(post originally from 2013 but continuously updated)

The Bubble Bubble is produced by economic analyst and Forbes columnist Jesse Colombo, who was called one of the “Ten People Who Predicted the Financial Meltdown” in 2008 by the London Times.

Switzerland’s housing bubble is a part of the overall Post-2009 Northern & Western European Housing Bubble that has inflated because of the strong investment inflows that these countries have attracted since the Global Financial Crisis due to their perceived economic safe-haven statuses, serving to further inflate these countries’ preexisting property bubbles that had expanded from the mid-1990s until 2008.

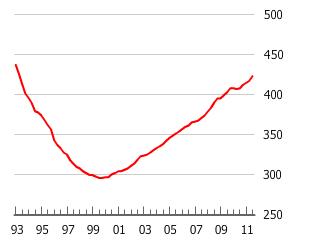

| Global and EU economic turmoil have heightened Switzerland’s traditional economic safe-haven appeal, particularly due to the fact that Switzerland is not a part of the EU and has its own currency, the Swiss Franc. After suffering from an early 1990s property bubble, Swiss property prices rose an average 42% since the year 2000, with prices doubling in some spots, for reasons similar to those of concurrent European housing booms. The median price for a house across Switzerland is now a California circa 2005-esque $850,000, $2.1 million in Zurich and an astronomical $2.55 million in Geneva. [1] Switzerland’s central bank (the Swiss National Bank), in an effort to stem the rapid EU-crisis induced rise in the Swiss Franc, cut interest rates to 0% and instituted a currency ceiling in the summer of 2011, creating alarmingly similar monetary conditions to those that caused Switzerland’s 1980s property bubble. [2]

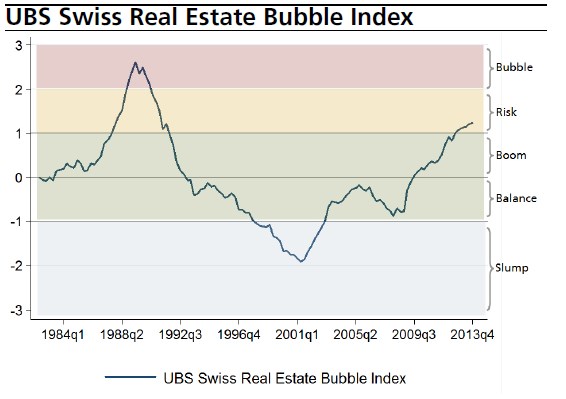

In response to rising Swiss real estate prices, UBS launched a Swiss real estate bubble index. |

|

| The index currently stands close record highs, while the Swiss National Bank Chairman Philipp Hildebrand warned that, “A rise in real-estate prices is among the greatest threats to Switzerland’s economy.” [4] Most worrisome is the warning of Janwillem Acket, chief economist for Julius Baer Group Ltd., who claims that Switzerland could experience its own version of the subprime borrowing crisis, saying, “People who shouldn’t be borrowing are now seriously considering entering the housing market.” [5] | |

The German DEKA bank claims that the Swiss home price to income ratio is in dangerous territory: Switzerland could be next to follow Norway and Canada into a bust of the real estate bubble. According to the IMF, Swiss real estate prices have risen by an average of 6% per year since 2008; they slowed to 4.3% in H2/2013. |

For us DEKA has not understood some mechanisms of global macro:

- Wealthy foreigners are still looking for a refuge against high taxes and potential capital confiscation in Europe. The wealthy in Asia and Russia need global capital diversification, away from corruption and potential confiscation in their home country. Regulation like Lex Koller is ineffective1

- The upper 20% in Switzerland are becoming rich and richer, a driving force is the Swiss current account surplus of 13% of GDP.

- The investment home-bias: For a Swiss investor there are currently no better investment alternatives available in a risk/return perspective. One of these risks is currency risk, which Swiss investors do not like after their bad experience with the ever falling dollar and the collapse of stock markets in emerging markets in 2013.

- The referendum against mass immigration aims to increase the “quality” of immigrants. It might reduce the yearly net immigration from 80000 to values between 50000 to 60000, which is a 0.7% yearly change compared to population. (Details about future immigration in the NZZ). The 0.7% is far more than the 0.4% net immigration to the United States. Improving Swiss values for natural population change are not counted yet (see more).

- As opposed to other immigration countries like the US and Canada, Switzerland has limited space.

- Swiss home prices are really high in hot spots like Geneva, Zurich or Zug, areas where highly qualified foreign personnel migrated to and foreign investors are most interested in. Prices in London or New York mirror the same phenomenon; but they are far higher than in Zurich, a bit higher than in Geneva.

- Cheap SNB money: The availability of cheap financing via ultra-loose monetary policy in Europe should last for another decade. As opposed to the rest of Europe, Swiss cheap interest rates help to massively increase money supply and credit.

- The combination of inflows via current and capital inflows, the absence of better investments and loose monetary policy creates rational expectations that push home prices higher than “sober investors” would suggest.

- The cyclicality of global macro combined with cheap money enables it that countries that did not have real estate bubble until 2007, must have one after it. This argument concerns in the future in particular Germany and Switzerland. The argument explains why bubbles last more than twenty years in commodity countries like Norway, Australia and Canada.

- Macro-prudential measures like the counter-cyclical capital buffer are teeth-less, because capital inflows, receding fear and rising risk appetite are able to counter the required higher capital ratios.

- Economists often claim that Swiss housing debt is too high. But they ignore that many Swiss have big financial assets in addition to housing debt. High Swiss financial assets are reflected in high current account surpluses. Therefore many global comparisons leave out Swiss housing debt, an example is the “McKinsey debt bible“.

Norway and Sweden are countries that follow the Swiss example: Massive housing debt does not harm thanks to rising financial assets and current account surpluses. This is reflected in the ongoing discussion between the dovish Krugman/Svensson on one side and the initially hawkish Swedish Rijksbank. Svensson even argues that debt to income (or GDP) is a misleading indicator. - Switzerland is still in a phase of slowly rising wages, while real estate price appreciate far more quickly. Real incomes are strongly positive.

Housing markets tend to break down in three steps:

Phase 1: The current account and the currency depreciates. This often happens when wages are rising too quickly. Inflation-adjusted home prices rise as people continue to buy into real estate as hedge against inflation.

Phase 2: The central bank hikes rates. This helps to stop capital outflows but weakens the economy and may increase unemployment. Most often inflation-adjusted home prices depreciate in this phase.

Phase 3: If high rates and unemployment are not able to stop excessive wage increases, then foreign investors leave the country (see point 1). Finally nominal home prices fall.

We are quite distant from all those symptoms in Switzerland. Wage increases are still weak: 0.8% per year, the current account surplus is at 13% of GDP. But rising wages in Canada, Norway or Russia combined with overvalued home prices triggered phase 1 in these countries.

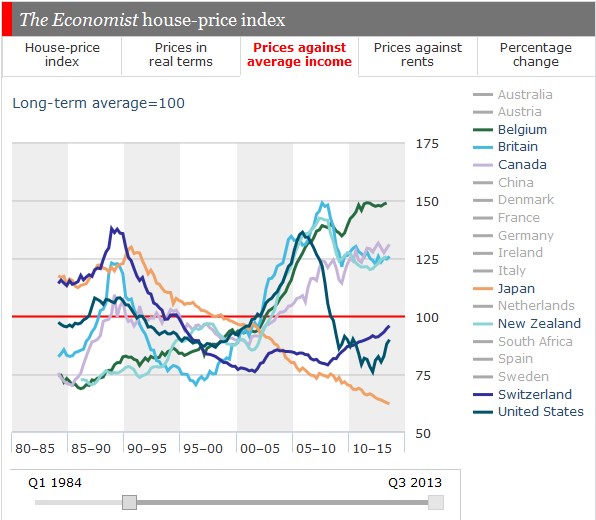

| 13. The following home price to income index by the Economist explains why Swiss or Japanese real estate is cheap in a historical and global perspective, but prices in Belgium, Canada , the UK or New Zealand are expensive. It must be emphasized that Switzerland has strong immigration and Japan strong population ageing and low immigration. Read more in Swiss home price to income ratio is small in global and historical comparison. |

The Economist house-price index |

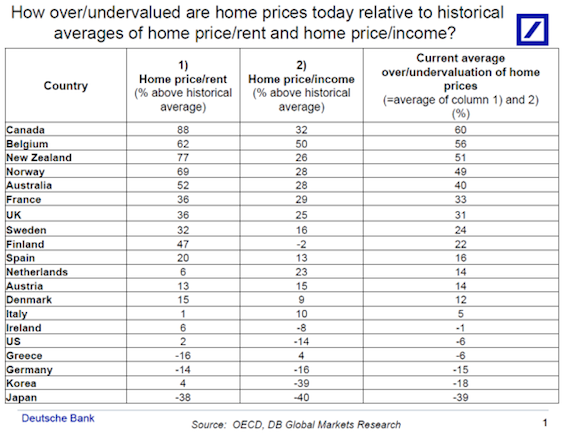

| The newest research from Deutsche Bank bases its analysis on the historical averages of price to income and price to rent. Unfortunately Deutsche does not show Switzerland in the overview. But Deutsche seems to be consistent with the full data of the Economist historical averages, when we look at the outlayers Belgium, Canada, New Zealand. Switzerland must be on the bottom of the list between the US and Germany: The recently released IMF website on housing includes Switzerland, it reveals that prices are 1% above the historical average of the price to rent ratio t and 10% below the historical average of the price to income ratio. |

Now we understand why DEKA published its research that shows three times green for Germany and at of red for other countries, incl. Switzerland. DEKA is the central asset manager and research provider behind all German Sparkassen; one main business is to sell mortgages in Germany. Research must fit into the sales strategy.

Update 2014:

White the Swiss GDP in Q1/2014 was driven solely by construction, home price increases started to slow. Whole Europe is in dis- or deflation and so is China. Recently prices in several Chinese cities have even started to fall. Given that real estate is a hedge against inflation, it is not surprising that prices in Switzerland slowed, too. But if you believe what the mainstream says, then low inflation will not continue for very long.

Read also:

- Wealthy foreigners might move physically to Switzerland, to which the Swiss are very open. Alternatively they could migrate to Switzerland at least on paper, renting a flat for some time [↩]

10 comments

Skip to comment form ↓

iakovos

2014-06-22 at 05:19 (UTC 2) Link to this comment

The Socialist Myth of Economic Bubbles

http://iakal.wordpress.com/2014/06/21/the-socialist-myth-of-economic-bubbles/

BarleyFutures

2014-11-09 at 00:07 (UTC 2) Link to this comment

I have to disagree with the rebuttal’s Phases of a Housing Cycle (#12), especially from the pov of the marginal buyer.

Phase 1: People who are wage-dependent don’t “jump” into housing because they are making too much money. If anything, they jump into a rising housing market because they aren’t making enough – their incomes are not keeping up with rising asset prices and rising rents, so to arrest the socioeconomic slide they take on tremendous debt in order to stabilize their monthly housing cost.

The average person is not good at predicting inflation in advance, especially if they are temporarily feeling richer in the small gap from their rising wage to rising prices – they only hedge against inflation once there is ample evidence of it being in effect already. Thus the rush to jump into an accelerating market.

Now if you’re speaking only for investors within the top 20%, then the rationale may be different, although “hedging against inflation” and “frontrunning the availability of cheap financing via ultra-loose monetary policy” don’t seem too awfully different at this point in time. And, of course, the top 20% do not an economy make.

GeorgeDorgan

2014-11-11 at 07:31 (UTC 2) Link to this comment

BarleyFutures Yes, this might happen in Canada, Norway and Russia currently and was the case in the U.S. before. The term “jump” is misplaced in the case of Switzerland. I corrected the formulation.

Equitykingkong

2014-11-22 at 12:33 (UTC 2) Link to this comment

great stuff but if I might make a suggestion… could you please include the date of your blog post

Equitykingkong

2014-11-22 at 12:35 (UTC 2) Link to this comment

btw. DEKA is still one of my top picks for being wrong most of the time

GeorgeDorgan

2014-12-04 at 10:08 (UTC 2) Link to this comment

EquitykingkongMy stuff has updated the wordpress theme so that it includes the date of the page.

Very often the date was already visible in the economic data presented.

The relevance most often does not change only because data is a bit older.

Cpersson

2015-01-17 at 10:09 (UTC 2) Link to this comment

If the steep appreciation of the chf leads to lower real wages (to stay competitive), do you see the Swiss housing bubble now bursting?

GeorgeDorgan

2015-01-21 at 00:51 (UTC 2) Link to this comment

Sorry for the late response.

You mean higher real wages: wages should go up by 0.5% or maybe 0% but inflation by -2%. Higher real wages.

Exactly the opposite with the stronger franc the bubble has been avoided, because they do not need to hike rates for another coupe of years.

Moreover, Swiss real estate gets expensive for foreigners. True it might burst for foreigners, but remains interesting for Swiss.

GeorgeDorgan

2015-01-21 at 00:51 (UTC 2) Link to this comment

Equitykingkong It is done as you have seen

BenniGholami

2015-03-02 at 06:06 (UTC 2) Link to this comment

I think the property bubble will only get worse over time. We still have a way to go before it plateaus only because there is still space for houses and villas to be built on, for now. Once all that space is utilised, people are going to want to buy the prime real estate nearer the city and that’s when the price of a home will really start to skyrocket.

http://thenetworkproperty.com