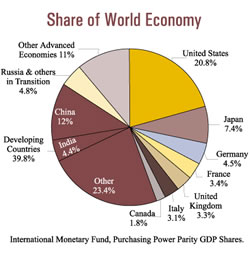

In our view the Swiss franc is not a pure Safe-Haven, but a “Safe Proxy for Global Economic Growth”. Global investors want to participate via the purchase of safe Swiss multi-nationals in global growth. This means inflows into Swiss franc denominated assets. Together with the big Swiss trade surplus, this implies a stronger franc. China stands for global economy, its slowing growth has a negative influence on the profits of Swiss multi-nationals and is therefore negative for the franc.

The text is originally written in May 2013 and adjusted to today’s developments.

The “Swiss Global” Economy

From the official Balance of Payments release: “In 2013, the receipts surplus from investment income surged by CHF 23 billion to CHF 53 billion.”This steep increase was due to the higher receipts from Swiss investment abroad”.

Global investors want to participate via the purchase of safe Swiss equities in global growth and the yield these companies are able to obtain.

According to an article in the Finanz und Wirtschaft, Swiss blue-chips contained in the SMI make less than 20% of their sales in Switzerland, but 25% are in the United States – as opposed to 16% for other European companies.

However, Swiss investors hold 80% of their equity portfolio in Swiss stocks. Swiss blue-chips are very much engaged in the so-called “defensive sectors” like health care and non-cyclical/food. Nestle makes up 20% of the index, the pharma companies Novartis a 19% share, Roche another 17% (source)

Visibly the aim of the Swiss establishment is to reduce the value of both euro and Swiss franc, to inflate revenues of Swiss companies; often obtained in US Dollar.

This despite Swiss unemployment that are at very low levels and a continued inflow of qualified personnel into Switzerland. Companies like Novartis and Roche have the choice among qualified people from all over the world that would love to work in Switzerland. As reported by Swiss radio, these specialists have issues in finding a new jobs, once their contracts with the big Swiss pharma giants finishes.

SNB Findings about the Swiss safe-haven

The SNB itself, has found finally found out that CHF is no “pure safe haven”, like for example the yen.

Based on Verdelhan’s “The Share of Systemic Risk in Bilateral Exchange Rates“, the SNB researchers Christian Grisse and Thomas Nitschka elaborated a risk-factor model of exchange rate changes, mostly based on VIX volatility. As control variables they employ the spread between German and Italian bonds and the TED spread (difference between US treasury bills and Eurodollar deposit rates) to confirm their results:

Our results highlight that the Swiss franc is a safe haven relative to many, but not all currencies: in response to increases in global risk the franc appreciates against the euro as well as against typical carry trade investment currencies such as the Australian dollar, but depreciates against the US dollar, the Yen and the British pound….

Around the period of the Lehman bankruptcy, the change in the VIX index was associated with a more than 0.2% appreciation against the Australian dollar, and a more than 0.2% depreciation against the US dollar. source

This research and that SNB leading officials keep on claiming that the Swiss economy needs the floor shows that the central bank does not really understand the CHF price movements. Once again in May 2013, markets are speculating on a higher floor.

Swiss Friends: Proxies for Switzerland

They do not grasp that for the first time fundamentals – and not speculation like last year September – help to push the EUR/CHF rate upwards, namely weak data for Germany, Japan, China and a weak Brent oil price.

Why did the EUR/CHF fall so quickly between 2010 and 2011 despite the previously observed high correlation between EUR and CHF?

This combination of the five major factors led to a strong revaluation of the franc between 2008 and 2011 from EUR/CHF undervalued at 1.60 to overvalued at 1.01 and – due to SNB intervention – finally 1.20. Since then, U.S. growth and risk-appetite has recovered, emerging markets have slowed. The SNB successfully anticipated these two developments. The question if this movement is cyclical or longer-term change (see more).

Sight deposits and EUR/CHF movements

At the occurrence of a negative event, especially in the US or the euro zone, then EUR/CHF weakens and investors pile into the Swiss franc. This is often visible in increasing sight deposits.

In certain risk-on environments, like the current one, it is possible that EUR/CHF moves upwards, while sight deposits are still increasing. This does not imply that the SNB is intervening to push the EUR/CHF to 1.25, but FX and carry traders take profit on the interest rate differential between euro zone and Switzerland. These derivative movements are not registered on the SNB balance sheet like the “sight deposits account”, but are visible later only on derivatives component of the balance of payments. Inflows on Swiss bank accounts – e.g. caused by profit repatriation into CHF – often take their toll on SNB sight deposits, because firms want to keep cash and consequently the banks “park” the funds at the SNB.

Putting this in FX theory terms, the current EUR/CHF movements are based on the conflict between EUR-positive carry trades against the CHF-positive movement of converting foreign profits into the “safe local currency CHF” and the CHF-positive movement of buying Swiss franc-denominated assets (see the asset market model). The big inflows of safe-haven-seeking foreign investors into Switzerland have mostly stopped.

The picture on the Japanese yen is even more extreme: huge derivative short yen “carry trade” positions outweighed the inflows of foreign investors into Japanese stocks and the profit-taking by Japanese investors that sold their foreign bond holdings.

If Growth of Emerging Markets Rebounds then CHF Will Appreciate again.

Neither a oil glut and high debt of emerging markets – like in 1980s – nor a technology boom – like in the 1990s – will help the U.S. to recover. On the contrary, thanks to their own accumulation of capital and better governance and education, growth of low- and middle income countries seems to consistent, while both the U.S. and Europe could remain in a sort of balance sheet recession. In 2012, most emerging markets have overheated and due to their high interest rates, growth has got stuck. Over time these central banks should get quickly rising wages under control and banks should provide cheaper loans for EM companies again.

References:

SNB, Working Paper, April 2013: Christian Grisse, Thomas Nitschka: On financial risk and the safe haven characteristics of Swiss franc exchange rates, Online Link

For German-speakers we recommend the article from Credit Suisse’s Brändle and Vautier that shows more details what Switzerland exports and that a bigger part of the value chain for these sophisticated goods is in Switzerland “Schweizer Exportwirtschaft langfristig gut positioniert”

See more for

2 comments

karl

2013-12-29 at 14:40 (UTC 2) Link to this comment

So do you think US growth is picking up now in 2014?

PMIs are improving quite faster than rest of the world in H2 2013

Oil rebounded in price to 100$

Us treasuries finally above 3%

S&P making highs,housing recovering well

twin deficits lowering

What if funds start coming to US, which then appreciates dollar, lowers commodity prices and improves economy(higher stocks,housing bubble…) which continues the circle.

George Dorgan

2013-12-31 at 01:12 (UTC 2) Link to this comment

If American monetary and fiscal policy tells you that you should spend and European tell that people should stop spending, what will do they?

But these policies are only temporary. Funds have already invested in the U.S. Commodity prices were already lower, global demand will drive them further upwards. US growth picked up in 2013.

German Markit manufacturing PMI is at 54.2, the U.S. one at 54.4. Do not compare with ISM, that has a different terminology.

2014 is the year when global growth, but also German growth will pick up. Still beware that inflation in some emerging markets is still too high, so it will not like 2010/2011.

But the dollar will go lower and lower.