Tag Archive: current account

Double Whammy: US CPI and Federal Reserve

Overview: Position adjustments ahead of today's US CPI and FOMC

meeting are giving the dollar a modestly heavier tone today. Each of these

events are typically a source of volatility in their own right and together

they promise an eventful North American session. The yen is the only exception

among the G10 currencies, but even there, the dollar is holding below

yesterday's highs. Even sterling's relative resilience this week was unmarred

by the...

Read More »

Read More »

Consolidative Tuesday

Overview: The dollar is consolidating but with a somewhat

heavier bias today. The G10 currencies are firmer but for the New Zealand and

Canadian dollars, which are slightly softer. Most emerging market currencies

are also firmer, except for a handful of Asian currencies. The news steam is

light. Equities are trading off. The MSCI Asia Pacific Index

snapped a seven-day rally, and Hong Kong shares and the mainland shares that

trade there led the...

Read More »

Read More »

Dollar Trades Above JPY150 and Truss Gets No Reprieve

Overview: China and Japan continue to struggle to stabilize their currencies, while global interest rates rise. The offshore yuan has fallen to new lows but in late dealings the onshore and offshore yuan have recovered.

Read More »

Read More »

Riksbank Hikes 100 bp but the Krona gets No Love

Overview: Yesterday’s late rally in US shares

carried into the Asia Pacific session where all of the large markets advanced. However,

the bears are not abdicating and Europe’s Stoxx 600 is off for the sixth

consecutive session and US futures are trading lower. The sell-off in the bond market

continues. European benchmark yields are mostly 8-10 bp higher and the US 10-year

Treasury yield is up nearly five basis points to approach 3.54%. The two-year...

Read More »

Read More »

Brent’s Back In A Big Way, Still ‘Something’ Missing

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status.

Read More »

Read More »

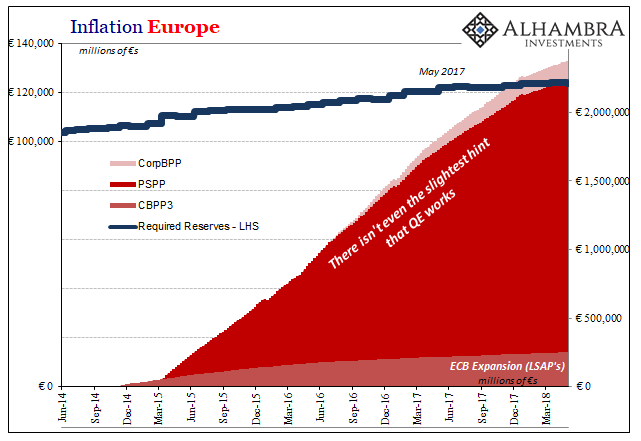

Europe’s Non-linear

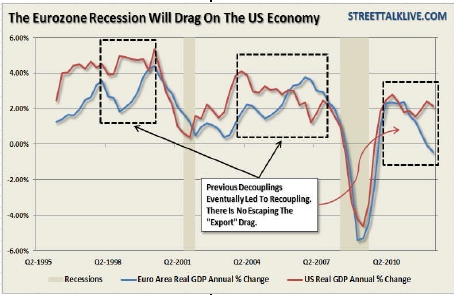

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant.

Read More »

Read More »

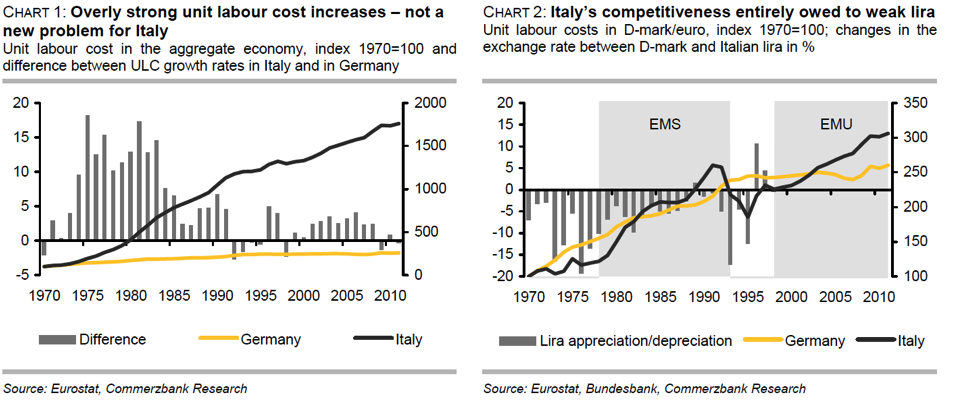

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

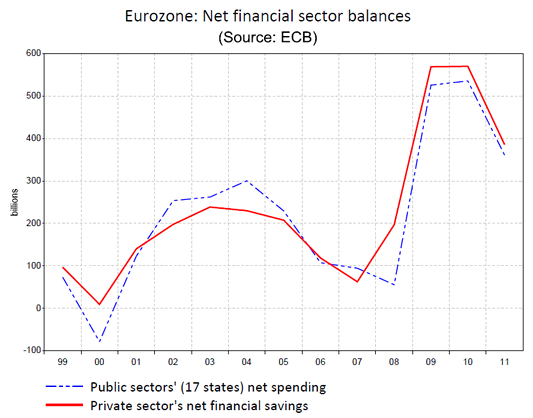

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

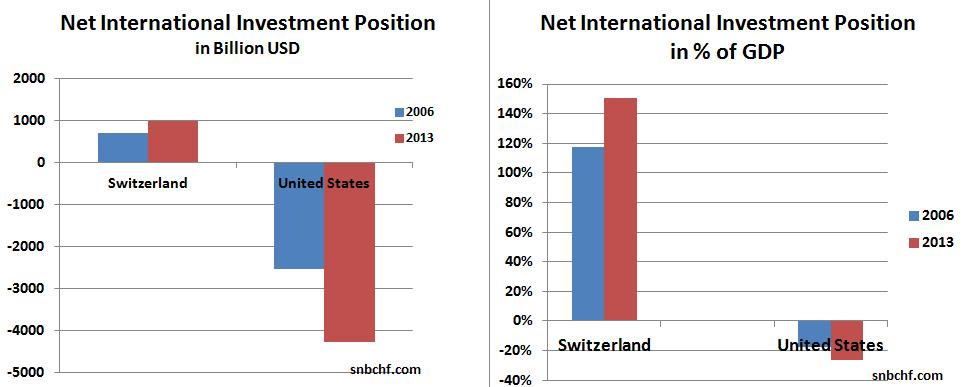

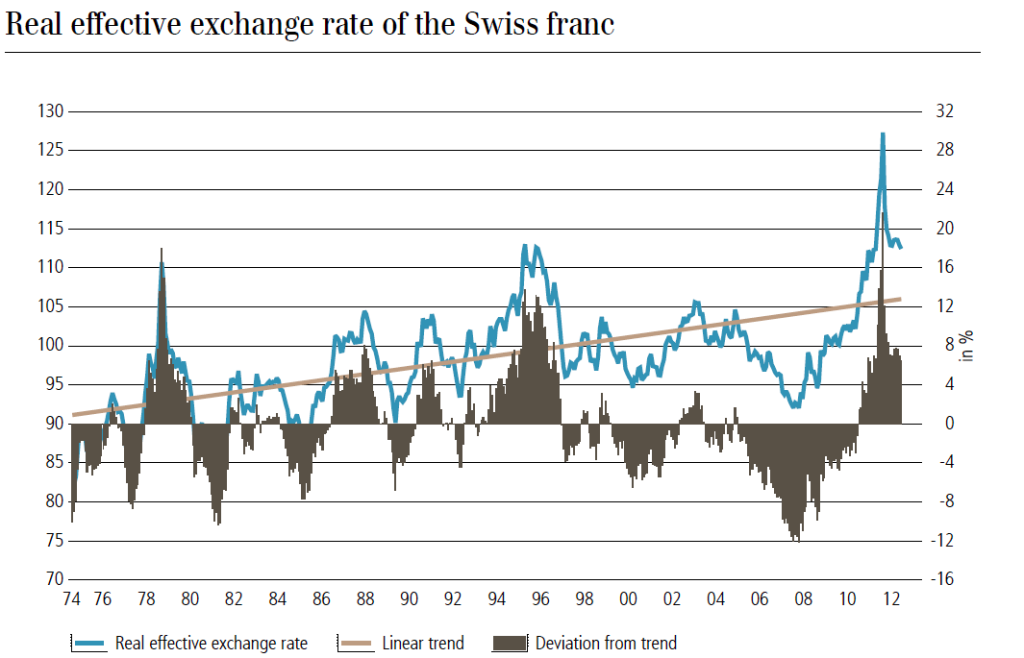

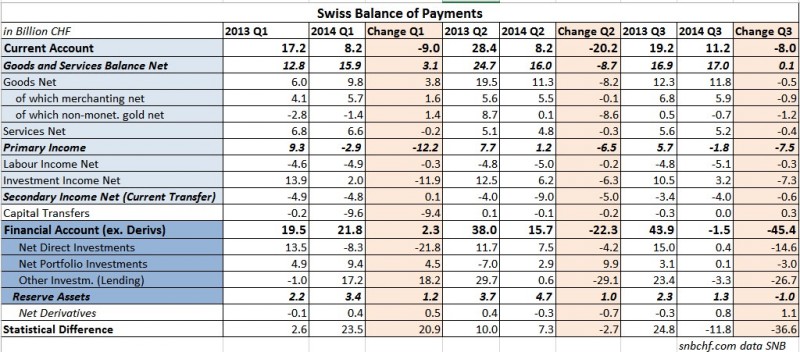

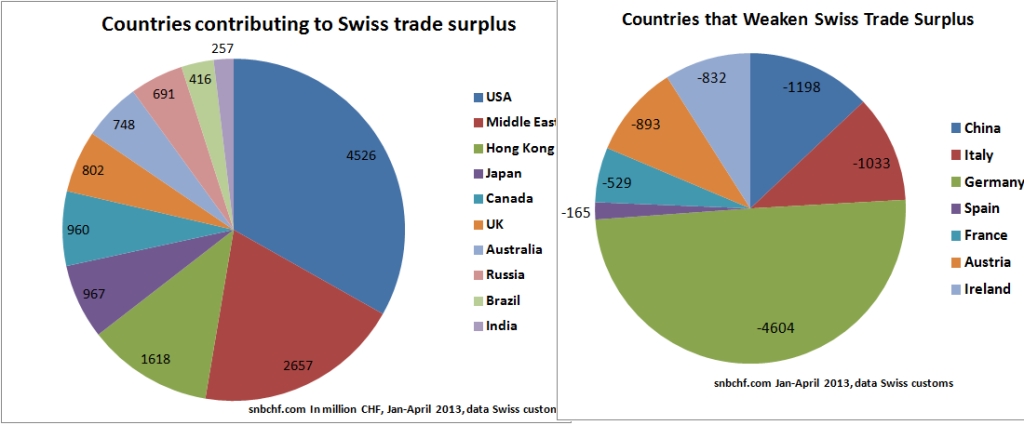

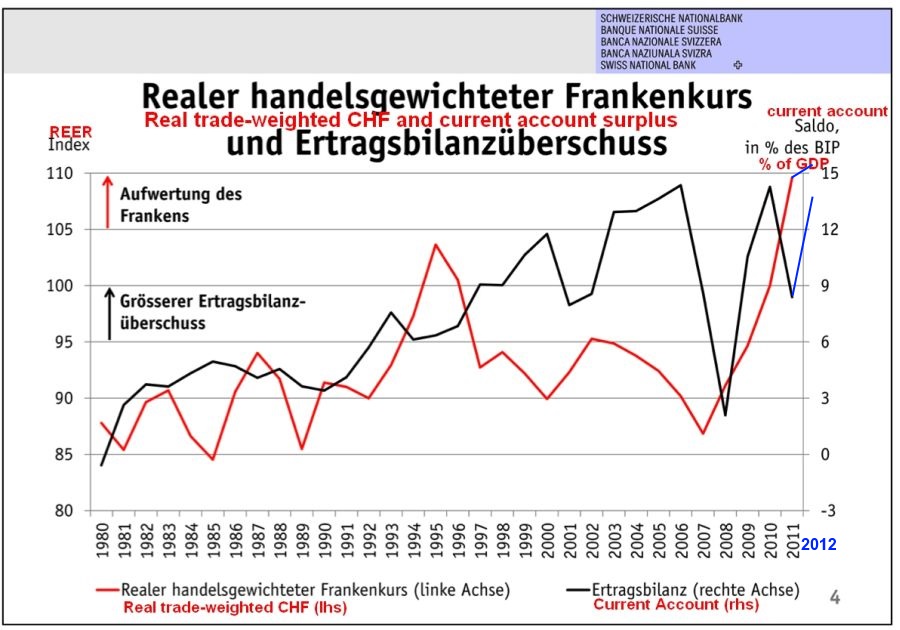

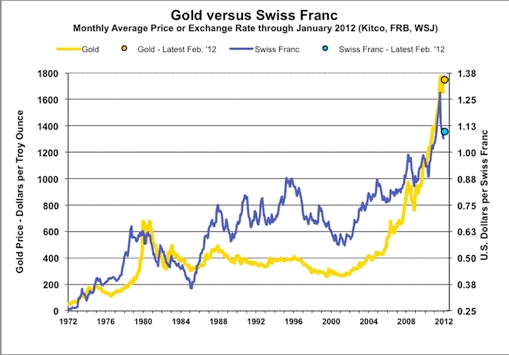

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

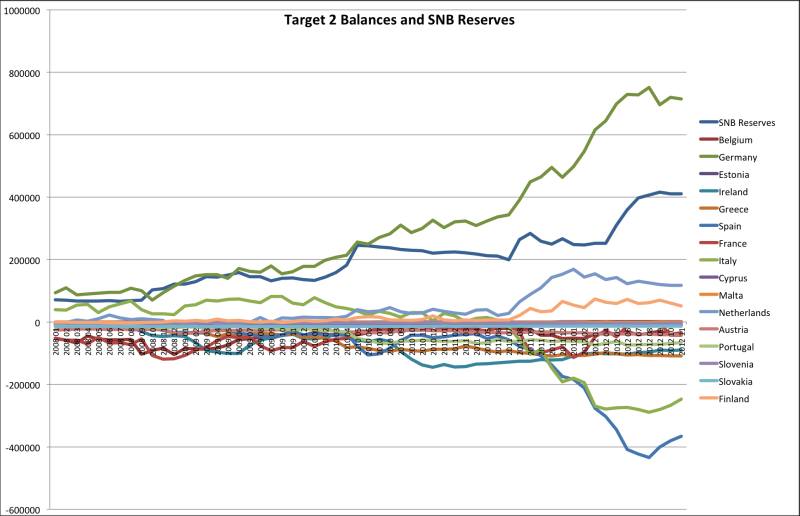

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

(1) What Determines FX Rates?

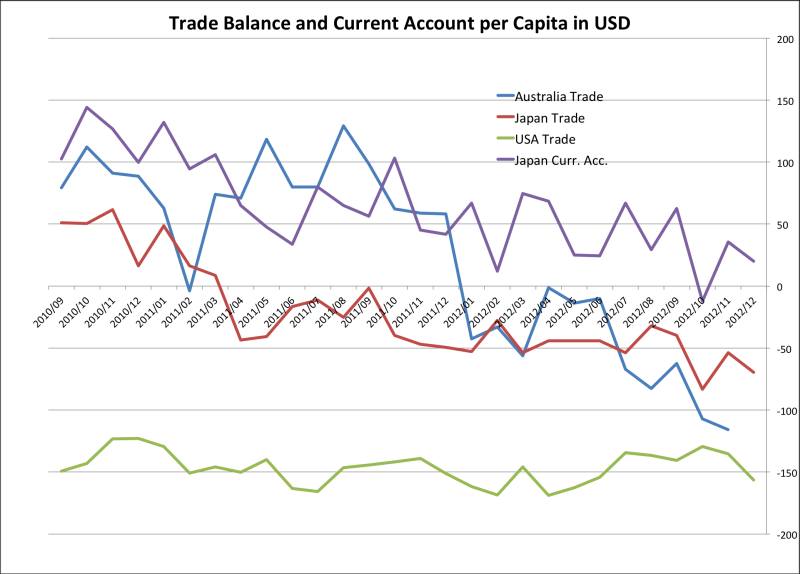

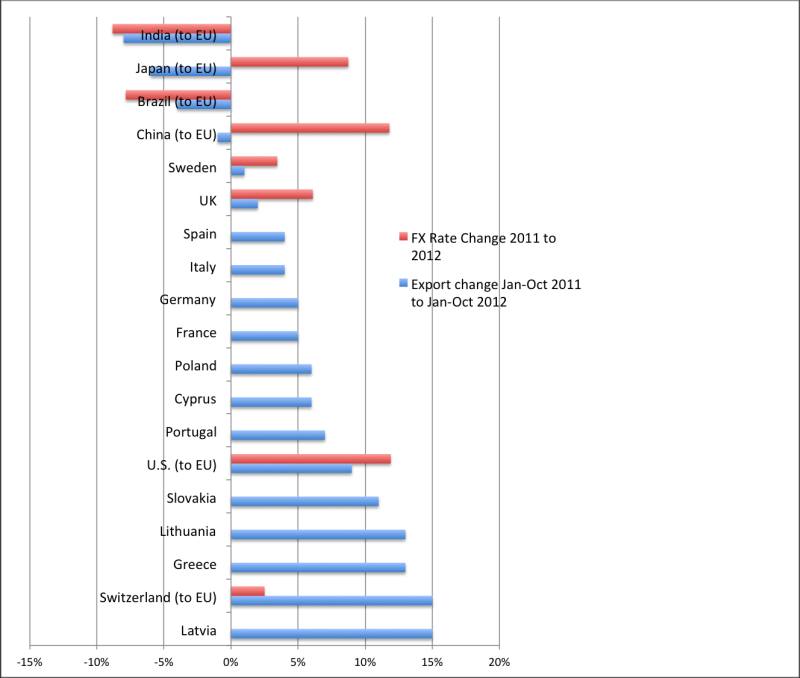

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

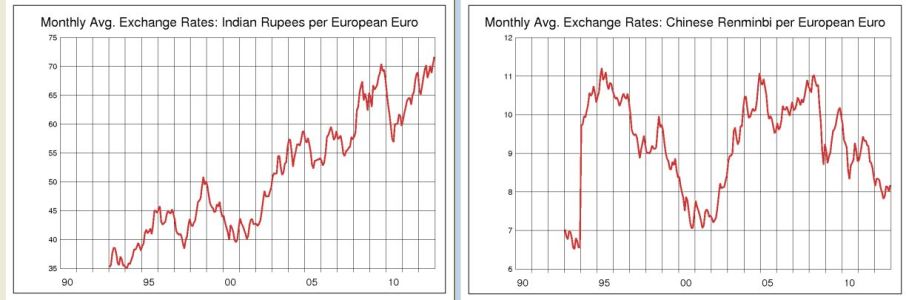

(1.2) Explaining price movements in FX rates

We indicate the main factors that influence FX rates in the longer term. We explain the movements of currencies based on these factors.

Read More »

Read More »

(2) FX Theory: Purchasing Power Parity

An economic theory that estimates the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to each currency's purchasing power.

Read More »

Read More »

(2.5) Real Effective Exchange Rate, Swiss Franc, Yen and Renminbi

The weighted average of country's currency relative to index or basket of other major currencies adjusted for inflation. We explain the Real Effective Exchange Rate for the Franc, the Yen and Renmimbi

Read More »

Read More »

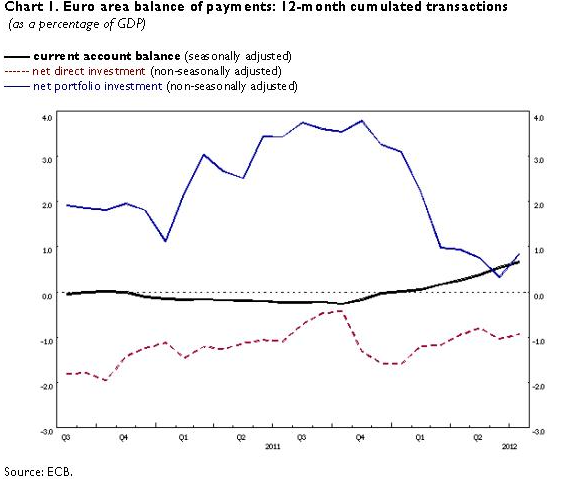

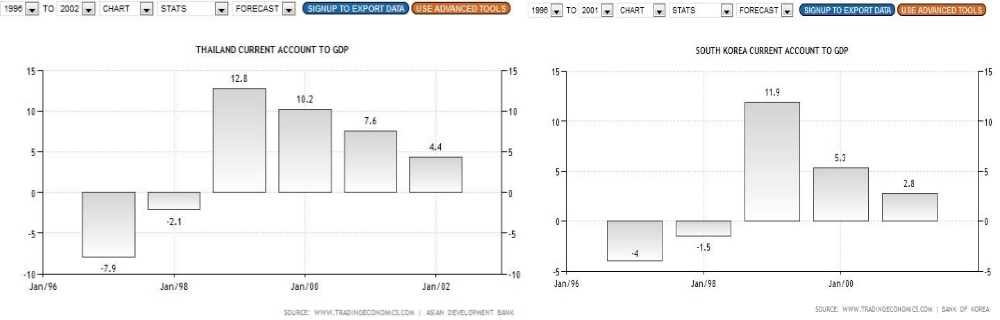

(5) The Balance of Payments Model

The Balance of Payments is the sum of current and capital account. The Balance of Payments model states that a currency appreciate when the Balance of Payments is positive. We give an explanation in around 400 words, that clarifies the relationships.

Read More »

Read More »

(5.2) FX Rates, the Balance of Payments Model and Central Bank Interventions

We will apply the balance of payments model for determining FX rate movements and FX interventions by central banks.

Read More »

Read More »

(5.4) The Relationship between Current Accounts and Savings

Private savings finance public deficit and current account surpluses. Important for understanding the euro crisis and the drivers of government bond yields.

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

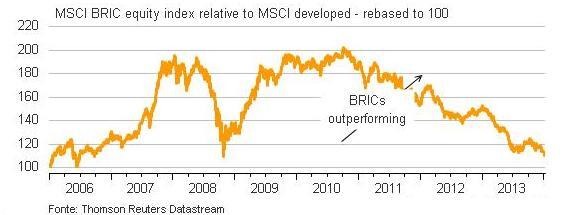

(6.1) FX Theory: The relationship between Current Accounts Surpluses and the Carry Trade

The EUR/USD is going on its longest winning streak for a long time. Since May 27, it has improved from 1.2850 to 1.3396 and is approaching 1.34. What are the reasons?

Read More »

Read More »

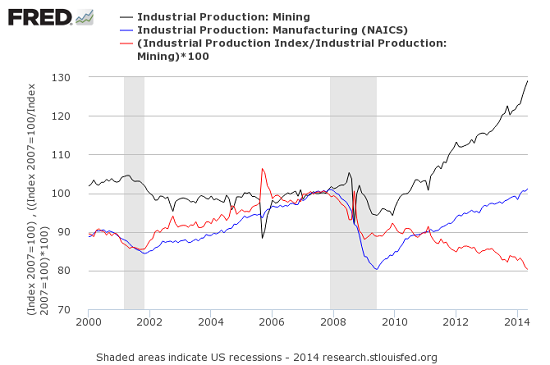

Will the Dollar Appreciate on higher U.S. Savings and a Smaller Trade Deficit?

In summer 2013, even the sceptical and "gold-friendly" economist John Mauldin followed the mainstream thinking that fracking and other technology could reduce OPEC's and the Chinese advantage in global trade and reduce the U.S. trade deficit. Recently both claims got refuted: the first with WTI crude oil prices rising to nearly 108$ despite enhanced supply. Detailed data showed that rising U.S. industrial production was not caused by more...

Read More »

Read More »