Category Archive: 4) FX Trends

FX Daily, August 27: After much Build-Up, Could Powell be Anti-Climactic?

The strong rally in US equities yesterday, with the fifth consecutive gain in the S&P 500 and a big outside up day in gold, failed to spur follow-through buying today. Asia Pacific equities were mixed. China, Australia, and India rose while most of the rest of the regional markets fell.

Read More »

Read More »

FX Daily, August 26: Hurricane Laura Lifts Oil Prices

A consolidative tone has emerged after US equity benchmarks reached new highs yesterday. The MSCI Asia Pacific Index had reached seven-month highs on Tuesday, but Japan, China, and Australian stocks saw modest profit-taking today. European shares are recouping yesterday's minor loss, and US shares are flat.

Read More »

Read More »

FX Daily, August 25: Stocks Extend Gains, while Yesterday’s Dollar Recovery Stalls

Soaring US stocks, optimism about a vaccine, and the affirmation of the US-China trade agreement are buoying global equities today. The MSCI Asia Pacific Index is near seven-month highs and was led today by more than 1% gains in the Nikkei and Kospi.

Read More »

Read More »

FX Daily, August 24: Markets Prove Resilient to Start New Week

New virus outbreaks in Europe and Asia are not adversely impacting the capital markets today. Global equities are firmer. Some reports suggesting the US ban on WeChat may not be as broad as initially signaled helped lift Hong Kong shares, but nearly all the markets in the region traded higher.

Read More »

Read More »

FX Daily, August 21: PMIs Shake Investor Confidence

The second disappointing Fed manufacturing survey report and an unexpected rise in weekly jobless claims helped reverse the disappointment over the FOMC minutes. Bonds and stocks rallied--not on good macroeconomic news, but the opposite, which underscores the likelihood of more support for longer.

Read More »

Read More »

FX Daily, August 20: FOMC Minutes Spur Profit-Taking

Overview: The FOMC minutes depicted a Federal Reserve that appeared to be not quite ready to take fresh initiatives, whether it is yield curve control or changing the composition or quantities of its bond purchases. This unleashed profit-taking on some of the large moves in equities, the dollar, and gold.

Read More »

Read More »

Cool Video: TD Ameritrade with Ben Lichtenstein

With the dollar continuing to trend lower, it was time to check again with Ben Lichtenstein at TD Ameritrade. It was a privilege to join him today to discuss the drivers. I sketched out my views that the greenback's two legs, growth and interest rate differentials have been knocked from under it.

Read More »

Read More »

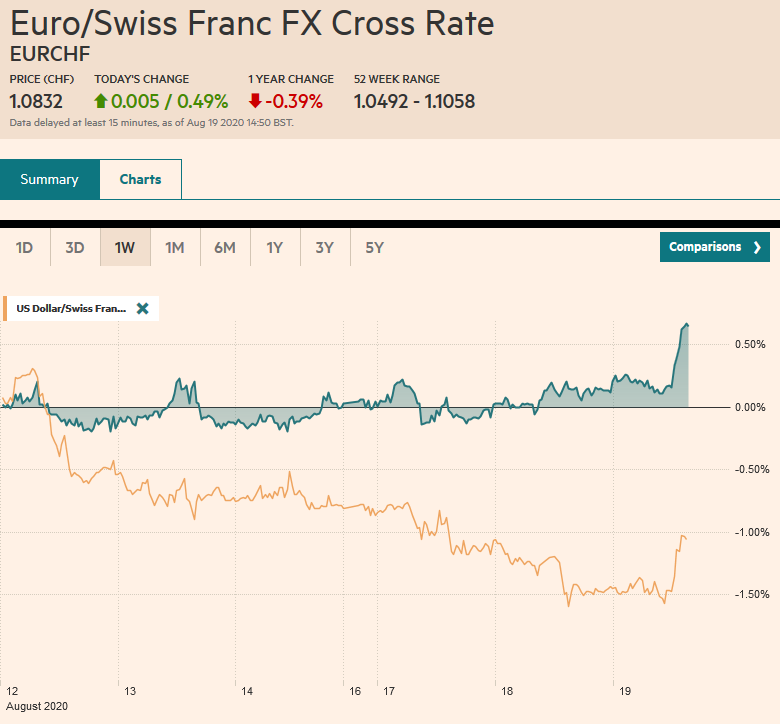

FX Daily, August 19: US Equities Outperform but Does Little for the Heavy Greenback

Overview: The S&P 500 and NASDAQ set new all-time highs yesterday, but the continued outperformance of US equities have failed to lend the dollar much support. It was sold to new lows for the year yesterday against the euro, sterling, the Swedish krona, and the Australian dollar.

Read More »

Read More »

FX Daily, August 18: Canada Shrugs Off Loss of Morneau and Gold Reclaims $2000 Threshold

The NASDAQ rallied 1% yesterday to record highs as the Dow Industrials struggled, and the S&P 500 was able to eke out a small gain. The coattails were short, and the strength of the yen may have contributed to a 0.2% loss of the Nikkei. Still, its 6.2% advance this month is the best among the G10.

Read More »

Read More »

FX Daily, August 17: The Dollar Softens to Start the New Week

The capital markets are looking for direction. Asia Pacific equity markets were mixed, with gains in China, Hong Kong, and Taiwan countering losses in Japan, South Korea, and Australia. European and US shares are trading slightly firmer.

Read More »

Read More »

August Survey Data and Beyond

Economists are often lampooned because of their inability to forecast changes in the business cycle. But the pandemic helped them overcome the challenge this time. A record contraction in Q2 was anticipated before in March. Similarly, economists generally expected the recovery after the March-April body blow.

Read More »

Read More »

FX Daily, August 14: Consolidation Featured Ahead of the Weekend

The equity rally is stalling ahead of the weekend. Most markets in the Asia Pacific region eased, though China and Australia advanced. Japanese shares were mixed. The Nikkei, though advanced for the fourth consecutive session, while the Topis slipped.

Read More »

Read More »

FX Daily, August 13: Dollar Remains Offered

The poor price action on Tuesday in the S&P 500 was shrugged off, and new highs for the recovery were made as the record high nears. The dollar, on the other hand, seemed to find plenty of sellers against most of the major currencies. The yen was a notable exception.

Read More »

Read More »

FX Daily, August 12: Dollar was Sold in Asia and Europe, but is Poised to Bounce in North America

The biggest rise in the US 10-year yield in a couple of months, as the record quarterly refunding, got underway may have helped stabilize the dollar after an earlier decline. The S&P 500 threatened to extend its advance for the eighth consecutive session yesterday, but a late sell-off stopped it cold after scaling to new five-month highs.

Read More »

Read More »

FX Daily, August 11: Gold and the Dollar are Sold while Stocks March Higher

A rotation of sorts seems to be unfolding. The euro posted its second back-to-back loss in over a month. The Canadian dollar, which has been an under-performer among the major currencies for the past six weeks, gained, while most fell.

Read More »

Read More »

Speculative Positioning in Selected Currency Futures

With the media playing up the US dollar's negatives, one would think speculators are short the greenback like there is no tomorrow. Yet a review of the Commitment of Traders report that covers the week through last Tuesday, August 4, shows that this is not really the case.

Read More »

Read More »

FX Daily, August 10: Monday in August

Overview: The new week has begun slowly with Singapore and Tokyo markets closed for national holidays. The MSCI Asia Pacific Index rose 2% last week and edged higher today, led by 1.5%-1.7% rallies in South Korea and Australia. Hong Kong was a notable exception and eased around 0.6%.

Read More »

Read More »

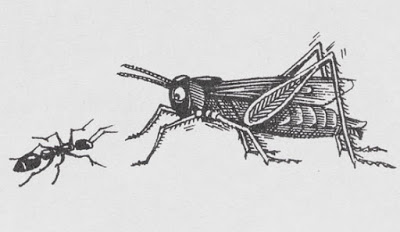

The Ant and the Grasshopper: A Window into Macro Part II

Regardless of the dollar's role and function in the world economy and the halls of finance, in the near and intermediate terms, investors and businesses are more concerned with foreign exchange prices. The greenback has fallen out of favor. Its main supports, like wide interest rate differentials, favorable growth differentials, and political certainty if not stability, have weakened.

Read More »

Read More »

FX Daily, August 07: Position Adjustment Dominates ahead of US/Canada Employment Reports

Escalating dramas may be behind the position adjustment today ahead of the US jobs data. The US and China feud expanded beyond Tiktok to WeChat, and efforts to tighten disclosure rules for Chinese companies listed in the US are nearing. The negotiations between the White House and the Democrats broke down, preventing or at least delaying additional stimulus.

Read More »

Read More »