Tag Archive: Eurozone Markit Composite PMI

The PMI monthly Composite Reports on Manufacturing and Services are based on surveys of over 300 business executives in private sector manufacturing companies and also 300 private sector services companies. Data is usually released on the third working day of each month. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Replies from larger companies have a greater impact on the final index numbers than those from small companies. Results are presented by question asked, showing the percentage of respondents reporting an improvement, deterioration or no change since the previous month. From these percentages, an index is derived: a level of 50.0 signals no change since the previous month, above 50.0 signals an increase (or improvement), below 50.0 a decrease.

FX Daily, June 23: Weebles Wobble but they Don’t Fall Down

Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However, in early Asia activity, Trump adviser Navarro seemed to have told Fox News that the US-China trade deal was over.

Read More »

Read More »

FX Daily, June 3: Dollar is Sold and ROW is bought

Overview: Two recent trends continue. Equities are moving higher, and the dollar remains heavy. Equity markets in the Asia Pacific region rose at least one percent, and South Korea, Singapore, and Malaysia rallied 2-3%. Europe's Dow Jones Stoxx 600 is up more than 1% for the third consecutive session. US shares are trading higher and are poised to extend their recent run.

Read More »

Read More »

FX Daily, May 21: Markets Pull Back after Flirting with Breakouts

Overview: New two and a half month highs in the S&P 500 yesterday failed to have much sway in the Asia Pacific region and Europe today as US-China tensions escalate and profit-taking set in. Perhaps it is a bit of "buy the rumor sell the fact" type of activity on the back of upticks in the preliminary PMI reading and hesitancy about pushing for what appeared to be breakouts.

Read More »

Read More »

FX Daily, March 4: Equities Trade Higher, While Yields Continue to Fall

Overview: The G7 delivered up a nothing burger than was shortly followed by a 50 bp Fed cut. The equity market seemed to enjoy it briefly and extended Monday's dramatic gains, before falling out of bed. The S&P 500 lost about 2.2%, while the Dow Industrial slumped 3%, but shortly after the markets closed, equities began recovering, and the recovery carried over to the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, February 21: Covid-19 Contagion Outside China Keeps Investors on the Defensive

Overview: The spread of Covid-19 outside of China and early signs of the economic consequences again emerged to weigh on investor sentiment. Poor Japanese and Australian preliminary February PMI reports and some trade indications from South Korea saw most Asia Pacific equities sell-off. China was an exception. The small gain (0.3%), lifted the Shanghai Composite 4.2% on the week.

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

FX Daily, January 24: Coronavirus Hits Asia Hardest, Europe and the US Resilient

Overview: The new coronavirus in China has moved into the vacuum left by the US-China trade agreement and clear indications that the Bank of Japan, the European Central Bank, and the Federal Reserve are on hold as investors searched for new drivers. The World Health Organization refrained from calling it a public health emergency even though China has dramatically stepped up its efforts to contain the new virus.

Read More »

Read More »

FX Daily, January 6: Markets Struggling to Stabilize to Start the New Week

Overview: The global capital markets have yet to stabilize amid heightened geopolitical tension. Even though the US stock market finished last week off its lows, the sell-off continued in the Asia Pacific region. Japan's markets re-opened after an extended holiday, and the yen, at three-month highs, saw the Nikkei sell-off nearly 2%. Several markets in the region lost over 1%, including Taiwan, India, Thailand, and Indonesia. Europe's Dow Jones...

Read More »

Read More »

FX Daily, December 4: Hope Springs Eternal

Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide.

Read More »

Read More »

FX Daily, November 22: Europe’s Flash PMI Disappoints and Hong Kong Shares Advance Ahead of Sunday’s Election

Overview: Equities in the Asia Pacific managed to mostly shrug off the drag of the losses in US equities yesterday. China and India could not escape the pull, but most other bourses were higher, led by Singapore and Hong Kong. It was the second consecutive week that the MSCI Asia Pacific Index fell. The US and European benchmarks are paring this week's small losses.

Read More »

Read More »

FX Daily, November 6: Markets Catch Collective Breath as Dollar Consolidates Yesterday’s Advance

Overview: Investors seem to be catching their collective breath today, and the global capital markets are consolidating recent moves. A notable exception is the Chinese yuan, which has continued to strengthen, and the dollar has slipped back below CNY7.0. Asia Pacific equities were mixed, and the four-day advance in the regional benchmark stalled today.

Read More »

Read More »

FX Daily, October 24: Flash PMIs Disappoint Despite Negative Interest Rates

Overview: As the UK awaits the EU's decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden's Riksbank retained a hawkish tone while keeping rates on hold, and Norway's Norges Bank also stood pat. The market expects Turkey to deliver a rate cut, while the ECB meeting is Draghi's last at the helm.

Read More »

Read More »

FX Daily, October 3: Shades of Q4 18?

Overview: Disappointing economic data again drove US equities lower, which in turn carried into Asia Pacific activity. Losses were recorded throughout the region, with the notable exception of Hong Kong. The Nikkei and Australia's ASX were off by 2%. After its largest losing session of the year (-2.7%) yesterday, Europe's Dow Jones Stoxx 600 continues to trade heavily.

Read More »

Read More »

FX Daily, September 04: HK Concession and Better EMU PMI Overshadows Self-Inflicted Trade and Brexit Woes

Risk appetites have been bolstered by three developments. The UK appears to have taken a tentative step away from leaving the EU without a deal. Hong Kong's Chief Executive Lam has agreed to formally withdraw the controversial extradition measure that had been suspended.

Read More »

Read More »

FX Daily, August 5: China Strikes Back

Overview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the mainland session a little above CNY7.03 and CNH7.07 for the offshore yuan.

Read More »

Read More »

FX Daily, July 03: Yields Extend Decline

Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy's benchmark is off 12 bp, while core yields are down 2-3 bp to new record lows. The German benchmark is almost minus 40 bp, while the Swiss 10-year is beyond minus 100 bp. Italy's two-year is breaking more convincingly below zero.

Read More »

Read More »

FX Daily, June 05: Dollar Remains on Back Foot

Overview: The Federal Reserve's patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has some tempering of trade anxiety on the margin that is also constructive. Asia and European equities were pulled higher after the strongest rally in several months in the US.

Read More »

Read More »

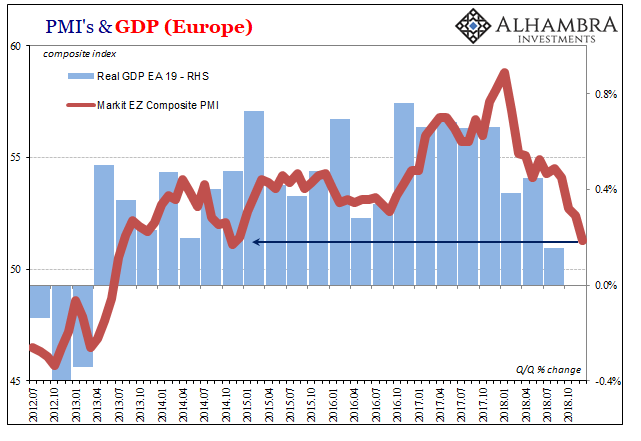

Just In Time For The Circus

Just in time to follow closely upon yesterday’s European circus, IHS Markit piles on with more of the same forward-looking indications looking forward the wrong way. Mario Draghi says the ECB is ending QE, good for him. The central bank will do this despite balanced risks rebalancing in a different place. The more bad news and numbers stack up the more “they” say it’s nothing just transitory roughness.

Read More »

Read More »

FX Daily, September 05: Continuing EM Pain Helps the Dollar, but does Little for Yen

The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia's bourse saw the largest decline (~3.75%) in the region. In part, it reflects concern that the rupiah's weakness (falling now nine of the past 10 sessions) will boost corporate debt servicing costs.

Read More »

Read More »

FX Daily, June 22: BOE Spurs Dollar Pullback

The Bank of England's hawkish hold yesterday, spurred by three dissents in favor of an immediate hike, changed the near-term dynamics in the foreign exchange market. Both the euro and sterling fell to new lows for the year before reversing higher. Yesterday's gains are being extended today.

Read More »

Read More »