- In this post we give our (Swiss) view for the financial tsunami on January 15th. In all major events in history one speaks of reasons/causes, triggers, chain reactions.

- Reason 1 & Trigger: SNB preferred secondary mandate, namely (reason1) financial stability, and risk reduction on its balance sheet triggered by massive inflows in fear of ECB QE.

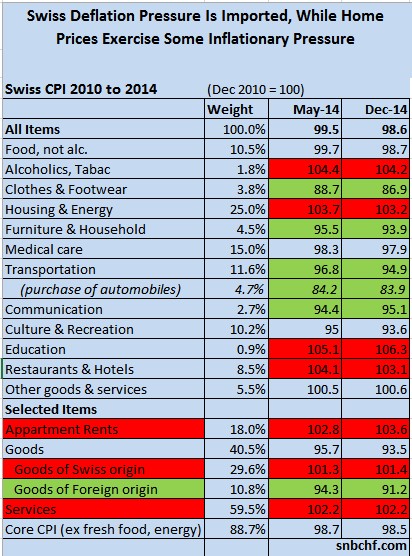

- Reason 2: No deflationary spiral: imported deflation in the short term, internal inflation > 0. In the medium and long-term inflation rate >0.

- Chain Reaction: Financial Tsunami caused by differing perceptions between Switzerland and the Anglophone world for “price stability in the medium and long-term”.

- Reason 3: The massive trade surplus of 10% of GDP, rising since EUR/CHF was at 1.68 in 2007, i.e. further monetary inflows.

With the end of the peg, our website, SNBCHF.com, might have lost its major reason for existence. The website’s aim was to provide a mirror for the central bank and cause deep reflection, and this is fulfilled. In our core thesis we were warning against wrong allocations of resources, in particular on the Swiss real estate market and that Switzerland needs and will see a stronger franc. Most of my posts on SeekingAlpha were effectively the anticipation of the January 15 financial tsunami. For the few regular readers, I played a part as a mouthpiece for (and often against) the SNB that was a bit more blunt, clear and maybe more hawkish than the central bank was. The leading FX site Forexlive.com often linked to my “blunt comments” (e.g. here linked by Forexlive on negative SNB rates).

Several SNB employees subscribed to our email reading list and received our updates regularly; potentially our opinion mattered a bit to them. The SNB has finally fulfilled our wishes and the ones of many Swiss that prefer sound money.

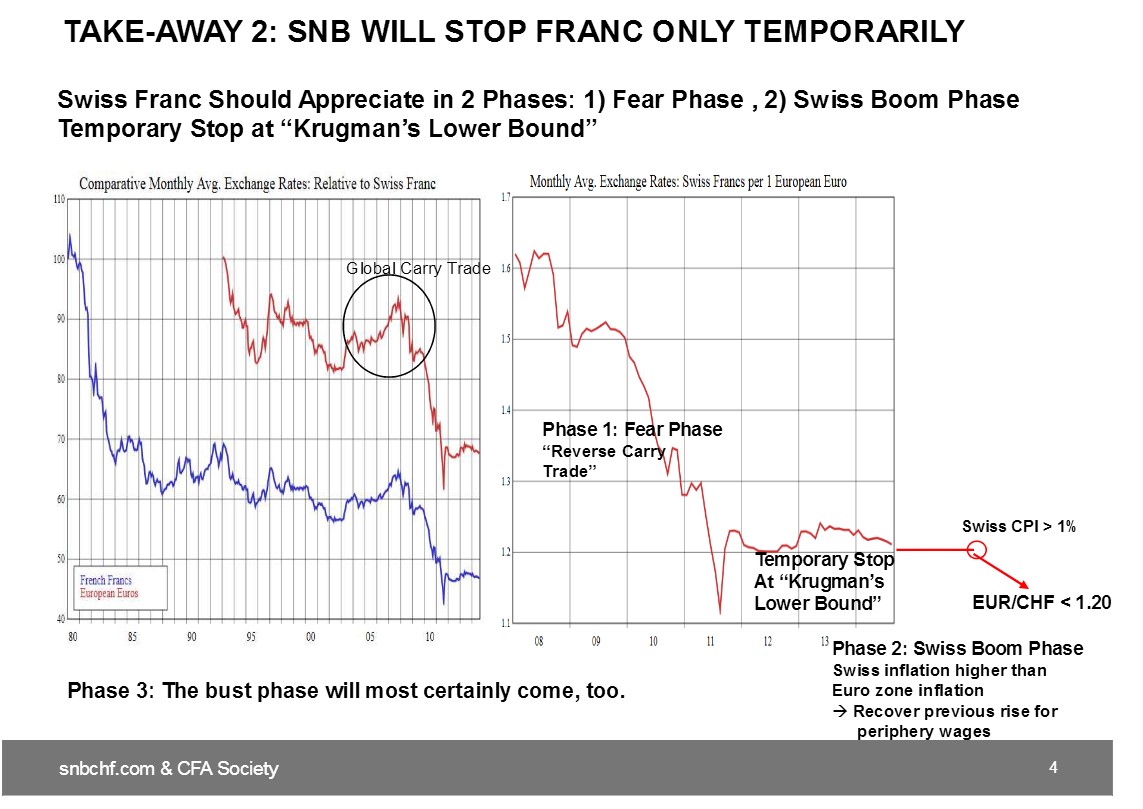

In my presentation at the CFA society in Zurich last September I recommended keeping cash in Swiss francs. I reckoned that the SNB would exit the cap when the Swiss CPI rose over 1%, and that the EUR/CHF would then fall to 1.10. Despite my announcement at the CFA Society, I did not manage to obtain more seed capital for the “EUR/CHF short” hedge/strategy fund, but I continued my consultancy work in the regulatory and operational risk area.

Only some friends and their relatives continued to profit on our strategy, our move into short EUR/CHF mini futures had only started, we were still reluctant to go into the full short because our price inflation target of 1% was still far away. Moreover, under prudent investor rules, the Swiss did not need this short positiobn. Investments in our private pension funds are nearly entirely denominated in CHF. For most Swiss they consist of bonds and money market papers, or even plain cash at very low interest rates. A 15% price appreciation of your entire pension assets is not too bad.

George Dorgan at CFA Society: EUR will fall to a new 1.10 CHF floor

At the CFA Society I mentioned the potential bust of the real estate bubble, if the SNB stops the EUR at 1.10. For me 1.10 was not low enough. Starting from a 1.10 level, inflation would have been higher later and the risks of a bust of the bubble too high.

The SNB has surprised me positively, and I am proud for the strong intellectual capacities and abstraction based on Swiss franc history achieved by our central bank. Now the SNB has a good chance to avoid the real estate bust, because it will not repeat the mistake of the 1990s – hiking rates too late, too high. I am fully aware that – as opposed to the 1990s – the development of inflation will take many more years, but, on the other side, the (Swiss) bubbles might get bigger than before.

Imposing a new floor at 1.10 is too difficult for a low inflation country like Switzerland, and waiting for a 1% measured CPI would have been too late. I was partially wrong. The SNB has left the CHF completely to market forces and finally followed Milton Friedman’s principle that interventions should happen from currency values that are clearly overvalued or where it has bottomed. This was not the case for EUR/CHF 1.20, in particular when the dollar heavily appreciates.

What Caused Swiss Financial Tsunami? Three Reasons

The SNB has finally obeyed her secondary mandate, financial stability and avoidance of wrong resource allocations, and ignored the primary mandate, the price inflation target, at least for the next three to five years, in the short-term.

While in the medium and long-term (maybe 5 -15 years) inflation should move above zero.

The aim of the SNB’s monetary policy is to ensure price stability in the medium and long term; in other words, it strives to prevent both sustained inflation and deflation. (source SNB mandate)

Hedge risk funds and FX traders did not have any understanding or blind ignorance of the “medium and long term target”. They were deeply short CHF, too lazy to surf the internet or still in December to read forexlive, the world leading FX site.

Explanation for this excessive risk taking can be found in the US history with the Great Depression that is different from the German-speaking history with the hyperinflation of 1923 with all the sociological implications and following economic history (more in a later post).

The second is the well-know thread of European QE combined with the Greek and Spanish political situations.

As Jordan’s Doyen Baltensperger points out, Swiss exporters have had 3 1/2 years to improve competitiveness – and they did so: Balance of Payments data shows that the Swiss trade surplus remains strong – 10% of GDP, far too high to allow for a weaker franc, nearly rising since 2009 (shit, missing the per capita numbers because we import highly-qualified personnel, same as the US imported oil until the shale revolution disaster). Low oil prices indicate that it could remain at 10% despite a stronger franc. This is the third explanation.

The trigger

The trigger, however, was renewed massive inflows into the franc: weekly M0 figures, similar to the period between April and July 2012, when the SNB doubled its balance sheet.

Investors shocked the SNB and the SNB shocked investors, a typical financial chain reaction. The SNB is also an investor with its massive liabilities but also quite some assets and a nice little seigniorage. As Baltensperger and Chandler point out, preferably US Treasuries (click on link please) and no risky stuff like gold or stocks as Prof. Bernholtz suggested.

Maybe those investors that bought francs were front-runners of the ECB decision (that we do not know yet) and the safe knowledge that pegs always fail.

Inflation Outlook

Given that internal inflation is at 0.5%, the SNB measure should prolong the period of imported deflation (currently -1%). Moreover, imported inflation is further lowered by QE-induced over-capacities in Chinese production and crude oil.

The Keynesian Liquidity Trappers and the Market Monetarist community (e.g. Scott Sumner or Lars Christensen) will be deeply disappointed. The inflationistas have won. For Sumner is an inflationistas the ones that fear inflation, …. for example the SNB.

Balance sheet and potential losses

The SNB expects profits of 38 billion for 2014, but this is lost in their books. At the end of 2010 the EUR/CHF was at 1.24, the dollar 0.94 CHF. The SNB had improved owners’ equity from around 42 billion at the end of 2010 to 73 billion CHF in November 2014. This is 31 billion CHF that the bank does not regret losing because they were bought with “printed money” that represented massive risks for financial stability. About 3 billion gains on USD for December 14/January 15 are not included yet.

An 18% loss on the FX rate, however, would mean that the SNB currently has an unrealized loss of 18% of its 540 billion CHF balance sheet, i.e. 97 billion CHF, which is a bit more than our estimate of 76 billion owners’ equity.

It is possible that the central bank moves into slightly negative equity: a scenario that Thomas Jordan did not fear in a speech given in September 2011. Hence owners’ equity remains around zero, slightly above or below.

The decision about when the central bank wants to achieve positive owners’ equity again, is a major political, strategic and maybe visionary one. It has nothing much to do with short-term economic data or fundamentals. We typically follow the balance of payments dynamics and the strong trade surplus. Therefore, we see further CHF strength in the next few years, similar to the late 1970s.

The SNB had surely at least ten reasons to give up the peg. I can imagine at least six, three are here. We will give additional ones in later posts.

References

Thomas Jordan, 2011: Does the Swiss National Bank Need Equity?

Thomas Jordan, 2014: Sound Money, a fundamental pillar of our society.

George Dorgan, (2014/2015 update): The SNB has Won the Risk Aversion Battle, When Will the Inflation Battle Start?

George Dorgan: Downwards and Upwards Drivers of Swiss Inflation

George Dorgan on Seeking Alpha (May 2014): The Swiss Franc, Pseudo Mathematics and Financial Charlatanism

Edwin M. Truman, Peterson Institute: Two Cheers for the Swiss National Bank

Scott Sumners: Inflationistas and Liquidity Trappers

See more for