Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Major Findings

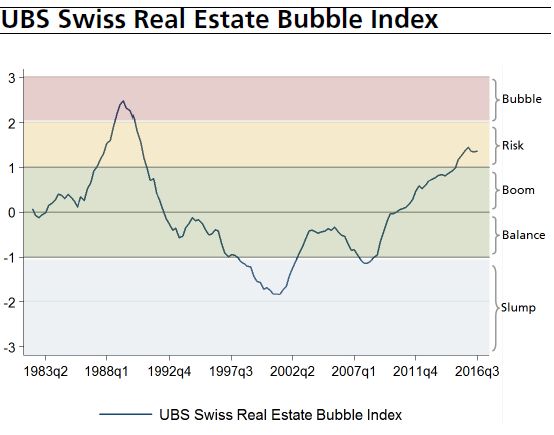

- The UBS Swiss Real Estate Bubble Index stayed in the risk zone in Q3 2016, unchanged at 1.35 index points.

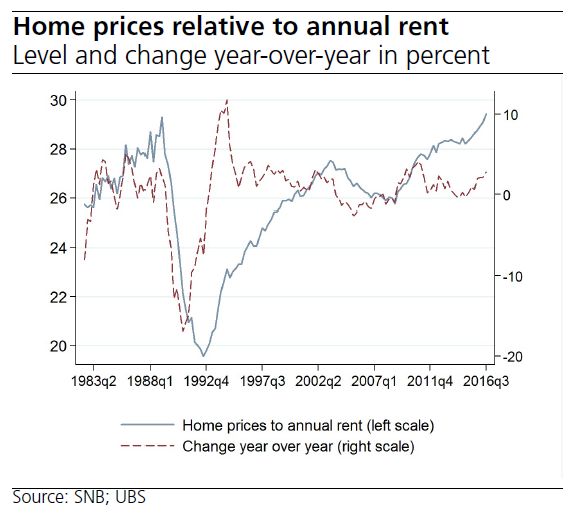

- The buy-rent price ratio reached an all time high due to a further increase in the price of owner-occupied homes and lower rentals

- The moderate growth in mortgages and the slightly improved economy however prevented an increase in imbalances on the market for owner-occupied homes.

UBS Swiss Real Estate Bubble IndexThe UBS Swiss Real Estate Bubble Index stayed in the risk zone in the 3rd quarter of 2016 at 1.35 index points, unchanged compared to the slightly revised figure for the previous quarter. In contrast, the sub-indicators fluctuated. The buy-rent price ratio rose sharply whilst the slower growth in mortgage debt had a dampening effect. Compared to the previous year, the volume of outstanding household mortgages increased by an unchanged 2.7 percent and thus continued to grow at a below average pace. Income growth in the current year again performed better than in the previous year. The stronger economic development thus balanced out the nominal owner-occupied home prices. The trend to stabilization in owner-occupied home prices however appears to remain intact. After adjustment for inflation, price growth rates are below that of the previous year and we do not expect a further acceleration in the next few quarters. |

Switzerland UBS Real Estate Bubble Index(see more posts on Switzerland Real Estate Bubble Index, ) |

Sub-indices of the UBS Swiss Real Estate Bubble IndexOwner-occupied house prices relative to annual rents |

Switzerland Home Prices Relative to Annual Rent |

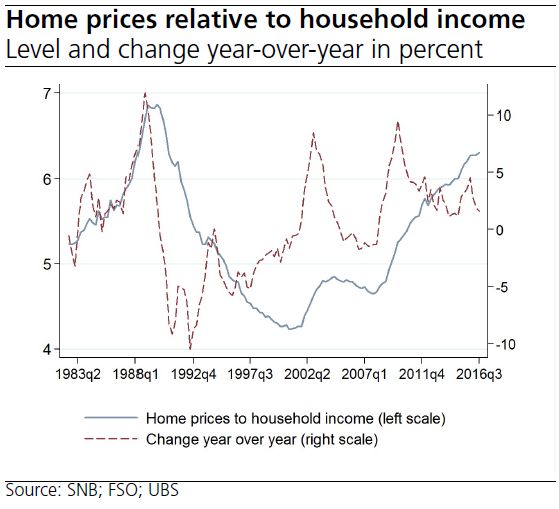

Owner-occupied house prices relative to household incomeThe nominal prices of owner-occupied homes increased 0.7 percent in the third quarter of 2016 whilst household income only increased minimally. The indicator thus increased slightly compared to the previous quarter. Approximately 6.3 annual household incomes are needed to purchase a home in the medium price segment. The long-term average is 5.3 annual incomes. |

Switzerland Home Prices Relative to Household Income |

Owner-occupied home prices relative to consumer pricesOwner-occupied home prices increased 1.2 percent in real terms in the third quarter due to negative inflation. Year-on-year, however, a nominal rise of 1.5 percent was recorded. The trend to stabilization in owner-occupied home prices thus appears to remain intact. After adjustment for inflation, owner-occupied home prices are however around 1 percent above the high of1989. |

Switzerland Home Prices Relative to Consumer Prices |

Tags: newslettersent,Switzerland Real Estate Bubble Index