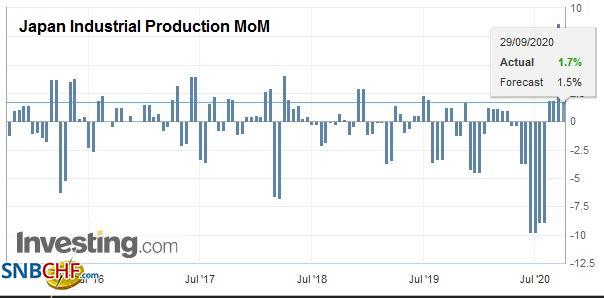

Swiss FrancThe Euro has risen by 0.05% to 1.0798 |

EUR/CHF and USD/CHF, September 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Quarter and month-end considerations could be overwhelming other factors today. Turnaround Tuesday saw early gains in US equities fade. Asia Pacific shares were mixed, with the Nikkei (-1.5%) and Australia (-2.3%) bear the brunt of the selling, while China, Hong Kong, Taiwan, and India rose. Europe’s Dow Jones Stoxx 600 is lower for a second day, but unlike yesterday, energy and financials are among the strongest sectors. US shares are extended yesterday’s losses, and the S&P 500 is off around 0.75%. Some link the selling to the US presidential debate, which did not showcase the rhetorical acumen of the candidates, and unlikely swayed many voters. The dollar is first against most of the major currencies after slipping the past two sessions. Emerging market currencies are mixed. The freely accessible Russian rouble, the Mexican peso, and Turkish lira are leading the advancers, while the eastern and central European currencies are laggards. Gold, which posted a key upside reversal on Monday and saw follow-through buying yesterday, stalled near $1900 and is testing support near $1880. November light sweet crude oil, which had been hovering around $40, is now straddling $39. |

FX Performance, September 30 |

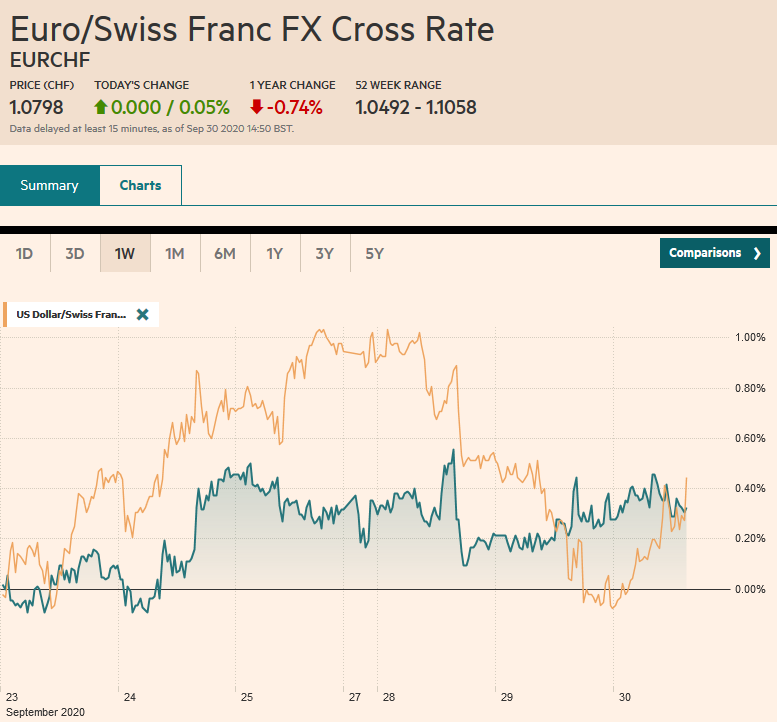

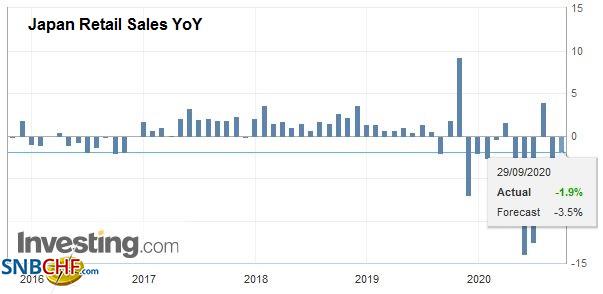

Asia PacificJapan’s economic reports also surprised to the upside. Industrial output rose by 1.7% in August instead of the 1.4%, the median forecast in the Bloomberg survey anticipated. It is the third consecutive rise. It follows August’s 8.7% increase and 1.9% in July. Retail sales jumped 4.6% in September, more than twice that economists forecast after a revised 3.4% decline (from -3.3%) in August. |

Japan Retail Sales YoY, August 2020(see more posts on Japan Retail Sales, ) Source: investing.com - Click to enlarge |

| Separately, Japan reported a small decrease than anticipated in August housing starts year-over-year. As a whole, the data confirms that the world’s third-largest economy expanded in Q3 for the first time since Q3 2019. Economists see growth around 15% at an annualized pace before slowing to 5% in the final quarter, which incidentally is the same as is anticipated for the US economy. |

Japan Industrial Production MoM, August 2020(see more posts on Japan Industrial Production, ) |

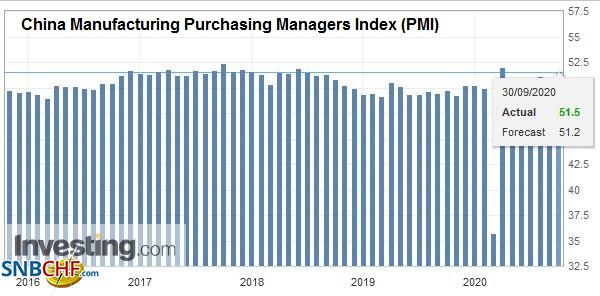

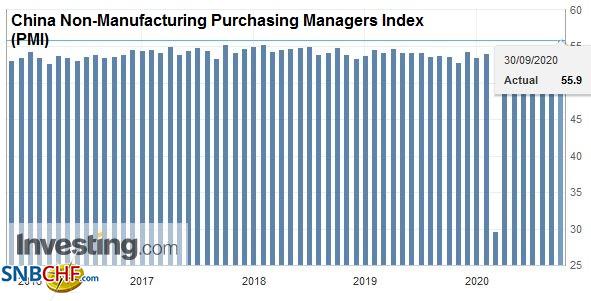

| China’s economic recovery is on track. The official September PMI composite rose to a new high of 55.1 from 54.5. It finished last year at 53.4. The manufacturing PMI edged up to 51.5 from 51.0, a little stronger than expected. |

China Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on China Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The non-manufacturing surprised many who had projected a decline. Instead, it rose to 55.9 from 55.2. |

China Non-Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on China Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| The Caixin manufacturing PMI, which puts more weight on small and medium-sized businesses, slipped to 53.0 from 53.1. |

China Caixin Manufacturing Purchasing Managers Index (PMI), September 2020(see more posts on China Caixin Manufacturing PMI, ) Source: investing.com - Click to enlarge |

The US dollar made a marginal new two-week high near JPY105.80. Position-adjusting in Asia saw the greenback retreat to about JPY105.45, where new bids were found. A downtrend line intersects near JPY106.00. The intraday technical indicators suggest the path of least resistance may be lower for the greenback in early North American activity. The Australian dollar saw a five-day high near $0.7150 before turning lower. The $0.7160 area presents a (38.2%) retracement of this month’s decline. A break of $0.7100 signals a return to the $0.7060-$0.7080 area. The PBOC’s dollar fix was slightly lower than anticipated at CNY6.8101. Chinese money market rates and bond yields are firm as the Golden Week holiday begins. As we have noted, the yuan’s 3.7% appreciation this quarter is its best performance in over a decade. Still, it has hardly satisfied the critics who see the trade surplus as evidence of an undervalued currency.

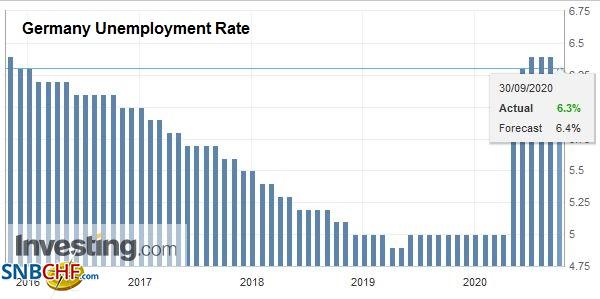

EuropeFollowing Germany and Spain yesterday, Italy and France have also reported lower than expected HICP September inflation readings. France’s came in at -0.6% instead of -0.4%, which pushes the year-over-year rate to zero from 0.2%. Italian prices rose 1.0% on the month, but the year-over-year pace slumped to -0.9% from -0.5%. The centrists and doves at the ECB see the inflation undershoot as part of the argument to extend its bond-buying operations. |

Germany Unemployment Rate, September 2020(see more posts on Germany Unemployment Rate, ) Source: investing.com - Click to enlarge |

The EU reportedly has rebuffed the UK’s latest move to redraw its state-aid plans. The negotiations have not proceeded very far this week, the last formal round of talks. Still, the EU summit is a couple of weeks away, and neither side has given up. Yet, the risks of a significant disruption of trade have grown.

The WTO concluded that the US did improperly aid Boeing and that Europe can put a levy on $4 bln of US goods. The EU asked for $12 bln. The WTO finding for Europe is not a surprise, but its scope for retaliatory action was less than the US got for the improper subsidies of Airbus ($7.5 bln). Still, the lingering hope is that the WTO decision will help facilitate a settlement.

The euro approached the (38.2%) retracement of this month’s decline (~$1.1765) and was turned back, and briefly dipped below $1.17 in the European morning, following the disappointing CPI reports. Yesterday’s nearly 0.65% gain was the largest of the month, but today the pressure is on the downside. Initial support is seen near $1.1680, and a break could target $1.1640 today. Sterling is still in Monday’s range (~$1.2745-$1.2930) but is trading heavily and testing $1.28 in Europe. Support is seen at the lower end of Monday’s range.

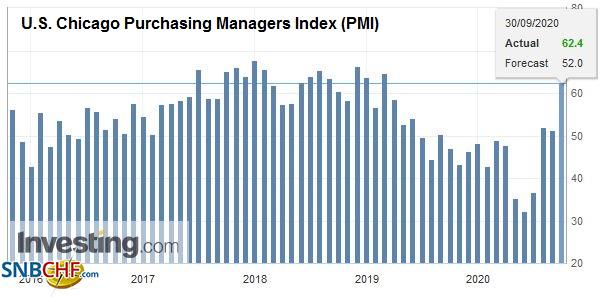

AmericaOpinion polls show a near-record low number of undecided voters and a low number who anticipated that yesterday’s debate could sway them. The debate, if it can be called that was painful to watch, did not put either candidate in the best light. The opinion polls have been very steady, and yesterday’s event, the first of three, is unlikely to change the standings by much. The data focus today is the ADP private-sector jobs estimate. Although it has not been particularly helpful in forecasting the non-farm payroll report, some economists may still fine-tune their forecasts. For the record, the Bloomberg survey found a median forecast for an increase of about 650k jobs after 428k in August. Another look at Q2 GDP is too historical to matter for market participants, and the MNI Chicago PMI used to be more helpful before Markit began reporting a preliminary national PMI. Canada reports the July monthly GDP. A 2.9% expansion is expected after June’s 6.5%. Still, here too, the data is too old to matter much. |

U.S. Chicago Purchasing Managers Index (PMI), September 2020(see more posts on U.S. Chicago PMI, ) Source: investing.com - Click to enlarge |

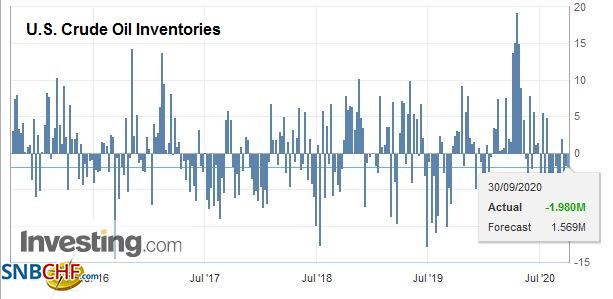

| Oil prices skidded lower, with both Brent and WTI falling to two-week lows. The energy sector was the biggest drag yesterday on the Dow Jones Stoxx 600 and the S&P 500. The unsuccessful conclusion of the latest attempt to reach a deal for additional stimulus in the US faltered, aggravating demand concerns expressed in recent industry forecasts. Among other things, Covid has disrupted the demand for diesel, and the surplus is prompting some US refiners to reduce capacity. It is distorting India’s energy sector, which is now is importing gasoline. November WTI briefly traded below $38.55, the (61.8%) retracement of the rally from the September 8 low around $36.60. New social restrictions in Europe and possibly parts of the US weigh on sentiment, and the passing of the Kuwaiti Emir did nothing to deter the pessimism. Bloomberg reported that Russia boosted crude and condensate output this month. On the other hand, the early signals suggest that Saudi Arabia may boost its official selling price to Asia by around 20 cents a barrel in November, a decision usually made early in the proceeding month. API estimated that distillate stocks fell sharply while crude inventories fell by 830k barrels. |

U.S. Crude Oil Inventories, September 30, 2020(see more posts on U.S. Crude Oil Inventories, ) Source: investing.com - Click to enlarge |

The US remains stuck in a CAD1.3325-CAD1.3420 range that has prevailed for a week. Position-adjusting pressures and weak impulses from the equity market warns of the risk of a range extension to the upside. There is scope for a marginal new high in the CAD1.3450-CAD1.3460 area. Similarly, the greenback is rangebound against the Mexican peso (~MXN22.00-MXN22.70). The dollar is offered in the European morning against the peso, but we suspect the risk is on the upside here at month/quarter-end and given limited risk appetites today.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,CPI,Currency Movement,Featured,newsletter,OIL,WTO