Swiss Franc |

EUR/CHF - Euro Swiss Franc, May 16(see more posts on EUR/CHF, ) |

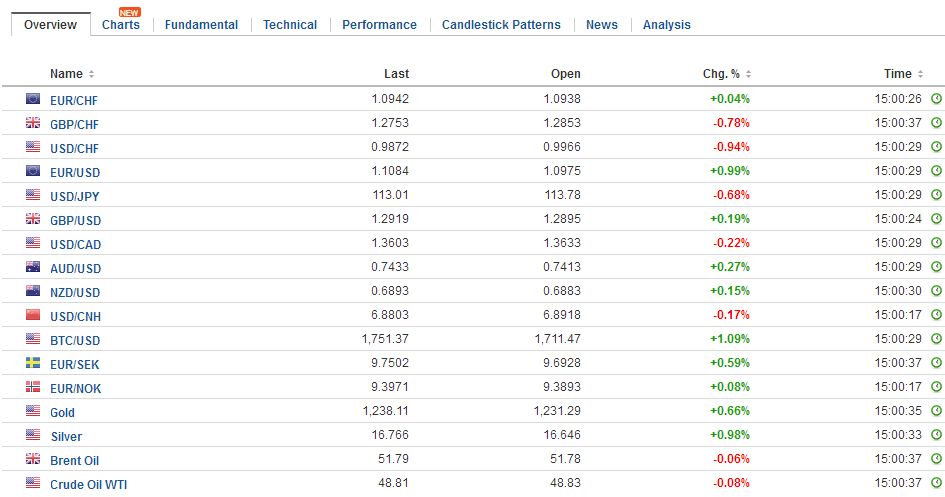

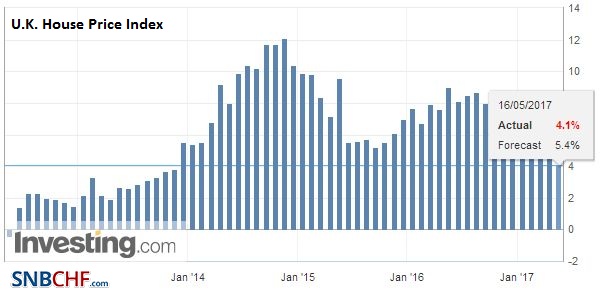

FX RatesDollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday’s activity. It appeared to have been trying to stabilize yesterday in the North American session. News that President Trump may have shared intelligence with Russia’s foreign minister and US ambassador not only heightened ongoing concerns about the Administration’s ties with Russia but also is seen by some as jeopardizing the aggressive legislative agenda. The mishandling of security issues was a Trump campaign criticism of Clinton. Although there was some attempt, of course, to play down the significance of what was shared with the Russians, the damage control exercise by aides may be almost as revealing as an acknowledgment. Also, that the story apparently was leaked by US intelligence officers suggests a key source of tension in the community. |

FX Daily Rates, May 16 |

| The dollar was sold against the yen, but found support ahead of yesterday’s low (~JPY113.10) and recovered toward JPY113.70 in the European morning. US Treasuries are flat and Japanese shares advanced about 0.25%. The Nikkei continues to knock on the psychologically important 20k level. The MSCI Asia Pacific eked out a small gain that was sufficient to lift the benchmark to fresh two-year high. Of note, India’s equities set new record highs. Exporter and positioning ahead of more earnings reports were seen as the main drivers.

Asia seemed slow to respond to the developments, but in the afternoon, it began to sell the dollar. The euro is the chief beneficiary. It was bid to $1.1050, the highest level since the US election. Note too that as of a week ago, speculators in the futures market are net long euros for the first time in three years. The next retracement target is near $1.1130, but the euro is unlikely to make it there today. The intraday technicals warn that the euro buying may have exhausted itself for the time being. A pullback to test the previous resistance that should act as support in the $1.10 area would not be surprising. |

FX Performance, May 16 |

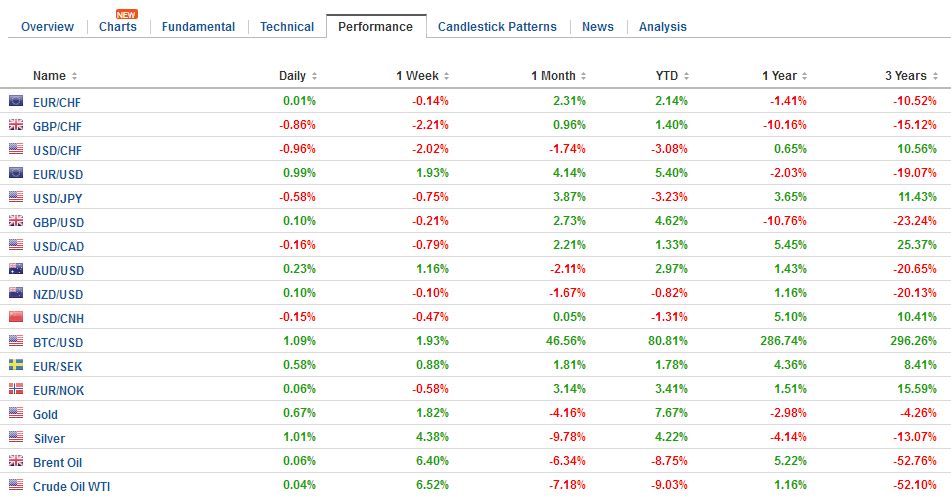

United StatesThe US reports housing starts, permits, and industrial/manufacturing output. Housing starts are expected to bounce back after a 6.8% fall in March. However, what we have seen is the bounce in April in other time series was not as much as economists expected.

|

U.S. Housing Starts, April 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

| Industrial output is expected to have risen 0.4% after a 0.5% increase in March. We expected the composition of the increase to change with manufacturing output recovering from the 0.4% decline in March.

Late yesterday the US reported the TIC data. Long-term inflows reached $59.8 bln up from $53.1 bln in February. The monthly average in 2016 was almost $20 bln. The average in Q1 17 was $39.6 bln. Total flows fell $700 mln, and this reflects the liquidation of short-term securities like T-bills. Of particular interest to many market participants was news that China bought $27.9 bln of US Treasuries, including T-bills. This was the most in a year. Japan, the largest foreign holder of US Treasuries, was also a buyer, but more modest at $3.4 bln. |

U.S. Industrial Production, April 2017(see more posts on U.S. Industrial Production, ) Source: macro.economicblogs.org - Click to enlarge |

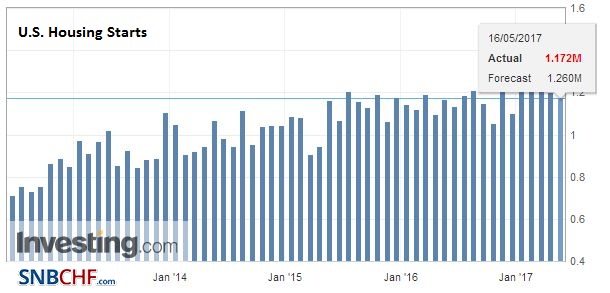

United KingdomSeparately, the UK reported that is official house price index rose 4.1% year-over-year in March compared with a revised 5.6% pace in February. The reading was the lowest in four years. House prices in London lag behind the national average. Sterling initially spiked higher to almost $1.2960 where a wall of sellers lurked and pushed sterling nearly a cent lower (~$1.2865). It has been stuck in a $1.2830-$1.2990 range in the first half of May. We suspect the range may be in place for the day and anticipate consolidative North American session. The yield on the 10-year Gilt rose 1-2 bp, but the short-end of the curve and the short-sterling futures were little changed. |

U.K. House Price Index YoY, April 2017(see more posts on U.K. House Price Index, ) Source: Investing.com - Click to enlarge |

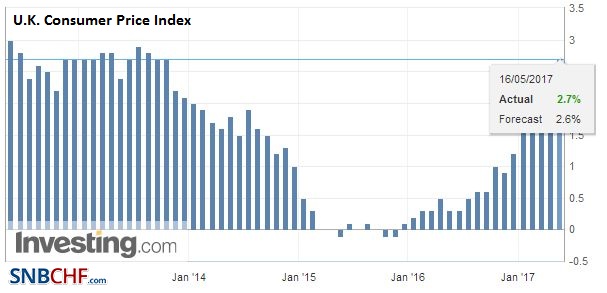

| The UK price pressures rose. Consumer prices increased 0.5% in April and the new CPIH, which includes owner-occupied housing costs, is 2.6% above a year ago levels after a 2.3% increase in March. |

U.K. Consumer Price Index (CPI) YoY, April 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

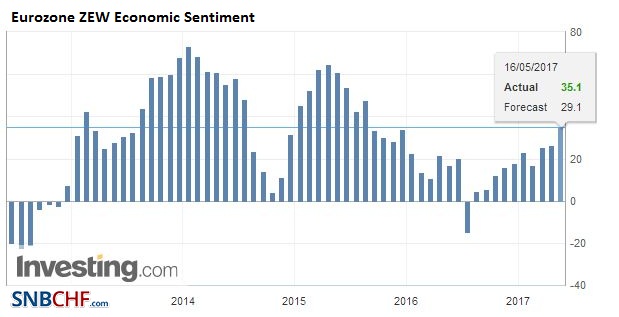

EurozoneThere were two reports from Europe today that draw investors attention. UK inflation and German ZEW. The core rate jumped to 2.4% from 1.8%. Part of the increase is a result of Easter calendar effect, such as the 19% jump in airfare. Tax and administered prices also rose. However, the past weakness of sterling also appeared to bleed through. Petrol prices fell 1.5% on the month. |

Eurozone ZEW Economic Sentiment, May 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

Eurozone Gross Domestic Product (GDP) YoY, Q1 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

|

Eurozone Trade Balance, March 2017(see more posts on Eurozone Trade Balance, ) Source: Investing.com - Click to enlarge |

|

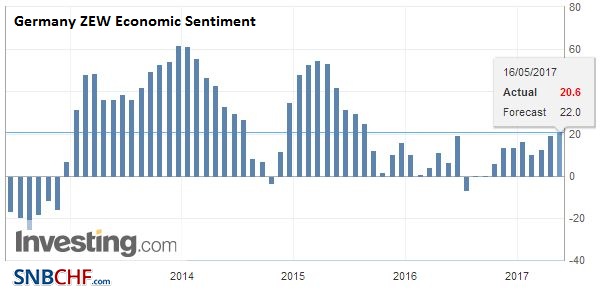

GermanyGermany ZEW survey results were elevated. The economy is expanding a strong clip, the DAX set record highs earlier today before some profit-taking set in, and the threat to the political status quo has diminished. The assessment of the current situation rose to 83.9 from 80.1 to stand at its best level in nearly six years. The expectations component rose to 20.6 from 19.5. This is almost a two year high. |

Germany ZEW Economic Sentiment, May 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

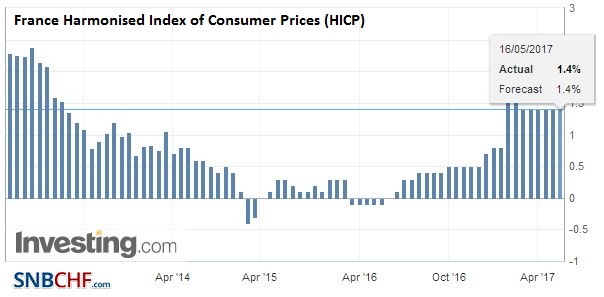

France |

France Harmonised Index of Consumer Prices (HICP) YoY, April 2017(see more posts on France Harmonised Index of Consumer Prices, ) Source: Investing.com - Click to enlarge |

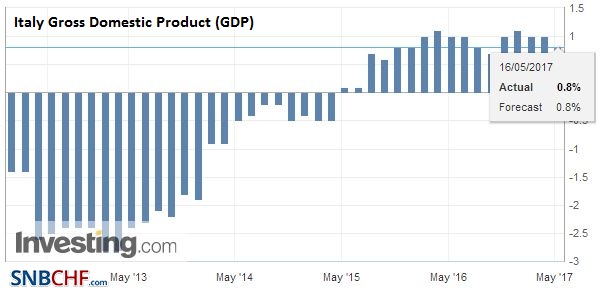

Italy |

Italy Gross Domestic Product (GDP) YoY, Q1 2017 Source: Investing.com - Click to enlarge |

Australia

Elsewhere, the minutes from the Reserve Bank of Australia’s meeting earlier this month may have weighed on the Australian dollar initially. The central bank’s focus seems to be on the labor and housing market, with macro-prudential policies aimed at the latter. The RBA did suggest that the distinction between full and part-time positions may be less significant than in the past. The Aussie spiked to $0.7400 in late morning turnover in Europe but found a bid and intraday technicals suggest this may very well prove to be the low of the day.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Gross Domestic Product,Eurozone Trade Balance,Eurozone ZEW Economic Sentiment,France Harmonised Index of Consumer Prices,FX Daily,Germany ZEW Economic Sentiment,Italy Gross Domestic Product,newslettersent,U.K. Consumer Price Index,U.K. House Price Index,U.S. Housing Starts,U.S. Industrial Production,U.S. Industrial Production (ZH)