Category Archive: 5) Global Macro

Russia-Ukraine Conflict: US President Joe Biden escalates rhetoric against Putin | World News

US president Joe Biden has escalated rhetoric against Russia's President Putin and termed Russian acts as 'genocide' several times. However, Emmanuel Macron has refused to term Russian acts as 'genocide'.

Read More »

Read More »

Produzentenfenster Globale Rezessionsuhr

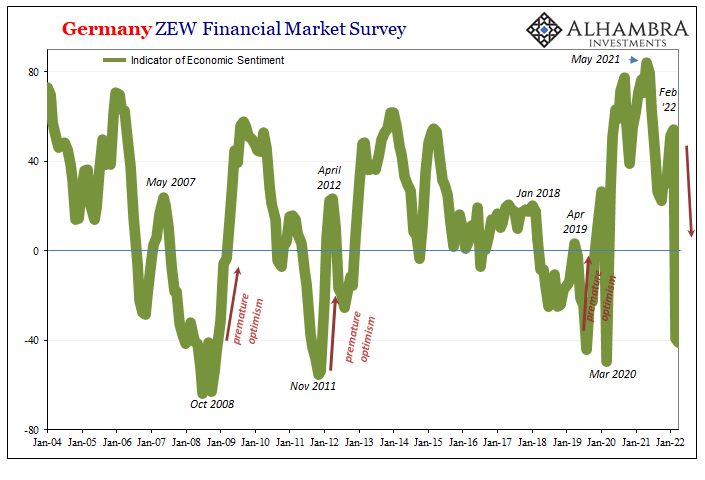

German optimism was predictably, inevitably sent crashing in March and April 2022. According to that country’s ZEW survey, an uptick in general optimism from November 2021 to February 2022 collided with the reality of Russian armored vehicles trying to snake their way down to Kiev. Whereas sentiment had rebounded from an October low of 22.3, blamed on whichever of the coronas, by February the index had moved upward to 54.3.

Read More »

Read More »

War in Ukraine: The Economist interviews Tony Blair | The Economist

Tony Blair, former British Prime Minister, talks to Zanny Minton Beddoes, The Economist’s editor-in-chief, about the war in Ukraine. He gives his opinions on how to deal with Vladimir Putin, the retreat of Western foreign policy and the future of geopolitics.

00:00 - The evolution of Vladimir Putin

01:52 - The wake up call for the West

02:20 - Consequences of Western retreat

05:09 - Is peace with Putin possible?

06:17 - What should the West’s...

Read More »

Read More »

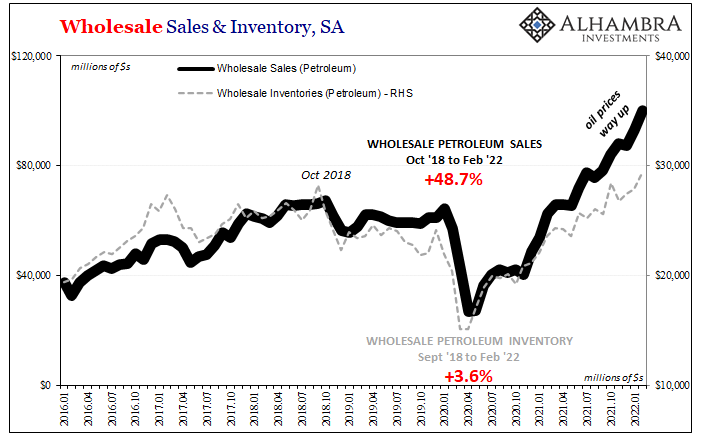

Concocting Inventory

The Census Bureau provided some updated inventory estimates about wholesalers, including its annual benchmark revisions. As to the latter, not a whole lot was changed, a small downward revision right around the peak (early 2021) of the supply shock which is consistent with the GDP estimates for when inventory levels were shrinking fast.

Read More »

Read More »

Ukrainian cities: Before & after the war – Kyiv, Bucha, Mariupol & others | WION Originals

Cities in Ukraine are bearing the brunt of the Russia-Ukraine war. Cities that were once tourist attractions have turned into war zones and rubble. Cities including the capital Kyiv, have been damaged. Destruction, dead bodies, and silence occupy the streets of some of the cities including Bucha, Kharkiv, Mariupol, and Odessa. Will these cities come back to life? War in Ukraine but at what cost?

#Ukraine #UkraineCities #WIONOriginals

About...

Read More »

Read More »

War in Ukraine: the journey to interview President Zelensky | The Economist

On March 25th, Zanny Minton Beddoes, editor-in-chief of The Economist, was granted rare access to President Volodymyr Zelensky's war room in Kyiv. In this exclusive interview he reveals the inside story of his transformation into a wartime leader - and what he thinks of Ukraine's chances.

00:00 - The realities of a war zone

01:05 - Our visit with President Zelensky

01:36 - Can Ukraine win?

02:59 - What is the current military situation?

Watch...

Read More »

Read More »

Worry Walls Don’t Explain Repeated Falls

Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over.

Read More »

Read More »

Russia-Ukraine conflict: ‘Russia faces a long descent into isolation,’ says EU Prez | World News

European Union has closed Bloc's ports to Russian vessels and will reduce dependence on Russia. On the other side, the EU has also rolled out additional funding to boost Ukraine's army.

Read More »

Read More »

Russian currency Rouble rebounds, no longer ‘in rubble’

After the Russian invasion of Ukraine, the Russian currency Rouble was at an all-time low, it shared 45 per cent of its value against the dollar. The collapse was an indication of Russia's economic isolation

#Russia #Rouble #WION

Read More »

Read More »

Why the French are fed up (and what it means for Macron) | The Economist

The French are miserable. Normally this means defeat for sitting presidents, but Macron is still just about leading in the polls. So what's going on?

00:00 - The French are fed up

01:03 - Has Macron boosted France’s economy?

02:02 - Why are the French so discontent?

02:57 - Why do voters lack confidence in Macron?

03:52 - A deeply divided France

05:32 - Why voters are flocking to political extremes

07:34 - France’s fragmented politics

View...

Read More »

Read More »

Gravitas: The big European Hypocracy over Russia

India abstained from a UNGA vote to suspend Russia from the UN Human Rights Council. The move came despite Russia's explicit warning against abstentions. Palki Sharma tells you more.

#Gravitas #India #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we...

Read More »

Read More »

NATO to step up military aid to Ukraine amid the ongoing Russian invasion | World English News

Amid the ongoing Russian invasion of Ukraine, NATO has pledged to step up military aid to Ukraine. Ukraine has also demanded an energy embargo on Russia.

Read More »

Read More »

The US commits more weapons to Ukraine & ends normal trade with Russia | English News | WION

Amid the ongoing Russian invasion of Ukraine, The US has committed more weapons to Ukraine. The US has also ended normal trade with Russia.

#US #Russia #Ukraine

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring you news on the hour, by the hour. We...

Read More »

Read More »

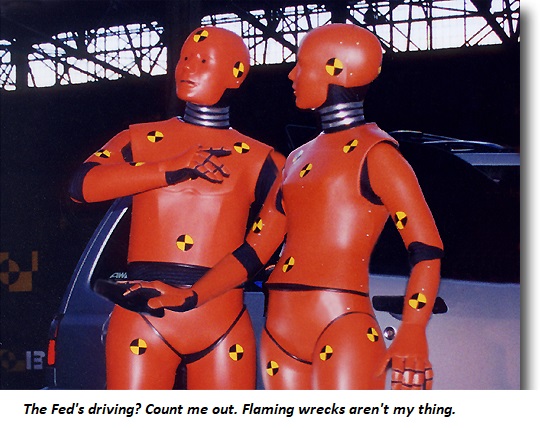

For Freak’s Sake, People, Even the Crash Test Dummies Are Nervous

Those trusting the Fed to be visibly weak, corrupt and incompetent forever might be in for an unwelcome surprise. When even the crash test dummies are nervous, it pays to pay attention. Being in a mild crash isn't too bad if all the protective devices inflate as intended. But in a horrific crash where nothing goes as planned, it's like speeding in a ready-to-explode Pinto and being side-swiped by a semi on Dead Man's Curve.

Read More »

Read More »

United Nations suspends Russia from human rights council | International News | WION

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global headquarters in New Delhi, we bring you news on the hour, by the hour. We deliver information that is not biased. We are journalists who are neutral to the core and non-partisan when it comes to the politics of the world. People are tired of...

Read More »

Read More »

Russia-Ukraine conflict: Ukraine asks for more weapons from NATO | World News | WION

During the 2nd day meeting of NATO foreign ministers, Ukraine asked for more weapons. Ukrainian foreign minister Dmytro Kuleba said, "The more weapons we get and the sooner they arrive in Ukraine, the more human lives will be saved."

#Ukraine #NATO #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their...

Read More »

Read More »

Western duplicity on Russian imports exposed, EU says won’t ban energy imports | WION

The Western duplicity on Russian imports gets exposed as Europe did not shut off Russian gas pipelines. European Union's Foreign Affairs Chief confirmed that 27 countries in the block are paying Russia over 1 billion dollar per day on fuel imports

#EuropeanUnion #Russia #WorldNews

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower...

Read More »

Read More »

Uzbekistan and India’s IT gain from the ongoing Russia-Ukraine war | WION

Russia-Ukraine war has driven an exodus of IT specialists to former parts of Soviet Union including Uzbekistan. Reports say that India's IT sector may also see creation of around 50,000 jobs

#Russia-Ukrainewar #India #Uzbekistan

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than the news of the day. Our aim to empower people to explore their world. With our Global...

Read More »

Read More »

Goldilocks And The Three Central Banks

This isn’t going to be like the tale of Goldilocks, at least not how it’s usually told. There are three central banks, sure, call them bears if you wish, each pursuing a different set of fuzzy policies. One is clearly hot, the other quite cold, the final almost certainly won’t be “just right.” Rather, this one in the middle simply finds itself…in the middle of the other two.Running red-hot to the point of near-horror, that’s “our” Federal...

Read More »

Read More »

New sanctions on Russia: UK targets Sberbank and credit bank of Moscow | Business News

Britain also ratcheted up sanctions on Russia. UK in a similar move to the United States has targeted Russia's largest bank and has decided to end all new British investment in Moscow, the latest round of sanctions were in response to the reports of civilians being killed by Russian forces in Bucha.

#UK #Sanctions #Russia

About Channel:

WION -The World is One News, examines global issues with in-depth analysis. We provide much more than...

Read More »

Read More »