Regardless of the dollar’s role and function in the world economy and the halls of finance, in the near and intermediate terms, investors and businesses are more concerned with foreign exchange prices. The greenback has fallen out of favor. Its main supports, like wide interest rate differentials, favorable growth differentials, and political certainty if not stability, have weakened. The pace accelerated from mid-June through the end of July. It seems to have entered a consolidative or corrective phase, perhaps aided by the stabilization of yields as participants make room for the quarterly refunding, and a surge in coupon issuance through October.

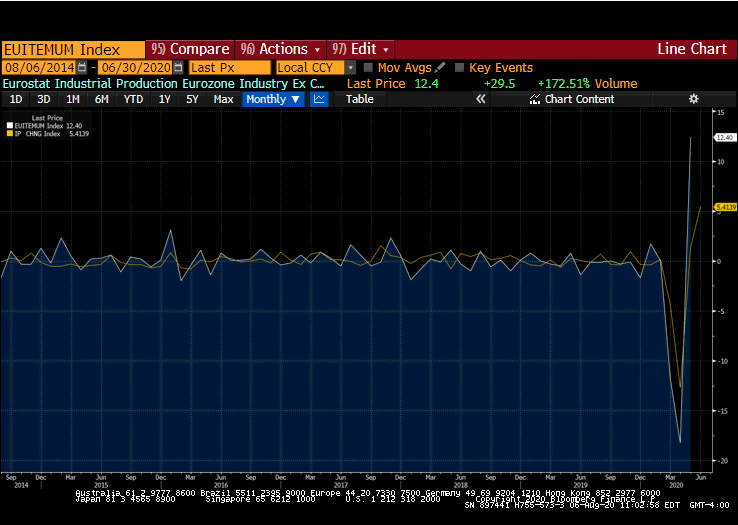

The upcoming US data features July CPI, retail sales, and industrial production figures. Taken as a whole, the data are likely to show that the US economic activity moderated from the pace seen in June. The July job figures showed a disturbingly low number of returning workers in manufacturing. The 26k increase paled in comparison to the median forecast for 255k and June’s 357k increase. Losses were reported in the production of computers and electronic goods, fabricated metals, and machinery. The auto sector, which has been a bit of an economic catalyst in Canada, and to a lesser extent, Mexico, as well as the US, saw another 39k workers return.

China reports yuan loans, aggregate financing, industrial production, fixed-asset investment, and surveyed unemployment. The takeaway is that the world’s second-largest economy is continuing to recover, but the pace has moderated. The PBOC is one of the few major central banks that has not engaged an asset purchase program, and it is moving to slow the rapid expansion of loans. Aggregate financing, which includes the formal banking system and the shadow banking sector, average CNY1.65 trillion a month in 2019, and more than doubled in Q1 to CNY3.7 trillion. In Q2 is slowed to CNY3.2 trillion and is likely to fall further in Q3, beginning with the July report.

Around the end of next week, senior US and Chinese officials will have a conference call to review Phase 1 of the trade deal, which seems a bit pretentious given that there is unlikely to be a Phase 2. It seems clear to everyone who looks at the data that China is so far behind its quantitative targets that it is nearly impossible for it to fulfill its obligations. China’s July trade figures, released before the weekend, showed imports from the US had fallen by 3.5% year-to-date. The question is what to do about it. Up until now, the mantra has been the trade agreement is on track (don’t believe your lying eyes). There is bound to be some headline risk around the review.

Ironically, President Trump’s confrontation with China was one of the few bipartisan developments over the last couple of years. Even if there were some tactical differences, Democrat leaders often applauded Trump’s strong stance. The Democrats’ criticism of the US policy toward China is that it is not sufficiently effective because the traditional allies have been cast aside or alienated.

The transformation and deterioration of the US-Sino relationship began when American leaders concluded that Xi’s era, for as long as it lasts, is a break from the Hu Jintao era (2002-2012) of “peaceful rise” or “peaceful development.” Xi goes against Deng Xiaoping’s instruction to “keep a low profile and never take the lead.” He wants to flex China’s muscles, sparred with India, clamped down on Hong Kong, and continues to harass Taiwan. At the same time, the US also has experienced its political center shifting in a more economic nationalist direction. The Democrat Party Platform on which Biden is running offers some variations on the common theme.

Some fraction of China’s “underperformance” is a function of a shift in prices. Crude oil prices are still off more than a quarter this year. The price of soy is off around 10%. Rather than focus on quantities, the US may have made a tactical error by focusing on dollar value. From a broader view, the push for a specific outcome is an abandonment of the traditional US approach of focusing on processes. It no longer sounds or acts like that confident country at the start of the 20th century that defended China’s territorial integrity against Europe and Japan’s attempts to carve up China into “concessions.”

The concession the US negotiated with China is only one of several fronts where national interests are clashing. Mobile apps have become part of the contested terrain. As we noted previously, India may have been the most aggressive is banning some Chinese apps. The US will ban TikTok and WeChat. Microsoft, who seems to the untrained eye to have a monopoly or oligopolistic control (operating systems), may be taking these monopoly rents to buy all or part of TikTok, a Chinese-based app platform of short video clips (less than a minute).

As hard as it may have been to secure in the first place, getting out of the Phase 1 trade agreement maybe even tricker. The proverbial can could be kicked down the road and double up next year’s efforts. The targets can be extended another year. New tariffs could be imposed to theoretically provide greater inducement to comply. Yet, at the coming review, it may serve both sides’ interests to say something that is innocuous and bland, like both sides remain committed to the agreement.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,EMU,Featured,newsletter,US