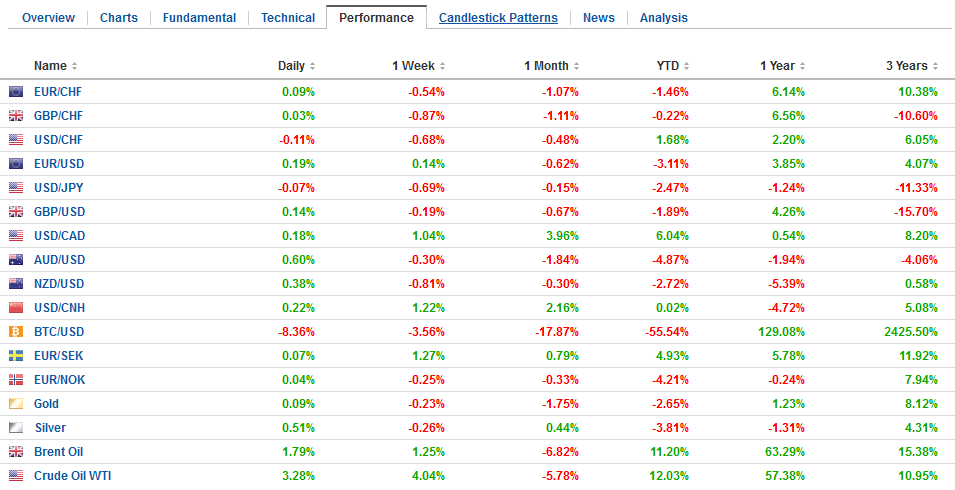

Swiss FrancThe Euro has risen by 0.23% to 1.153 CHF. |

EUR/CHF and USD/CHF, June 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe euro and sterling closed above Wednesday’s highs yesterday, and after making new lows for the year, chartists regard the price action as a key reversal and the follow-through buying today confirms it. Although we expected a hawkish hold from the BOE and thought a rate hike in August was more likely than was discounted, we feared that anticipation of a clash next week at the EU summit over Brexit would temper any enthusiasm spur by the central bank. Instead, sterling, which fell to almost $1.31 yesterday is set to push through $1.33. Several technical levels that converge in the $1.3310-$1.3330 area, including a couple retracement objectives and the 20-day moving average. A convincing push through there would offer the $1.3450 area as the next target. The euro recorded a similar key reversal yesterday. It made a marginal new low for the year, briefly dipping below $1.1510 and finished the North American session above $1.16. Continued buying today (short-covering?) lifted it to $1.1675, the 20-day moving average, nearly meeting the 50% retracement objective of the losses spurred by the ECB last week. Above there, the next target is near $1.1720. |

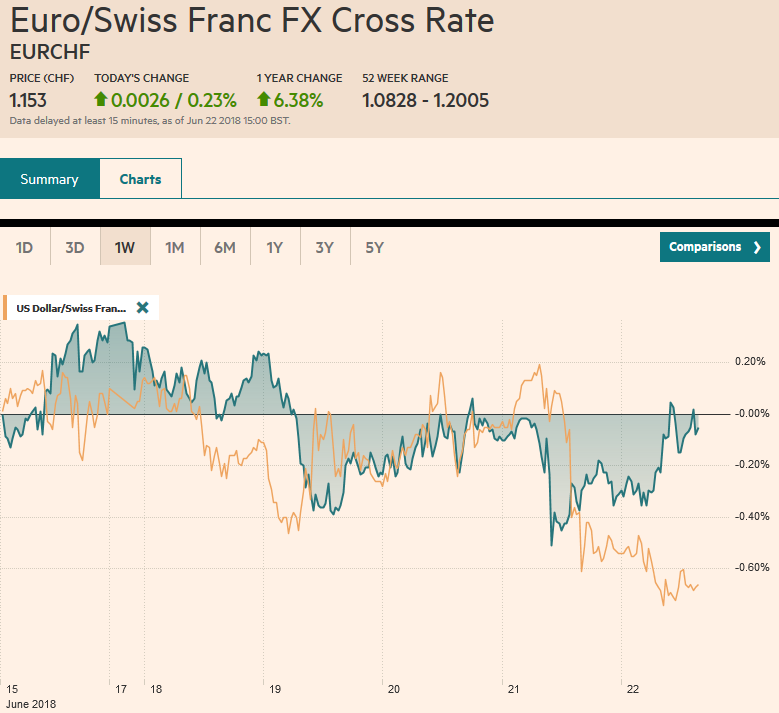

FX Performance, June 22 |

EurozoneA modest recovery in the euro area flash PMI (June) helped provide some fuel for the move that was already underway. The improved composite (54.8 from 54.1) was driven by better service sector readings in both Germany and France, but the manufacturing sector in both countries softened further. |

Eurozone Markit Composite Purchasing Managers Index (PMI), Jan 2014 - Jul 2018(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

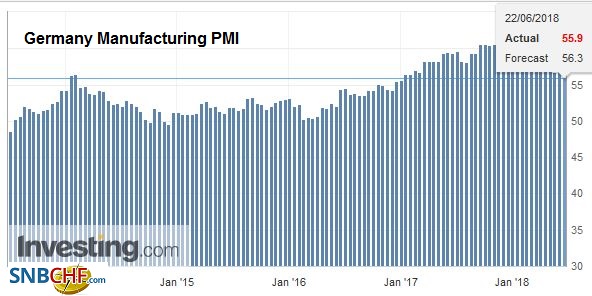

GermanyIn Germany, the manufacturing PMI slipped to 55.9 from 56.9 and in France, it fell to 53.1 from 54.4. These readings are 17-18 month lows. The weakness Germany exports to the US and China do not appear to be attributed to directly attributable to the trade tensions, but the impact on investor confidence was a common refrain from central bankers at the ECB conference this week. Export orders for the eurozone are near two-year lows, and prices pressures did not increase in Q2. |

Germany Manufacturing PMI, Jan 2014 - Jun 2018(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The Bank of England’s hawkish hold yesterday, spurred by three dissents in favor of an immediate hike, changed the near-term dynamics in the foreign exchange market. Both the euro and sterling fell to new lows for the year before reversing higher. Yesterday’s gains are being extended today.

European equities are firmer, and the Dow Jones Stoxx 600 has recoup about half of yesterday’s losses in late morning turnover. The benchmark is still off around 1.7% for the week. It is the fourth weekly loss in the past five. Going forward, it is noteworthy that it has held the 50% retracement of the rally off the last March lows (low for the year) at 380.

Peripheral bonds are recovering while core bonds are trading heavier. As the new Italian government and parliament fill posts, Five Star and League personnel will, of course, be given positions and some of these people are euro skeptics. This does not change the thrust of the government, which the finance minister continues to confirm is committed to EMU. In part, the reaction in the market reflects a skepticism about this commitment, which may have been forced by the “golden straight jacket,” to borrow an old phrase from Thomas Friedman, imposed by the market, when investors went on strike (selling Italian assets aggressively) initially when the first nominee as finance minister did not appear sufficiently committed to the project.

Greece’s 10-year bond yield is off 25 bp following yesterday’s decision by the Euro group to make good on its promise for debt relief. The debt relief had to be constrained by the political realities in the creditor countries, but the deal was at the upper end of what seemed likely a week ago. Greece’s debt to the EFSF (~100 bln euros) was extended by 10-years, and the country was given a 10-year deferral to debt payments. Greece was also given the last tranche of aid (15.5 bln euros) of which about 20% can be used for debt buybacks. Going forward, Greece will have to rely on the private sector for funding, but it has built a cash cushion that may help the transition.

Earlier, Asian equities were mixed, and the MSCI Asia Pacific Index eked out the smallest of gains (less than 0.1%). For the week, it lost about 2.1%. It is the largest weekly loss in Q2. It is the fifth weekly loss in the past six weeks. It fell to a new low for the year today before recovering to close near session highs. Gains in China, Korea, and India helped offset the losses elsewhere. Excluding Japan, the benchmark was up nearly 0.5% today, though it is still off a little more than 2% for the week.

Japan reported its All-Industries Index, rose 1.0% in April after a flat reading in March. The report lends credence to ideas that the economy is recovering in Q2 after contracting in Q1. The dollar has found a base near JPY109.85 in recent days. However, the upside seems limited. Today’s high near JPY110.20 is the lowest high in two weeks. Unless the greenback moves above JPY110.65, it will snap its three-week advance against the yen. Otherwise, this will only be the dollar’s second weekly loss against the yen here in Q2.

OPEC appears to be moving toward a formal hike of as much as a million barrels, but in practice, this will likely be closer to 600 mln barrels, of which Saudi Arabia and Russia are almost halfway toward providing with the recent increase in output. Brent is snapping a three-day slide with a 1% rally today, which puts in marginally higher on the week. WTI for August delivered has been alternating between gains and losses this week, is finishing the week on a firm note. It too is trading 1% higher today, doubling its weekly advance, and snapping a four-week slide.

The US calendar is light with only the flash PMI due out today. Canada, on the other hand, reports April retail sales and May CPI. Weak auto sales will likely dampen the headline retail sales, but excluding them, a 0.5% rise is expected after a 0.2% decline in March. Headline CPI is expected to rise, but the core measures are likely to be little changed. Extrapolating from the OIS, the market has downgraded the chances of a Bank of Canada rate hike in a couple weeks (July 11) to about 65% from 73% a week ago and 78% two weeks ago.

We suspect the odds are a bit higher. While there is still a great deal of uncertainty being generate from US trade policy, the US has not pulled out of NAFTA, and the investigation into auto imports (on national security grounds) will take the better part of a year to play out. The weakness of the Canadian dollar, which is the worst performing major currency this month (-2.4%) may also, on the margins, encourage a rate hike. After encountering offers above CAD1.33, initial potential extends toward CAD1.3180-CAD1.3200.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Composite PMI,Eurozone Markit Composite PMI,FX Daily,Germany Manufacturing PMI,newslettersent,USD/CHF