Tag Archive: EUR/CHF

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »

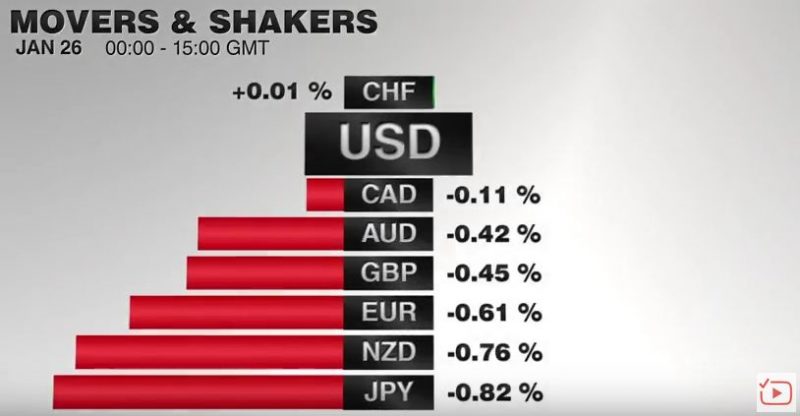

FX Daily, January 26: EUR/CHF collapses to 1.670

The US dollar is mostly firmer against the major currencies but is confined to narrow ranges, and well-worn ranges at that, but the focus has shifted to the strong advance in equities. Yesterday, the Dow Jones Industrials finally rose through the psychologically-important 20k level, and the S&P 500 gapped higher to new record levels.

Read More »

Read More »

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

FX Daily, January 24: UK Supreme Court Requires May to Submit Bill on Brexit to Parliament

As widely expected, the UK Supreme Court ruled that Parliament approval is needed to trigger Article 50 start the divorce proceedings with the EU. The Court decided by an 8-3 majority that a bill needs to be submitted to both chambers, but that the approval of the regional assemblies (e.g. Scotland, Northern Ireland) is not necessary.

Read More »

Read More »

FX Daily, January 23: Dollar’s Pre-Weekend Retreat Extended in Asia Before Stabilizing in Europe

The US dollar had a poor close in the North American session before the weekend as investors appear increasing anxious about the new US Administration's economic policies and priorities.With no fresh details emerging over the weekend, some stale dollar longs exited. The dollar stabilized in the European morning, but broader risk appetites were not rekindled, and the Dow Jones Stoxx 600, led by financials, was sold to its lowest level this month.

Read More »

Read More »

FX Weekly Review, January 16 – 21: Dollar Still Appears to Carving out a Bottom

The US dollar turned in a mixed performance over the past week. The technical indicators continue to support our expectation that after correcting since mid-December, following the Fed's hike, the dollar is basing.

Read More »

Read More »

FX Daily, January 20: Trump Day

The dollar peaked against the yuan two days after the Federal Reserve hiked interest rates in the middle of last month. We argue that that is when the market correction began, not at the turn of the calendar. Despite claims that China's currency is dropping like a rock, it has actually risen for the fifth consecutive week. That is the longest rising streak for the yuan since early 2016.

Read More »

Read More »

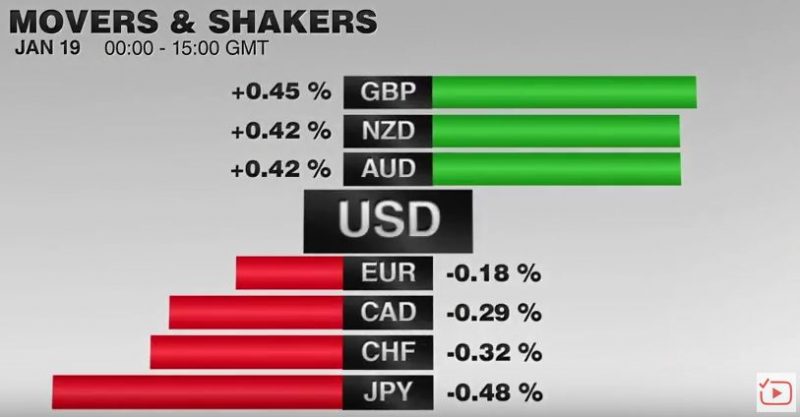

FX Daily, January 19: Dollar Gives Back Most of Yellen-Inspired Gains

While the US 10-year yield is unchanged, the dollar is consolidating its gains against the yen in a relatively narrow range of about half a big figure below JPY115.00. It has seen its gains pared more against the euro and sterling, where most of Yellen-inspired gains have been unwound. Sterling found support near $1.2250 and was bid up to $1.2335 by early in the European sessions.

Read More »

Read More »

FX Daily, January 18: Markets Stabilize, Awaiting Fresh Cues

The US dollar has stabilized after yesterday's bruising. From a fundamental perspective, little has changed. After hard exit signals from the UK government sent sterling down from $1.2430 on January 5 and 6, to below $1.20 at the start of the week, the pound rallied back to almost $1.2430 yesterday amid "sell the rumor buy the fact" activity.

Read More »

Read More »

FX Daily, January 17: Trump’s Comments Send the Dollar Reeling

The Pound has been subjected to a heavy amount of pressure as we progress further into 2017, with GBP/CHF rates being one of the heaviest losers. The pairing is now trading at a similar level to GBP/USD levels below the 1.22 mark. Their is an enjoyable symmetry between the two from an analysts point of view. Both are well regarded as safe-haven currencies, and in this time of increased uncertainty, both have almost the exact same value in the...

Read More »

Read More »

FX Daily, January 16: Hard Exit Talk Sent Sterling Below $1.20

The euro has been sold to $1.0580 in the European morning, a cent lower from the pre-weekend high. In addition to the drag from sterling, the euro appears to have been sold in response to the interview in two European papers of the next US President. Among other things, Trump reported claimed that NATO was obsolete and that other countries will leave the European Union, which is largely a German project.

Read More »

Read More »

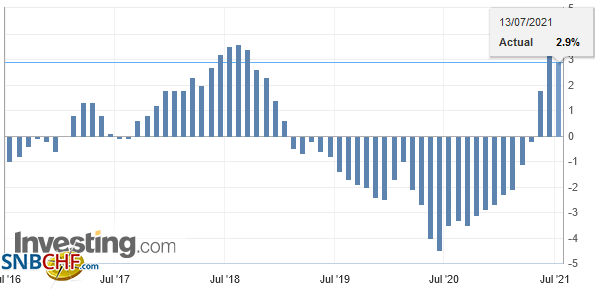

FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days.

Read More »

Read More »

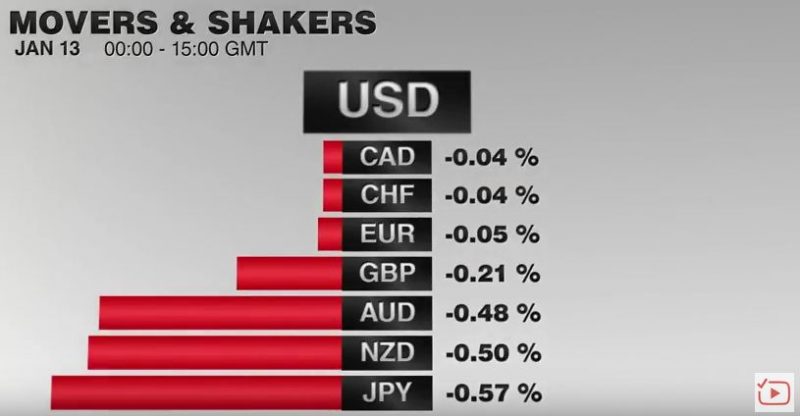

FX Daily, January 13: Corrective Forces Persist

The Supreme Court Judgement on whether parliament will have to O.K the triggering of article 50 is ongoing and when the ruling is announced expect big swings on GBP/CHF. I think the likely outcome will be that parliament will get the vote, most broad sheet papers have indicated the majority of the judges are in favour of the parliamentary vote.

Read More »

Read More »

FX Daily, January 12: Dollar and Yields Ease Further, but Look for Recovery

After a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso.

Read More »

Read More »

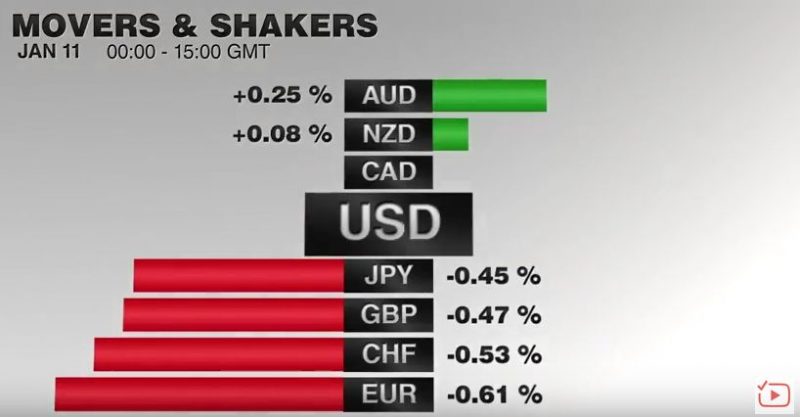

FX Daily, January 11: Dollar Comes Back Bid

The pound has seen a sharp fall following the interview that Theresa May gave with Sky news on Sunday although there has been a small rebound this afternoon. GBP CHF exchange rates are hovering around 1.2350 for this pair.

Read More »

Read More »

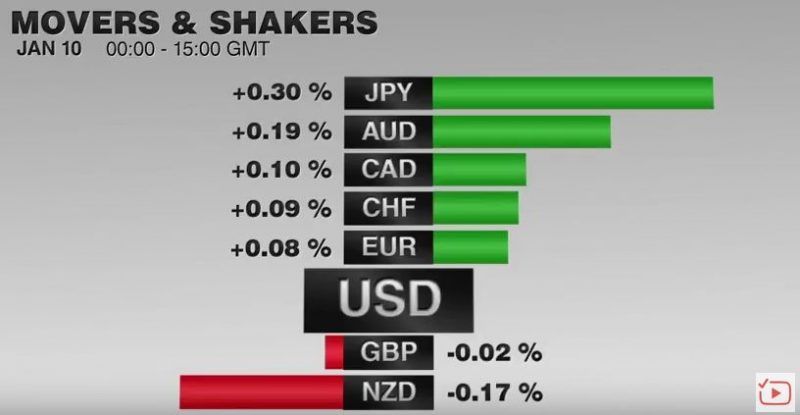

FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

After strong moves to start the year, the capital markets continue to consolidate. Many observers are suggesting a fundamental narrative behind the loss of momentum, but in discussions with clients and other market participants, it seems as if the main source of caution is coming from an understanding of market positioning rather than a reevaluation of the macro drivers.

Read More »

Read More »

FX Daily, January 09: Sterling Pounded by May’s Hard Brexit

Sterling has stolen the US dollar's spotlight. The issue facing market participants was if the rise in hourly earnings reported as part of the pre-weekend release of US December jobs data was sufficient to end the dollar's downside correction. Instead, May's comments over the weekend indicating not just a desire but strategic thrust to abandon the single market in exchange for regaining control over immigration and not being subject to the...

Read More »

Read More »

FX Weekly Review, January 02 – 07: Is the corrective phase of the dollar over?

The lack of full participation and the resulting choppy conditions may have obscured the signal from the capital markets. That signal we think was one of correction since shortly after the Fed's rate hike in id-December. The question now, after the US employment data showed continued labor market strength and that earnings improvement remains intact, is whether the corrective phase is over.

Read More »

Read More »

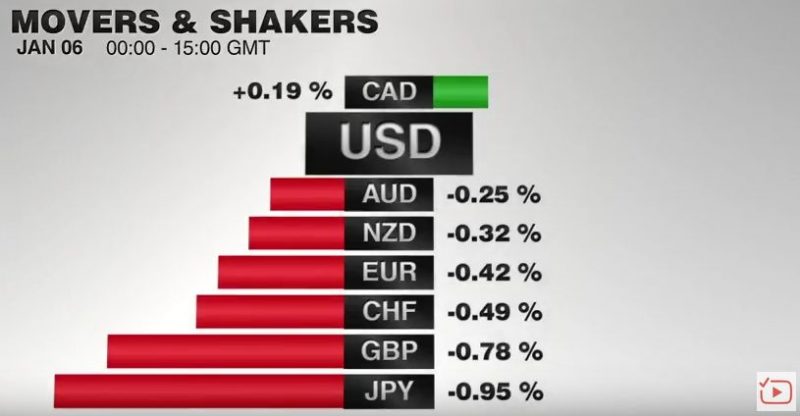

FX Daily, January 06: Dollar Consolidates Losses, Peso Firms while Yuan Reverses

I am reading a lot about the pound in 2017 which is likely to be as volatile as in 2016. But the Franc is a harder beast to predict. Loosely tracking the euro but subject to its own rules and trends GBPCHF could be an interesting pair to watch in 2017. There are numerous global events which can shape the direction on the Franc and clients looking to exchange pounds into Francs or move Francs back to the UK should be considering the path ahead.

Read More »

Read More »

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »