Swiss FrancThe euro is lower at 1.0848 (-0.12%). |

EUR/CHF - Euro Swiss Franc, June 22(see more posts on EUR/CHF, ) |

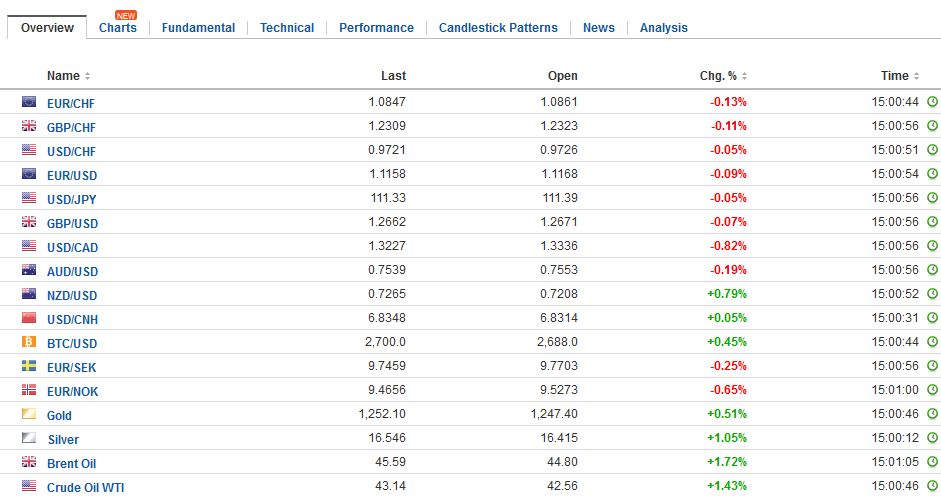

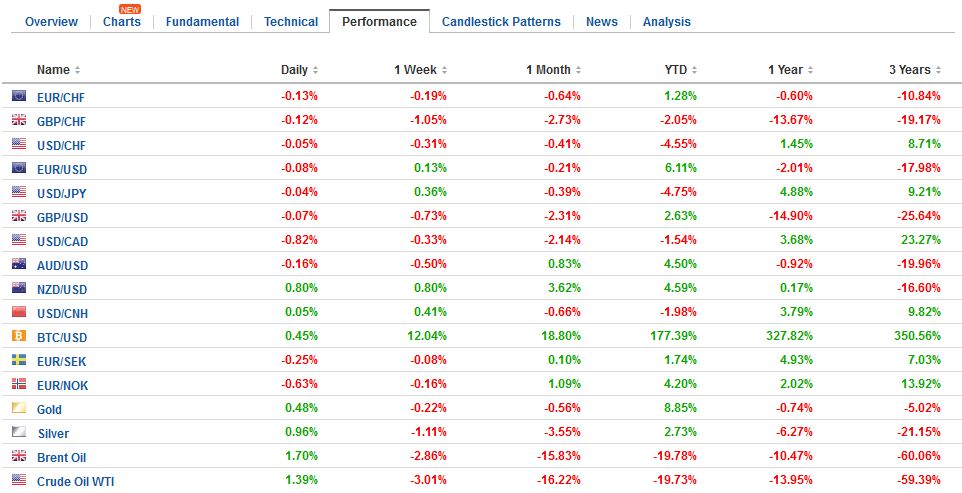

FX RatesThe summer doldrums begin early. The US dollar is little changed against most of the major currencies. Bond yields are mostly one-two basis points lower, and equity markets are mixed but with a downside bias. Oil prices slump more than 2% on Tuesday and again on Wednesday. This is weighing on bond yields and equities. European shares are lower for the third day and the Dow Jones Stoxx 600, off 0.5%, is dragged by a 1.5% drop in the energy sector. The MSCI Asia Pacific Index rose nearly 0.4% as the other markets offset the losses in Japan and China. The Nikkei slipped 0.15%, with a 0.75% drop in energy. The Shanghai Composite surrendered half of the gains scored yesterday, ostensibly in response to the MSCI decision to include A-shares for the first time in its emerging market equity index beginning near the middle of next year. The central banks of New Zealand and Noway left rates on hold, as did the couple of Asian central banks that met. That leaves Mexico still on tap. With firm price pressures, the market is looking for the central bank to deliver a 25 bp rate hike, which would be the seventh consecutive meeting it would hike. The Mexican peso remains the world’s strongest currency this year, gaining a little more than 14% against the US dollar (the Polish zloty in second place with a 10.4% gain). Since the end of June 2016, the peso is practically flat (+0.7%). It has been a round trip, but the price pressures from the past depreciation are proving sticky. |

FX Daily Rates, June 22 |

| Notable option expiries today include 1.5 bln euros at $1.1175, 1.1 bln euros at $1.12, and 1.5 bln euros at $1.1250. There is $2 bln struck at JPY111.00, and another nearly $400 mln struck at JPY110.95 that roll off today. Almost GBP375 mln options with a $1.27 strike are on the bubble.

Federal Reserve Governor Powell speaks before the Senate Banking Committee shortly after the US equity market opens. Powell is the only Republican-appointed Governor. One cannot tell that by his voting pattern. This is important to keep in mind as in the coming weeks, nominations for the vacant three Governor seats are expected. We are struck by the technocrat and collegiate culture. Think about more than three- decade tradition of the Chair being named by the president from one party and re-nominated by the president of the other party (Volcker, Greenspan, Bernanke). This is not to argue for rigid institutional inertia, but rather suggest the difficulty, for example, in trying to set monetary policy driven by a set of decision-making rules, like the Taylor Rule. It also suggests that being in favor or high or low interest rates is a misleading abstraction. The views must be understood within the context of economic and financial conditions. Hawks and doves are contextual and relative categories. |

FX Performance, June 22 |

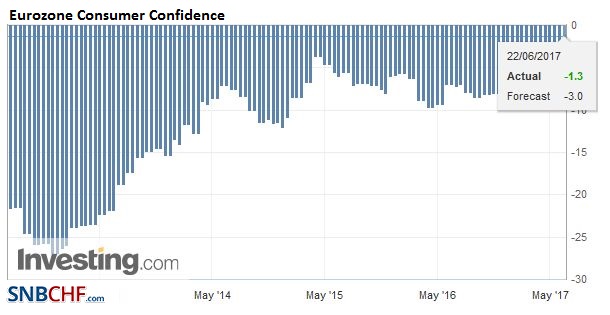

Eurozone |

Eurozone Consumer Confidence, June (flash) 2017(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

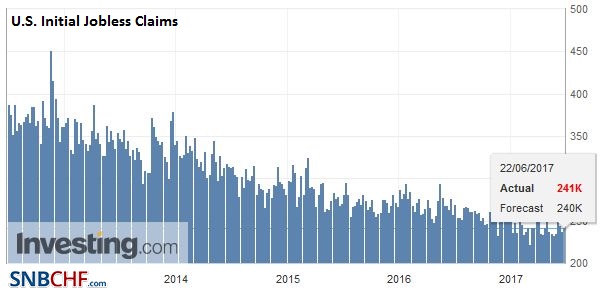

United StatesFresh market moving news remains light. The US and Canada report data that provide some headline risk. The US reports weekly initial jobless claims that cover the week that the national non-farmpayrolls survey is conducted. As of last week, weekly jobless claims were at three-week lows. Contrary to claims in some quarters that the US is headed or already in a recession, the Leading Economic Indicators. There is no sign that it is signaling anything like a recession. The monthly reading was negative three times last year. The last one being in August. The LEI rose on average 0.2 each month in 2016. It is averaging 0.4% this year. |

U.S. Initial Jobless Claims, May 2017(see more posts on U.S. Initial Jobless Claims, ) Source: Investing.com - Click to enlarge |

Switzerland |

Switzerland Trade Balance, May 2017(see more posts on Switzerland Trade Balance, ) Source: Investing.com - Click to enlarge |

Canada

Canada reports April retail sales. The headline is unlikely to repeat the 0.7% gain in March. Auto sales will likely drag it lower. The higher gasoline prices may boost the ex-auto figure, but the volume of retail sales may have fallen. The Canadian dollar has pared half of the gains scored in the wake of the more hawkish talk from senior BoC officials. US dollar sellers have emerged in front of that retracement near CAD1.3350. Support is pegged near CAD1.3380. Tomorrow, Canada reports May CPI figures and the headline rate is expected to ease.

United Kingdom

Things are about to get tougher for UK Prime Minister May, who is carrying on as if the Tories still enjoyed a majority. The DUP is reportedly seeking an increase of about GBP2 bln in government spending on infrastructure and National Health Service for their support of a minority government (which means no ministerial portfolios for DUP MPs). The Tories themselves seem to be jockeying for position behind the scenes to succeed May. Depending on which report you read, Hammond, Davis, and/or Johnson are quietly maneuvering, not wanting to seem too eager. Meanwhile, Labour and the Lib Dems are reportedly considering the more than 70-year old convention that the House of Lords refrains from blocking or significantly amending laws that implement the governing party’s manifesto. How can the Tory’s manifesto now have the same gravitas as then the Tory’s had a majority?

In addition to this fluid, yet fractured, political situation, we seemed to learn yesterday that the BOE Governor and chief economist are odds about the outlook for the UK economy, and the urgency by which the accommodation provided last summer should be removed. Haldane suggested he nearly voted for a hike last week. That would have made it a four-four tie. The odds of a rate hike before the end of the year has risen but does not appear to be the most likely scenario (still below 40%, interpolating from the OIS). UK high frequency data in the run up to the next BOE meeting, which is in August, may have more impact in the market than is usually the case.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$JPY,EUR/CHF,Eurozone Consumer Confidence,Federal Reserve,FX Daily,MXN,newslettersent,Switzerland Trade Balance,U.K.,U.S. Initial Jobless Claims