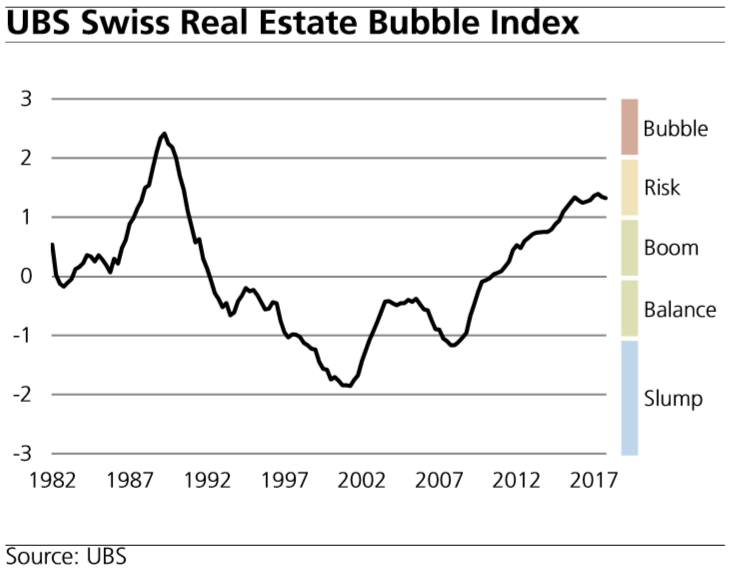

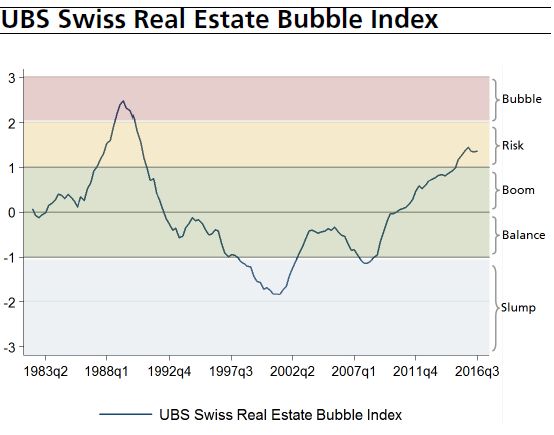

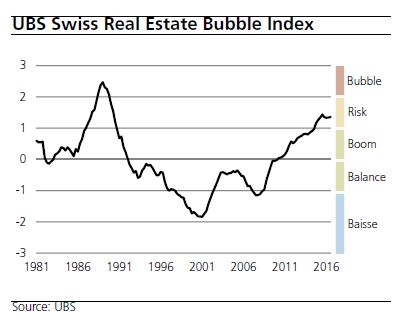

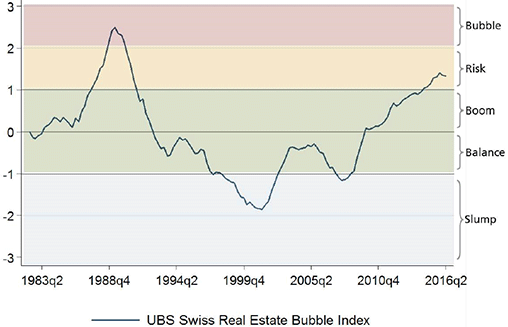

The UBS Swiss Real Estate Bubble Index declined in the fourth quarter of 2017, and is currently in the risk zone at 1.32 index points. This second fall in succession was driven by the persistently low increase of mortgage volumes. However, this may have been underestimated, as the records of mortgages granted by insurers and pension funds are inadequate. The majority of the sub-indicators remained unchanged in the last quarter.

Read More »

Tag Archive: Switzerland Real Estate Bubble Index

Swiss real estate market UBS Swiss Real Estate Bubble Index Q1 2017

The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks.

Read More »

Read More »

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2016

The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016. The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks. The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth.

Read More »

Read More »

Swiss real estate market UBS Swiss Real Estate Bubble Index 3Q 2016

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Read More »

Read More »

Swiss Real Estate Bubble Index 2Q 2016 continues falling, Still in Risk Zone

The UBS Swiss Real Estate Bubble Index nudged down in 2Q 2016 to 1.32 points and thus remains in the risk zone. This second drop in a row was due to house prices falling in real terms and the declining momentum of mortgage growth. Investments in real estate remain popular due to low interest rates.

Read More »

Read More »