Tag Archive: $AUD

Great Graphic: US 2-year Yield Rises Above Australia for First Time since 2000

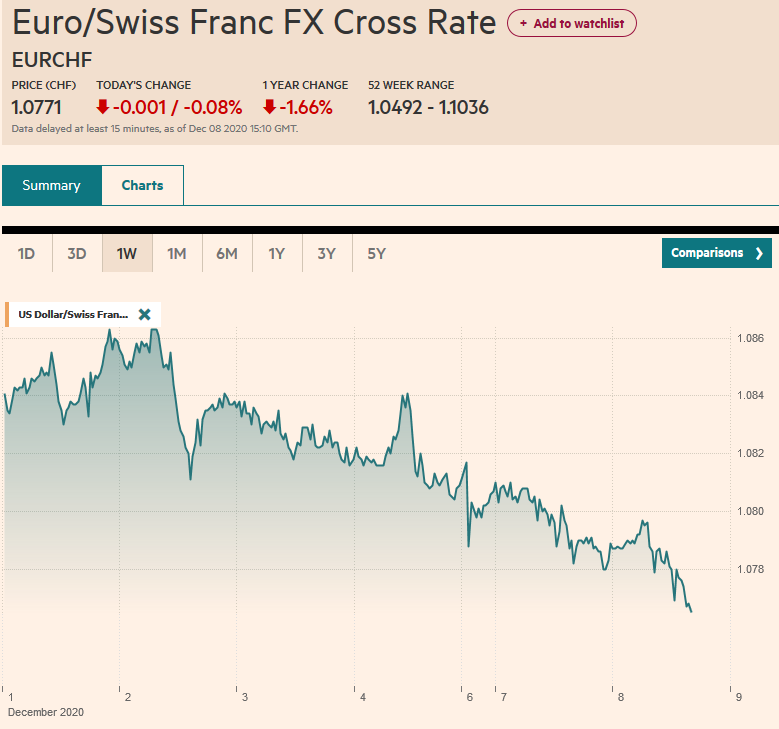

The US and Australian two-year interest rates have diverged. There is scope for a further widening of the spread. Directionally the correlation between the exchange rate and the rate differentials is strong, but not stable. Near-term technicals are supportive but the move above trendline resistance is needed to confirm.

Read More »

Read More »

FX Daily, November 28: Greenback Ticks Up in Cautious Activity

The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed's Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year's BOE stress test saw all seven banks pass.

Read More »

Read More »

FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones Stoxx 600 is struggling, as the CAC and DAX are nursing small losses.

Read More »

Read More »

FX Daily, November 16: Euro Extends Pullback

After rising to its best level since October 20, the euro reversed direction yesterday and has extended its pullback today. The unexpected tick up in US core CPI and better than expected retail sales may have helped spur the euro losses after three cent run-up over the past several sessions. There bearish candlestick (shooting star) leaves the late euro longs in weak hands.

Read More »

Read More »

FX Daily, November 15: Dollar Slides

The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month's highs in the $1.1860-$1.1880 area. As was the case yesterday, a consolidative tone in Asia was followed by strong buying in the European morning. There does not appear to be a fresh fundamental driver.

Read More »

Read More »

FX Daily, November 13: Sterling Trounced by Growing Political Challenges

The US dollar has begun the new week on firm footing, without the help of either higher interest rates or increased confidence that Congress will agree on a tax plan. Indeed, over the weekend the Chair of the House Ways and Means Committee was explicit that the Senate plan to repeal the federal tax break for state and local taxes will not find support in the House of Representative.

Read More »

Read More »

FX Weekly Preview: The Week of Digestion

Quiet week ahead. RBA and RBNZ policy meetings; no change is expected. US tax reform and the newest Fed governor, Quarles speaks. Q3 data renders September data too old to matter much.

Read More »

Read More »

FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version out after the weekend so the committee work can begin on Monday.

Read More »

Read More »

FX Daily, November 02: Dollar Pulls Back in Asia

We suggested the market was at crossroads. It is still not clear if the dollar's breakout, supported by higher yields is real or simply the fraying of ranges. Asia has pushed the dollar broadly lower. While the greenback finished the North American session above JPY114.00 for the first time since July, the fact that the US 10-year yield could not push back above the 2.40% level, does not help confidence.

Read More »

Read More »

FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

Most participants seemed comfortable marking time ahead of tomorrow's ECB meeting, and an announcement President Trump's nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3 GDP injected fresh incentives. Australia reported headline CPI rose 0.6% in Q3.

Read More »

Read More »

FX Daily, October 20:Tax Prospects Lift Rates and Dollar Ahead of Weekend

The US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies and nearly all the emerging market currencies.

Read More »

Read More »

FX Daily, October 6: Look Through the US Jobs Report

Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that flattered some high frequency data will likely skew today's employment report (both headline and details) to the downside. Of course, investors will quickly look for the number of people who could get to work due...

Read More »

Read More »

FX Daily, October 05: Sterling and Aussie Weakness Featured in the Otherwise Becalmed FX Market

The US dollar is mostly little changed as the broad consolidation that has emerged this week continues. The two powerful forces that have emerged--expectation of a Fed hike at the end of the year and European political challenges--appear to have reached a tentative equilibrium.

Read More »

Read More »

FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It has recovered toward the highs seen in North America yesterday (~$1.1760). There are several euro option strikes that may be in play today. In the euro, between $1.1750 and $1.1775, there are nearly 2.9 bln euros...

Read More »

Read More »

FX Daily, October 02: Dollar Upbeat to Start Fourth Quarter

The US dollar is broadly higher as the quarter-end positioning losses seen at the end of last week area reversed. Developments in the US are seen as dollar positive, while the Catalonia-Madrid conflict, and slightly softer EMU manufacturing PMI weighs on the euro. The UK also reported a disappointing manufacturing PMI, and more differences with the Tory government are taking a toll on sterling. Japan's Tankan Survey was stronger than expected, but...

Read More »

Read More »

FX Daily, September 28: Greenback Consolidates while Yields Continue to March Higher

The US dollar is consolidating inside yesterday's ranges against the euro and yen while extending its gains against sterling and the dollar-bloc currencies. The sell-off in the US debt market continues to drag global yields higher. The 10-year Treasury yield reached 2.01% on September 8 and now, nearly three weeks later, is near 2.35%. It had finished last week at 2.25%.

Read More »

Read More »

FX Daily, September 22: Markets Limp into the Weekend

The cycle of sanctions, recriminations, and provocative actives continues as the Trump Administration leads a confrontation with North Korea. The US announced yesterday new round of sanctions on North Korea. Reuters reported that the PBOC has instructed its banks not to take on new North Korean clients and to begin unwinding existing relationships.

Read More »

Read More »

FX Daily, September 21: Market Digests Fed, Greenback Consolidates, Antipodeans Tumble

The market has mostly interpreted the Fed's action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses are somewhat mysterious, the Fed clearly signaled its bias toward hiking rates one more time this year and three next year.

Read More »

Read More »

FX Daily, September 20: Shrinkage and Beyond

After much anticipation, the FOMC decision day is here. Much of the focus is on the likely decision that the Fed will allow its balance sheet to shrink gradually. No other country who employed quantitative easing has is in a position to begin unwinding the emergency expansion of its balance sheet. The Fed's experience in QE, communication, and now unwinding, will be part of the information set other central banks can draw upon.

Read More »

Read More »

FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration's agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative branch itself, as in limiting the...

Read More »

Read More »