The capital markets are off to a mixed start to start the last week of the month. Asian shares were mostly higher, though the Nikkei shed 0.5%. European shares are also higher, extending the three-week high seen last week.

FX Rates

|

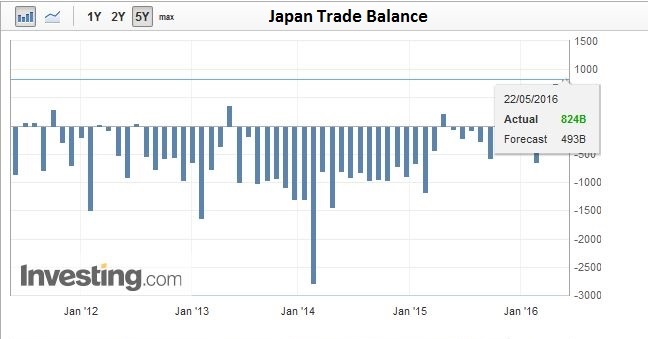

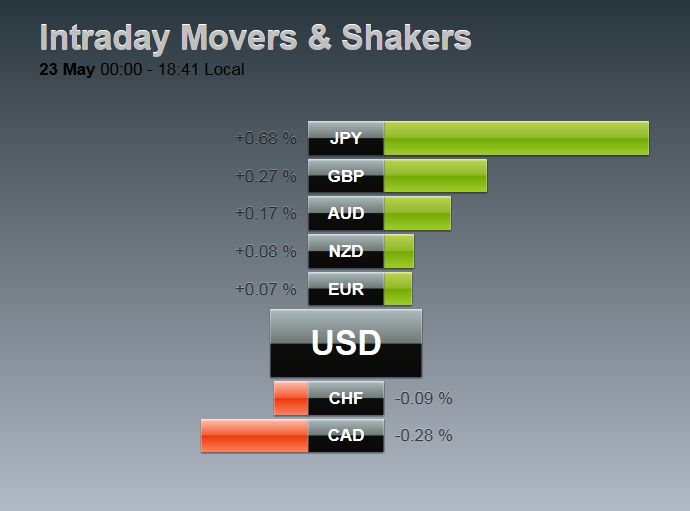

The US dollar is mixed. The yen is the strongest of the majors. The media continues to play up tension between the US and Japan at the weekend G7 meeting over the appropriateness of intervention, but Europe is not very sympathetic either. Today’s news makes it even more difficult. Japan reported its largest trade surplus in several years and nearly 30% higher than economists expected.

|

|

Japan Trade Balance

|

Below the surface, the details were not particularly inspiring. Exports fell for a seventh consecutive month and the year-over-year pace of -10.1% was a little more than expected. Imports shocked with a 23.3% plunge. The market has expected a little more than a 19% decline. In March, they fell by almost 15%.

|

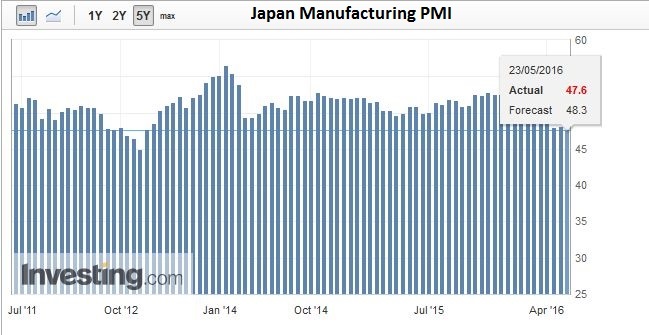

Japan Manufacturing PMI

|

Also, illustrating the difficult straits the economy is in, the preliminary manufacturing PMI fell to 47.6 from 48.2, its third month below the 50 boom-bust, and the lowest since the end of 2012. Separately, the Cabinet left is economic assessment unchanged from April–weakness within moderate recovery. It updated its estimate of the recent earthquake damage to JPY2.4-JPY4.6 trillion (~$22-$42 bln)

|

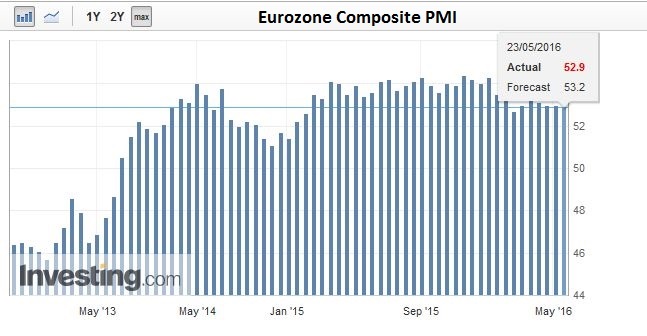

Eurozone Composite PMI

|

The flash eurozone composite PMI slipped marginally to 52.9 from 53.0. The market had expected a small increase. The service component was unchanged at 53.1 while the manufacturing PMI eased to 52.4 from 52.6. The composite appears consistent with 0.4%-0.5% Q2 GDP, which by most estimates, is near trend growth for EMU.

A worrisome feature is that the forward-looking new orders fell their lowest level since the start of the year. German new orders were at ten -month lows. This warns that the increase in output was to fill the backlog rather than new business. On the other hand, at next week’s ECB meeting, officials may note the first of input prices in five months.

|

Company News

There are three other talking points today. First, as emerged last week, Bayer is making an unsolicited offer for Monsanto. Reports today suggest a cash offer of $62 bln. Second, reports suggest Apple is telling suppliers to prepare for a new version of smartphones. This helped lift share prices, and Taiwan’s Taiex gained 2.6%, the largest advance in more than six months. Third, commodity prices have been hit hard continuing this month’s slide. Iron ore (Dallan) is off 7% today to bring the monthly drop to 30%. Steel rebar is off 5% for a 32% decline in May. Hot rolled coil steel is off 6% today and 28% for the month. Copper is trading at three-month lows today. Oil is off almost 1% today, with Brent holding just above $48.

The greenback is mixed, with sterling and yen gaining while the euro is flirting with the $1.12 level. The tone is consolidative as the market appears to be waiting for the leadership of the US market. It is the shifting views of the trajectory of Fed policy that was the major driver last week.

(graphs added by the team of snbchf.com)

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: FX Daily,Japanese yen,newslettersent