Recent figures show an annual 4.2% rise in the number of vacant homes in Switzerland, extending a trend that started 10 years ago, according to the Federal Statistical Office. At the start of June 2019, there were 75,323 vacant homes, representing 1.66% of Switzerland’s total stock of homes.

Read More »

Tag Archive: Swiss real estate

Swiss real estate risk falls two quarters in a row, says UBS

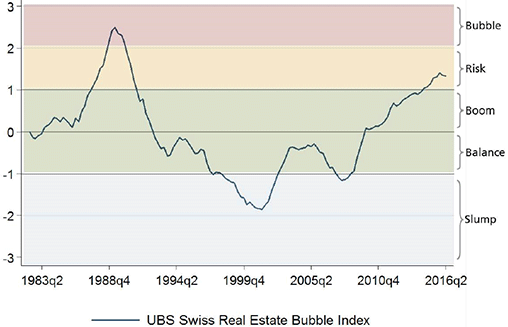

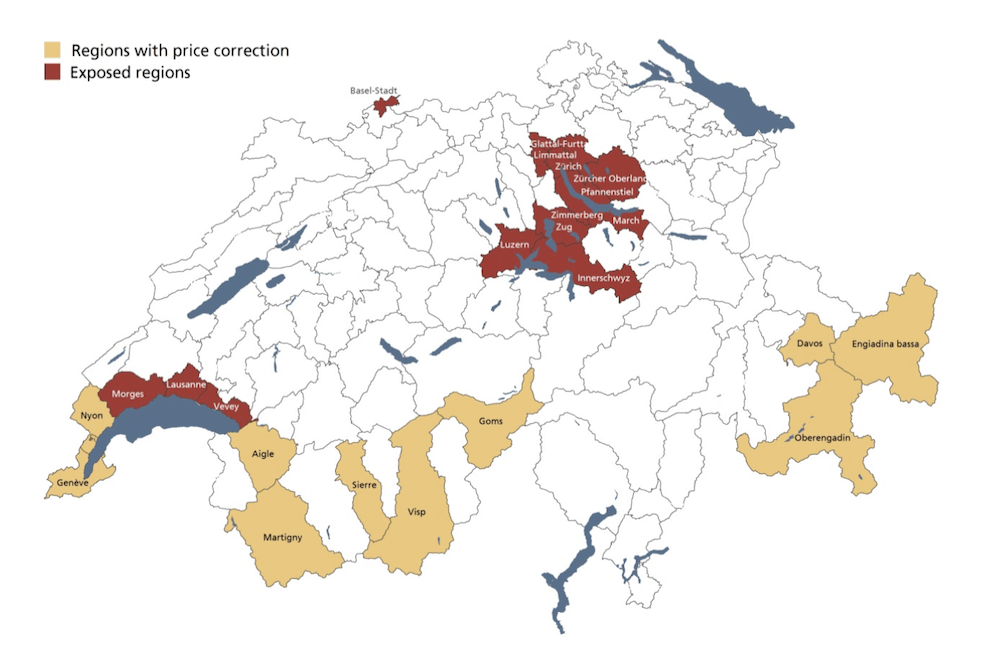

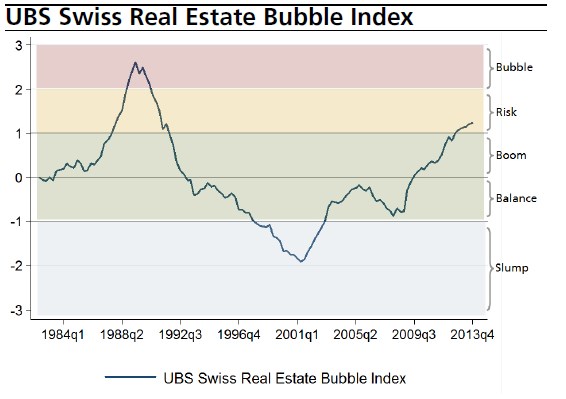

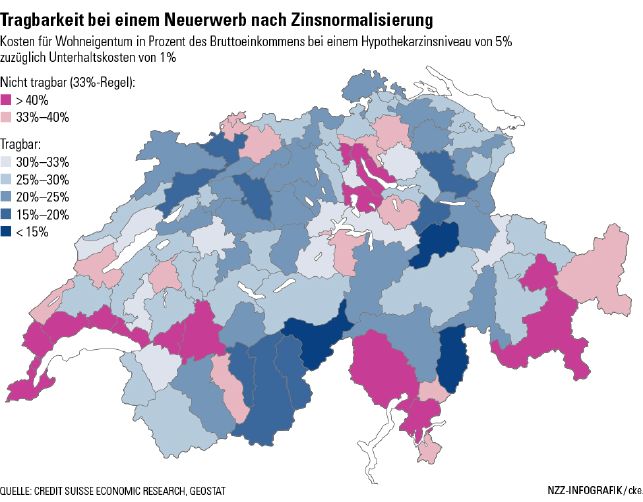

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction.

Read More »

Read More »

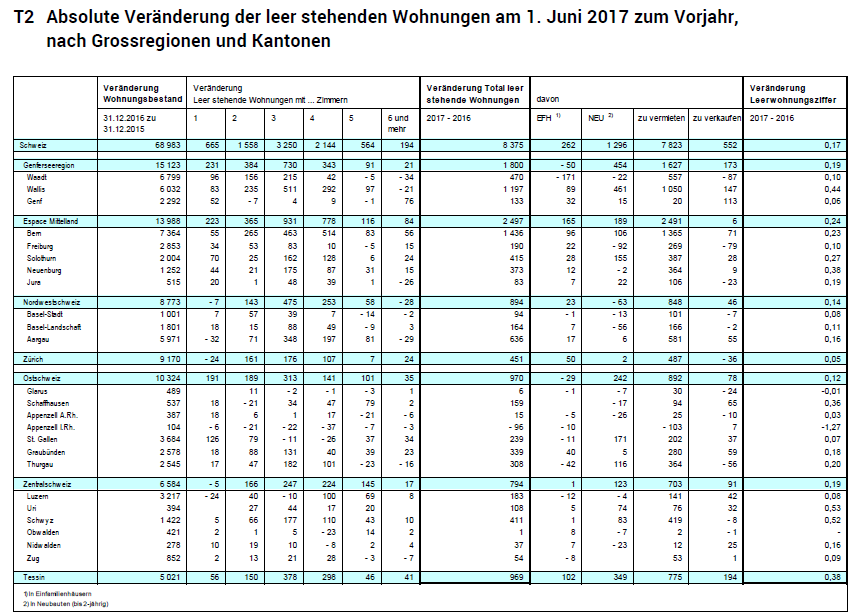

Swiss Real Estate: The Empty Dwellings Rate Continues to Increase

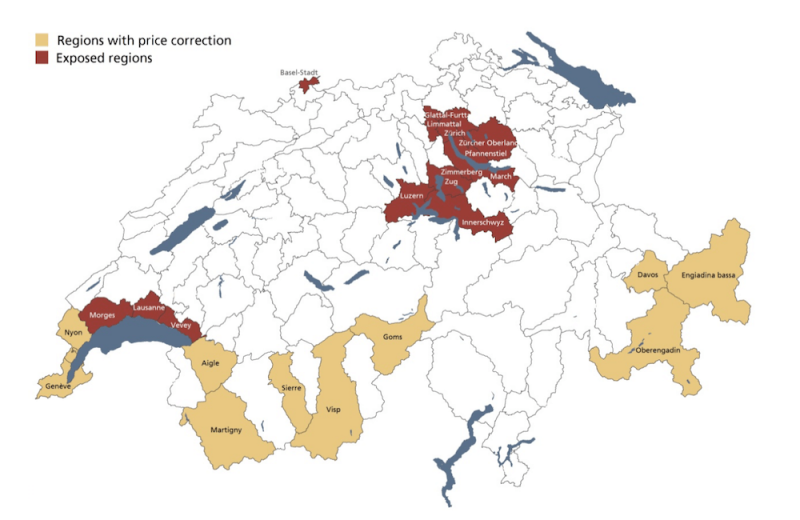

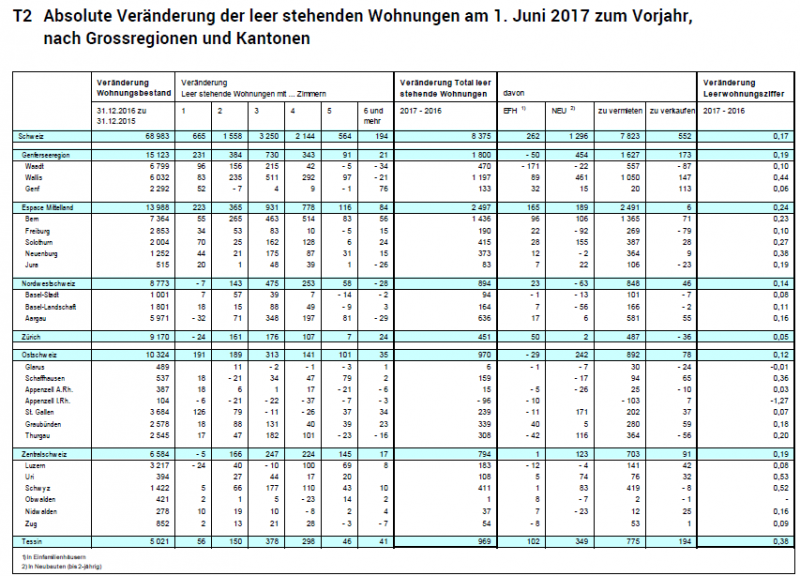

On 1 June 2017, there were 64'893 empty dwellings in Switzerland, i.e. 1.47% of the entire country's dwelling stock (including single-family houses). This figure represents an increase of 8375 empty dwellings compared with the previous year, i.e. a rise of almost 15%.

Read More »

Read More »

Swiss home vacancy rate climbs to 15-year high

Switzerland has around 4.4 million homes. In 2000, 52,608 (1.49%) of them were vacant. By 2003, this number had dropped to 33,039, a vacancy rate of 0.91%. After fluctuating between this level and 1.07%, the rate started to climb in 2014 to its current rate of 1.30%, its highest level in 15 years.

Read More »

Read More »

Swiss Real Estate Bubble Index 2Q 2016 continues falling, Still in Risk Zone

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates.

Read More »

Read More »

Purchasing Power Parity, REER: Swiss Franc Overvalued?

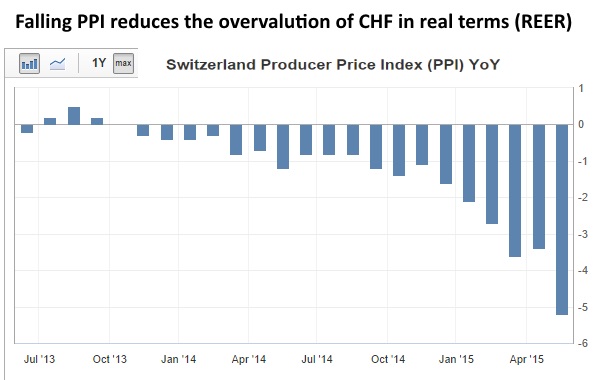

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

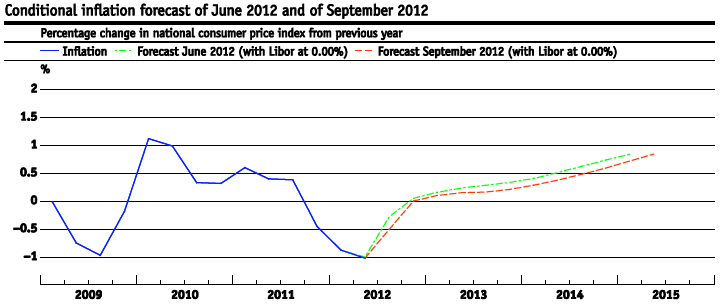

SNB Monetary Policy Assessment and Critique

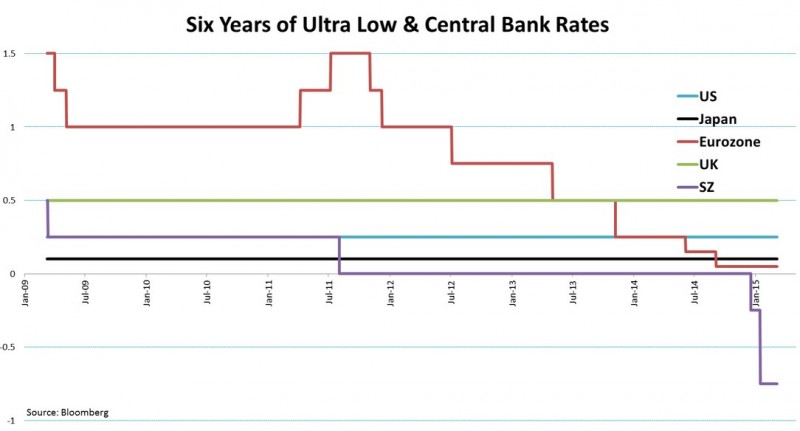

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

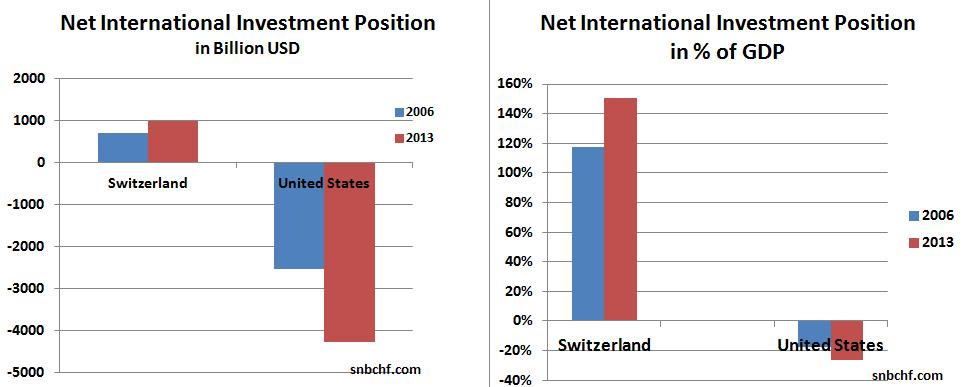

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

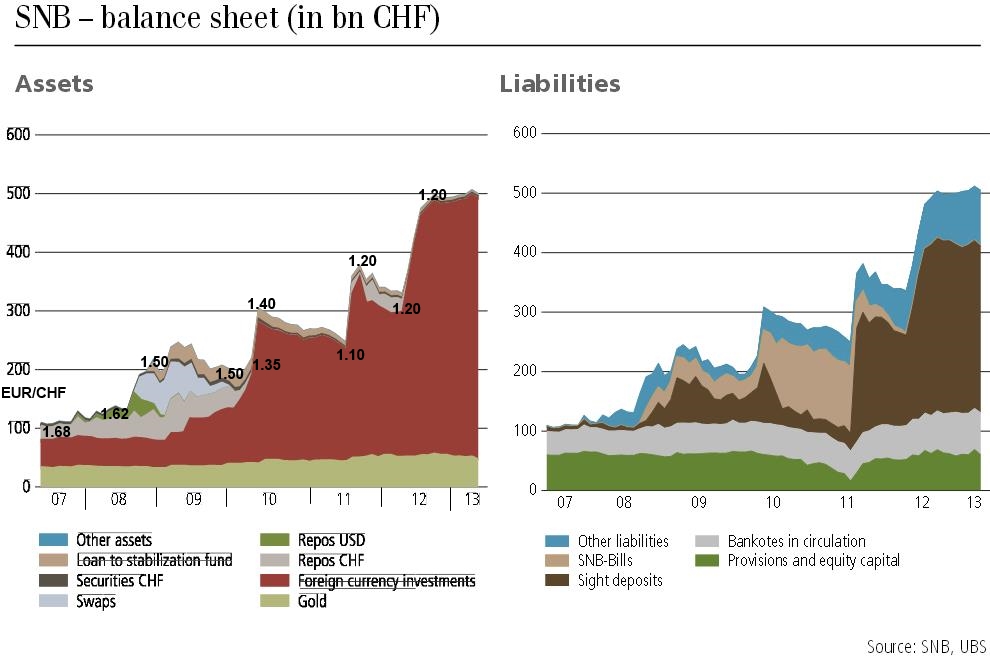

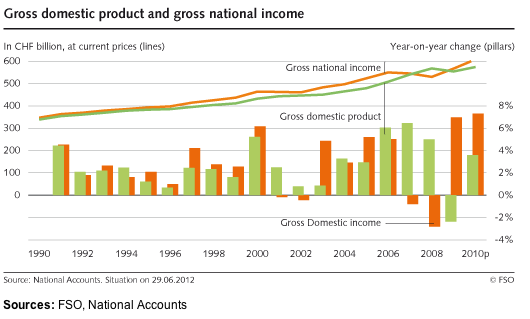

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

What Caused The Swiss Financial Tsunami? Three Reasons, One Trigger, One Chain Reaction

In this post we give our (Swiss) view for the financial tsunami on January 15.

The SNB has preferred its secondary mandate, namely financial stability, and the elimination of risks on its own balance sheet caused by ECB QE.

It will not obey its primary target, price inflation, for the next three to five years. While in the mid-term (5 -10 years) inflation should move up.

Differing perceptions between Switzerland and the Anglophone world about...

Read More »

Read More »

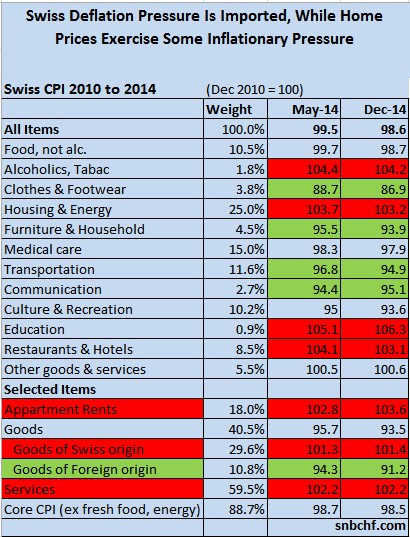

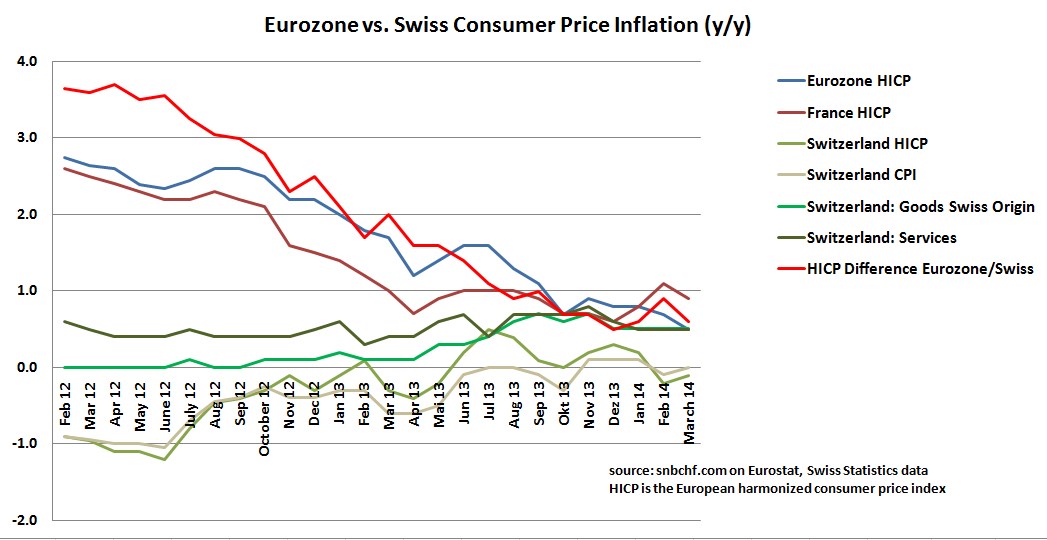

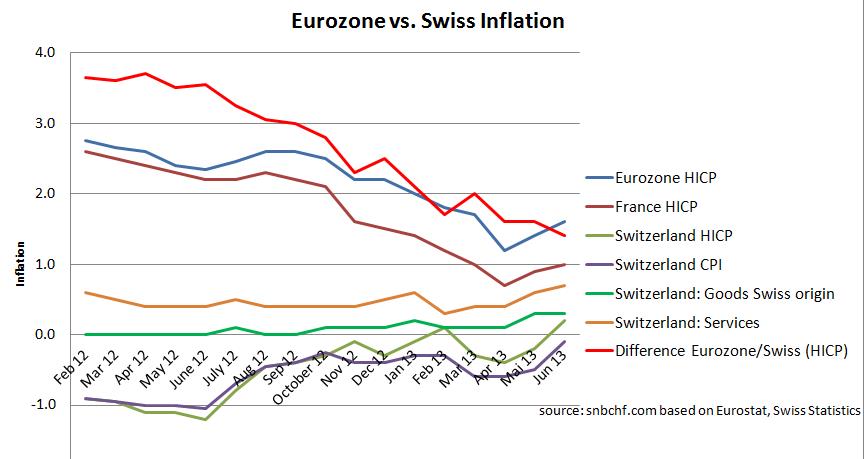

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

December 2014: SNB Introduces Negative Rates, a Toothless Measure?

The Swiss National Bank has introduced negative interest rates. They apply only to sight deposits in excess of 20 times minimum reserves. Therefore they will affect hardly any bank and can be considered symbolic or even toothless. The view of the SNB is different.

Read More »

Read More »

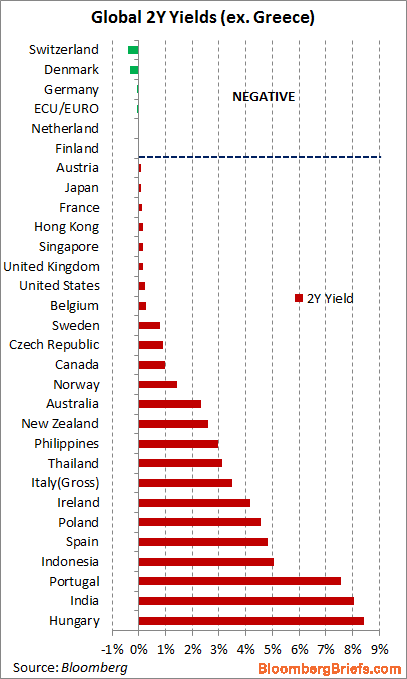

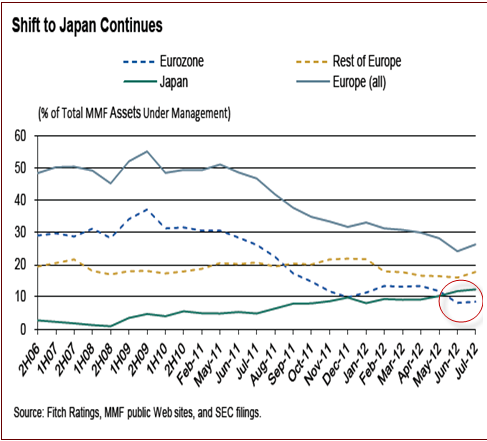

Negative and Close to Zero Yields of Government Bonds and the Reasons

We judge that negative or close to zero yielding government bonds reflect three points: Risk off environment, long-run currency gains on currency with low inflation, insufficient supply of government bonds for bank refinancing purposes.

Read More »

Read More »

History of SNB Interventions

High inflows of around 400 billion francs between 2009 and 2012 in the Swiss balance of payments could only be countered with an increase in reserve assets and interventions by the Swiss National Bank. This number is far higher than the one seen during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF). We look at the detailed history of...

Read More »

Read More »

Peter Schiff’s Message to Switzerland: Preserve Your Wealth, Gold is Better than Pegging to the Euro

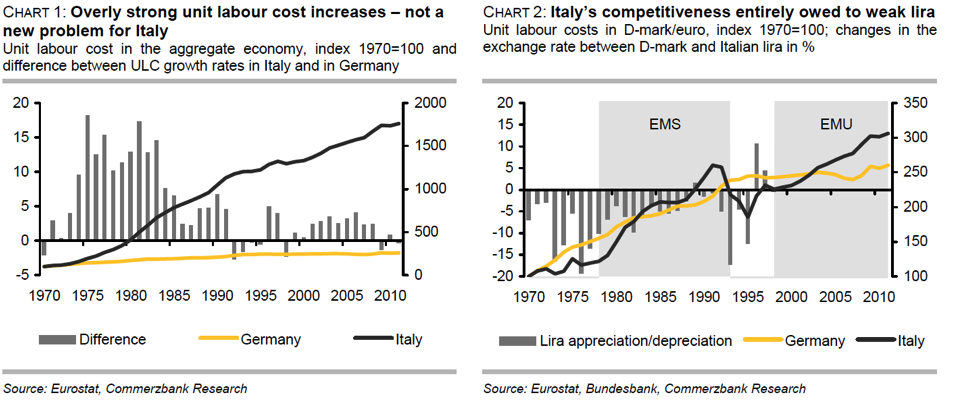

Peter Schiff, an Austrian economist who predicted the financial crisis urges the Swiss to preserve their wealth. Therefore, they should vote yes in the gold referendum. He thinks that buying gold is better than pegging to the euro. The Swiss will be better off if they possess a strong currency. Pegging to the euro implies that the Swiss Franc will become a new Italian Lira, Peseta or French Franc.

Read More »

Read More »

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

Already in 2013, the Swiss National Bank (SNB) spoke out against the gold initiative and revealed that the Swiss gold is stored mostly in Switzerland and 20% in the UK and 10% in Canada. There is no Swiss gold in the United States according to SNB chairman Jordan. In this post we provide an exchange of Jordan's arguments against the ones of the gold initiative. We also state our view that is not as strict as the one of the referendum proponents.

Read More »

Read More »

Swiss Housing Bubble: Thirteen Reasons Why It Will Continue for another Decade

The Bubble Bubble is produced by economic analyst and Forbes columnist Jesse Colombo, who was called one of the "Ten People Who Predicted the Financial Meltdown" in 2008 by the London Times.

Read More »

Read More »

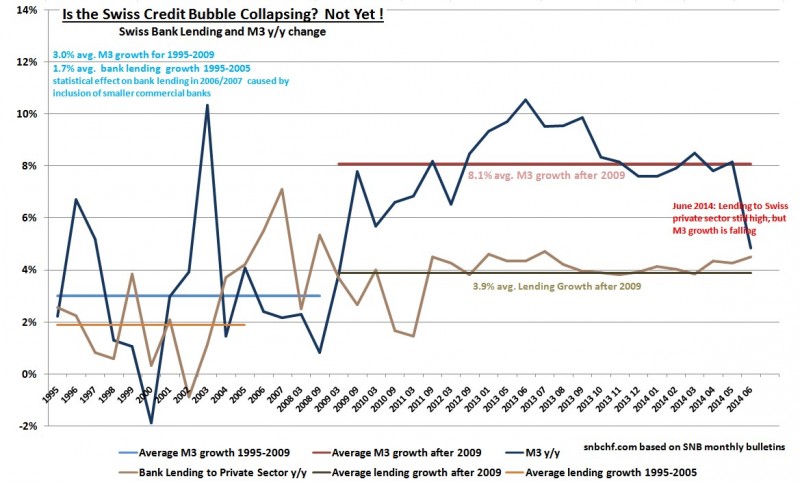

2014: Swiss Credit Bubble Popping? No, Lending to the Swiss Private Sector is even Accelerating!

Despite macro-prudential measures like the countercyclical capital buffer, Swiss credit to the private sector is rising more quickly than previously. On the other side, real estate prices are not increasing so rapidly any more. Global risks let M3 money supply growth slow in June 2014.

Read More »

Read More »

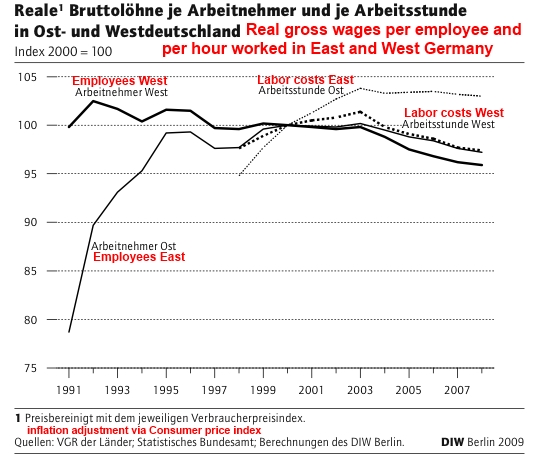

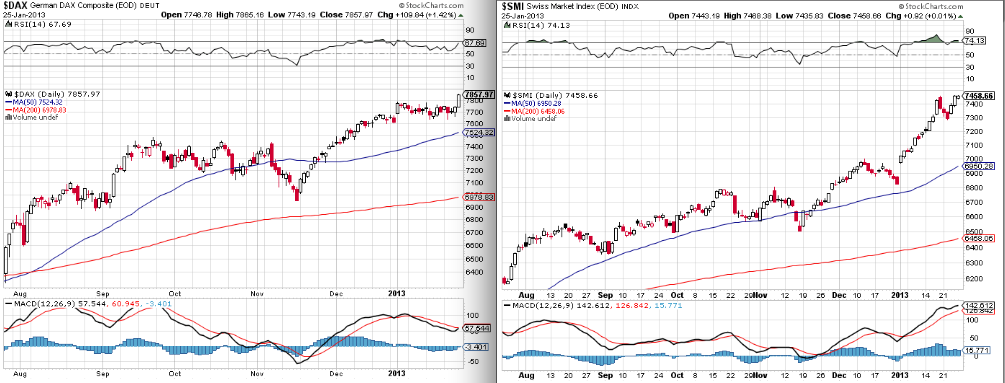

Swiss Franc History: Weak German and Swiss growth between 1996 and 2004

A critical Swiss Franc History: Between 1996 and 2004 Switzerland and its main trading partner and FX proxy Germany saw slower growth compared to other European countries. We explain the reasons

Read More »

Read More »