Swiss FrancThe Euro has risen by 0.13% to 1.0716 |

EUR/CHF and USD/CHF, February 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%. Europe’s Dow Jones Stoxx 600 is powering ahead with a 1.25% gain through the morning, the third consecutive advance, led by information technology and materials. Real estate and utilities are struggling. US shares are firmer, pointing to another gap higher opening in NY. Benchmark bond yields are backing up with the Antipodeans jumping 10-11 bp, playing catch-up. European benchmarks are mostly 2-3 bp higher, while the US yield is near 1.63%, having flirted with 1.50% at the end of last week. The dollar’s role as the fulcrum is evident as it is slipping against the currencies seen as levered to growth, like the dollar-bloc and Scandis. The greenback is firmer against the yen, Swiss franc, and euro, which are used as funding currencies. JP Morgan’s Emerging Market Currency Index is higher for the third day running. Oil is getting a reprieve from the selling pressure that knocked it lower in 10 of the past 11 sessions, though OPEC+ still is debating cuts in output Gold continues to surrender its recent gains. It has not gained this wee and is off about $40 an ounce. |

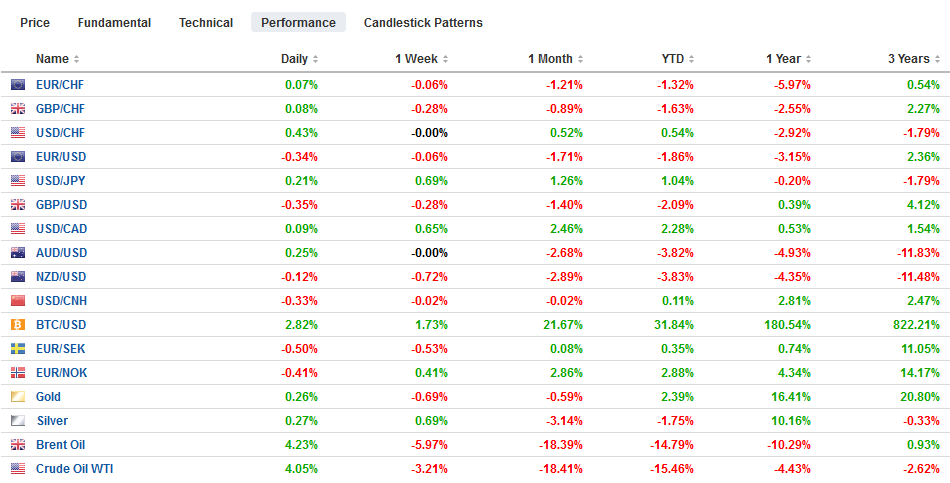

FX Performance, February 5 |

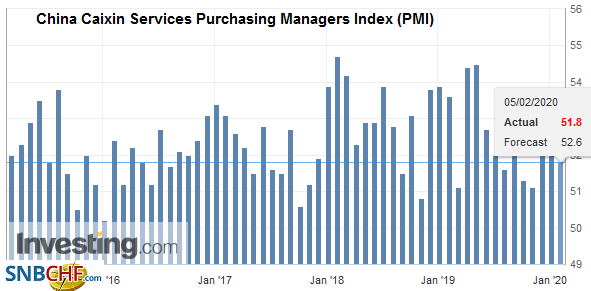

Asia PacificChina’s Caixin PMI has been superseded by events. It does not capture the extent of the economic disruption. The service PMI eased to 51.8 from 52.5, and the composite slipped to 51.9 from 52.6. Meanwhile, the US is sending conflicting signals to China. The US Secretary of State called the Chinese Communist Party, “the central threat of our time,” while in the State of the Union address late yesterday, President Trump said the US had the best relationship with China, especially with President Xi. Trump’s economic adviser Kudlow warned of “proportionate action” if China uses the virus as “an excuse” to break its newly struck trade commitments. |

China Caixin Services Purchasing Managers Index (PMI) January 2020(see more posts on China Caixin Services PMI, ) Source: investing.com - Click to enlarge |

Japan’s service and composite PMI saw the flash gains pared, but both retained their foothold above the 50 boom/bust level. Services were revised to 52.0 from 52.1 and 49.4 in December. The composite reading is at 50.1 from 51.1 of the flash report, and 49.4 in December. Both are at their highest level since September. The Q4 GDP estimate is due February 16. The economy may have contracted by 1% in Q4 (quarter-over-quarter). The rebound is expected to be muted by the fallout from the coronavirus.

The dollar is extending its recovery against the yen. Yesterday’s gains had it retrace (61.8%) of its recent decline (~JPY109.50) and has poked through JPY109.70 in Europe today. The intraday technicals warn increases into the JPY109.80-JPY110.00 area may meet sellers. The Australian dollar is seeing follow-through buying after it posted a key reversal yesterday. It rebounded from a dip below $0.6680 yesterday to a little above $0.6740 and today has marched to nearly $0.6775. In so doing, it has recouped half of what it lost since the start of China’s Lunar New Year holiday (January 23). Here too, additional near-term gains may be hard-pressed to secure. The greenback opened sharply higher to start the week against the Chinese yuan. It has entered the gap yesterday and filled more of it today as it approached the 200-day moving average near CNY6.9645.

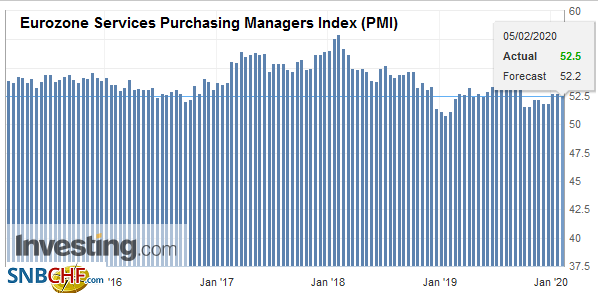

EuropeThe key takeaway from the eurozone PMI is an uneven and modest recovery is taking hold. The service PMI was a little better than the 52.2 flash estimate at 52.5 but still was a decline from December’s 52.8. The service PMI of France was weaker than the flash (at 51.0 vs. 51.7 flash and 52.4 in December. Both Spain and Itay’s service PMI eased from December’s report.The EMU composite improved from the 50.9 flash and December reading to reach 51.3. |

Eurozone Markit Composite Purchasing Managers Index (PMI), January 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| Of note, the French economy was disrupted by more strikes against Macron’s pension reforms. Italy’s composite moved back above the key 50-level (50.4 vs. 49.4), and Spain, which had been a relative bright spot softened more than expected (composite 52.3 from 54.9 in December. A smaller decline was expected. |

Eurozone Services Purchasing Managers Index (PMI), January 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

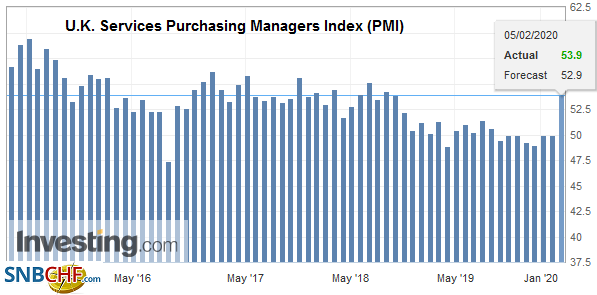

| The UK’s service and composite PMI show the economy is shrugging off the uncertainty that dampened activity at the end of last year, and the recent decision by the Bank of England not to cut rates seems validated by the recent data. The service PMI rose to 53.9 from a 52.9 flash report and a 50 reading in December. The composite PMI surged to 53.3 from 49.3 in December and a 52.4 earlier estimate. These January readings are the strongest since last September. |

U.K. Services Purchasing Managers Index (PMI), January 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

| The euro could not resurface above $1.1050, and the sellers in Europe grabbed the initiative and pushed the euro below the $1.1030, retracement target. While it is a poor technical omen, support in the $1.0980-$1.1000 may offer sufficient support in the near-term to stem larger declines. The realization that a hard Brexit (re-marketed as an Australia-like trade relationship) is still possible, and maybe likely, scenario saw sterling trade near $1.2940 yesterday before recovering. It reached about $1.3045 yesterday and extended those gains to $1.3070 today, just shy of a (50%) retracement of the decline from Monday’s high near $1.3215. Support is now seen near $1.30. |

Eurozone Retail Sales YoY, December 2019(see more posts on Eurozone Retail Sales, ) Source: investing.com - Click to enlarge |

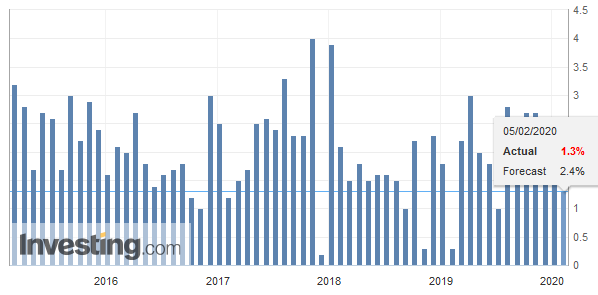

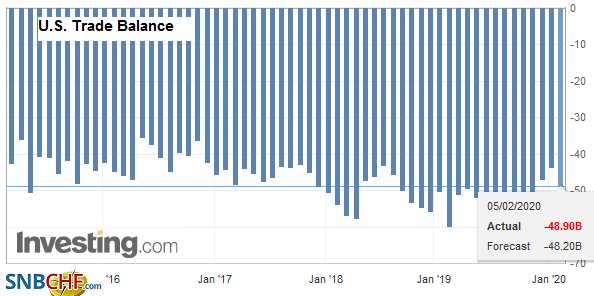

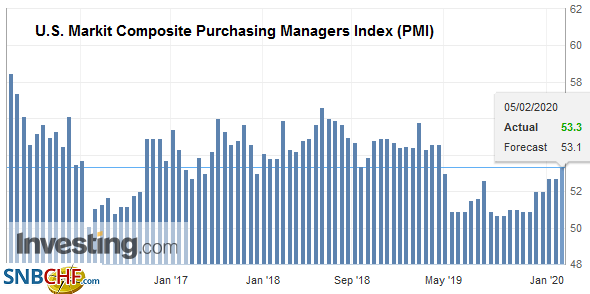

AmericaThe US releases a slew of data that includes the ADP private-sector employment estimate, the December trade balance (preliminary estimate of the goods balance was released previously), the final PMI services, and the ISM non-manufacturing survey. Outside of the headline risks, the data will not mean very much. Before the Fed meets again (March 18), new updates of these reports will be seen. But, arguably, more importantly, the pressure on the Fed to adjust policy is not coming from domestic considerations. Still, the global risks, which, while different, are as profound as last year’s challenges that prompted the three rate cuts. |

U.S. Trade Balance, December 2019(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

| The Treasury’s refunding announcement may draw attention. Actually, it is not the refunding announcement itself. After all, it is well understood that the US is running around a trillion fiscal deficit in a non-recessionary (relatively) peacetime economy. Instead, the focus may be on three other elements of the announcement. First, some more insight into the resumption of the 20-year bond sales. Many expect them to resume in May. Another dimension of the issue is whether the new issue will reduce the amount raised in the other note and bond sales. |

U.S. Markit Composite Purchasing Managers Index (PMI), January 2020(see more posts on U.S. Markit Composite PMI, ) Source: investing.com - Click to enlarge |

| Second, is to help facilitate a shift from LIBOR, the Treasury will issue some floating-rate debt linked to the secured overnight financing rate (SOFR). This will help create a term structure for the overnight rate and make it more operational for lenders and borrowers. Third, the US Treasury is running its highest cash balances since 2008, and this needs to be taken into account when assessing financial conditions. At the same time, the Fed is buying $60 bln of T-bills a month, and these will continue into Q2. They will likely last longer, even as the Fed retreats from the repo market, though a slower pace is possible. |

U.S. Services Purchasing Managers Index (PMI), January 2020(see more posts on U.S. Services PMI, ) Source: investing.com - Click to enlarge |

Canada reports December’s trade balance. Canada reported a trade deficit every month except May in 2019. Through November, the average shortfall was about C$1.5 bln. The December deficit is expected to be around C$600 mln, which would be the smallest since June. Investors often emphasize non-oil exports. Canada reports its January employment data on Friday, along with the US. Brazil’s central bank meets today, and it is expected to cut the Selic rate by 25 bp to 4.25%. It cut rates four-times in H2 19 and adjusted for inflation is hoving around zero. This has pushed the Brazilian real to record lows (at the end of last week, the dollar reached almost BRL4.29).

The US dollar is meeting resistance near CAD1.33 after rebounding from CAD1.2950 in early January. We expected the dollar to falter as it approached the upper end of its six-month range against the Canadian dollar. Initial support for the greenback is seen near CAD1.3225, around the 200-day moving average. The Mexican peso did not suffer much in the risk-off climax last week as its high nominal and real yields offer support. The US dollar is poised to fall below MXN18.6450, the low for the year. The next big chart area comes in near MXN18.50.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brazil,China,China Caixin Services PMI,Currency Movement,EUR/CHF,Eurozone Markit Composite PMI,Eurozone Retail Sales,Eurozone Services PMI,newsletter,U.K. Services PMI,U.S. Markit Composite PMI,U.S. Services PMI,U.S. Trade Balance,USD/CHF