Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks’ collateral in the form of real estate falls in value. Therefore the banks’ assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called “counter-cyclical capital buffer” (CCB).

The Counter-Cyclical Capital Buffer: Macro-prudential measures

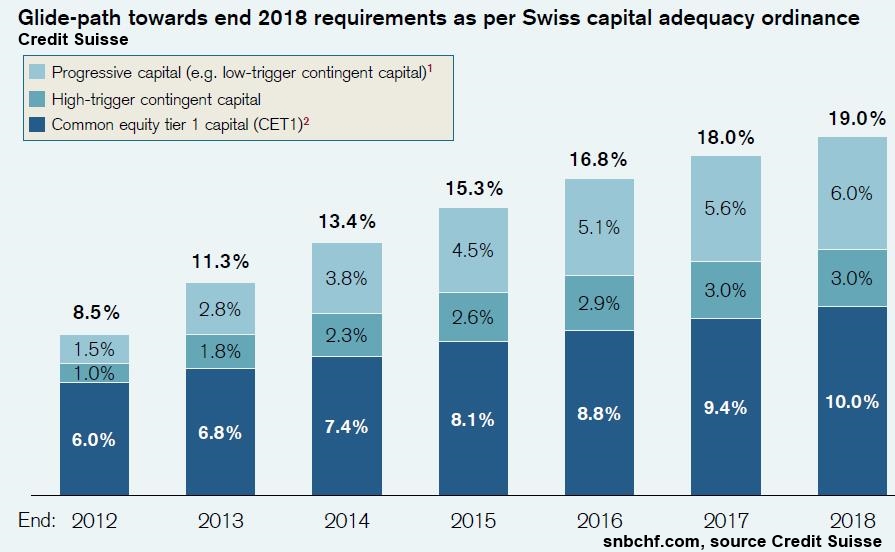

In addition to the Basel3 requirements, the counter-cyclical capital buffer (CCB) requires that banks raise even more equity. The Swiss capital requirements are higher than the global Basel 3 standard – 13% of Risk Weighted Assets (RWA). The Swiss regulators required a so-called “Swiss finish”, that could be up to 6% by 2019 for important banks.

The recent hike of the CCB to 2% of the risk weighted mortgage portfolio implies a capital increase of 0.5% of total RWA, given that mortgages and loans make up a quarter of (for example) Credit Suisse’s assets

Credit Suisse’s assets consists of 27% mortgages and loans, 18% deposits at the SNB (aka SNB debt due to Credit Suisse), 7% cash at other banks, 28% trading assets, 6% brokerage receivables, 1.6% investments, 7% other assets.

In 2012 Credit Suisse expected to fulfil the Swiss Basel 3 requirements with the following “glide path”:

Banks have three typical types of reaction:

- They increase their equity via new shares and tier-2 capital, “contigent capital (CoCos)“. This is debt that is converted into equity once the equity to risk-weighted assets (RWA) ratio falls under a certain threshold. The issue is that UBS and Credit Suisse currently pay around 7% interest on the CoCos. This reduces profits.

- Banks must cut costs. The cost saving programs are massive in Swiss banks, the recent UBS Fixed Income outsourcing program is only one.

- They reduce their assets, i.e. give less loans and mortgages and hand over the costs to the customers, i.e. make mortgages more expensive. Finally it implies that there is a gap between official interest rates (e.g. government bonds) and the rates on mortgage lending.

The CCB is a macro-prudential measure. CCB are recently not only applied in Switzerland, but also in Norway and New Zealand.

Activation of the Buffer in January 2013

The Swiss National Bank (SNB) has decided to propose the establishment of a CCB to the Swiss government, at last. It is a first step in preventing the Swiss asset price bubble or at least an asset price bubble that causes bank defaults.

It took a long time for the SNB to decide if it would activate the countercyclical capital buffer (CCB). Due to fears of an intensification of the euro crisis, the SNB delayed the introduction on August 27, 2012.

In January 2013 the central bank finally decided to propose it to the Swiss government so that banks have to reserve 1% of risk-weighted assets in case of a bust in the current housing boom.

The proposed capital buffer is targeted at mortgage loans financing residential property located in Switzerland. The proposal sets a level of 1% of associated risk-weighted positions, and a deadline for compliance with the CCB of 30 September.

(Risk-weighted, direct or indirect mortgage-backed positions secured by domestic residential property, as set down in art. 72 CAO. ), full release

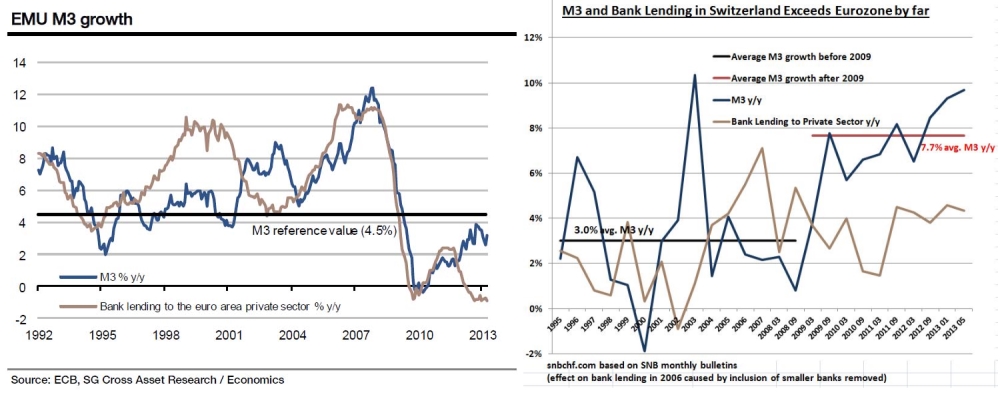

Money supply is rising excessively in Switzerland

The following graph shows that an activation of a capital buffer was urgent. Since 2009, things have changed, M3 is rising with an average of 7.7% per year, while before 2009 it was 3% per year. This is far higher than in the euro zone where money supply is still stuck.

While M1 in the euro zone has risen by a mere 32% since 2008, M1 in Switzerland increased by 120%. This means that the 120% more bank notes and deposits at Swiss banks helped to increase the credit volume to the Swiss private sector, which increased by 20%, a number that seems low when compared to the increase in money supply (see definition of money supply).

Opinions on the counter-cyclical capital buffer

UBS’s chief economist Daniel Kalt (source Swiss radio “Echo der Zeit”) estimated in 2012 that CCB is a far weaker method than hiking interest rates, something which is currently unthinkable for the SNB. He thinks that the CCB implies only marginally higher costs for banks – 1-2 % higher capital requirements can be translated into 0.1% higher rates for clients.

Claudio Saputelli, an economist at UBS, said that he did not expect the new requirements to have a huge impact on mortgage rates, due to the competitive nature of the Swiss mortgage market.

“We think it will increase the cost of a mortgage by 5-10 basis points, at most. However, there will also be indirect consequences: some banks may now toughen their criteria for offering a mortgage. These will be harder to predict,” he said. source FT

Still, in expectation of slowly rising inflation, and maybe due to the CCB, Swiss mortgages have become more expensive recently.

While Julius Bär’s Janwillem Acket thinks that the CCB gives a warning to many Swiss banks, ZKB’s Anastassios Frangulidis already complains that higher costs of mortgages will weaken Swiss construction and consequently Swiss GDP.

The Swiss banker’s association (SBA) continues to maintain that the CCB is the wrong method.

The SBA regrets that the Federal Council has not with the activation of the countercyclical capital buffer still waits until the entry into force in July 2012 demand-side measures, the banks were able to develop their full dampening effect. (Guidelines concerning minimum requirements for mortgage loans)…..

The SBA continues to believe that the countercyclical capital buffer is an inappropriate instrument to achieve the stated objectives, as it is defined too coarse and sets the wrong incentives. There is the risk that the credit policy of the banks to the economy is affected negatively by themselves credit costs could increase even for SMEs.

In an important article on project syndicate, Nouriel Roubini uttered his opinion:

To be clear, macro-prudential restrictions are certainly called for; but they have been inadequate to control housing bubbles. With short- and long-term interest rates so low, mortgage-credit restrictions seem to have a limited effect on the incentives to borrow to purchase a home. Moreover, the higher the gap between official interest rates and the higher rates on mortgage lending as a result of macro-prudential restrictions, the more room there is for regulatory arbitrage.

But the global economy’s new housing bubbles may not be about to burst just yet, because the forces feeding them – especially easy money and the need to hedge against inflation – are still fully operative, source Project Syndicate

In our humble opinion, any attempt to improve Swiss GDP, via construction, by an amount much greater than the growth in the euro zone will backfire, through either huge central bank losses or the bust of a potentially upcoming huge housing bubble (albeit still a remote scenario) or by both, first by SNB losses and later by the busting of the bubble.

Therefore we are happy that the central bank has finally taken this decision. For the first time the SNB seems to give financial stability more importance than growth – see Thomas Sedlacek‘s theses.

But we judge that 1% of risk-weighted capital is still far from sufficient, potentially even 2.5% would not be enough, but rate hikes are needed.

A CCB cannot stop a bust of a housing bubble, but it at least helps to control the banking crisis after it.

Update 2014:

The SNB and the Swiss government require that banks must raise the weight of the “counter-cyclical capital buffers” (CCB) by holding extra capital worth 2 per cent of the risk-weighted assets in their mortgage portfolios, from 1% previously.

In the view of the SNB, the imbalances on the Swiss residential mortgage and real estate markets have increased further since the Federal Council activated the CCB in February 2013. Certainly, the activation of the CCB was at least one important factor which motivated several banks – including some major banks – to implement capital measures in 2013, which helped to increase resilience.

Moreover, in 2013, the annual nominal growth in both mortgage lending and residential property prices was lower than in the previous year.

Nevertheless, growth was still so strong that there was a further increase in imbalances on the mortgage and real estate markets.

Consequently, neither the activation of the CCB nor the other measures taken, for example, the revision of the self-regulation rules, were sufficient to avoid the risk of a sharp correction on the mortgage and real estate markets rising further.

What is more, in an environment of persistently low interest rates, coupled with banks’ continued appetite for risk, the danger that imbalances will build up even more unless additional countermeasures are taken is considerable.

.. the countercyclical capital buffer for specific market segments be increased by 100 basis points and banks be therefore obliged, from 30 June 2014, to hold a countercyclical capital buffer amounting to 2% of their risk-weighted, direct or indirect mortgage-backed positions secured by residential property in Switzerland (source SNB)

Being fined by the U.S., Credit Suisse has lost some time on its way for higher ratios.

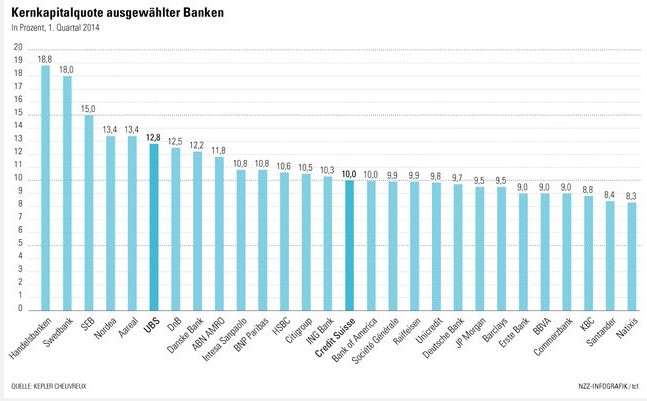

Capital ratios 2014 Credit Suisse UBS

Capital Ratios 2014 big banks, source NZZ

Read also:

Swiss home price to income ratio small in historic and global comparison

Countercyclical capital buffer, a critical assessment, Rafael Repullo, Bank of Spain

See more for

1 comment

Joseph

2014-02-02 at 15:15 (UTC 2) Link to this comment

This is not a bobble. Is a inflation creeping in from the new printed CHF… If has nothing to do with loans. The real estate market is flooded with money from foreign inverstors.