Tag Archive: WTO

Subdued Ending to a Quiet Week, Ahead of Next Week’s Fireworks

Overview: Leaving aside the Australian dollar, which

is benefiting from the optimism over China's re-opening and a reassessment of

the trajectory of monetary policy after a stronger than expected inflation

report, the other G10 currencies traded quietly this week and are +/- less than

0.5%. The risk-on honeymoon to start the year remains intact. The MSCI Asia

Pacific Index has risen every day this week and index of mainland shares that

trade in...

Read More »

Read More »

A Real Example Of Price Imbalance

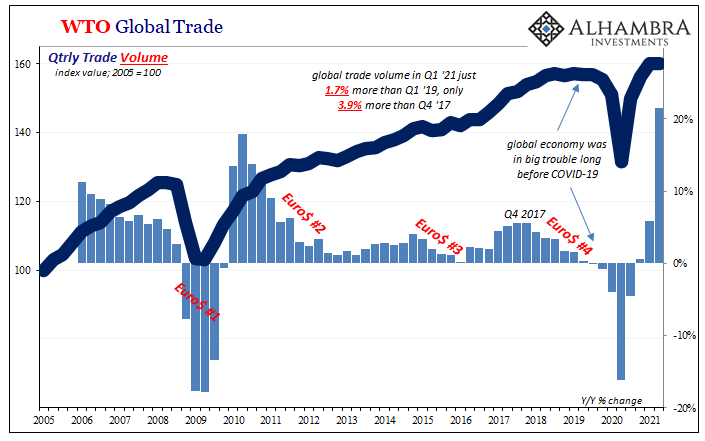

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

FX Daily, February 23: Dramatic Market Adjustment Continues

Overview: Rising rates continue to spur a rotation and retreat in stocks. Yesterday the NASDAQ sold-off by nearly 2.5% while the Dow Industrials eked out a minor gain. Equities are mostly higher in the Asia Pacific region while Japanese markets were on holiday.

Read More »

Read More »

FX Daily, February 16: Greenback Remains Heavy

The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today, the Dow Jones Stoxx 600 is consolidating.

Read More »

Read More »

FX Daily, October 14: UK Blinks on Threat to Walk Away on Eve of EU Summit

Overview: Turn around Tuesday saw the dollar bounce, particularly against the Australian dollar and European currencies, among the majors. Sterling pared earlier losses on reports that the UK would not walk away from the talks just yet, while the euro remains on its back foot.

Read More »

Read More »

FX Daily, September 30: Nervous Calm

Quarter and month-end considerations could be overwhelming other factors today. Turnaround Tuesday saw early gains in US equities fade. Asia Pacific shares were mixed, with the Nikkei (-1.5%) and Australia (-2.3%) bear the brunt of the selling, while China, Hong Kong, Taiwan, and India rose.

Read More »

Read More »

FX Daily, September 16: Dollar Eases Ahead of the FOMC

Overview: The dollar has been sold against nearly all the world's currencies ahead of what is expected to be a dovish Federal Reserve, even if no fresh action is taken. The Scandis and Antipodean currencies are leading the majors.

Read More »

Read More »

The Real Diseased Body

Another day, another new Federal Reserve “bailout.” As these things go by, quickly, the details become less important. What is the central bank doing today? Does it really matter?For me, twice was enough. All the way back in 2010 I had expected other people to react as I did to QE2. If you have to do it twice, it doesn’t work.

Read More »

Read More »

FX Daily, December 19: Whiff of Inflation in the Air

It is risky to read too much into the price action in holiday-thin markets, but inflation fears are beginning to surface. The price of January WTI is around $61, having tested $50 a barrel in Q3. The CRB Index made new highs for the year yesterday and is up almost 9% for the year. The US yield curve (2-10 year) has been steepening after being inverted for a few days in August, and now at nearly 29 bp, also is new highs for the year.

Read More »

Read More »

FX Daily, December 10: Capital Markets: Still Seems to be the Calm before the Storm

Overview: Equities are trading lower, and bonds are mixed as the FOMC, UK election, and the US decision on the December 15 tariffs draw near. The MSCI Asia Pacific Index three-day rally ended today as only China and South Korea's markets rose. Europe's Dow Jones Stoxx 600 gapped slightly lower at the open.

Read More »

Read More »

FX Weekly Preview: Synchonized Emergence from Soft Patch?

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone.

Read More »

Read More »

The Big Picture Doesn’t Include ‘Trade Wars’

The WTO today downgraded its estimates for global trade growth. In April, the international organization had figured the total volume of world merchandise trade would expand by about 2.6% in all of 2019 once the year closed out on the anticipated second half rebound. Everyone took their lumps in H1 and the WTO like central bankers everywhere were thinking “transitory” factors.

Read More »

Read More »

FX Daily, July 2: Post-G20 Euphoria Fades, Stuck with Same Reality

Overview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday's surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over one percent, and the Hong Kong Dollar strengthened beyond its band midpoint for the first time in nine months.

Read More »

Read More »

The Direction Is (Globally) Clear

It is definitely one period that they got wrong. Still, IHS Markit’s Composite PMI for the US economy has been one of the better forward-looking indicators around. Tying to real GDP, this blend of manufacturing and services sentiment has predicted the general economic trend in the United States pretty closely. The latter half of 2015 was the big exception.

Read More »

Read More »

Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought.

Read More »

Read More »

FX Daily, December 18: Trade Tensions with China Set to Escalate

The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure initiative is likely to be unveiled as early as next month. Before that, the US is poised to ratchet up the tension on China.

Read More »

Read More »

Rising Trade Tensions

Obama Administration has taken a hardline against China's trade practices. Other countries are also resisting China's arguments that it is a market economy. Last week, US imposed anti-dumping duties on imported washing machines from China.

Read More »

Read More »