Category Archive: 5) Global Macro

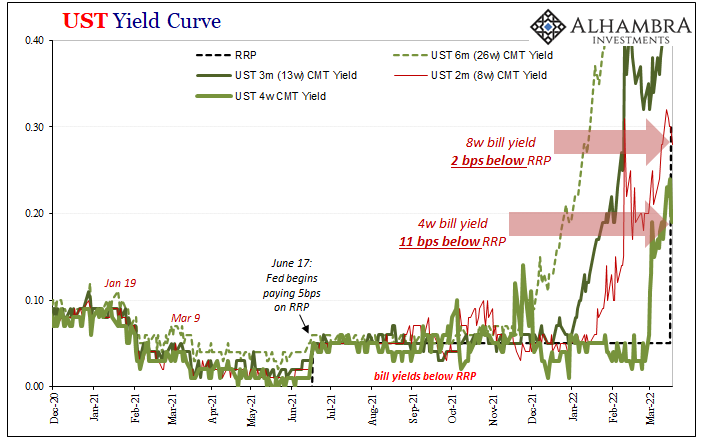

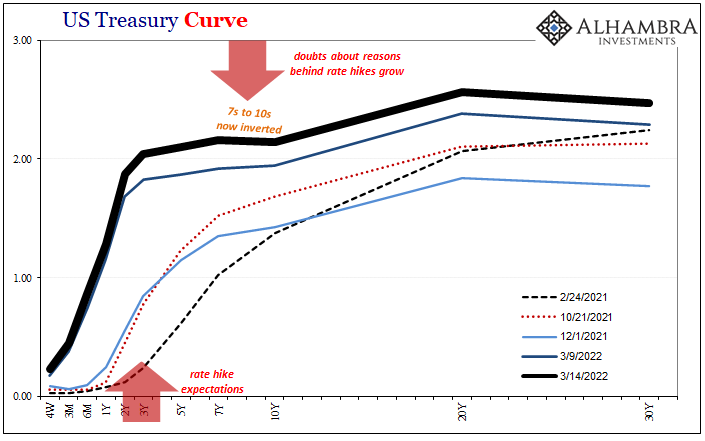

Inversion Is The Real March Madness, Just Don’t Take It Literally

With such low levels of self-awareness, it isn’t surprising that the FOMC’s members continue to pour gasoline on the already-blazing curve fire. March Madness is supposed to be on the courts of college basketball, instead it is playing out more vividly across all financial markets.

Read More »

Read More »

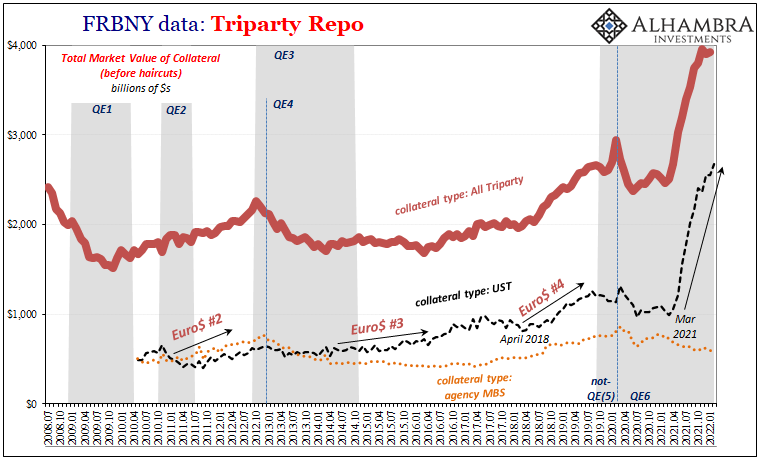

The Fed Inadvertently Adds To Our Ironclad Collateral Case Which Does Seem To Have Already Included A ‘Collateral Day’ (or days)

The Federal Reserve didn’t just raise the range for its federal funds target by 25 bps, upper and lower bounds, it also added the same to its twin policy tools which the “central bank” says are crucial to maintaining order in money markets thereby keeping federal funds inside the band where it is supposed to be. The FOMC voted to increase IOER from 15 bps to 40 bps, and the RRP from 5 bps to 30 bps.

Read More »

Read More »

Baby Boomer Retirement at Risk

The seven deadliest words in the English language—We’ve never done it this way before. And that certainly applies to Baby Boomers whose prospects for retirement are different than any preceding generation.

Read More »

Read More »

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy by: Charles Hugh Smith

National Security is not just military force. In an age of scarcity, security is a degrowth economy of energy independence, social cohesion and civic virtue.

All nations, including the United States, face systemic crises that are reinforcing each other at an explosive point in history.

Read More »

Read More »

Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end.We shouldn’t care much about the Fed.

Read More »

Read More »

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 2]

Securities lending as standard practice is incredibly complicated, and for many the process can be counterintuitive. With numerous different players contributing various pieces across a wide array of financial possibilities, not to mention the whole expanse of global geography, collateral for collateral swaps have gone largely unnoticed by even mainstream Economics and central banking.

Read More »

Read More »

Gene editing: should you be worried? | The Economist

From combating climate change, to curing disease, to creating designer babies, gene-editing technologies have the potential to transform lives. What risks do they pose?

00:00 - Gene editing: risk v reward

01:06 - Cavendish bananas are under threat

03:47 - GM crops have a bad reputation

05:18 - GM mosquitoes could reduce transmissible viruses

07:50 - Ethical concerns around genetic interventions

09:30 - Editing genes with CRISPR

10:57 - CRISPR...

Read More »

Read More »

The Roundtable Insight with Charles Hugh Smith on The Great Awakening Vision

Http://financialrepressionauthority.com/2022/03/17/the-roundtable-insight-charles-hugh-smith-on-the-great-awakening-vision/

Link to the Article on the alternative Great Reset - http://financialrepressionauthority.com/2022/03/08/the-great-awakening-an-alternative-great-reset-based-on-the-principles-of-the-austrian-school-of-economics

Read More »

Read More »

There Is An Absolutely Solid Collateral Case For What’s Driving Curve Inversion(s) [Part 1]

With the 7s10s already inverted, and the 5s today mere bps away, making a macro case for the distortion isn’t too difficult. Despite China’s “upside” economic data today, even the Chinese are talking more about their downside worries (shooting/hoping for “stability”) than strength. In the US or Europe, no matter the CPIs in either place there are cyclical (not just inventory) warning signs all over the place.

Read More »

Read More »

Risk Accumulates Where No One Is Looking For It

All this decay is so incremental that nobody thinks it possible that it could ever accumulate into a risk that threatens the entire system. The funny thing about risk is the risk that everyone sees isn't the risk that blows up the system. The mere

fact that everyone is paying attention to the risk tends to defang it as everyone rushes to hedge or reduce the risk.

Read More »

Read More »

China’s Loan Results Back The PBOC Going The Opposite Way From The Fed

This week will almost certainly end up as a clash of competing interest rate policy views. Everyone knows about the Federal Reserve’s upcoming, the beginning of what is intended to be a determined inflation-fighting campaign for a US economy that American policymakers worry has been overheated.

Read More »

Read More »

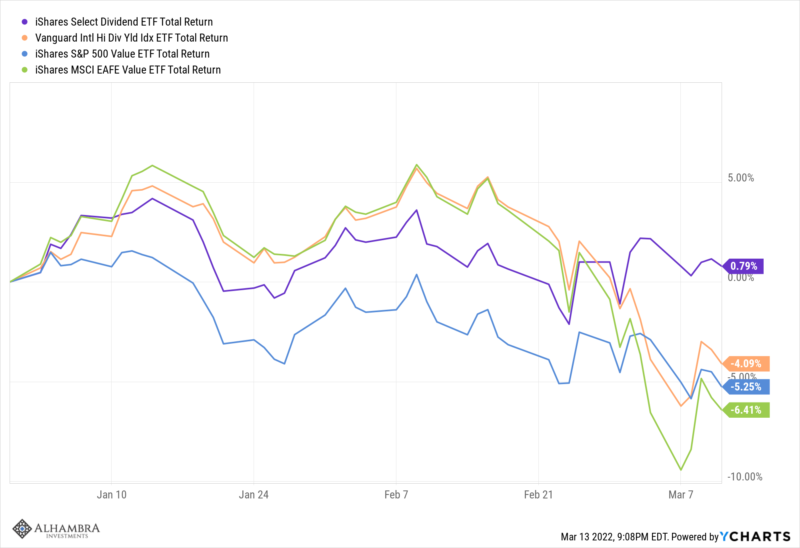

Weekly Market Pulse: Is This A Bear Market?

I don’t know the answer to the question posed in the title. No one does because the future is not predictable. I don’t know what will happen in Ukraine. I don’t know how much what has already happened there – and what might – matters to the US and global economy. I don’t know if the Fed is making a mistake by (likely) hiking interest rates by an entire 1/4 of 1% this week.

Read More »

Read More »

War in Ukraine: how could this end? | The Economist

As Russia continues the bombardment of Ukraine, peace talks falter and threats of escalation increase, our Economist experts discuss how the war could end.

00:00 - Introduction

00:37 - A Russian quagmire?

02:06 - Could Putin lose power?

03:38 - The biggest escalation risks

05:39 - A negotiated end to the war?

Find all our coverage on the war in Ukraine: https://econ.st/3hHrkS5

The war in Ukraine, explained in maps: https://econ.st/3sOaCGN...

Read More »

Read More »

SMART BOURSE – Thomas Costerg (Pictet WM)

Lundi 14 mars 2022, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

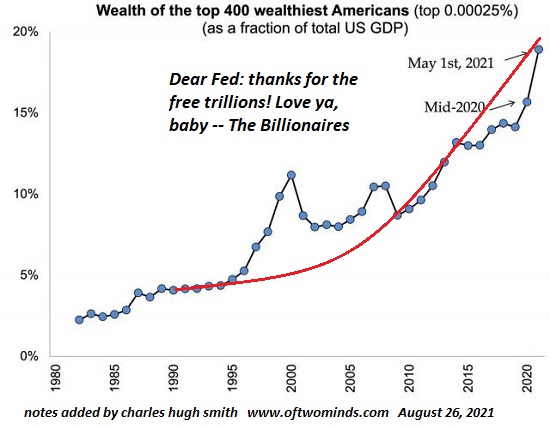

Serf-Expression

Eventually the "flock of timid and industrious animals" changes their minds about how much exploitation by the few is acceptable.

Read More »

Read More »

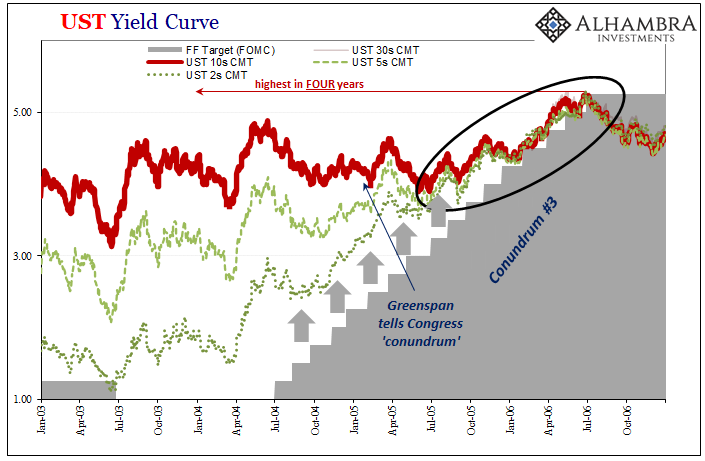

Another One Inverts, The Retching Cat Reaches Treasuries

As Alan Greenspan’s rate hikes closed in, longer-term Treasury yields were forced upward as the flattening yield curve left no more room for their blatant defiance. By mid-2005, though, the market wasn’t ready to fully price the downside risks which had already led to that worrisome curve shape (very flat). While all sorts of bad potential could be reasonably surmised, none of it seemed imminent or definite.

Read More »

Read More »

The Roundtable Insight with Charles Hugh Smith on The Great Reset Agenda

Here is the link to the article referenced in the podcast - http://financialrepressionauthority.com/2022/02/10/the-great-awakening-an-alternative-great-reset-based-on-the-principles-of-the-austrian-school-of-economics/

Read More »

Read More »

How the IRS Taxes Your Retirement Income

Oh, the day you can hang up your career and ease into that status you’ve been working toward most of your adult life, the place that brings a smile to your face, your happy place where you no longer answer to an employer, where you set your own schedule—that magical place called “Retirement.”

Read More »

Read More »

Consumer Prices And The Historical Pain(s)

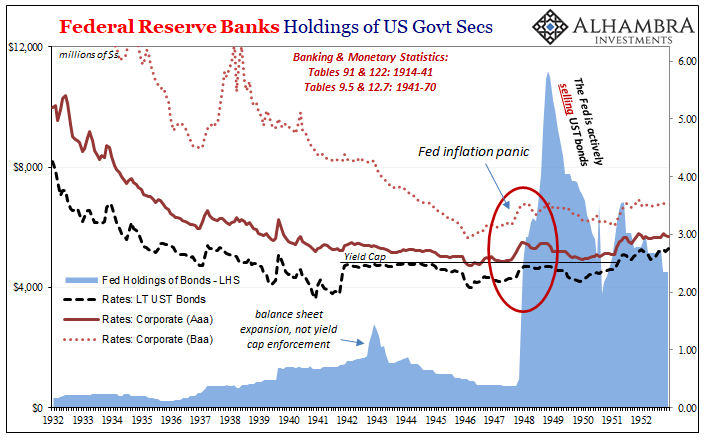

The 1947-48 experience was truly painful, maybe even terrifying. The US and Europe had just come out of a decade when the worst deflationary consequences were so widespread that the period immediately following quickly erupted into the worst conflagration in human history.

Read More »

Read More »