We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week.

China

The People’s Bank of China made good on its recent signal and announced a 0.5% targeted cut in the reserves requirement ratio, effective July 5. The funds freed up will stay in the banking system and will likely be used to repay MLF borrowings. It appears that despite the economic slowdown, officials remain committed to the deleveraging reform and facilitating the integration of shadow banking assets on to bank balance sheets. At the same time, the roughly CNY700 bln that is freed up is also designed to help support small businesses.

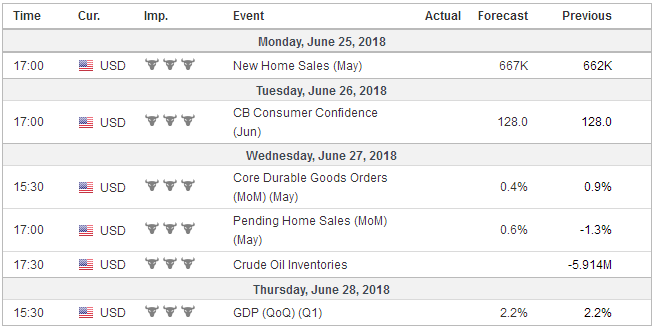

United StatesThe late-month data schedule includes US personal income and consumption, along with the Fed’s preferred inflation measure, the core PCE deflator. US income is steadily increasing as employment growth is strong and average weekly earnings are rising faster than headline inflation. In turn this support consumption. The personal consumption expenditure rose 0.5% a month in H2 17 before slowing to a 0.2% average in Q1. The Bloomberg consensus of a 0.4% gain in May would be the weakest since February but would put the three-month average back at 0.5%. The third estimate of Q1 GDP that will be reported is of little interest to investors. The Atlanta and St. Louis Fed’s GDP trackers see the US economy tracking about a 4.7% annualized pace in Q2, while the NY Fed’s model is at 2.9%. The median private sector forecast is around 2.5%. The headline deflator is expected to edge up 0.2% and lift the year-over-year rate to 2.2%. That would match the highest level since 2013. The core rate, which the Fed targets is also expected to rise 0.2%. This would allow the year-over-year rate to edge up to 1.9% from 1.8% and for all practical purposes reaching the Fed’s target of 2.0%. |

Economic Events: United States, Week June 25 |

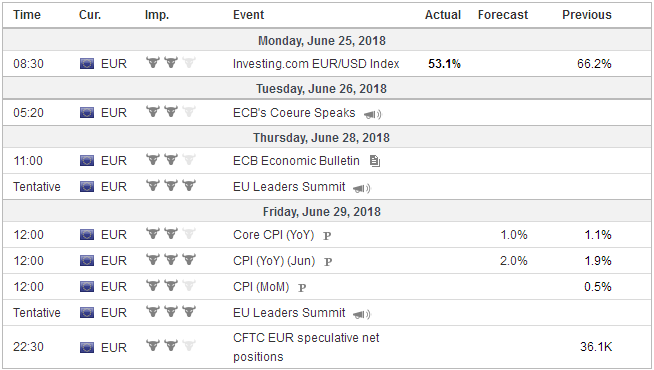

EurozoneThe eurozone’s flash CPI is the most important European report. The headline rate will likely be lifted by the rise in energy prices. The median Bloomberg survey forecast looks for 2.0% from 1.9%. The core rate, which the ECB may not target, but seems to use it or some derivative to shed light on the sustainability of the headline rate may soften to 1.0% from 1.1%. |

Economic Events: Eurozone, Week June 25 |

JapanJapan’s reports industrial output figures for May. METIs’s survey warned so a 1.3% decline after April’s 0.5% increase. The market thinks it can come in a bit better than that, though real exports declined. Even if the METI survey is correct, it would still be consistent with a modest acceleration of the year-over-year pace for a third month. The 1.6% pace seen in February was the slowest since October 2016. The 3.4% the median forecast calls for would be the best this year. |

Economic Events: Japan, Week June 25 |

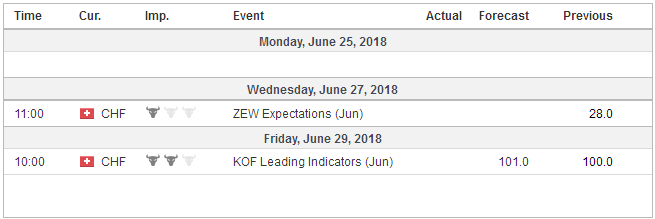

Switzerland |

Economic Events: Switzerland, Week June 25 |

That said the broader outlook is cautious. US industrial output expectedly contracted in May and the June manufacturing PMI slowed further. China’s industrial production slowed more than expected in May. German and French industrial output fell in April, and the May and June PMIs warn that the slowing in the manufacturing sector likely continued.

The outlook is also challenged by the rise escalating trade tensions, which will likely intensify in the coming weeks. On July 1, Canada will put 10%-25% tariff on $12.8 bln of US goods. On July 6 US tariffs on $34 bln of Chinese goods for intellectual property rights violations and China’s retaliatory action. There is another $16 bln of US tariffs (and counter tariffs) that are pending review but could be implemented by the middle of the July. This week, the US Treasury Department is expected to announce additional restrictions on Chinese direct investment in the US.

Before the weekend, the EU imposed retaliatory tariffs on $3.3 bln of US good to express extreme displeasure at the US steel and aluminum tariffs on national security grounds. The EU has been joined by at six least other countries in formally challenging the US tariffs at the WTO. The US has threatened to unleash a new round of tariffs in response to retaliation.

President Trump, who has already authorized an investigation of auto imports as a risk to national security, threatened to put a 20% tariff on European cars if the EU does not reduce their import duties and other barriers to US exports. Trump is also threatening to impose an additional 10% tariff on another $200 bln of Chinese goods, though no details are available. In quarters, there is lingering hope that an agreement between the two largest economies can be struck before the tariffs are implemented on July 6. This strikes as unlikely and an exaggeration of the influence of the seemingly shrinking free-trade wing.

In addition, the Wall Street, economists and the financial press mostly endorse free-trade. This may give a myopic view of America. America is divided. The post-WWII consensus in favor of free-trade has long dissolved. The way that free-trade agreements have been approved in the US is with the vast majority of Republicans and a small minority of Democrats.

What has changed is that protectionist-wing is dominant in the Republican Party. Despite the divisiveness and masterful exploitation of wedge issues, the White House’s trade agenda appears to be broadly supported by a bipartisan consensus, and more importantly, by the President’s electoral base. Similarly, the threat put a 20% tariff on European auto imports are unlikely to be as unpopular in the heartland as they may be among bankers, asset managers, and economists. Some German cars are produced in the US, but the imports are often associated with the high-end luxury models.

The Trump Administration de-emphasizes ideological conflict and puts more emphasis on economic rivalry. There are two main ways that companies service foreign demand. The traditional method was export. The second way emerged in a significant way after WWII, led by US multinationals, was to produce locally and sell locally. It is direct investment.

In recent years, direct investment has been discredited by the extensive use of tax minimization strategies. However, there is much more to it, historically and presently, than tax arbitrage. For example, it has recently been reported that there a new Starbuck shop is opening up in China every 15 hours. European companies are the largest direct investors in the US (~72% share) and employ 3.2 mln Americans. The most recent US data shows that in 2015 majority-owned affiliates (MOA)of US companies employed16.6 mln people abroad and the value-added was estimated at $1.36 trillion (which is almost $82k per employee).

Since the early 1960s, when US records began, the sales by the majority-owned US affiliates easily outstripped US exports. Consider that in 2015, the sales by MOA was $6.9 trillion in 2015 compared with $716.4 bln of exports. The implication of the US policies is to encourage more foreign direct investment in the US, which is what Japanese auto and part makers did in reaction to Reagan’s tariffs. The Trump Administration’s action may disrupt US companies supply chains and encourage greater reliance on exports to service foreign demand. Yet to compete, US producers will likely substitute capital for labor.

Investors will be interested in the progress on three issues at the EU Summit. The most pressing issue of migration, which is tied up with security and defense. This is the most pressing issue because German Chancellor Merkel faces a threat to her government unless she is able to strike a deal with other EU countries. Rather than EC being able to weigh on the Visegrad Group (Poland, Hungary, Czech, and Slovakia) on immigration, the new Italian government, Austria (which assumes the rotating EU Presidency on 1 July).

A fundamental problem arises because of the EU rule that makes the first country a refuge lands is responsible for their welfare. Given the dictates of geography, this, perhaps more than any other single issue, fueled the rise of the League in Italy. Germany’s Interior Minister Seehofer wants to turn “asylum shoppers” away at the border. Merkel seeks a non-unilateral solution.

Some pundits are claiming that Bavaria, where Germany’s Seehofer heads up the CSU, the sister party to Merkel’s CDU, is trying to dictate EU immigration policy. Bavaria holds regional elections in Q4, and the AfD is threatening to deny the CSU its customary majority in the local parliament. Immigration has been made into a key issue. The assessment is partly true in that it is given Merkel a sense of urgency that might not have existed, but it does not do justice to the changing political climate, the seriousness that the elites are taking the populist challenge, and potency of the issue.

However, Northern European countries do not want to change the Dublin Rules that govern this despite the unfairness. Nor is simply giving money to the front-line states, like Italy, Greece, and Malta a realistic solution. Instead, what seems a likely resolution may be the establishment of processing centers off-shore, as in Northern Africa and the Middle East.

Merkel faces another challenge. In recent years, the weakness of the French presidency weakened the two-pillar condominium that drove Europe. The two pillars are back, and Europe is not thrilled. Merkel and Macron struck a broad agreement that was not particularly ambitious or detailed about the next steps in the European project. It included a new fiscal capacity to promote competitiveness, convergence, and stabilization. This prompted a dozen countries to object (Netherlands, Belgium, Luxembourg, Austria, Sweden, Denmark, Finland, Malta, Ireland, and the Baltic States). We suspect there is plenty of room for compromises.

In addition to the EU fiscal issues, and more on the banking and monetary union, Brexit will be discussed. UK Prime Minister May survived a bruising week in Parliament. There simply may not be a set of policies that are acceptable to her cabinet, parliament, and the EU. One may argue that May could have played better, but it seems the hand is unwinnable, which may explain her tenure.

Judging from comments by EC negotiators, there has been little progress on key issues, including the Irish border. The timeframe is getting tighter. A final agreement is to be in hand at the October heads of state summit. The EC may warn that given this, members ought to ensure robust contingency plans in case the UK leaves EU without an agreement in place.

Sterling recovered smartly in response to the hawkish hold by the Bank of England. It rallied more than two cents from the new low for the year near $1.31, recorded hours before the BOE’s decision. However, ahead of the weekend, the momentum faltered, and sterling closed a half a cent off its highs, set at $1.3315, corresponding to the 20-day moving average and the 61.8% retracement of the leg down that began on June 14 near $1.3450.

Risks of a hard exit often seem to correspond with a weaker pound. The exchange rate will also be influenced by the broader performance of the dollar. We continue to put an emphasis on the policy mix and the interest rate differentials that are behind our constructive medium-term outlook for the dollar. However, a downside correction in the dollar began last week, and it may have more room to run.

If the dollar’s correction is part of a larger move within the capital markets, it may be favorable European equities. The S&P 500 closed softly, near the lows, even if higher on the session. MSCI Asia Pacific Index and the MSCI Emerging Market Index finished last week near session highs, and in the current environment, a weaker dollar would seem to support higher prices. Oil, which posted its biggest single-day rally in a couple of years after OPEC and non-OPEC agreed to boost output, may find a softer dollar to its liking as well.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$EUR,$JPY,newslettersent,SPY