0.7525, which appears safe. Another run at the highs in North America seems likely given the intraday technical readings.

The euro and sterling are trading with a softer bias near yesterday’s lows. We anticipate that both currencies will pare their losses in the North American session. The euro needs to resurface above $1.1200, and sterling faces initial resistance near $1.3100-$1.3120. |

|

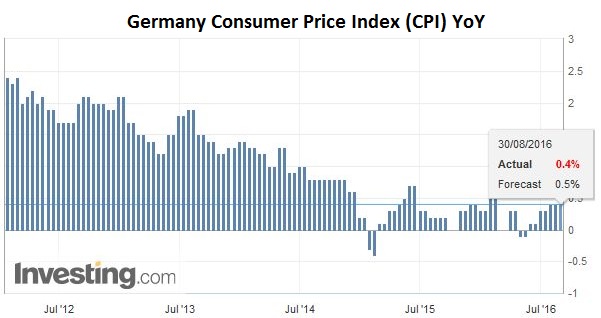

EurozoneIn Europe, the preliminary German state August inflation reports warn of downside risks to the median forecast for a 0.5% year-over-year rise for the country as a whole. In turn, this could risk tomorrow’s eurozone preliminary CPI (median estimate is for a 0.3% increase after 0.2% year-over-year in July). Spain’s August estimate was in line with expectations (-0.3% year-over-year). The more interesting focus today in Europe is the EC’s ruling on the tax concessions Ireland made to Apple. The EC ruled that Apple may have to repay 13 bln in taxes and interest. The EC argues that Ireland’s tax concessions amounted to an illegal subsidy. The EC claimed that the selective treatment given to Apple allowed it pay a tax rate of 1% on its European profits into 2003 and 0.005% in 2014. The US Treasury is at loggerheads with the EC over the handling of the issue. Note that the foreign tax that US companies pay, reduces their liability to the US tax authorities. Apple and Ireland will likely appeal whatever judgment is delivered, but Apple will likely seek credit from US tax authorities for any additional taxes they pay to Ireland. Some 700 US companies have facilities in Ireland, employing140k people. |

Germany Consumer Price Index (CPI) YoY(see more posts on Germany Consumer Price Index, ) Click to enlarge. Source Investing.com |

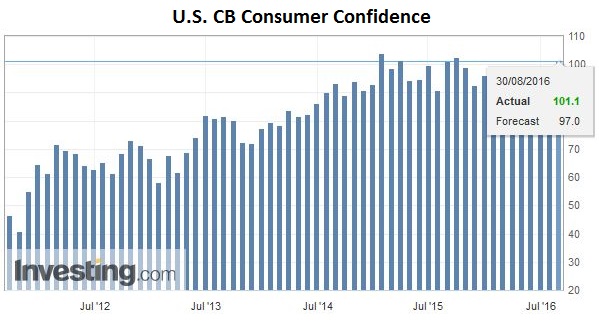

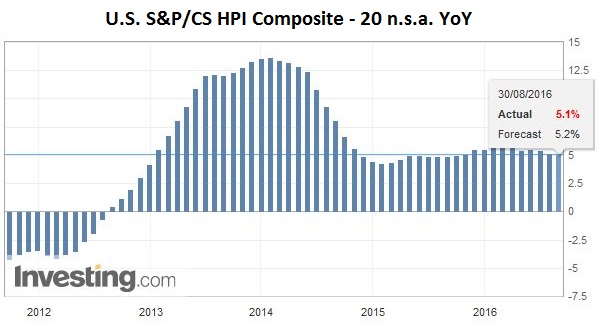

United StatesThe US data stream is light with house prices and consumer confidence the only reports of note. |

U.S. CB Consumer Confidence Click to enlarge. Source Investing.com |

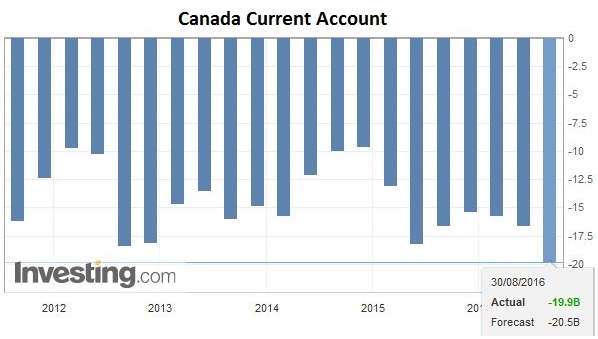

Canada Current AccountHowever, Canada reports Q2 current account. The deficit is likely to approach the record shortfall posted in Q3 2010 of C$20.2 bln. |

Canada Current Account |

U.S. S&P/CS HPI Composite – 20 n.s.a. YoYThe larger the deficit, the more the downside risk of Q2 GDP, which will be reported tomorrow. Canada is the only G7 country that appears to have contracted in Q2. The median forecast is for a 1.5% annualized pace of contraction. The US dollar may challenge a downtrend against the Canadian dollar that comes in today just below CAD1.3100. |

U.S. S&P/CS HPI Composite - 20 n.s.a. YoY Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CAD,$EUR,FX Daily,Germany Consumer Price Index,Japanese yen,newslettersent