SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand.

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand.

Danthine has perfectly understood that times for the SNB might get hard again in 2014.

Jean-Pierre Danthine has made some comments recently:

– Swiss franc stays strong currency;

– Swiss franc became protective currency since the beginning of global recession;

– Expects positive level of inflation for the end of 2013. (source)

Comments from SNB vice president Danthine at an event in Montreal:

- CHF policy wasn’t a competitive devaluation

Translation: it was a competitive devaluation

Update:

- Swiss franc remains strong, posing a challenge

- Franc cap is an indispensable part of SNB policy (source ForexLive)

These comments imply that from 2014 on, the SNB will face four (well-known) problems:

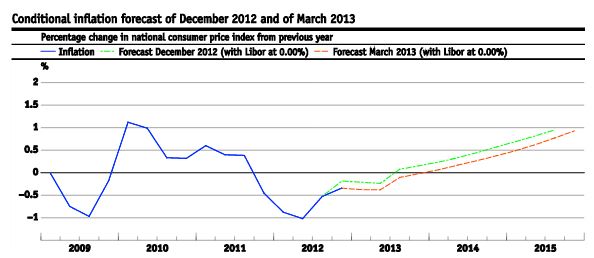

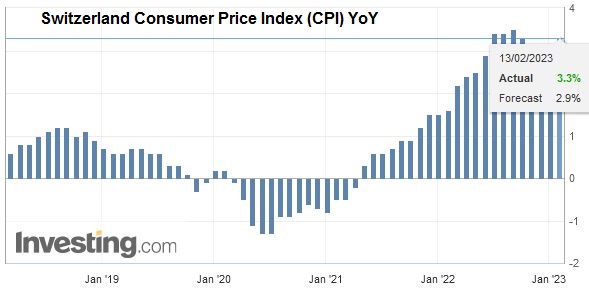

- Rising Swiss inflation: We already reported that prices of services rose by 0.6% YoY and goods produced in Switzerland by 0.3%. Only imported goods and falling energy prices helped to maintain deflation on a yearly basis. Provided that emerging markets grow more strongly than the U.S. again, the effect of weak energy prices should be washed out again. Rising inflation is already contained in the SNB inflation path: the bank sees 0.5% inflation for 2014.

This confirms that at that moment the Swiss CPI increase could be higher than inflation in France or Italy, while ECB rate hikes are far-fetched. - Continuing Swiss real estate bubble: Danthine is responsible for Swiss real estate and the counter-cyclical capital buffer. This bubble continues to be fueled by the huge Swiss current account surplus (13% of GDP) and rising Swiss incomes. According to the Homegate service, offered rents rose by 2.33% YoY. The CPI, that also includes existing rents, is up 0.5% as for the “rents component” against last year. According to Swiss statistics 25% of Swiss tenants change the flat in a year.

- U.S. money printing might have only temporary positive effects for the US dollar: For us improvements in the U.S. are mostly due to another real estate bubble that undoubtedly favors the creation of services jobs. But the strong dollar puts in danger U.S. manufacturing; more spending further weakens the U.S. trade balance and GDP growth. As Mario Draghi states in the ECB monetary policy statement, U.S. spending will foster European trade surpluses and a European recovery in 2014.We agree with Draghi: the U.S. will not be able to maintain strong growth in comparison to other countries.There is also the possibility that stronger US growth/spending translates into more inflation and further QE3 tapering. A combination of higher U.S inflation and tapering is also an argument to short USD/CHF.

- Anybody believing in a Draghi Deus Ex Machina effect might ignore us, but we think that Improvements in peripheral Europe will still be sluggish in 2014, even if Draghi speaks about 1% European growth in 2014, for us mostly driven by stronger German consumption.

Even if Danthine says that the cap on the franc is indispensable now (what is true in 2013); we think that based on Draghi’s 1% European growth estimate for 2014, the cap should be removed by then.

If Danthine states that inflation is no danger in the foreseeable future, we wonder how far his foreseeable future takes, possibly only one year:

- Internal inflation seems to be nailed to levels around 0.5% despite total CPI deflation

- A quick rebound in prices of imported products, e.g. energy, could easily add another 0.5% inflation.

And the SNB must comply with the IMF if conditions improve. 0.5% to 1.0% inflation in 2014 or in 2015. This would imply that Swiss growth has picked up and the floor must be removed.

U.S. and global growth might have recovered at that moment so that, despite the floor removal, the EUR/CHF does not collapse.

Strangely Danthine’s four issues were already valid in 2011 and also valid in 2010 when EUR/CHF was trading around 1.40.

The difference to 2011 is that Swiss exporters do not have a problem with the FX rate any more. The Swiss PMI was at 44 at the end of 2011, but is 52 in 2013, while the American ISM fell from 51 in October 2011 to 49 recently.

Hopefully for the SNB, we will not utter the same four arguments in 2015, when EUR/CHF could trade around 1.10.

Read also:

Tags: current account,Swiss National Bank,Swiss real estate,Switzerland Consumer Price Index,Switzerland inflation