Tag Archive: Chart Update

Why There Will Be No 11th Hour Debt Ceiling Deal

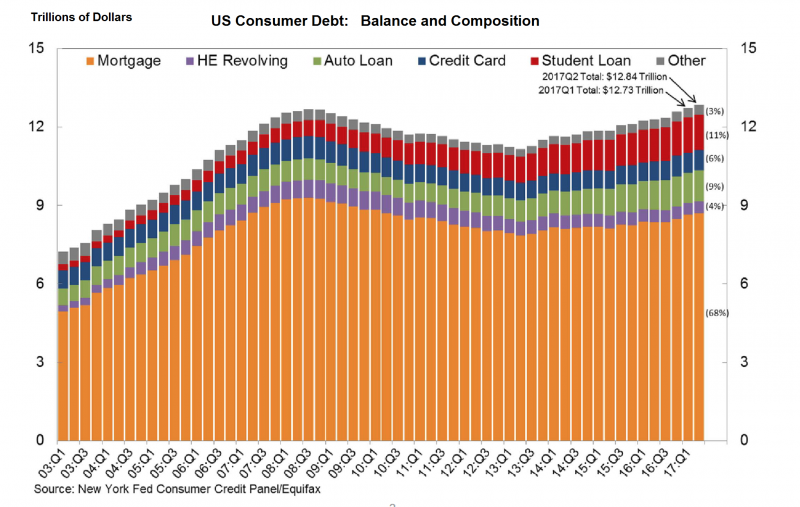

A new milestone on the American populaces’ collective pursuit of insolvency was reached this week. According to a report published on Tuesday by the Federal Reserve Bank of New York, total U.S. household debt jumped to a new record high of $12.84 trillion during the second quarter. This included an increase of $552 billion from a year ago.

Read More »

Read More »

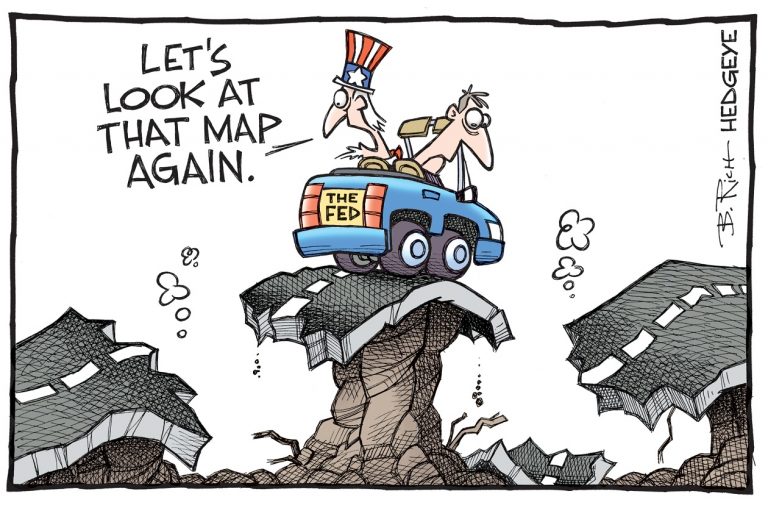

How Dumb Is the Fed?

Bent and Distorted. POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

Read More »

Read More »

Moving Closer to the Precipice

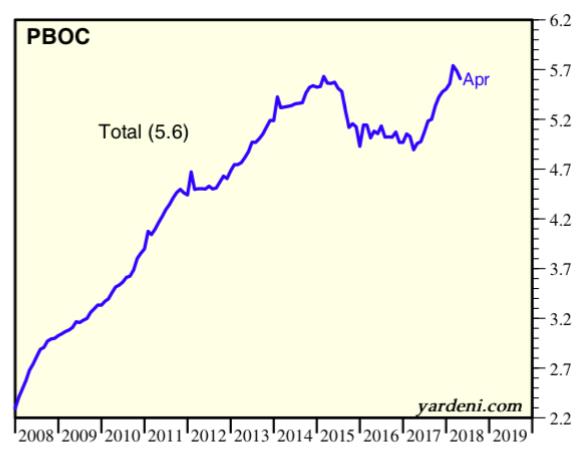

The decline in the growth rate of the broad US money supply measure TMS-2 that started last November continues, but the momentum of the decline has slowed last month (TMS = “true money supply”). The data were recently updated to the end of April, as of which the year-on-year growth rate of TMS-2 is clocking in at 6.05%, a slight decrease from the 6.12% growth rate recorded at the end of March.

Read More »

Read More »

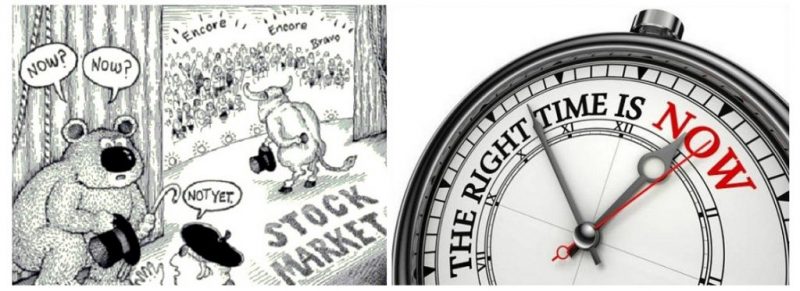

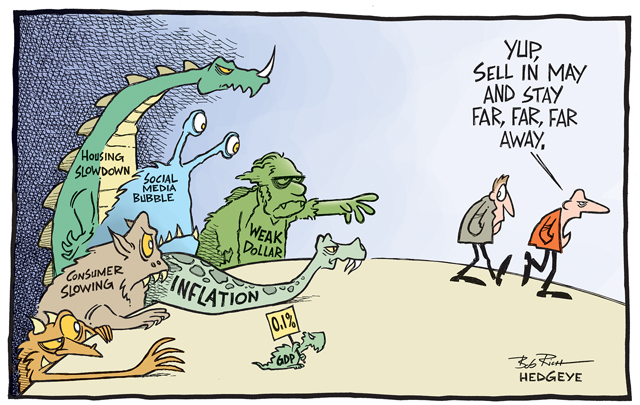

“Sell in May”: Good Advice – But Is There a Better Way?

If you “sell in May and go away”, you are definitely on the right side of the trend from a statistical perspective: While gains were achieved in the summer months in three of the eleven largest stock markets in the world, they amounted to less than one percent on average. In six countries stocks even exhibited losses!

Read More »

Read More »

Rising Oil Prices Don’t Cause Inflation

A very good visual correlation between the yearly percentage change in the consumer price index (CPI) and the yearly percentage change in the price of oil seems to provide support to the popular thinking that future changes in price inflation in the US are likely to be set by the yearly growth rate in the price of oil (see first chart below).

Read More »

Read More »

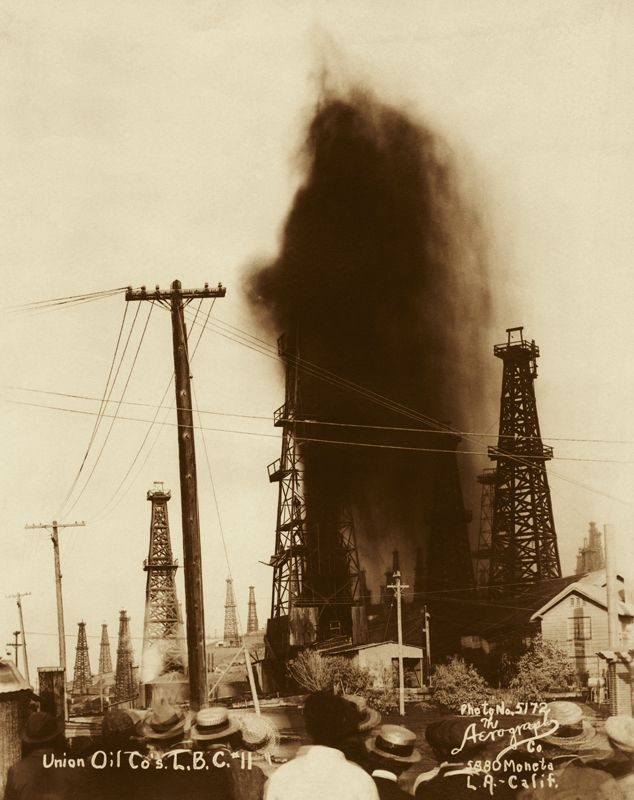

A Cloud Hangs Over the Oil Sector

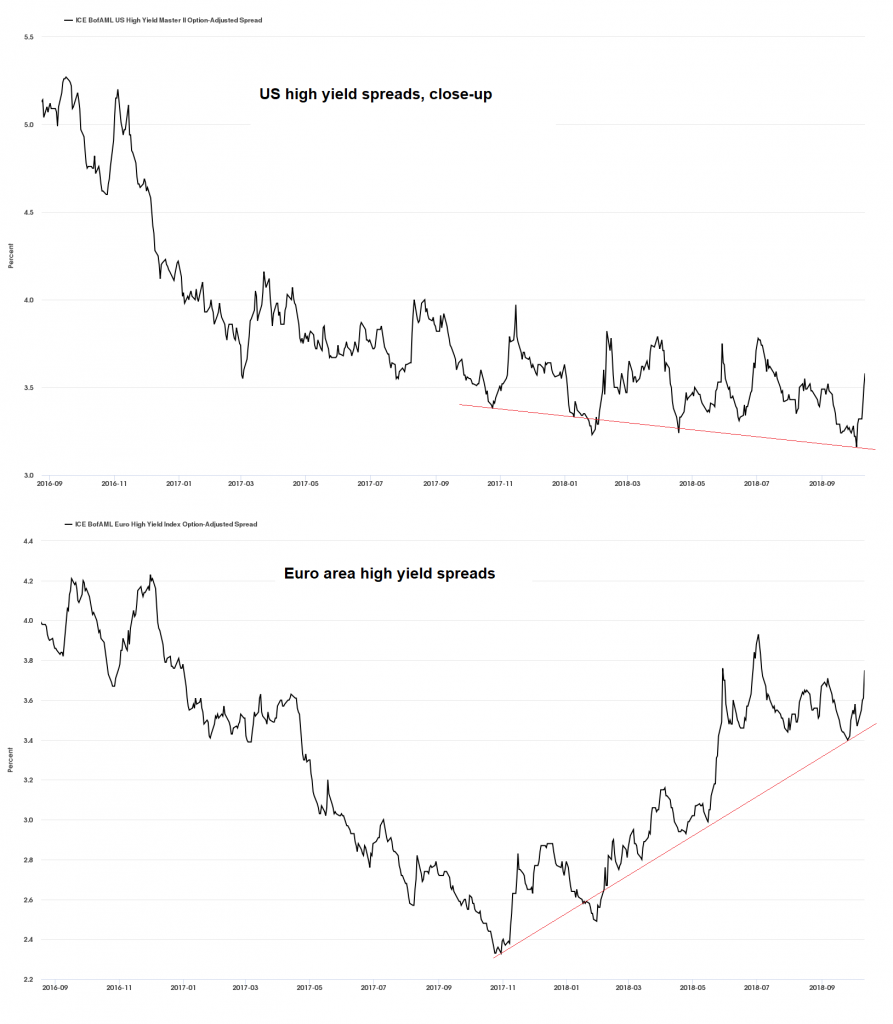

As we noted in a recent corporate debt update on occasion of the troubles Neiman-Marcus finds itself in (see “Cracks in Ponzi Finance Land”), problems are set to emerge among high-yield borrowers in the US retail sector this year. This happens just as similar problems among low-rated borrowers in the oil sector were mitigated by the rally in oil prices since early 2016.

Read More »

Read More »

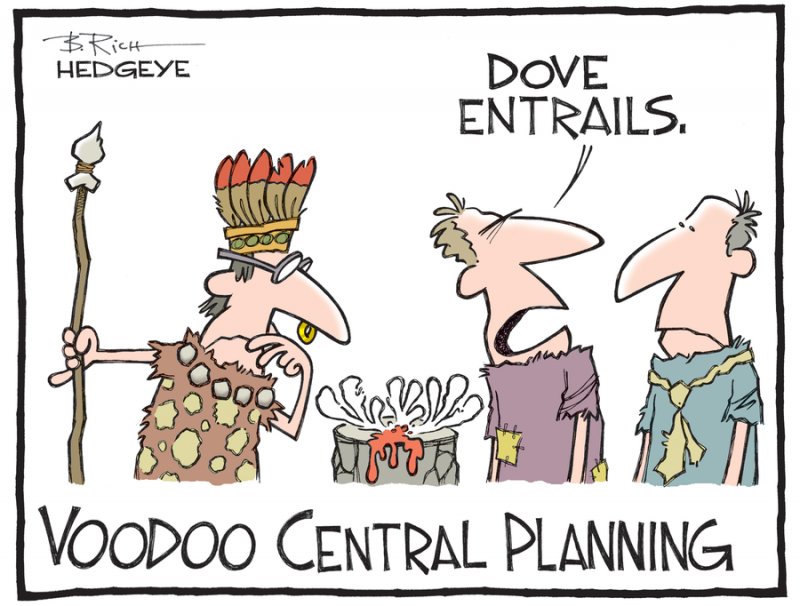

The Triumph of Hope over Experience

On Wednesday the socialist central planning agency that has bedeviled the market economy for more than a century held one of its regular meetings. Thereafter it informed us about its reading of the bird entrails via statement (one could call this a verbose form of groping in the dark).

Read More »

Read More »

“Sell in May and Go Away” – in 9 out of 11 Countries it Makes Sense to Do So

An Old Seasonal Truism Most people are probably aware of the saying “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months.

Read More »

Read More »