Tag Archive: EUR/CHF

FX Daily, February 24: Anxiety? What Anxiety?

The US dollar is finishing the week on a mixed note in choppy activity in narrow ranges. It is an apt way to finish this week, which has been largely directionless as investors wait for fresh incentives, and are especially looking toward Trump's speech to a joint session of Congress next week.

Read More »

Read More »

FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

The US dollar is confined to narrow ranges today within yesterday's ranges. Equity markets posted small gains in Asia and have an upside bias in Europe. Core bond yields are softer, and today this includes France, but peripheral European 10-year benchmark yields are 3-6 bp firmer. Italian bonds are the poorest performer, while the 10-year Dutch bond yields are off the most (3.2 bp to 0.56%) despite the looming election.

Read More »

Read More »

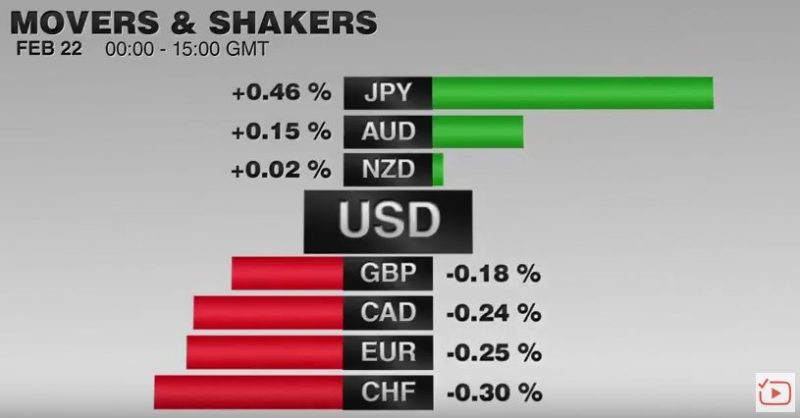

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

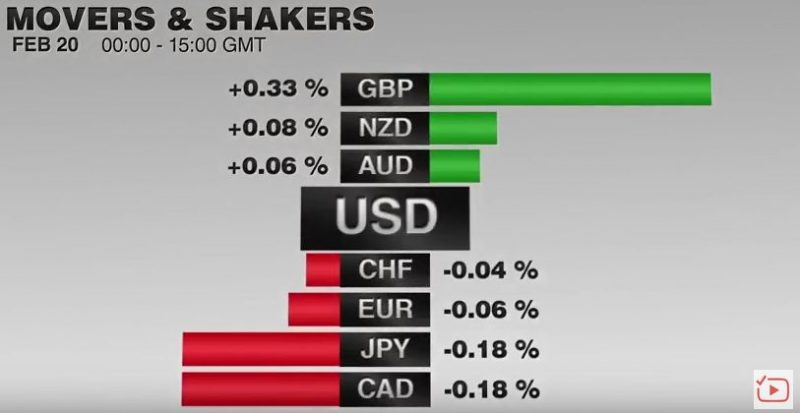

FX Daily, February 20: Marking Time on Monday

US markets are closed for the Presidents' Day holiday, but it hasn't prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today.

Read More »

Read More »

FX Weekly Review, February 13 – 18: Why still long the dollar?

Arguments for being long the dollar: FX investors because of the difference in monetary policy (e.g. higher US rates), Bond investors long US Bonds because higher bond yields, On the other side, European and Swiss equities are not so much overvalued as U.S. stocks are.

Read More »

Read More »

FX Daily, February 17: Greenback Stabilizes Ahead of the Weekend

The US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling, the euro and Canadian dollar.

Read More »

Read More »

FX Daily, February 16: Corrective Forces Emerge, Tempering the Dollar’s Rally

The Dollar Index had moved higher for ten consecutive sessions before reversing yesterday's gains to close lower. Yesterday and today's losses have seen the Dollar Index retrace 38.2% of the advance since February 2. That retracement objective was near 100.80. The 50% retracement is found near 100.50 and the 61.8% retracement by 100.20.

Read More »

Read More »

FX Daily, February 15: Yellen Helps the Dollar Extend Streak

The Dollar Index's ten-day rally was at risk yesterday, but Yellen's reiteration of the commitment to continue to lift rates gradually helped extend the streak to eleven sessions.This surpassed the streak around the election (November 7-November 18). With today's gains, it may draw closer to what appears to be the long streak, 14 sessions between April 30, 2012 and May 17.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

FX Daily, February 13: Quiet Start of Busy Week

With inflation and growth reports due out this week and Federal Reserve Chair Yellen's testimony before Congress, it promises to be a busy week for investors. However, the week has begun off fairly quietly, while the recent rally in equities continues.

Read More »

Read More »

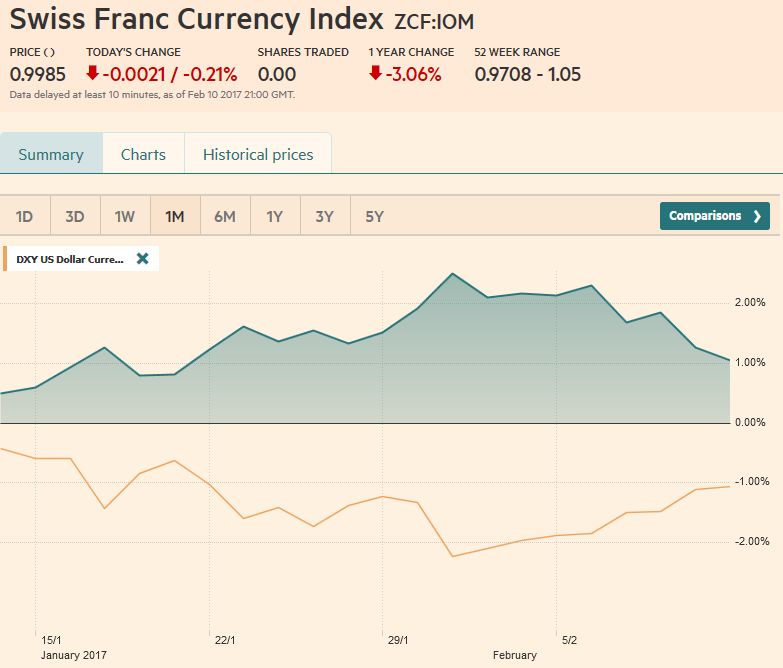

FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

We are expecting a further strengthening of both dollar and Swiss Franc against the euro over the next 3 months. Reason is the rising Swiss demand the continued dovishness of the ECB, despite rising inflation.

Read More »

Read More »

FX Daily, February 10: US Dollar Holding on to Week’s Gains

The US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week's decline. The Aussie is the strongest on the day, up about 0.2% to trim the week's loss to about 0.45%.

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

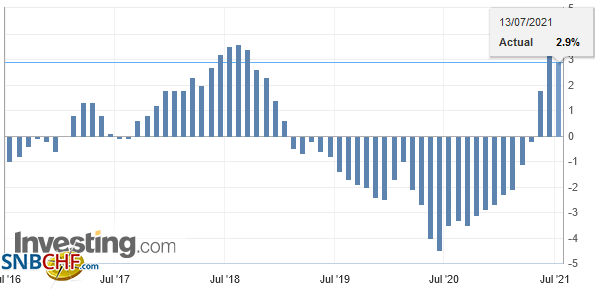

FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come.

I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015.

Read More »

Read More »

FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

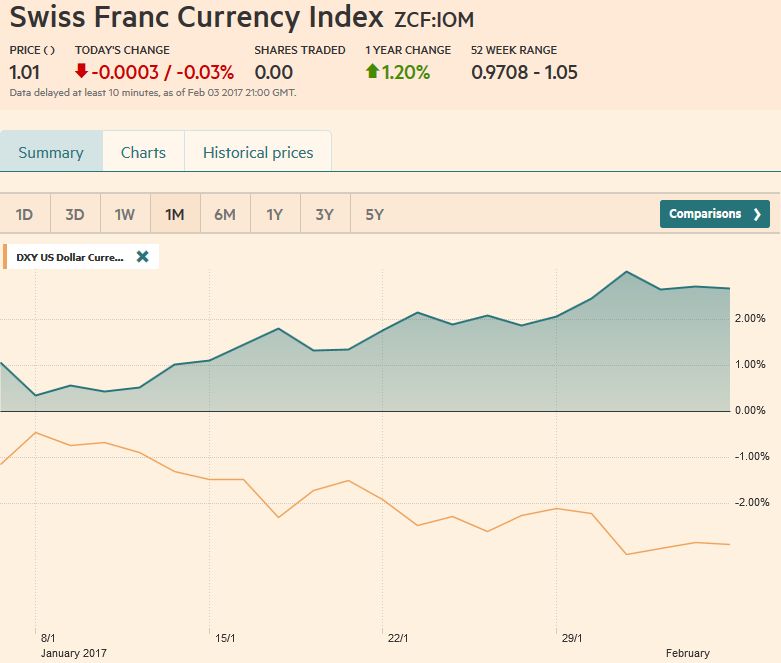

The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now - and with it the franc recovered.

Read More »

Read More »

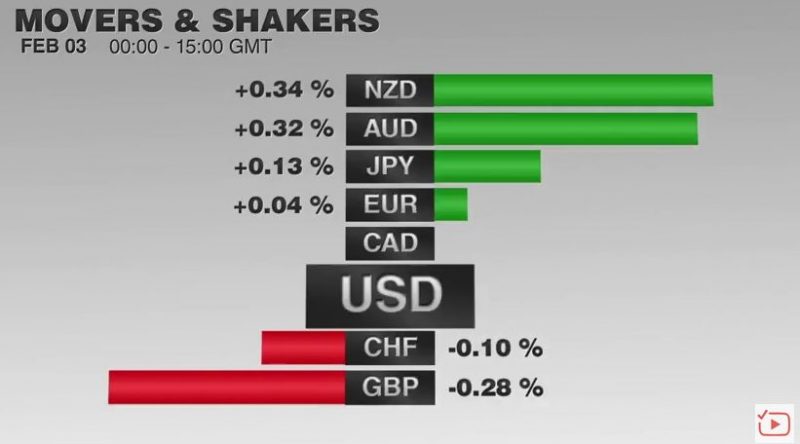

FX Daily, February 03: US Jobs Trump Europe’s Service PMIs

Ahead of the weekend, there are two series of economic reports. The first are Europe's service PMI reports and the second is the US employment report. Neither report is likely to alter views significantly, but the latter has greater potential to move the market.

Read More »

Read More »

FX Daily, February 02: Dollar Remains on Back Foot After ADP and FOMC

The US dollar remains on its back foot despite the stronger than expected ADP job estimate and the FOMC that said nothing to dissuade investors that it will be gradually raising rates this year.

Read More »

Read More »

FX Daily, January 31: Markets Look for Solid Footing

The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday's drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar's losses yesterday, which it is consolidating today.

Read More »

Read More »

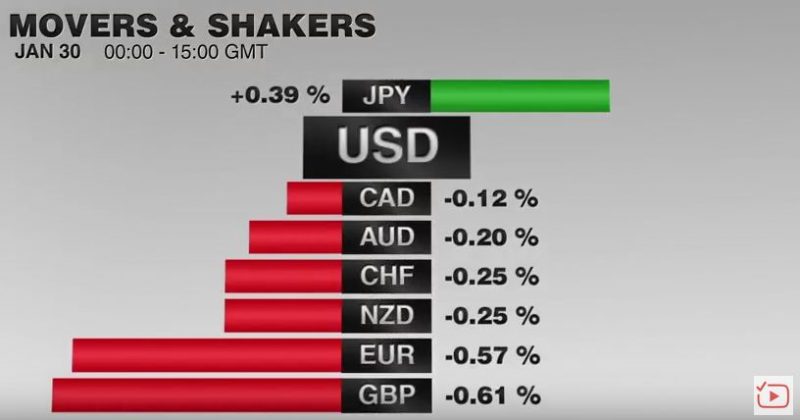

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »

FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

The US dollar spent the first month of the new year correcting lower after a strong advance in the last several months of 2016. We argue that the correction actually began in mid-December following the Federal Reserve's rate hike.

Read More »

Read More »