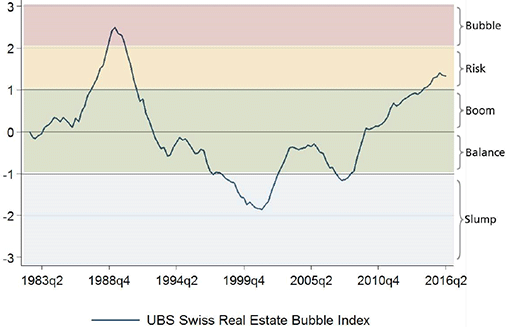

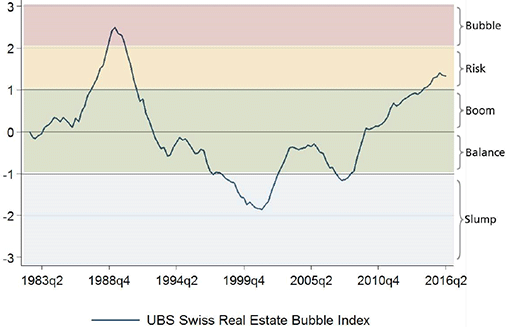

| Zurich, 10 August 2016 – The UBS Swiss Real Estate Bubble Index was in the risk zone in 2Q 2016 at 1.32 index points. The index decreased 0.03 points over the revised figure for the previous quarter. There were two factors behind the slight drop: First, nominal home prices were unchanged compared to the previous quarter. Adjusted for inflation, this corresponds to a decline of 0.6%. On an annual basis, this was the lowest growth rate since 2000. Second, the momentum of mortgage growth also weakened. Private household mortgage debt rose by only 2.7% compared to the previous year – likewise the slowest rate since the turn of the millennium.

The uncertainty surrounding the Brexit decision recently increased pressure on mortgage rates again. A long-term mortgage now costs about 30% less than three years ago. Despite the attractive financing, however, the price momentum on the market is declining, since stagnating household incomes dampen the growth of home prices. This is compounded by the fact that, since the introduction of self-regulation, banks have been keeping strictly to the economic viability rules for mortgage lending. As a consequence, at the current price level combined with stagnating incomes, fewer and fewer households are meeting the requirements for a mortgage loan. |

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates. - Click to enlarge

Methodology

Depending on its current value, the index falls into one of the following risk categories: slump, balance, boom, risk and bubble. These categories are specifically defined and ranked in order of risk. The UBS Swiss Real Estate Bubble Index comprises six sub-indices that track: the relationship between purchase and rental prices, the relationship between house prices and household income, the development of house prices relative to inflation, the relationship between mortgage debt and income, the relationship between construction and gross domestic product (GDP), and the ratio of loan applications filed for intended rental properties to total loan applications filed by UBS private clients. |

| Low interest rates are continuing to boost the “buy-to-let” investment strategy. In 2Q 2016, the proportion of loan applications for real estate not intended for owner-occupancy hovered at almost 18%. Real estate investments thus continued to enjoy great popularity, as also confirmed by the figures for building permits. Building permits for almost 30,000 dwellings were granted in the first half of the year, which corresponds to a rise of around 8% compared with the same period of the previous year. |

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates. - Click to enlarge |

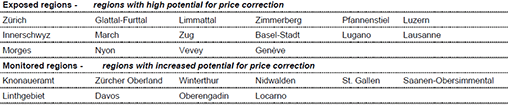

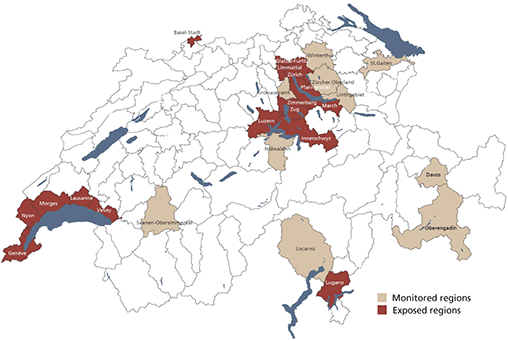

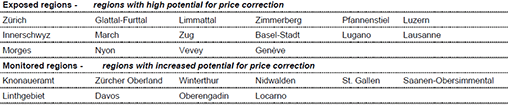

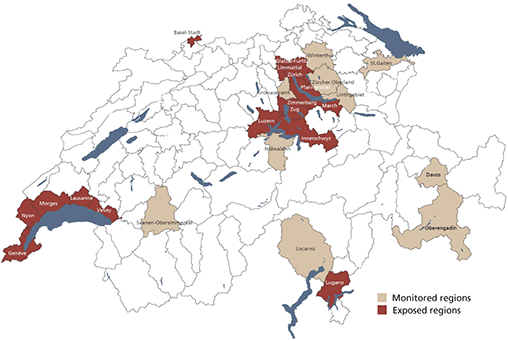

| The risk map has changed to reflect the decrease in the real estate bubble index. The regions Appenzell Innerrhoden, Baden and Thurtal are no longer among the monitored regions. The composition of the exposed regions remains unchanged. |

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates. - Click to enlarge |