Tag Archive: $AUD

FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America's national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda.

Read More »

Read More »

FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week's gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is up 1.1% this week, in comparison.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

Great Graphic: Aussie is Approaching 15-month Trendline

This Great Graphic, made on Bloomberg, depicts the Australian dollar since April 2016. We drew in the trendline from that April high, through the November high and the March 2017 high. It nearly catches last month's high as well. It comes in now near $0.7725.

Read More »

Read More »

FX Daily, July 05: Dollar Firm as Investors Await Fresh Directional Cues

The US dollar is enjoying a firm tone today. Yesterday's two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday.

Read More »

Read More »

FX Weekly Preview: Official Coordination or Is the Market Getting Ahead of Itself?

The consensus narrative sees a coordinated attempt by officials to prepare investors for less accommodative monetary policy. Data from the eurozone and UK may suggest the respective economies are not accelerating. Before getting to the jobs report, the US economic data, like auto sales, may be soft, while the prices paid in the manufacturing ISM may ease.

Read More »

Read More »

FX Daily, June 29: Run on Dollar and Yen Continues

The main driver of the foreign exchange market is the continued reassessment of the trajectory of monetary policy in the UK, EMU, and Canada. The OIS market does not show that higher rates are discounted for the next policy meeting (August, September, and July respectively), but rather there is greater confidence that, outside of Japan, peak monetary stimulus is behind us.

Read More »

Read More »

FX Daily, June 21: Heavy Oil Weighs on Yields and Lifts Yen

The US dollar is narrowly mixed against the major currencies. The drop in oil prices (3.3% this week) is seen as one of the factors that may be underpinning the appetite for fixed income, and this, in turn, is lifting the yen. The greenback had approached JPY112 yesterday, but with the drop in oil prices and yields has seen it retreat toward JPY111.00.

Read More »

Read More »

FX Daily, June 20: Officials Fill Vacuum of Data to Drive FX Market

The light economic calendar has cleared the field to allow officials to clarify their positions. Yesterday it was NY Fed President Dudley and Chicago Fed Evans who argued that economic conditions continued to require a gradual removal of accommodation. The Fed's Vice Chairman Fischer did not address US monetary policy directly but did note that housing prices were elevated and that low interest rates

contributed.

Read More »

Read More »

FX Daily, June 19: Dollar Mixed while Equities Recover to Start Eventful Week

The US dollar is mixed against the major currencies, and while it is firmer against the euro and yen, it is within last week's ranges. The success of Macron's new party in France, and the majority is secured, was well anticipated by investors and is having little effect on today's activity in the capital markets.

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

FOMC, BoE, and BOJ meet next week; only the Fed is expected to change policy. High frequency data may be less important than the central bank meetings and politics in the week ahead. UK political situation is far from resolved, and US drama continues, while several hot spots in the EMU are emerging.

Read More »

Read More »

FX Daily, June 07: Markets Mark Time Ahead of Tomorrow

Tomorrow may be the most important day of the quarter for investors. The ECB meets. The UK goes to the polls. Former FBI Comey testifies. Ahead of these significant events, the global capital markets are mostly quiet, with some pockets of activity.

Read More »

Read More »

FX Daily, June 06: Yen Propelled Higher

The week was supposed to be dominated by the UK election and the ECB meeting, but the yen is stealing the show in the first part of the week. The US dollar has been sold through JPY110 for the first time since late April. The euro has fallen from JPY125.30 before the weekend to JPY123.25 today.

Read More »

Read More »

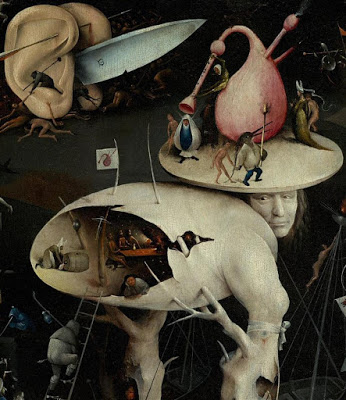

Great Graphic: Iron Ore and the Australian Dollar

This Great Graphic, from Bloomberg, shows the correlation between the price of iron ore and the Australian dollar on a rolling 60-day basis over the past year. The correlation is a little more than 0.81. The relationship is the tightest since last August. This is purely directional.

Read More »

Read More »

FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord may have garnered the headlines, but as a market force, it is difficult to detect the immediate impact.

Read More »

Read More »

What Happened Monday

No impact from the latest North Korean missile test. Polls suggest Tories still ahead for the June 8 election. Prospects of an Italian election this year weighed on Italian stocks and bonds.

Read More »

Read More »

FX Daily, May 22: Dollar Pushes Back

After being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors' minds from intensifying political uncertainty in the US.

Read More »

Read More »

FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

Yesterday's dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI's investigation into Russia's attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump Administrations economic program is back the front burners, but it is sufficient to stem the time for the moment.

Read More »

Read More »

FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday's activity. It appeared to have been trying to stabilize yesterday in the North American session.

Read More »

Read More »

FX Daily, May 12: Markets Becalmed Ahead of US data and Weekend

The foreign exchange market is becalmed, and the major currencies are little changed. The US dollar is mixed, but mostly a little lower. Sterling is the weakest of the majors, off 0.3%, near $1.2850, having been rebuffed by offers in front of $1.30 several times. It has not recovered from the quarterly inflation report and Carney's press conference.

Read More »

Read More »