Swiss Franc |

EUR/CHF - Euro Swiss Franc |

There were several developments that took place while US markets were closed for its Labor Day holiday.

Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin’s China’s service PMI.

What the market did react to is also important. The German election that saw the CDU come in third place in Merkel’s home state elicited little reaction. The pro-democracy movement picked up a few more seats in the Hong Kong legislature amid the highest voter participation since direct election of the legislature began in 1991. The pro-democracy moved now has 30 seats in the 70 seat chamber, which is sufficient to obstruct and embarrass, but little more. Investors ignored the news and instead boosted the Hang Seng Index by 1.65%, the most since mid-July.

On the other hand, the investors over-responded to suggestions that Saudi Arabia and Russia may agree to freeze output later this month. At its best, the price of Brent was up by more than 5%, but as cooler heads prevailed, the gains were pared to less than 1%. As we have noted, assuming rational actors embracing realpolitik values, we should expect output to increase ahead of serious negotiations to freeze production. And that is exactly what has happened.

An agreement to refrain from increasing output is also something smaller producers, many of whom are already producing near capacity, can agree to a freeze. They are not giving up anything. Iran is a different story. It’s output has not returned to pre-embargo levels, in part due to continued obstacles in securing financing from US and European banks. A freeze on the part of the Saudis without Iran participation would be tantamount to a surrender of market share in a rivalry that extends well beyond oil policy.

FX RatesThe dollar has been mostly moving higher against the yuan since the end of April.The dollar has fallen against the yuan in four of the past 18 weeks. However, it has been trading broadly sideways between CNY6.65 and CNY6.70 here in Q3. Sterling extended last week’s gains to reach $1.3375, surpassing by a few ticks the August 3 high. However, sellers were lurking, and sterling eased to $1.3290 in late London dealings. It is flirting with a trendline, drawn from the June 27, July 15 and September 1 highs, but has been unable to close above it. The trendline is found near $1.3325 on September 6. The euro finished last week just above the session and week’s lows near $1.1150. There was follow-through selling on Monday, but the range extension took place in Europe, not Asia. The low was near $1.1140. We have noted important technical support in the $1.1115-$1.1130 area. It houses a retracement target of the rally since late-July and the 200-day moving average. |

|

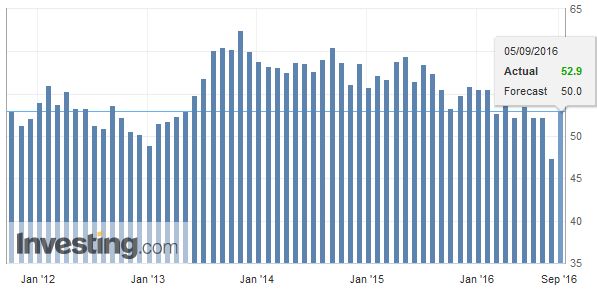

United KindgomThe UK hit the trifecta. Last week the manufacturing and construction PMIs popped back from the July, Brexit-shock drop. Today, the service sector PMI joined. It rose to 52.9 from 47.4, besting expectations for a 50 reading. To put it in perspective, consider that the Q2 average was 52.7, 54.0 in Q1, and 55.4 in Q3 and Q4 15. The composite reading jumped to 53.6 from 47.6. It is well above the Q2 average of 52.4, but below the 54.2 in Q1 and 55.4 in Q4 15. The UK’s Brexit Minister Davis is expected to explain in broad terms the government’s strategy for negotiating with the EU later this week before Parliament. Prime Minister May also questioned the effectiveness and desirability of an Australian point system for immigration, which many of the leaders of Brexit have advocated. |

U.K. Services PMI(see more posts on U.K. Services PMI, ) |

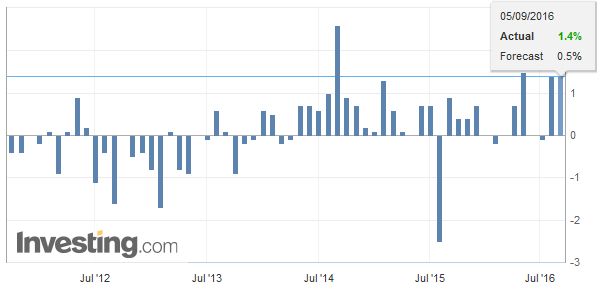

JapanOver the last couple of months, Japanese wages have begun rising. Specifically, in both June and July, cash wages rose 1.4% year-over-year. The two-month average is the largest since April 2010. There has also been a steady increase in the averages. The 12-month average is 0.5%. The six-month average is 0.8%, and the three-month average is 0.9%. Adjusted for inflation, real cash wages are rising at their fastest level since the middle of 2010. At the end of last week, the BOJ confirmed it had begun buying an ETF of companies with desired wage and investment policies. Even though the composite PMI, released early Monday in Tokyo, showed a return to sub-50, where it has been since February, except July, there is much talk that the BOJ may buy few long-term JGBs. The idea is later this month; the BOJ may announce intentions to facilitate curve steepening and/or introduce more flexibility into its asset purchase. This is an important factor that has been pushing up long-term Japanese interest rates. The 10-year yield is near its highest level in six months, though still slightly negative. The 30-early bond yield has risen from 2 bp in early-July to nearly 54 bp now. Over the past three months, long-dated JGBs are among the worst performing bond markets. The implications for the yen are clear. It is not just about the bond, but hedging decisions too. The dollar spent the Asian and European sessions confined to the pre-weekend trading range, but the tone was heavy as it was pushed away from the JPY104 level. Initial support is seen in around JPY102.70-JPY102.80. A break could signal a move toward JPY102.00-JPY102.20. |

Japan Average Cash Earnings YoY(see more posts on Japan Average Cash Earnings, ) |

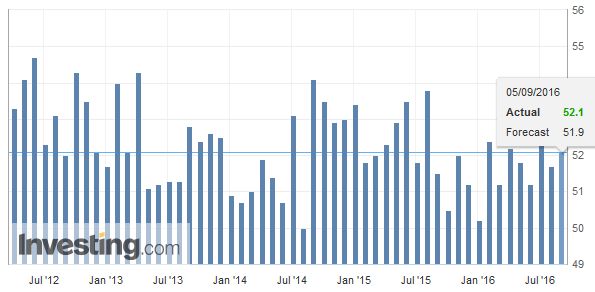

ChinaSeparately, Caixin’s non-manufacturing PMI rose to 52.1 from 51.7. Recall that last week, the government’s measure to 53.5 from 53.9. In contrast, the government’s PMI for manufacturing rose while the Caixin’s version slipped. The recent string of data suggests the Chinese economy is stabilizing though at the cost of greater leverage, and foreign demand (growing trade surplus; the August trade balance due later this week is expected to be a little above $58 bln). |

China Caixin Services PMI(see more posts on China Caixin Services PMI, ) |

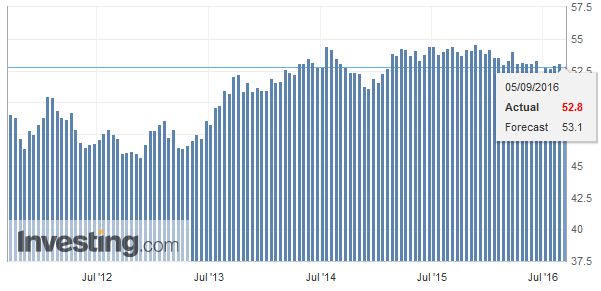

EurozoneThe eurozone’s August service PMI was disappointing. It was revised to 52.8 from the flash reading of 53.1. In July it stood at 52.9. The culprit was not the usual suspects, but Germany. Its service PMI was revised to 51.7 from 53.3. The composite fell to 53.3 from 55.3. It averaged 54.2 in Q1 and Q2. It is the lowest since May 2015. It is not particularly the kind of news Merkel would have wanted to hear, the day following the embarrassing third place finish of the CDU in her home state. It is more embarrassing than consequential, as the CDU will most likely will continue to be the junior partner of the SPD in the state government. The SPD may want to keep its options open, but the alternative is an alliance with the Left Party, which they have so far spurned. |

Eurozone Services PMI(see more posts on Eurozone Services PMI, ) |

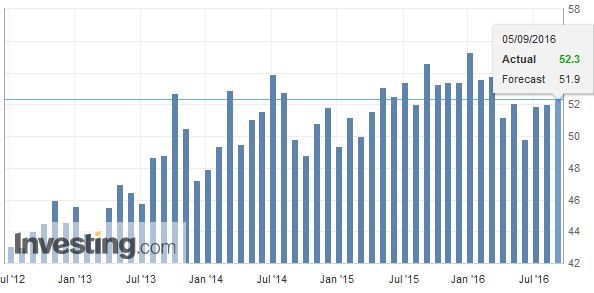

ItalyItaly’s service PMI was a pleasant surprise at 52.3, up from 52.0. Many expected a decline. However, the composite PMI eased to 51.9 from 52.2. Some earthquake relief and rebuilding funds could help Renzi, but it appears that whatever forward momentum the economy had is at risk of fading. It may not provide a favorable backdrop for the constitutional referendum in a couple of months. |

Italy Services PMI(see more posts on Italy Services PMI, ) |

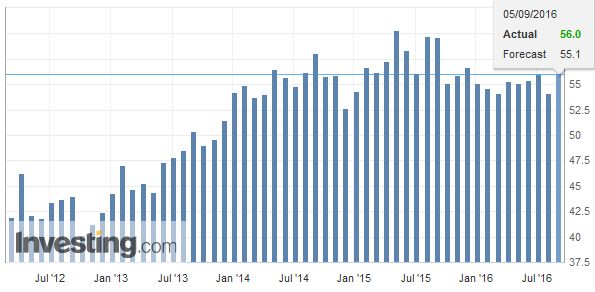

SpainSpain political deadlock continues, with Rajoy unable to secure even a plurality in last week’s confidence votes. There are some ideas that he may try again after the regional elections in Galicia and Basque next month. Despite (not because) the lack of an elected government (Rajoy is caretaker, with limited mandate), the economy still expanding at an enviable clip even if it has lost some momentum. The August service PMI rose to 56.0 from 54.1, and the composite stands at 54.8, up from 53.7. |

Spain Services PMI(see more posts on Spain Services PMI, ) |

Leaving the tarmac issues aside, the G20 meeting was successful, and the signing of the Paris Accords by the Presidents of the two largest economies is notable. Obama and Xi also pledged to avoid competitive currency devaluations, which continues to strike us as an arms control agreement of sorts, though one country has a current account surplus and the other a deficit.

We note that the US two-yield is above the similar German yield by 142 bp. It had fallen to 126 bp a month ago but rebounded to multi-year high near 146 bp in late-August near where it is consolidating now.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CNY,$EUR,China Caixin Services PMI,Eurozone Services PMI,FX Daily,Italy Services PMI,Japan Average Cash Earnings,Japanese yen,newslettersent,Spain Services PMI,U.K. Services PMI