Category Archive: 4) FX Trends

Is the Dramatic Yen Short Squeeze Over?

Overview: The powerful yen short squeeze that has roiled the capital market this week has stalled today. It is the first day this week that the dollar has not fallen below the previous day's low and has risen, though slightly, above previous session's high. The Antipodeans and Scandis are trading with a firmer bias. The yen and Swiss franc are the only two G10 currencies that are not stronger today. The stability of the yen appears to have removed...

Read More »

Read More »

Yen’s Surge Continues, while PBOC Surprises with Another Rate Cut, and US 2-30 Year Yield Curve Ends Inversion

Overview: The capital markets are in flux. The powerful short-covering rally of the yen and unwinding of carry trades continues. For the second time this week, the PBOC has surprised by cutting interest rates. The dramatic sell-off of equities continues. The unexpected contraction of South Korea's Q2 GSP (-0.2%) is seen as confirmation of broader economic weakness Speculation of a more aggressive Federal Reserve is gaining ground. It is not that...

Read More »

Read More »

Greenback and Yen Extend Gains

Overview: The dollar's gains have been extended today, but in the risk-off mode, and unwinding of carry positions, the Japanese yen and Swiss franc are firmer. the dollar has stabilized in late European morning turnover. The Bank of Canada is widely expected to cut rates today and the greenback is pushing against CAD1.38, which it has not traded above for three-months. The US dollar gains, which we anticipated, are coming despite interest rates...

Read More »

Read More »

Short Covering Squeezes the Yen Higher

The US dollar is firmer against all the G10 currencies but the Japanese yen. Local reports and the price action are consistent with short covering of the previously sold yen positions ostensibly ahead of next week's BOJ and FOMC meetings. Still, the greenback is holding above last week's low, slightly below JPY155.40.

Read More »

Read More »

Dollar Mixed as Markets Digest US Political Developments

Overview: News that President Biden will not seek re-election has left investors unsure of the next step, but PredictIt.org still points to a Trump advantage of slightly better than 60-40. It is not clear yet whether Vice-President Harris will be challenged for the nomination. The dollar is mixed against the G10 currencies, with the dollar bloc and Norway weaker. The yen is up around 0.45% to lead the others higher. The Swiss franc, euro and...

Read More »

Read More »

Week Ahead: US Dollar to Extend Recovery while Stocks Correct Lower

The consolidative phase for the dollar, we anticipated last week, after its recent drop, is evolving into a proper upside correction. We expect the dollar to trade broadly firmer over the next week or so. It is also part of a larger picture, where US interest rates also look to have put in a near-term bottom and are set to recover. Ideas that next US administration may favor a weaker dollar has become a talking point. Yet, of all the forces that...

Read More »

Read More »

Dollar Consolidation is Morphing into Correction

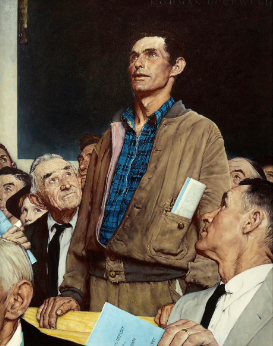

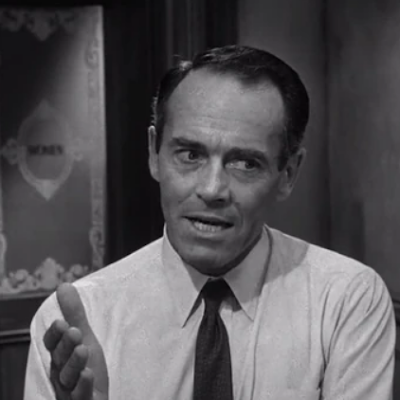

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The failure of computer systems has disrupted airlines, banks, media companies, and the London Stock Exchange, ostensibly stemming from an update from a third-party software update, according to Microsoft. The dollar is trading with a firmer bias. The consolidation, we anticipated, appears to be morphing into a correction. Weaker than expected retail sales...

Read More »

Read More »

Euro Trades Quietly Ahead of ECB Meeting

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The US dollar enjoys a firmer bias today, in mostly quiet turnover in narrow ranges. The Australian dollar is a noted exception, and the better than expected jobs growth may have lent it some resilience today. The greenback initially was sold to almost JPY155.35, a new low (since June 7) before recovering to nearly JPY156.60 in Europe. The UK's employment...

Read More »

Read More »

Dollar Crushed, Stocks Slump

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The dollar is broadly lower, and stocks are under pressure. Comments by a Japanese official, which did not appear to break new ground, coupled with Trump's interview in BusinessWeek, where he was critical that Japan was benefiting from a weak yen, despite having apparently spent some $80 bln this year trying to stop it from falling, may have been the trigger....

Read More »

Read More »

BOJ Appears to have Intervened last Friday Too, but Market Sells Yen Anyway

Jury duty assignment prevents a more comprehensive note, but here is a snapshot. Overview: The US dollar is consolidating in narrow ranges against most of the G10 currencies. The Australian and New Zealand dollars, along with the Japanese yen are off by about 0.25%, but the others are +/- 0.10. The latest BOJ data appears to imply that officials intervened not only last Thursday, but Friday as well. Emerging market currencies are mixed but mostly...

Read More »

Read More »

Dollar Consolidates to Start the New Week

Overview: The assassination attempt on former President Trump has injected a new dynamic as his chances of being re-elected appear to have risen. There are a few trades that seem to benefit from a second term: steepening yield curve, weaker Mexican peso, and stronger crypto. The dollar initially strengthened as the market's initially responded, while Tokyo markets were closed for Marine Day. As North American activity is about to begin, the dollar...

Read More »

Read More »

Week Ahead: Following Up a Watershed Week

Slowing US jobs growth, the third consecutive rise in the unemployment rate, and the softer than expected CPI are a watershed. Although the Federal Reserve will not cut rates when it meets at the end of the month, Chair Powell will likely lay the groundwork for a cut in September. Indeed, the Fed funds future market has priced in slightly more than a 25 bp cut. The deteriorating economic conditions dragged US two-and 10-year yields to their lowest...

Read More »

Read More »

Market Takes JPY Lower Despite Intervention Speculation, While Sterling Shines

Overview: The dollar is mostly consolidating yesterday's CPI-inspired decline. The main features include the market bidding the US dollar back above JPY159 despite more speculation that the BOJ did in fact intervene yesterday and checked on the euro-yen cross in the local session today, and unexpectedly soft Swedish inflation, which the swaps market says could spur three rate cuts here in second half. A record trade surplus and strong aggregate...

Read More »

Read More »

Today’s Battle: Soft US CPI vs Stretched Momentum Indicators and Two Fed Cuts Discounted

Overview: The focus today is on the US CPI report. Another soft reading is expected, and it may strengthen ideas of a Fed cut in September, which ostensibly gives it time to cut again before the end of the year. The dollar is trading with a softer bias against most of the G10 currencies. A stronger than expected May GDP report helped sterling reach new four month high. The greenback is also holding below yesterday's high near JPY161.80 against the...

Read More »

Read More »

Narrow Ranges for the Dollar Prevail Ahead of Tomorrow’s US CPI

Overview: The dollar is mostly softer today, but largely within the recent ranges, as the market appears to be waiting for tomorrow's US CPI. There are a few exceptions to note. The yen is trading near its recent lows. A less hawkish Reserve Bank of New Zealand has triggered a sell-off of the local dollar. Softer than expected Norwegian inflation has knocked the krone lower. Most emerging market currencies are firmer, with several Asia Pacific...

Read More »

Read More »

Quiet Summer Tuesday with Powell’s Testimony and a Deluge of US Supply on Tap

Overview: In the absence of fresh developments, the dollar is consolidating in narrow ranges today against the G10 currencies and enjoys as slight upward bias against most emerging market currencies but for a few currencies from the Asia Pacific region. With practically an empty US data calendar, Fed Chair Powell's testimony with be the highlight, and a soft headline CPI on Thursday anticipated. The US two-year premium over Germany has fallen from...

Read More »

Read More »

Euro is Little Changed, while the Yen is Softer to Start the New Week

Overview: The dollar is narrowly mixed against the G10 and emerging market currencies today. The euro is little changed, holding on to last week's gains, after the surprising French election results, where the focus shifts finding a prime minister that can carry a majority of the new and closely divided National Assembly. Despite firm underlying wage data, the Japanese yen has given back its initial gains, and the dollar is pushing back above...

Read More »

Read More »

Week Ahead: Market Eyes Two Fed Cuts this Year ahead of June CPI

Four drivers are shaping the investment climate. First, ahead of the run-off elections in France, the market feels more comfortable that Le Pen will not secure a parliamentary majority. The French premium over Germany narrowed to 65 bp, falling by about 14 bp last week, and arguable a supportive factor for the euro. Second, the British election was largely a foregone conclusion, and Labour did secure majority. It ought not be construed as a shift...

Read More »

Read More »

No Turn Around Tuesday as Greenback Remains Firm

Taking the next few days off. Will be back with week ahead commentary on July 6. Overview: The sharp jump in US long-term interest rates has helped lift the greenback in recent sessions and it remains firm against most of the G10 currencies today. The Canadian dollar is the best performer, and it is nearly flat. The intraday momentum indicators warn that after a mostly consolidative Asia Pacific and European morning, the greenback may probe...

Read More »

Read More »

Sigh of Relief Lifts French Markets, But…

Overview: The market feels a bit more at ease after the first round of the French elections that extreme policies will be avoided by an effort to deny the National Rally a legislative majority. French stocks have recouped some of their recent losses and the euro reached $1.0775, its best level since June 13. The yen remains soft after the Tankan survey showed little change but an uptick in capex plans. Outside of the yen and Swiss franc, the dollar...

Read More »

Read More »