Swiss FrancThe Euro has risen by 0.17% to 1.1477 CHF. |

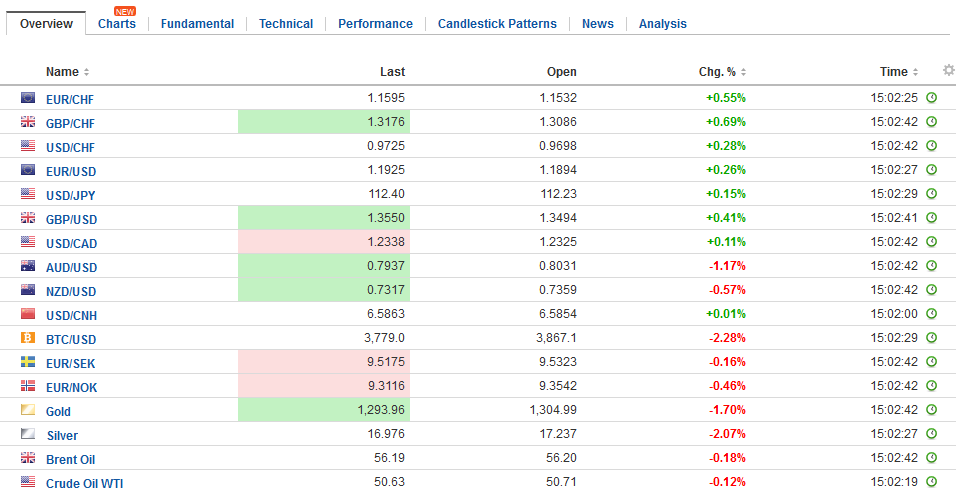

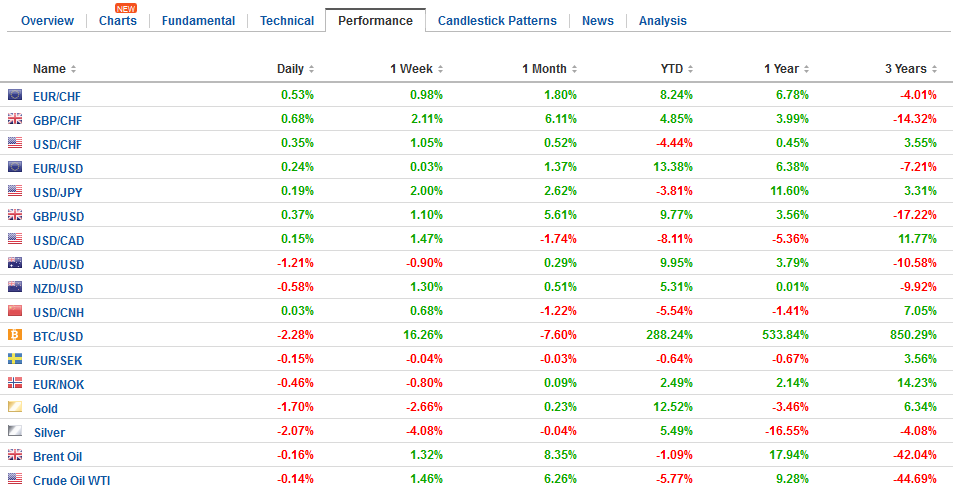

EUR/CHF and USD/CHF, September 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe market has mostly interpreted the Fed’s action in line with our thinking. Despite the lowering of the long-run Fed funds rate, the shifting one of the three hikes from 2019 into 2020, and recognizing that the weaker price impulses are somewhat mysterious, the Fed clearly signaled its bias toward hiking rates one more time this year and three next year. The long-term Fed funds rate has trended lower. In March 2015, it was thought by the Fed’s dot plots to be near 3.75%. A year later it had been cut to 3.25%. It briefly fell to 2.88% in September 2016 before being lift last December to 3%. The cut now to 2.75% has been generally signaled by Yellen (and other officials) suggesting the it may be lower. One of the discrepancies between the Fed and the markets is investors collectively see the long-run rate as considerably lower than the Fed. Looking at the Fed Funds futures strip to give an approximation suggest the market-based view of the long-term rate is closer to 1.75%. The US 10-year breakeven is 1.86%. The implication is that the investors do not think the real Fed funds rate will be positive in this cycle. |

FX Daily Rates, September 21 |

| The biggest surprise about the Fed’s balance sheet signal was the seeming confusion of the media and several times Yellen had to repeat herself. The Fed had, we thought, made it clear, that the balance sheet operations were not going to main tool of monetary policy. The operations would be put on automatic pilot and not disrupted by short run vagaries in the economy.

Some seemed critical of this as being rigid, but if it were subject to regular FOMC decisions, the Fed would have been criticized for not aiding market visibility and not being committed to reducing its balance sheet. Some were critical that monetary policy did not address the disparity of wealth and income in the US, but surely this is beyond what monetary policy can do. The Fed’s QE arguably prevented a larger or longer downturn in the economy and this is often forgotten in such discussions. There are a few option strikes that are worth noting. The $1.1950 level in the seems some distance now with the euro ticking backup barely through the $1.1900 level, but a 1.7 bln euro option struck there will be cut in NY later today. There is a strike at GBP0.8840 for almost 450 mln euros also expires today. There are options struck at NZD0.7300, with a notional value of NZD243 mln. |

FX Performance, September 21 |

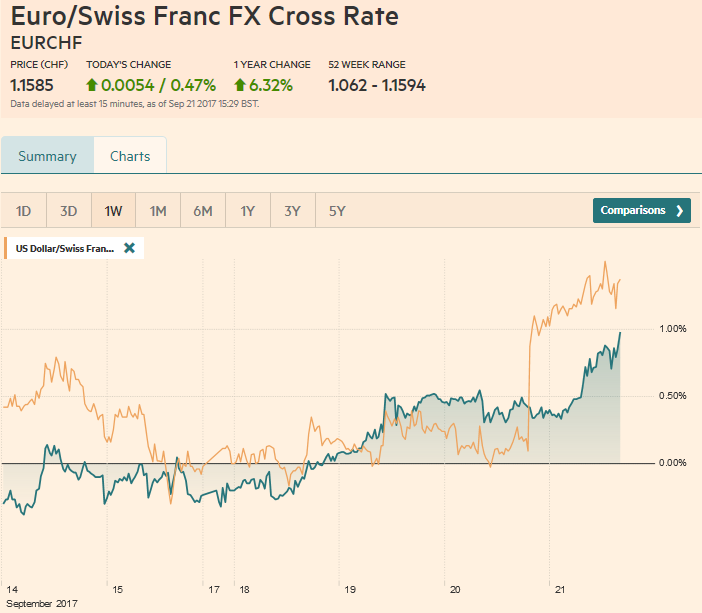

EurozoneNorway’s central bank, Norges Bank meet. It too left rates on hold, but increased its likely interest rate path for the second consecutive meeting. Norges Bank now sees the first hike toward the middle of the next year. If so, it will raise rates while the ECB’s balance sheet continues to expand, and well before the ECB can raise rates. The krone is the strongest of the majors in the European morning, gaining about 0.5% against the greenback and 0.4% against the euro. The euro held NOK9.30 on the first try. A break could see NOK9.22. |

Eurozone Consumer Confidence, Sep 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

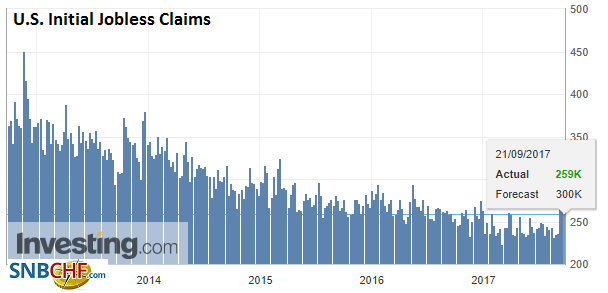

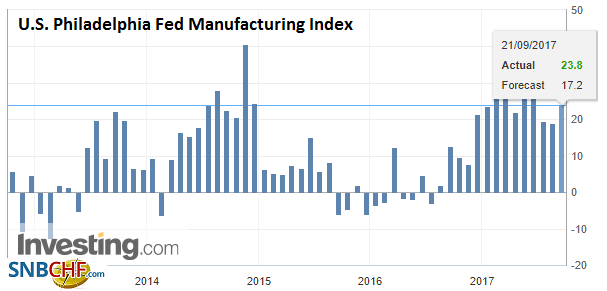

United StatesThe US reports weekly initial jobless claims. This time series is being skewed by the powerful storms that have hit in recent weeks. The noise to signal ratio is high and most likely will not have much impact. The Philly Fed survey for September will be interesting, but Yellen acknowledged yesterday what investors have accepted. The storms will reduce Q3 growth. |

U.S. Initial Jobless Claims, 21 September 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

| Our back of the envelop calculation suggested the hit could be as much as one percentage point. Given that the US economy was growing above trend growth, it can fall back to it (which the Fed estimates the long-run growth is 1.8%). Leading economic indicators for August are expected to rise 0.3%. The monthly increase averaged 0.2% in 2016 and 0.4% thus far this year. The diffusion, how many indicators improved and how many deteriorated will likely confirm Yellen’s assessment that the underlying economy remains strong. |

U.S. Philadelphia Fed Manufacturing Index, Sep 2017(see more posts on U.S. Philadelphia Fed Manufacturing Index, ) Source: Investing.com - Click to enlarge |

The cost of a larger and longer downturn falls primarily on the economic disadvantaged. It is true that homeowner and equity owner did well as asset prices rose. Rising asset prices were a means to an end, the end being a stronger economic environment that created more opportunities. Although Yellen did not repeat it as forcefully as the July FOMC minutes, but she acknowledged that the Fed was concerned about financial conditions, and the elevated valuations of assets. Doesn’t that mean that so-called Greenspan put (Fed would provide accommodation in the case of equity market decline) is less reliable, if it is there at all?

Two other central banks have meet today. The Bank of Japan left policy on hold. A takeaway is that a new Board member (Kataoka) argued that more stimulus is needed if the BOJ’s inflation is to be reached. This is important. Until now, Kuroda was criticized for doing too much. Now a new voice is calling for more not less.To be sure this does not mean that more stimulus will be delivered but for the first time, there can be a debate within Kuroda’s framework and not simply old Shirakowa acolytes pushing back against the considerably more activist monetary policy.

The Antipodean currencies are bearing the brunt of the greenback’s strength today, with the Australian dollar pushing below $0.8000. Trend line support, drawn from the mid-August low comes in near $0.7940 today, which is also near the 61.8% retracement of that move (~$0.7930). A break would warn of the vulnerability of stops below $0.7900.

The New Zealand dollar has come off half has much as the Aussie has, and perhaps is being support by the latest polls that seem to suggest increased likelihood that the Nationals continue to led the government. The Kiwi had previously under-performed the Aussie and technically it appears poised for a recovery. It is gaining against the Aussie for the fifth consecutive session today and is at its best level in a month. The Aussie is approaching NZD1.0850, which corresponds to a 38.2% retracement of its Q3 advance.The 50% retracement is a big figure lower (~NZD1.0750).

More broadly the dollar is largely consolidating yesterday’s post-Fed gains. Short-term market participants will not have a lot of conviction of the near-term direction. The dollar bears will emphasize the lower long-term Fed funds rate and note that despite the market pricing in a greater chance of a Fed hike in December, it remains skeptical about hikes in 2018. The bulls’ argument is mostly based, it seems, on market positioning, though we argue that divergence is still a powerful force, the political risks in Europe (Catalonia first, Italy next) may reemerge as an important consideration, and the prospects of a tax cuts/reform in the US may be under-appreciated.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,newslettersent,Norwegian Krone,NZD,U.S. Initial Jobless Claims,U.S. Philadelphia Fed Manufacturing Index,USD/CHF