Swiss FrancThe Euro has fallen by 0.11% to 1.0942 CHF. |

EUR/CHF - Euro Swiss Franc, July 05(see more posts on EUR/CHF, ) |

GBP/CHFYesterday Ian McCafferty one of the current eight voting members of the Monetary Policy Committee from the Bank of England, gave another hawkish press conference in relation to interest rates. The MPC member explained that the economy has not slowed as much as they first thought it would therefore he believe rates should be hiked to 0.5%. The Bank of England have set a target of 2% for many years and currently inflation levels are 2.9%. The reason why inflation has increased by a substantial amount over the last 12 months is because the pound has been sold off by investors due to the risk surrounding Brexit which in turn has made goods and services more expensive. In times on global uncertainty the swiss franc reaps the rewards as investment flies into the safe haven currency even though Banks charge their clients to hold there assets in the franc. This is one of the reasons why the franc has performed so well in recent years. Looking further ahead if the Bank of England start to raise interest rates towards the end of the year you would expect the pound to start to strengthen against the swiss franc. With exchange rates so favourable at the moment for selling CHF to buy GBP many of my clients are taking advantage and I understand why. |

GBP/CHF - British Pound Swiss Franc, July 05(see more posts on GBP/CHF, ) |

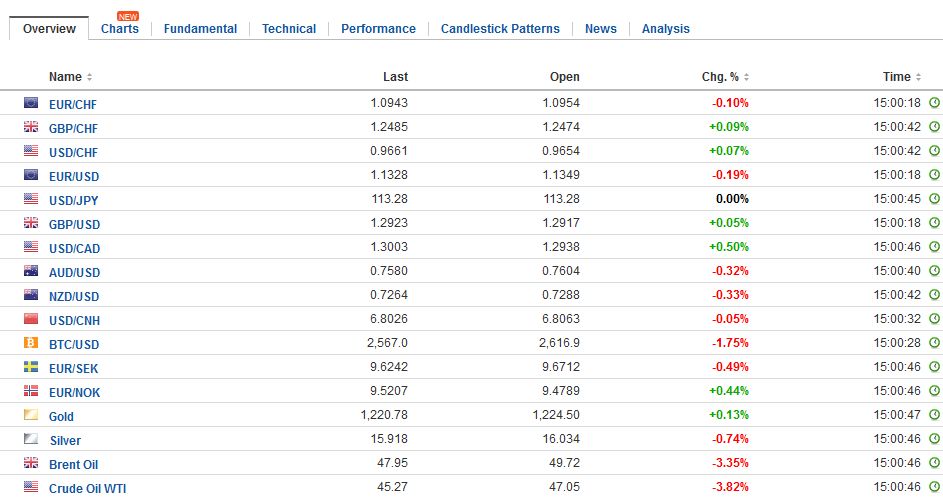

FX RatesThe US dollar is enjoying a firm tone today. Yesterday’s two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday. The euro was sold briefly through $1.1320 before finding a bid, while the sterling and yen are extending this week’s declines. Global equities are mixed, with modest gains in Asia and small losses in Europe. Bond yields are mostly firmer. The dollar is at its best level against the Japanese yen since the middle of May, as it tries to get a handhold above JPY113.50. Chart resistance is seen in the JPY113.80-JPY114.00 area. The dollar edged higher against the yen for the past two weeks. It is up a little more than 1% this week after a gain of a similar magnitude last week. The inability of the euro to rally on what seems to be good news appears to be a break from the recent price action where nearly any excuse was sufficient to lift the single currency. It is consistent with our sense that the market has discounted a favorable news stream for Europe and may have gotten ahead of itself. Initial support is seen in the $1.1320 has been tested, and a break would set up a test on $1.1280. The US two-year premium over Germany has widened about six basis points this week and the 10-year premium is about three basis points wider this week. |

FX Daily Rates, July 05 |

| The US confirmed North Korea’s claims that its tested an intercontinental ballistic missile. The US and South Korea almost immediately announced a new joint military exercise.

The UN Security Council will meet today to discuss. Besides tightening the isolation of North Korea, it is not clear what other options are really available. Although the US has indicated that all options are on the table, there does not appear to be support for military options by South Korea, Japan, Russia or China. The South Korean won was little changed and the Kospi gained 0.3% to recover most of yesterday’s decline and is off slightly on the week. More broadly, the MSCI Asia Pacific Index snapped a three-day fall and rose 0.25%. Note that China’s bond-connect program went operational yesterday. Turnover was a little more than CNY6 bln yesterday. The bond-connect program, complements the stock-connect initiative, and improves international investors access to China’s financial markets. Sterling has snapped an eight-day advance with a three-day fall this week. Today’s losses were marginal and may have exhausted themselves in the European morning a little below $1.29. Initial resistance is seen in the $1.2940 area. |

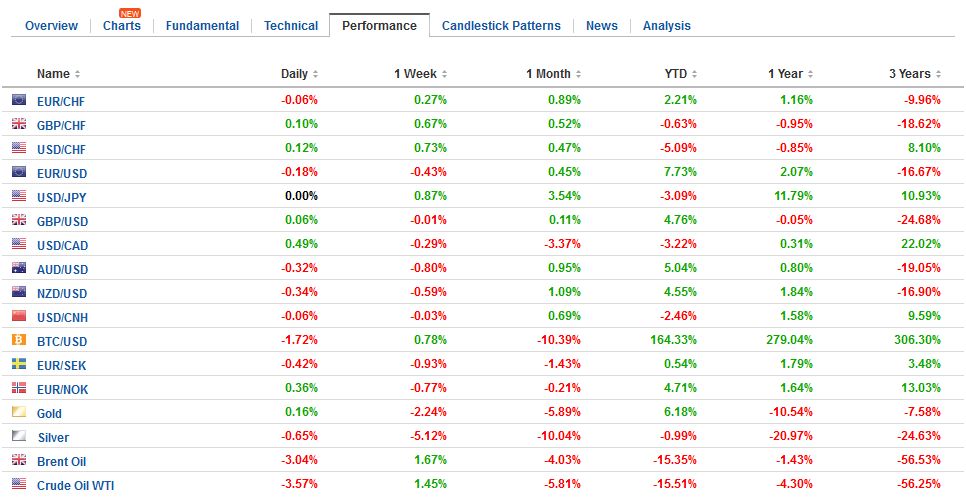

FX Performance, July 05 |

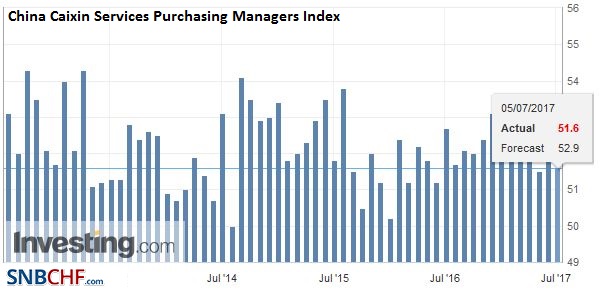

ChinaCaixin reported China’s service and composite PMI. The service reading eased to 51.6 from 52.8. The composite slipped to 51.1 from 51.5, which is the lowest since last June. The composite averaged 51.3 in Q2 after 52.3 in Q1 and 53.1 in Q4. It averaged 51.4 last year. The Shanghai Composite gained 0.75% to move above 3200 for the first time since mid-April. |

China Caixin Services Purchasing Managers Index (PMI), June 2017(see more posts on China Caixin Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

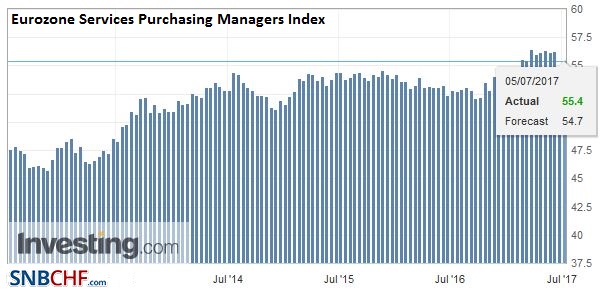

EurozoneThe service and composite PMI release is the main economic data from Europe today. The eurozone service PMI was revised from the flash estimate of 54.7 to 55.4 from it is still off the May reading of 56.3, and is off for the second month. |

Eurozone Services Purchasing Managers Index (PMI), June 2017(see more posts on Eurozone Services PMI, ) Source: Investing.com - Click to enlarge |

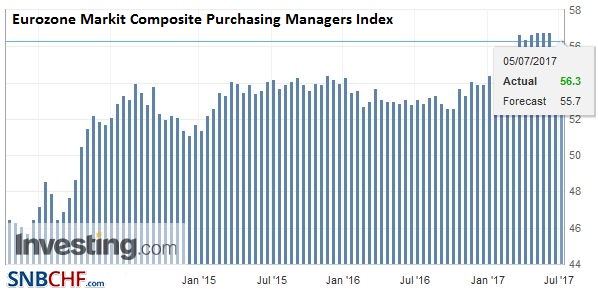

| The composite PMI was also revised higher from the 55.7 flash estimate to 56.3. It was 56.8 in May. It averaged 56.6 in Q2 after 55.6 in Q1 and underpins expectations that the regional economy may have accelerated. |

Eurozone Markit Composite Purchasing Managers Index (PMI), June 2017(see more posts on Eurozone Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

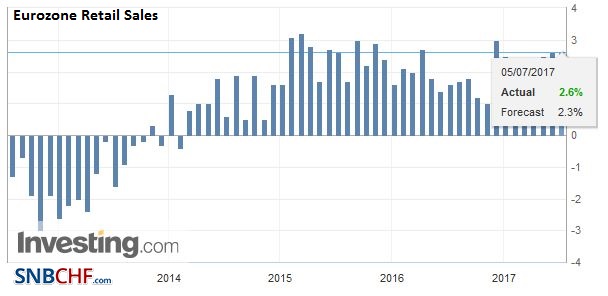

Eurozone Retail Sales YoY, May 2017(see more posts on Eurozone Retail Sales, ) Source: Investing.com - Click to enlarge |

|

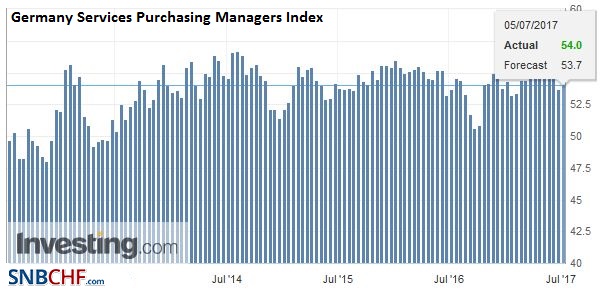

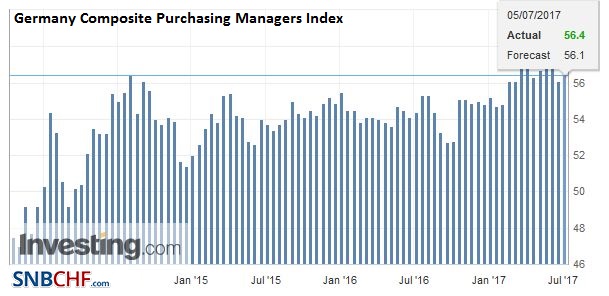

GermanyIn terms of the country breakdown, German and French flash service reports were revised higher. Note that the French and German composite readings did slip from May. |

Germany Services Purchasing Managers Index (PMI), June 2017(see more posts on Germany Services PMI, ) Source: Investing.com - Click to enlarge |

Germany Composite Purchasing Managers Index (PMI), June 2017(see more posts on Germany Composite PMI, ) Source: Investing.com - Click to enlarge |

|

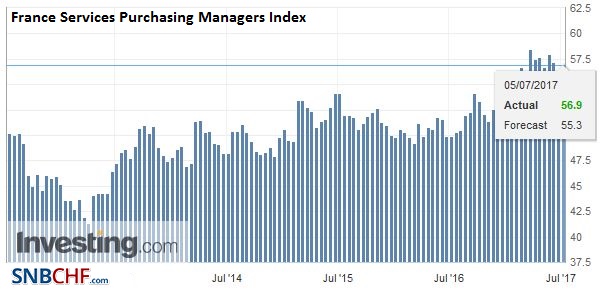

France |

France Services Purchasing Managers Index (PMI), June 2017(see more posts on France Services PMI, ) Source: Investing.com - Click to enlarge |

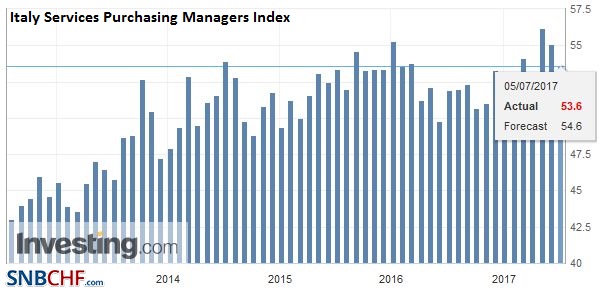

ItalyItaly’s service PMI eased to 53.6 from 55.1 and was weaker than the 54.6 median estimate in the Bloomberg survey. Still, the Q2 average composite was 55.5 after 53.9 in Q1 and 52.5 in Q4 16. |

Italy Services Purchasing Managers Index (PMI), June 2017(see more posts on Italy Services PMI, ) Source: Investing.com - Click to enlarge |

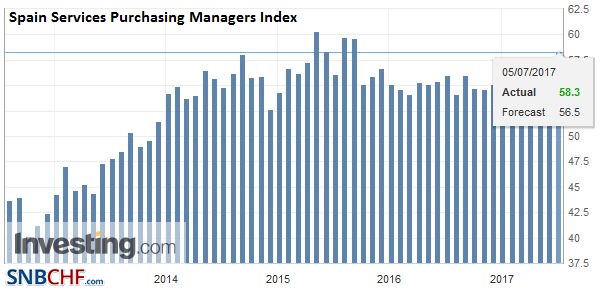

SpainSpain accelerated. The services PMI jumped to 58.3 from 57.3 and the composite rose to 57.7 from 57.2. |

Spain Services Purchasing Managers Index (PMI), June 2017(see more posts on Spain Services PMI, ) Source: Investing.com - Click to enlarge |

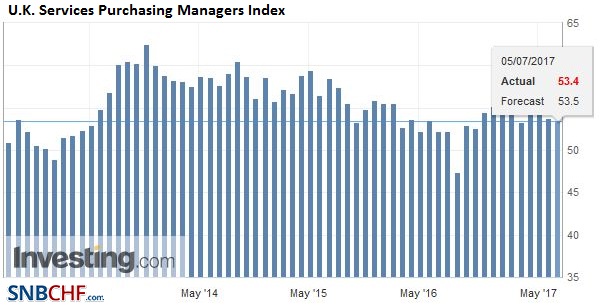

United KingdomThe slightly disappointing UK service PMI rounds out the three PMI reports and each was reported below expectations. The miss was not large but the direction is notable. The services PMI eased to 53.4 from 53.8 and the composite reading eased to 53.8 from 54.3. In fairness, the Q2 composite average of 54.8 is above the 54.6 average of Q1 and last year’s average of 53.5. This suggest that growth may not have deteriorated from the 0.2% quarter-over-quarter pace recorded in Q1. However, the quarter appears to have ended on a weak note. In June, the employment sub-index was the strongest in a little more than a year. Price data was mixed, with input prices rising and prices charged easing, warning of the risk of a profit squeeze. |

U.K. Services Purchasing Managers Index (PMI), June 2017(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

Japan

Japanese shares initially fell to near two-week lows before recovering. The Topix and Nikkei closed on session highs, almost 0.6% and 0.3% higher respectively. Japan reported a stronger service PMI (53.3 in June from 53.0 in May). The composite reading slipped to 52.9 from 53.4. Still, it average 53.0 in Q2 after 52.5 in Q1 and 52.0 in Q4 16.

United States

The final US May durable goods orders and factory orders are unlikely to capture the market’simagination. The FOMC minutes may be more interesting. Participants are looking for insight into two things. First, even though the Fed hiked, how cautious are Fed officials in the wake of disappointing economic data and the four-month softening of measured inflation. Second, observers are looking for more details about when the balance sheet operations will begin.

We see more observers coming to our view of that an announcement to start no recycling the maturing issues fully at the September FOMC meeting (for October start) and for what would be the third rate hike of the year more likely to be delivered in December (data permitting). In terms of data, this week’s employment report is the highlight and improvement is expected in the June report.

Australia

The Reserve Bank of Australia did not completely remove the downside potential, but more banks appear to be giving up the idea that it will cut rates again this year. The Australian dollar bounced from dipping below $0.7600 yesterday to a little more than $0.7630 today before running out of steam. A break of $0.7590 would target $0.7530-$0.7540 initially. The market appears to have discounted a Bank of Canada rate hike next week. It would be more destabilizing if a rate hike at this juncture was not delivered. The US dollar is finding support against the Canadian dollar, but it needs to rise above CAD1.3020 to be anything significant.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,China Caixin Manufacturing PMI,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Retail Sales,Eurozone Services PMI,France Services PMI,FX Daily,gbp-chf,Germany Composite PMI,Germany Services PMI,Italy Services PMI,newslettersent,Spain Services PMI,U.K. Services PMI