Category Archive: 4) FX Trends

FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act.

Read More »

Read More »

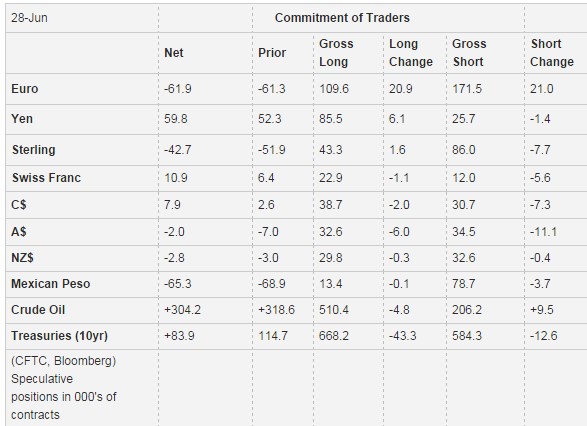

Weekly speculative Positions: Bulls and Bears Saw Speculative Opportunity in Euros

In the sessions before and after the UK referendum speculators in the currency futures did three things. First, they generally reduced exposure. This means gross longs and short positions were reduced. CHF long positions increased to 10K Speculators were divided about what to do with the euro.

Read More »

Read More »

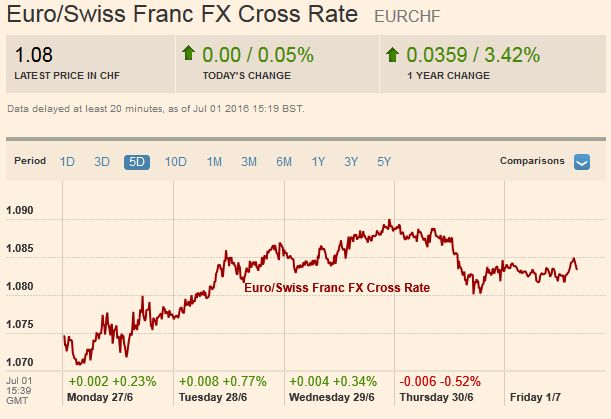

FX Weekly Review: June 27 – July 01: Swiss Franc Strength Reversed

Week after Brexit.: The Swiss franc (-0.3%) and the yen (-0.5%) were the worst performers, as so-called safe haven buying was reversed.

But the Swiss Franc index is still stronger in the last month than the dollar index.

Read More »

Read More »

Why the Fed Will Talk Down the Dollar

And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by virtue of the “peg”) strengthens the Chinese Yuan and the Saudi Riyal… something neither country will tolerate.

Read More »

Read More »

Forex technical analysis: USDJPY finishes a fairly quiet week near 100 hour MA

The USDJPY is finishing the trading week near the 100 hour MA at 102.56. The pair spent the last two trading days mostly between the 100 hour and 200 hour MAs. Those levels will define the close range in trading in the early week. Look for the break and run.

Read More »

Read More »

EURUSD ends the week on a soft note. What’s in store for next week?

The EURUSD has moved a little lower in the last few hours of trading – holding against the 200 hour MA in the process. The 50% retracement level held earlier today. So the pair has a bit of a negative bias heading into the weekend For trading next week, the pair will be looking toward … Continue...

Read More »

Read More »

FX Daily, July 01: Markets Head Quietly into the Weekend

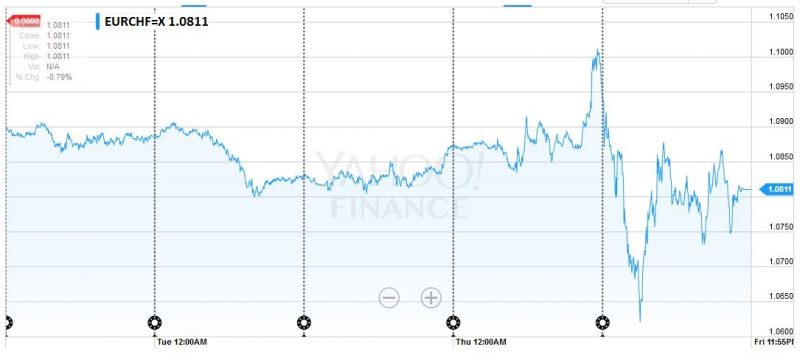

EUR/CHF finished the week after Brexit with slight improvement of 0.18%. The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney's comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08.

Read More »

Read More »

FX Daily, June 30: Calm Continues, but Rot Below the Surface

During the week the Swiss Franc lost momentum. It could regain speed only on June 30, after BoJ Carney's speech.

Read More »

Read More »

Great Graphic: What are UK Equities Doing?

Domestic-oriented UK companies have been marked down. The outperformance by UK's global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy.

Read More »

Read More »

FX Daily, June 29: Fragile Calm Ahead of Quarter-End

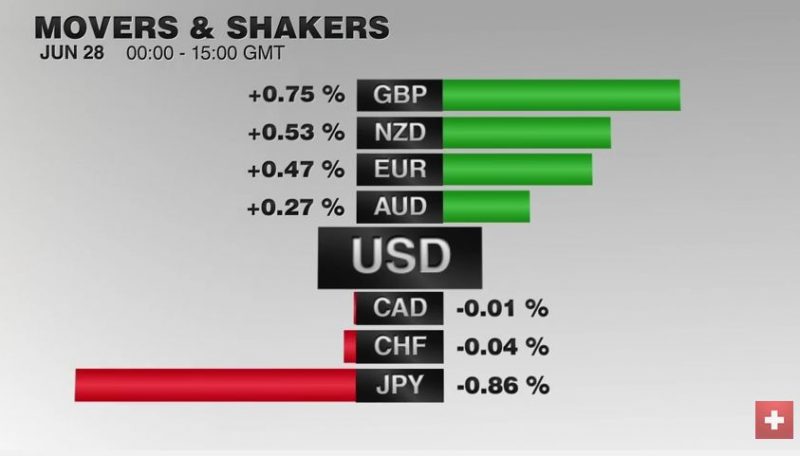

Sterling is firmer, but quarter-end considerations seem to be the key driver. Poor Japanese retail sales keep focus on policy response likely next month. New Zealand and Australian dollars are leading today's advance against the US dollar.

Read More »

Read More »

The Worst is Yet to Come–Don’t be Seduced by the Price Action

The two-day bounce in sterling seems technically driven rather than fundamental. The Brexit decision has set off a unfathomable chain of events whose impact and implications are far from clear. The economic hit on the UK may spur a BOE rate cut, even if not QE, as early as next month.

Read More »

Read More »

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

How Exceptional are Conditions?

If conditions are exceptional, isn't BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe.

Read More »

Read More »

Great Graphic: Sterling Monthly Chart and Outlook

Sterling's losses are not simply a product of thin liquidity or panic. Both main political parties are in disarray just when strong leadership is needed. The rough projection pre-vote of what could happen on Brexit suggests $1.20-$!.2750.

Read More »

Read More »

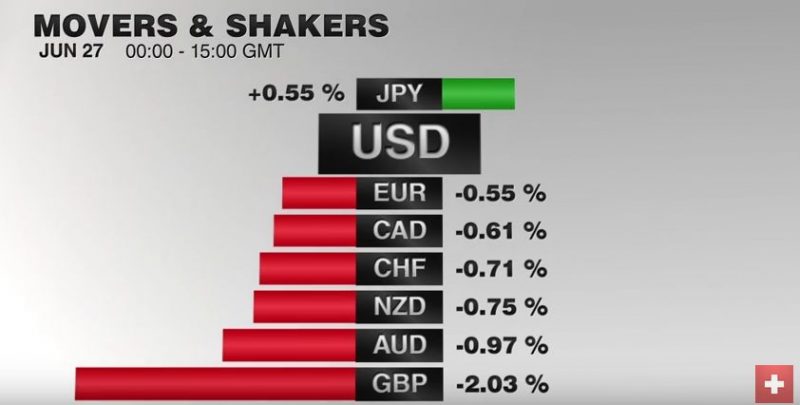

FX Daily, June 27: Post-Referendum Confusion Continues

Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to medium-term negative economic implications.

Read More »

Read More »

UK Seeks Divorce, Rajoy Needs a Shotgun Marriage

Center-right PP won the Spanish election. Anti-EU forces were setback. Rajoy needs a coalition partner.

Read More »

Read More »

FX Weekly Preview: Post-Brexit: Week One

The EU response to Brexit is important. The EU summit and the talks with Turkey are very important. Brexit leaders seem as surprised and unprepared for the results as anyone. And a preview on economic data for the week.

Read More »

Read More »

Cool Video: Early Thoughts on Brexit Implications with FT’s John Authers

The Financial Times' John Authers visited me at Brown Brothers Harriman to discuss the initial implications. The situation is very fluid and there are many moving pieces. In Chinese, the characters for crisis are "danger" and "opportunity."

Read More »

Read More »

Weekly Speculative Positions: Speculators Cut Currency Exposure ahead of FOMC, BOJ, and Brexit

The CFTC reporting week ending June 21 covers the day FOMC and BOJ meetings and ends two days before the UK referendum. The overarching theme was the reduction of exposure. This is not measured by net positions but by gross positions. Of the eight currencies we track, six saw a reduction of gross long positions and a six saw a reduction in the gross short positions.

Read More »

Read More »

FX Weekly Review: June 20 – June 24: Dollar Appreciates with Brexit

The dramatic reaction to the UK decision to leave the European Union has changed the technical condition in the foreign exchange market. The EUR/CHF peaked shortly before the Brexit referendum, when traders were anticipating a yes. It found its trough when the No was published. Then the SNB intervened.

Read More »

Read More »