Tag Archive: Eurozone Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe's Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~3081-3099) offers technical support.

Read More »

Read More »

FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher.

Read More »

Read More »

FX Daily, March 4: Equities Trade Higher, While Yields Continue to Fall

Overview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday's dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the markets closed, equities began recovering, and the recovery carried over to the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today's rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a nearly 1.4% advance in Australia, with the exception of Taiwan.

Read More »

Read More »

FX Daily, December 5: Sterling Sent Higher as Market Discounts Next Week’s Election

Overview: Global equity markets have resumed their climb after a wobble at the end of last week and earlier this week. A strong recovery in the S&P 500 on Tuesday signaled yesterday's strong advance that left a bullish one-day island low in its wake. MSCI Asia Pacific Index snapped a two-day decline today with nearly all the market with the notable exception of South Korea advanced.

Read More »

Read More »

FX Daily, November 6: Markets Catch Collective Breath as Dollar Consolidates Yesterday’s Advance

Overview: Investors seem to be catching their collective breath today, and the global capital markets are consolidating recent moves. A notable exception is the Chinese yuan, which has continued to strengthen, and the dollar has slipped back below CNY7.0. Asia Pacific equities were mixed, and the four-day advance in the regional benchmark stalled today.

Read More »

Read More »

FX Daily, October 3: Shades of Q4 18?

Overview: Disappointing economic data again drove US equities lower, which in turn carried into Asia Pacific activity. Losses were recorded throughout the region, with the notable exception of Hong Kong. The Nikkei and Australia's ASX were off by 2%. After its largest losing session of the year (-2.7%) yesterday, Europe's Dow Jones Stoxx 600 continues to trade heavily.

Read More »

Read More »

FX Daily, August 2: End of Tariff Truce Trumps Jobs

Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell's attempt to give insight into the Fed's thinking. Trump's tweet than signaled an end to the tariff truce with a 10% levy on the $300 bln of imports from China that have not been subject to action previously.

Read More »

Read More »

FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers in front of JPY105.80. Sterling is firm against the dollar as it recovers against the euro. Before the weekend, the euro reached GBP0.8950, its best levels since last November. The euro is testing GBP0.8900...

Read More »

Read More »

FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past nine sessions. The notable exception in Asia was the Shanghai Composite. The 0.75% was led by the financial sector amid talk that a report later this week will show a strong jump in yuan lending from banks, which...

Read More »

Read More »

FX Daily, January 08: Dollar Posts Modest Upticks to Start the New Week

The US dollar is enjoying modest but broad-based gains after trading firmly at the end of last week despite the slightly disappointing jobs report. The dollar's upticks are understood to be corrective in nature. The Canadian dollar appears to be protected by the increased prospects of a rate hike next week after its stellar employment report.

Read More »

Read More »

FX Daily, December 05: Sterling Sold on Negotiating Snafu, Aussie Bounces on Retail Sales and RBA

The US dollar is confined to narrow ranges against the euro and yen, straddling unchanged levels in the Asian session and the European morning. The action in elsewhere. The British pound is the weakest of the majors, paring 0.4% against the greenback, though around $1.3425, it can hardly be considered weak. A month ago, sterling was a few cents lower. Still, its gains reflected two things: broader dollar weakness and optimism on Brexit talks.

Read More »

Read More »

FX Daily, October 04: Consolidative Tone in FX Continues

The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager's call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair.

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

FX Daily, July 05: Dollar Firm as Investors Await Fresh Directional Cues

The US dollar is enjoying a firm tone today. Yesterday's two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday.

Read More »

Read More »

FX Daily, June 06: Yen Propelled Higher

The week was supposed to be dominated by the UK election and the ECB meeting, but the yen is stealing the show in the first part of the week. The US dollar has been sold through JPY110 for the first time since late April. The euro has fallen from JPY125.30 before the weekend to JPY123.25 today.

Read More »

Read More »

FX Daily, May 04: Greenback Struggles to Sustain Upticks, Though Odds of June Hike Rise

The US dollar is struggling to maintain even modest upticks against the euro and sterling despite the recognition of the increased likelihood of a June Fed hike. Bloomberg sees current pricing in the Fed funds as making a hike in June a near certainty (97.5%), while the CME and our own calculation estimates the market is discounting around 70%-75% chance of a hike.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

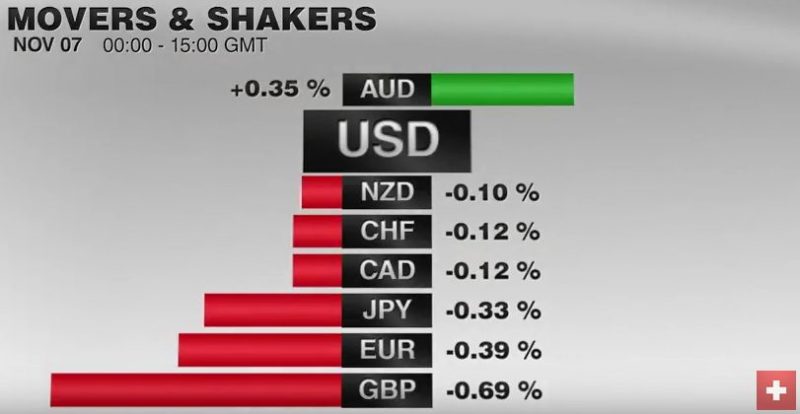

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »